What Is A 401 Anyway

Simply put, a 401 is a type of retirement plan offered through your workplace. If your employer offers a 401 plan it makes a lot of sense to participate in it as soon as possible. Here are a few reasons why:

There’s a bit more to it, but that may be all you need to know to get going. If you’re interested in learning more, review the documents provided by your employer. They’ll include more details about your specific plan.

Whats A 401 Expense Ratio

All 401 plans are subject to a range of administrative fees and investment fees. Administrative fees cover costs like customer support, legal services, record keeping, and transaction processing. Investment fees are charged by the investment funds in which the plan invests and are typically disclosed as expense ratios in the plans literature. Some fees are covered by the employer, but typically, most fees are passed onto the plans participants .

The expense ratio is expressed as a percentage of assetssay, 0.75% or 1.25%. Across the board, the average 401 expense ratio is 1% of assets, or $1,000 for every $100,000 in plan assets .

Still, expense ratios vary greatly depending on the size of the plan and, in general, larger 401 plans have the lowest fees due to economies of scale, while small business 401sfor example, plans with 10 participantstend to be the priciest. Below are the average expense ratios by plan size, according to data from the 401 Books of Averages.

| Average Expense Ratios by Plan Size |

|---|

| Number of Participants |

Contributing To Your Mit 401 Account

You contribute to your 401 account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of both. You may change your contribution preferences any time through Fidelity NetBenefits.

Your contributions are sent to Fidelity Investments at the end of each pay period. You may contribute as little as 1% and as much as 95% of your salary after amounts for Social Security and Medicare taxes and health and dental insurance have been subtracted. You may start, stop, or change your deferral or investment elections at any time.

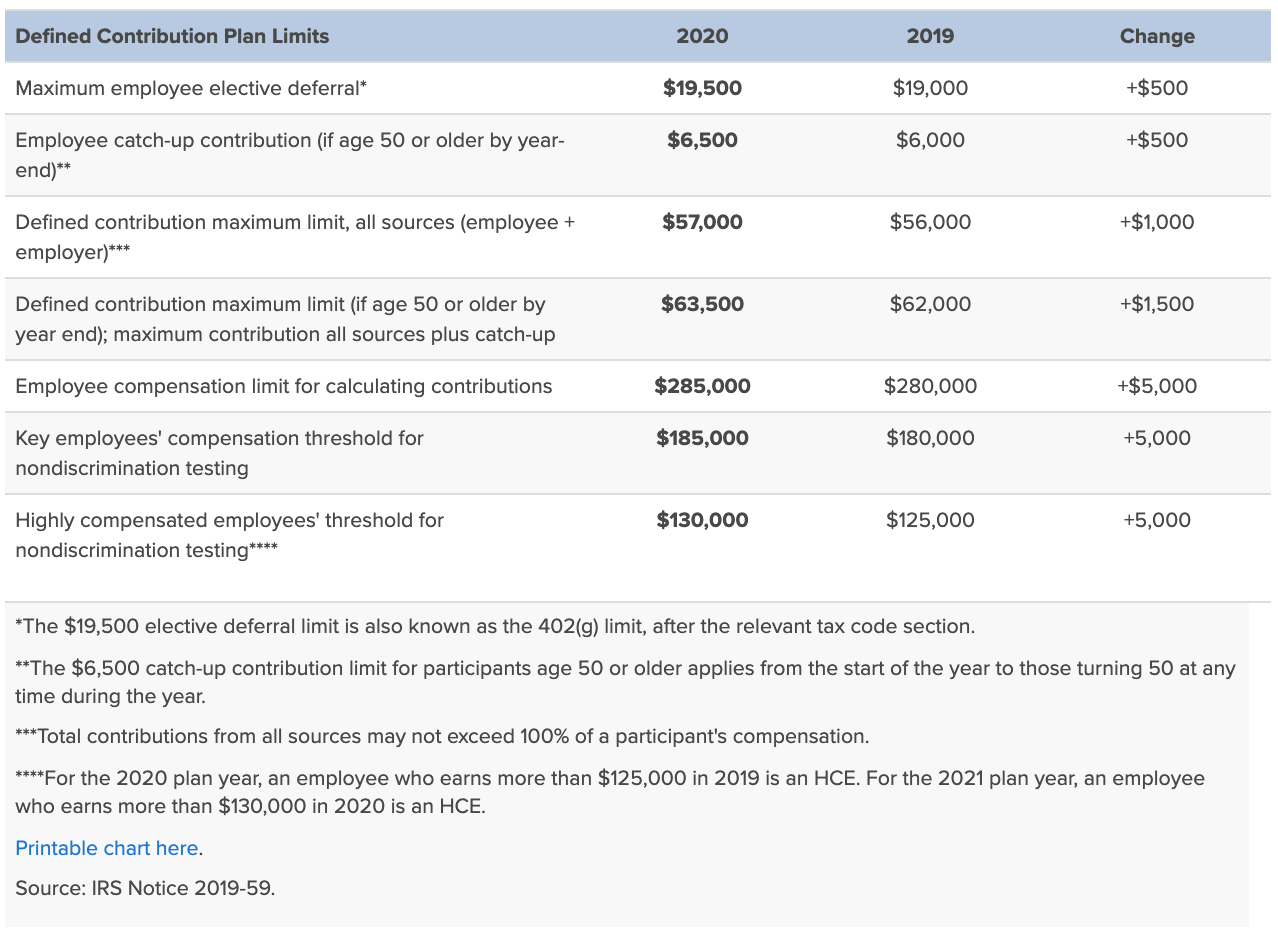

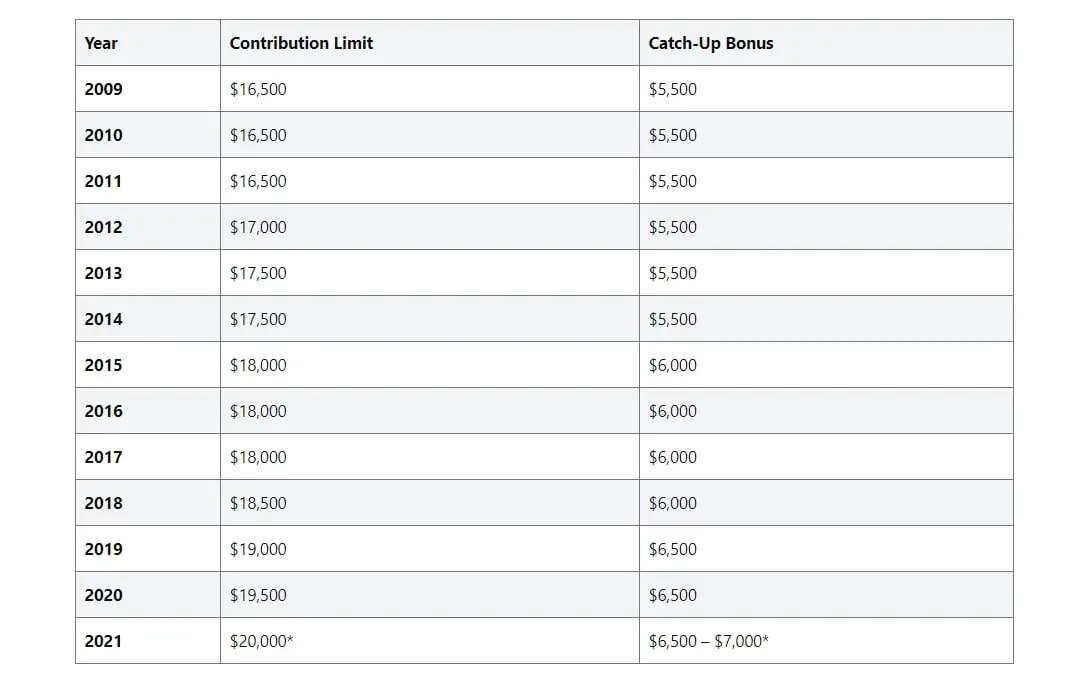

Federal law limits the amount of your pay each year that may be recognized for determining your allowable contribution. In 2021, MIT can consider only the first $290,000 of pay for calculating your allowable contributions. This means that if your annual compensation exceeds $290,000, MIT Payroll will take 401 deductions from your pay until your pay for the year reaches $290,000, or one of the other 401 program limits has been reached .

Contribution limits

What MIT contributes to your 401 Plan

- MIT matches your 401 contributions dollar-for-dollar up to the first 5% of your MIT pay .

- MIT only contributes a match during months in which you have made a contribution

- The MIT match is provided pre-tax, and therefore is fully taxable when you withdraw your matching contributions from the plan, along with associated investment earnings.

When contributions are invested in your 401 account

Recommended Reading: How Do I Use My 401k To Start A Business

Create A Larger Current Year Deduction By Combining Cash And Securities

While donating appreciated securities typically eliminates long-term capital gains exposure, you are limited to 30% of your adjusted gross income for deducting contributions of long-term appreciated securities. This is sufficient for most people, but there are some years when you might benefit from a larger current year deduction. In those select situations, you may choose to supplement a charitable gift of securities with a charitable contribution of cash. This strategic combination of giving is an opportunity to reduce your taxable income.

Fidelity Investments customers can use the Fidelity Charitable Appreciated Securities Tool when making a contribution to help find the most highly appreciated securities from your portfolio.

Don’t Let Plan Costs Derail Your Profits

Are your 401 fees too high? Recent data show that the average person pays about 0.45% on their balance annually in plan administration fees and costs. And as the average 401 balance now exceeds $103,000, the costs and fees associated with retirement plans become an even more significant consideration. Even a fraction of a percent more in fees can eat away at your investments and mean thousands less in retirement.

Speak with your plan administrator or human resources department to understand your plan and investment selection fees. Choose quality mutual funds or exchange-traded funds with low fees. The average equity mutual fund fee in 2018 was 0.55% and for bond funds, it was 0.48%, according to the Investment Company Institute. Index mutual funds should be even lower. The average fee for a target date fund the popular 401 option that uses a variety of individual mutual funds matched to your risk profile and expected retirement age was 0.40% in 2018.

If you’re considering switching employers, consider the difference in fees between your existing plan and new one. You might do better by keeping your existing 401 with your old employer if it offers significantly lower-fee choices.

You May Like: Why Cant I Take Money Out Of My 401k

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on “Register Now” at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose “Contribution Amount“. If you are already logged in, click on the “Contributions” tab.

Step 2:There are three choices:

- Contribution Amount – to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program – to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers – to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Don’t Miss: How To Recover 401k From Old Job

The Number Of Workplace Retirement Accounts With $1 Million Or More Hit An All

Despite surging covid cases and climbing inflation, Americans retirement account balances continue to rise to record levels. Others, though, are fighting to pay rent unable even to think about investing for the future.

Lets look at the haves who are saving for retirement in workplace plans.

Fidelity Investments just released its quarterly analysis of more than 30 million 401 and 403 retirement accounts. Average retirement account balances maintainedan upward trend for the third straight quarter.

Workers who continue to contribute to their plans, even as the pandemic produced some heart-clutching moments in the stock market, were rewarded with significant increases in their account balances, according to Fidelity, the largest administrator of workplace retirement accounts.

In fact, as the pandemic caused people to lose their jobs, 38 percent of 401 savers increased their savings rate. And this wasnt just among older workers, who you might expect would contribute more as they get closer to retirement.

People are really seeing the benefit of long-term investing, said Jessica Macdonald, vice president for thought leadership at Fidelity.

Macdonald said 85 percent of the growth in account balances came from stock market performance.

Need Help With Your Rollover

- Well help you track down your 401 and initiate the rollover to Fidelity

- Customer support available if you have questions along the way

- Feel confident about your decision to move to Fidelity by answering a few questions to compare with other top providers

We’ve laid out a step-by-step guide to help you roll over your 401 to Fidelity in five key steps:

Also Check: How Do You Take Money Out Of 401k

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

Donating An Ira To Charity Upon Death

When you name a charity as a beneficiary to receive your IRA or other retirement assets upon your death, rather than donating retirement assets during your lifetime, the benefits multiply:

- Neither you and your heirs nor your estate will pay income taxes on the distribution of the assets.

- Your estate will need to include the value of the assets as part of the gross estate but will receive a tax deduction for the charitable contribution, which can be used to offset the estate taxes.

- Because charities do not pay income tax, the full amount of your retirement account will directly benefit the charity of your choice.

- Its possible to divide your retirement assets between charities and heirs according to any percentages you choose.

- You have the opportunity to support a cause you care about as part of your legacy.

You May Like: How Much Money Should I Put In My 401k

Watch For High Turnover Ratios

A 100% turnover ratio means a $10 billion dollar fund sells 100% of its holdings every year. Buying and selling positions cost money. Thats how the equities department of major Wall Street firms make money. I know because I worked in equities for 13 years.

Buying a large new $300 million position for a 3% weighting in a $10 billion dollar mutual fund can also cause the stock to rise in the open market. As a result, the potential acquisition cost of owning shares increases the more a fund turns over.

Yes, dark pools, algorithmic trading, and block trading have helped minimize the impact large transactions have on the share price. However, the more a fund trades, the higher the likelihood of an impact.

Shoot for a fund with under a 50% turnover ratio. The lower the better as that means there will also be less tax drag.

Master The Employer Match

Are you missing out on your employer match because you’re not contributing enough? A recent study from personal finance website MagnifyMoney shows that roughly 20% of Americans are failing to receive their full 401 employer match by not contributing enough.

With the average employer match now reaching an all-time high of 4.7% of a worker’s salary, according to Fidelity Investments, that could result in a cost of tens of thousands of dollars over the typical worker’s career and much more, when compound interest is considered.

Remember, a match is free money you’re leaving on the table if you don’t take advantage of it. By not contributing enough to secure the match, your overall compensation is lower. Think of it as giving yourself an unintentional pay cut. Cut back on whatever you need to in order to contribute enough to get that full match. You’re opting for lower total compensation, otherwise.

Recommended Reading: How Do I Know If I Have A 401k

Contact Your 401 Provider

Youre making great progress. You know where your 401 is and you have an IRA at Fidelity to transfer your money into. The next step is to initiate your rollover by contacting your 401 provider.

Often, the easiest way to do this is by phone. Your 401 providers phone number should be visible on an old account statement.

In order for your call to go smoothly, follow these tips:

Next Steps To Consider

A distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, qualified first-time home purchase, or death.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Also Check: Can You Roll A 401k Into A Roth

Tax Implications Of Donating Retirement Assets During Life

Retirement plan benefits are only payable to the employee or account holder who earned them, with a few exceptions for spouses or survivors. With the exception of a qualified charitable distribution as described above, distributions from non-Roth retirement plans are taxable as ordinary income to the person who receives them.

This is true whether the recipient is the original account holder or a beneficiary of the account holder. Unlike other inheritances that can be passed to heirs free of income tax, distributions from inherited retirement plans are taxable as ordinary income to the person who receives them.

TIP: If you want to support charities without dipping into your cash reserves, think about donating appreciated assets such as stocks or privately held business interests directly. This strategy can eliminate capital gains taxes youd incur by selling them separately before donating the cash, therefore ensuring that your intended charity receives the full value of the asset.