Have Insurance And Emergency Plans

The fourth, and probably the most important step, have a healthcare plan. This could easily be your first 3 steps if you get this early in life.

If you start investing early in your health insurance and term plans it works out a lot cheaper. And not just health in terms of insurance, start early on maintaining actual health. Maintain a healthy diet and lifestyle and continue with it so your health does not deteriorate quickly with age. But lets face it: it is not easy getting old. Health issues and medical expenses are unavoidable.

Taxable Iras Pensions And Annuities

Taxable income from IRA distributions, IRA withdrawals, pensions, and annuities all impact your tax bracket calculations.

Not all IRA distributions are taxable. For instance, Roth IRA distributions are usually tax-free.

Pensions and annuities may or may not be taxable depending on your situation and the particular pension or annuity.

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

Recommended Reading: How Do I Cash Out My 401k After Being Fired

Does Tsp Automatically Stop At Limit

After this change is made, member contributions will only be suspended on the Elective Deferral Limit of $ 19,500, and will prevent any additional contributions taken from the paying member, preventing the need for a refund.

How do I max out my TSP 2021?

To provide the 2021 annual maximum for all familiar TSP and TSP Catch-up combinations of $ 26,000, you must deposit an additional $ 1,000 in payment on MyPay on December 6 â 12, 2020, and your choice must be effective. December 20, 2020, the first payment period for 2021.

Does TSP have a limit?

The maximum amount you can contribute to this years TSP account is $ 19,500. If you are 50 years old or older, your plan may allow you to donate another $ 6,500 as a catch-up contribution, bringing your 2021 TSP contribution up to $ 266.

How Long Can You Stay On Each Page

For security reasons, there are time limits for viewing each page. You will receive a warning if you dont do anything for 25 minutes, but you will be able to extend your time on the page.

After the third warning on a page, you must move to another page. If you do not, your time will run out and your work on that page will be lost.

Recommended Reading: How Long Does A 401k Rollover Take

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

How Do You Withdraw Money From A 401 After Retirement

To withdraw money from your 401 after retirement, you’ll need to contact your plan administrator. Depending on your company’s rules, you may be able to take your distributions as an annuity, periodic or non-periodic withdrawals, or in a lump sum. Your plan administrator will let you know which options are available to you. You can typically have funds deposited into an account or have your plan send you a check.

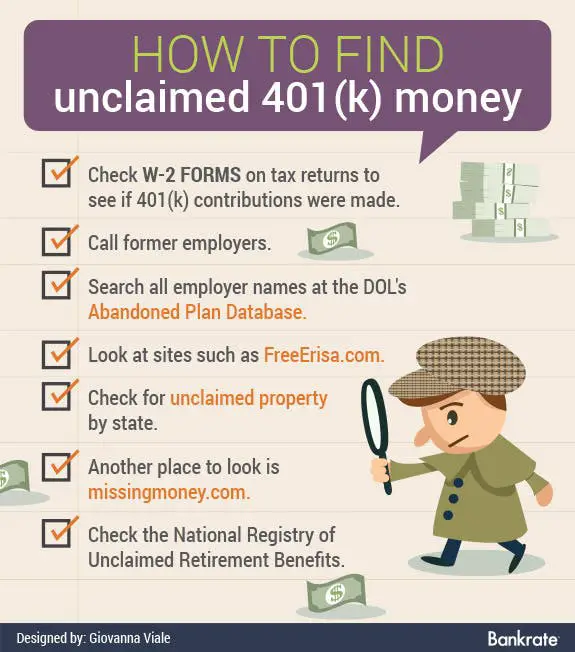

Also Check: How To Recover 401k From Old Job

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employer’s plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Recommended Reading: How Much Money Do I Have In My 401k

Tax On Early Distributions

If a distribution is made to you under the plan before you reach age 59½, you may have to pay a 10% additional tax on the distribution. This tax applies to the amount received that you must include in income.

Exceptions. The 10% tax will not apply if distributions before age 59 ½ are made in any of the following circumstances:

- Made to a beneficiary on or after the death of the participant,

- Made because the participant has a qualifying disability,

- Made as part of a series of substantially equal periodic payments beginning after separation from service and made at least annually for the life or life expectancy of the participant or the joint lives or life expectancies of the participant and his or her designated beneficiary. ,

- Made to a participant after separation from service if the separation occurred during or after the calendar year in which the participant reached age 55,

- Made to an alternate payee under a qualified domestic relations order ,

- Made to a participant for medical care up to the amount allowable as a medical expense deduction ,

- Timely made to reduce excess contributions,

- Timely made to reduce excess employee or matching employer contributions,

- Timely made to reduce excess elective deferrals, or

- Made because of an IRS levy on the plan.

- Made on account of certain disasters for which IRS relief has been granted.

What Can I Claim If I Have To Give Up Work Due To Ill Health

You might be able to get working tax credit for up to 28 weeks, including help with childcare costs, if you are off work due to ill health or disability, and you get statutory sick pay or employment and support allowance. You could qualify for an extra amount called a disability element when you return to work.

Recommended Reading: How Do I Find My Old 401k Account

What Is The Best Month To Retire For Tax Purposes

So as you can see there is plenty of Income Tax to be saved by choosing March as the best month to relax inside. As a bonus there is also another good reason to retire at the end of the tax year. You will be going in the spring so the weather should be warm and long nights with plenty of work to do!

Is it best to retire at the end of a tax year?

Is it better to retire at the end of the year or the beginning?

Silverberg recommends that retirees receive a three-to-five-year retirement savings plan. That way, they will not have to spend money on investments such as stocks during the downturn. For such employees, the best time to retire may be at the beginning or end of the year.

Different 401 Retirement Options

Next, let’s look at what choices Owen will have when he retires. The decision will largely be his. The law allows for five different alternatives for a 401 account at retirement. The options include lump-sum distribution, continue the plan, roll the money into an IRA, take periodic distributions, or use the money to purchase an annuity. Owen’s particular plan will allow for some or all of them.

The fastest way for Owen to get his “big wad” of money is to take a lump-sum distribution. He’ll get the money quickly. But there are two disadvantages. First, he’ll pay ordinary income taxes on the entire amount withdrawn. Second, the money will no longer be growing tax-free.

If Owen does take a lump-sum distribution, he’ll be subject to 20% withholding. That means the IRS will take 20% of the money distributed now and apply to his tax bill next April. Owen can thank the “Unemployment Compensation Amendments Act of 1992” for that idea.

Owen could decide to leave the money in the account. It will continue to grow tax-free. That can make a big difference in how much is available to him during retirement. Many retirees choose to spend taxable accounts first saving IRAs and 401s until they need the money or are forced by law to begin distributions.

Another possibility would be to roll the 401 into an IRA. That would give Owen the largest number of investment options. He could still withdraw the money when he wants or choose to let it grow tax-free.

Also Check: How To Lower 401k Contribution Fidelity

Early Withdrawal Age Rules Only Apply To The Assets In The 401 Plan Maintained By Your Former Employer

Assets in an IRA have their own rules regarding a penalty-free early withdrawal. In a similar vein, assets that youve rolled over from your 401 to an IRA will generally no longer be eligible for penalty-free early withdrawals unless you qualify for a different exemption . If theres a possibility you may need to tap into the savings in your 401, you may want to hold off on rolling those assets over to an IRA until you turn 59 ½.

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

You May Like: How To Transfer 401k To Another 401 K

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

What To Do With Your 401 Money When You Retire

By Rodney Brooks, Next Avenue Contributor

Billions of dollars are at stake as boomers decide what to do with the $5.3 trillion theyve invested in company-sponsored 401 plans when they retire. Leave the money where it is? Roll it over to an Individual Retirement Account at a financial firm? For many, its a head-scratcher.

The topic is especially timely with the Wall Street Journal recently reporting that the U.S. Department of Labor is looking into whether Wells Fargo has been pushing retiring clients to move their 401 money into more expensive IRAs at the bank.

Financial advisers say there are pros and cons to leaving your 401 in place and to rolling it over into an IRA.

Also on Forbes:

It depends on the individual needs of the employee and the quality of the plan, says Harris Nydick co-founder of CFS Investment Advisory Services in Totowa, N.J., and author of Common Financial Sense, Simple Strategies for Successful 401 and 403 Retirement Plan Investing.

There is not a one-size-fits-all when it comes to making this decision, says Dan Houston, chairman, president and CEO of Principal Financial Group in Des Moines,

5 Reasons to Leave your 401 With Your Company

Here are five reasons to consider leaving your 401 with your company as 22% of 401 owners did when exiting, according to an Ameritrade survey rather than moving it to a Rollover IRA when you retire:

5 Reasons to Roll Over Your 401 Into an IRA

What Not to Do With Your 401

Recommended Reading: Should I Roll My 401k Into An Annuity

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Apply For Retirement Benefits

Starting your Social Security retirement benefits is a major step on your retirement journey. This page will guide you through the process of applying for retirement benefits when youre ready to take that step. Our online application is a convenient way to apply on your own schedule, without an appointment. You can also apply by phone or by appointment at a Social Security office.

Also Check: How Many Loans Can I Take From My 401k

How Much Money Do You Need To Retire

A common guideline is that you should aim to replace 70% of your annual pre-retirement income. This is what the calculator uses as a default. You can replace your pre-retirement income using a combination of savings, investments, Social Security and any other income sources . The Social Security Administration website has a number of calculators to help you estimate your benefits.

It’s important to consider how your expenses will change in retirement. Some, like health care and travel, are likely to increase. But many recurring expenditures could go down: You no longer need to dedicate a portion of your income to saving for retirement. You may have paid off your mortgage and other loans. And your taxes are likely to be lower payroll taxes, which are taken out of each paycheck, will be eliminated completely.

Be sure to adjust based on your retirement plans. If you know you wont have a mortgage, for instance, maybe you plan to replace only 60%. If you want to travel every year, you might aim to replace 100% or even 110% of pre-retirement income.

How To Get Retirement Ready

Open a retirement account. If you have access to a GRSP, you should at the very least contribute the amount of money your employer is willing to match. You should also open a RRSP if you don’t already have one. A RRSP is one of the most popular ways to save for retirement in Canada and it comes with nice tax benefits. Learn more about RRSPs and GRSPs.

Avoid paying high fees. Fees are like savings termites they’ll chew right through your savings. When you invest with Wealthsimple, we charge a 0.5% management fees when you invest up to $100,000 and 0.4% when you deposit more than $100,000. That’s significantly less than the 2% fees paid by traditional mutual fund investors in Canada.

Make smart moves. Begin saving for retirement as early as you can and take advantage of the power of compounding. Create a budget that includes retirement savings, learn how investing works, discover smart retirement strategies and understand what it takes to retire early.

Recommended Reading: How To Pull 401k Early