How Much Should I Be Putting Into My 401k

Aim to save between 10% and 15% of your income toward retirement. Another piece of general advice is to put all of those funds into your 401k up until your employer’s matching contribution amount. Once that has been reached, maxed out your Roth IRA contribution. If there are funds leftover then consider putting those funds into your 401k.

Another way to determine how much you will need to save is to look at what income amount you will need in retirement. Fortunately, there are a lot of calculators out there that will help you figure out your magic number. Here are two of our favorites.

-

Nerdwallet provides a great basic calculator that lets you play with different contributions and matching amounts.

-

CalcXL makes a recommendation on how much you should be saving based on projected inflation. Tip: You should aim for a retirement income of roughly 80% of your current salary.

Basics: When It Was Invented And How It Works

Tim Stobierski

Whether you want to retire to a quiet life on the beach or spend your golden years globetrotting to exotic locations, one thing is for sure: Retirement is likely to be the most expensive thing you ever pay for.

And unlike other major life purchases there are no loans for retirement. That means you’ll have to save for it.

Enter the 401. Itâs a special account that you can sign up for at work, if your employer offers one, and itâs designed specifically to help you save for retirement. Hereâs the 101 on 401s.

Distribution Rules Must Be Followed

Generally, distributions cannot be made until a “distributable event” occurs. A “distributable event” is an event that allows distribution of a participant’s plan benefit and includes the following situations:

- The employee dies, becomes disabled, or otherwise has a severance from employment.

- The plan ends and no other defined contribution plan is established or continued.

- The employee reaches age 59½ or suffers a financial hardship.

See When can a plan distribute benefits?

Benefit payment must begin when required. Unless the participant chooses otherwise, the payment of benefits to the participant must begin within 60 days after the close of the latest of the following periods:

- The plan year in which the participant reaches the earlier of age 65 or the normal retirement age specified in the plan.

- The plan year which includes the 10th anniversary of the year in which the participant began participating in the plan.

- The plan year in which the participant terminates service with the employer.

Loan secured by benefits. If survivor benefits are required for a spouse under a plan, the spouse must consent to a loan that uses the participant’s account balance as security.

Recommended Reading: How To Set Up A 401k Account

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

The Forgotten : 5 Ways To Find Out If You Have A Lost Retirement Plan

NEW YORK Americans hold an average of 11 jobs by the time they are 46, according to a 2012 study of the youngest Baby Boomers. Many reports say Millennials are on track to raise that average even higher. Its not uncommon for exiting workers to leave the scraps of their company-sponsored retirement plan behind, believing theyll think about that later.

Now, years have passed and it occurs to you: what if those scraps have grown to be something a bit more than just spare change? A few bucks here and there combined with some market growth over the years and it may all add up to a nice addition to your now even-more-serious effort to save for retirement.

How do you find a forgotten 401?

Contact former employers

Youve tried Googling the company, right? Of course.

And its a good bet you cant find an old statement or check stub with any information that would be the first place to look. Over time, many of us toss out that information, thinking meager leftover retirement savings statements arent worth the paper theyre printed on.

In that case, your next move would be to call the HR department for your former employer. Have your Social Security number handy and try to remember the specific period of your employment.

Seek out former co-workers

Search the government database

Read Also: Can I Contribute To Traditional Ira And 401k

What Is An Ira

While there are a number of benefits to 401ks, they’re not the only retirement plan in the game. An IRA is an individual retirement account. Where a 401k can only be offered through an employer, an IRA account can be opened up by an individual whether they’re associated with an employer or not. That means they’re the best option for independent contractors without an employer or anyone who wants to do some extra retirement planning on top of their 401k.

You Can Withdraw Money Early From A 401

Money you stash in a 401 isn’t meant to be touched until retirement, and any money withdrawn before you turn 59 1/2 could be subject to a 10% early-withdrawal penalty. But if you leave a job as early as age 55, you can tap the 401 penalty-free.

Company 401s also generally allow participants to borrow from their accounts. You may have to pay a fee to take a loan. Plus, you’ll be charged interest on the amount you take out. But you’ll basically be paying interest to yourself because the money goes into the account. Watch out if you have outstanding loans when you leave a company — the loans will have to be repaid within 60 to 90 days. If not, the amount of the loan will be considered a taxable distribution.

Recommended Reading: Can I Open A 401k Without An Employer

How Can I Determine What Guidelines Affect Me

To fully understand the vesting policies of your company, speak with the human resources department. They should be able to explain your company’s vesting policy and schedule. Being aware of this policy can help you to make the most of your retirement contributions and accounts.

It can also help you determine the right time to begin looking for a new job. For example, if you are only six months away from becoming fully vested in your retirement account, it may be worth waiting to switch jobs.

There Are Contribution Limits For 401s

The IRS sets an annual limit on how much money you can set aside in a 401. That limit can change because it is adjusted for inflation. For 2021, you can put away $19,500. Those 50 or older by year-end can contribute an extra $6,500. Check out the Financial Industry Regulatory Authority’s 401 Save the Max Calculator, which will tell you how much you need to save each pay period to max out your annual contribution to your 401. If you cannot afford to contribute the maximum, try to contribute at least enough to take full advantage of an employer match .

Don’t Miss: What Happens When You Roll Over 401k To Ira

Do I Have To Report My Ira Or 401k On My T1135

Canadian taxpayers that own foreign assets with a cost more than $100,000 are required to report and file form T1135 foreign income verification form with the CRA. Although this form will be required for any non-registered investment and/or cash accounts, they are not required for IRA and 401k accounts.

Take A Close Look At Investment Fees

Investment fees can seriously reduce your overall investment return.

Take a close look at those investment fees, as they can take the form of an annual management fee, mutual fund load fees and sometimes transaction fees.

In particular, if the load fees on your mutual funds tend to be high on all investment choices, you may be giving back too much of your investment gains to fees.

There are plenty no-load mutual funds and exchange-traded funds available, but if your own 401 plan favors higher load funds, your money is not being properly invested.

Don’t Miss: How To Get Your 401k Without Penalty

How To Track Down That Lost 401 Or Pension

Tweet This

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Don’t Miss: How To Avoid Penalty On 401k Withdrawal

Search The National Registry

Still not having any luck? Past employers may list you as a missing participant if you no longer work for the company but left your 401 behind. The National Registry of Unclaimed Retirement Benefits is a nationwide, secure database listing retirement plan account balances that have been left unclaimed .

What Happens To My Ira Or 401k When I Die

Unlike RRSP accounts which are deemed to be disposed when a taxpayer dies , IRAs and 401k accounts can move down to a second generation without any tax levied on the amount of the account to the primary holder. This result is unlike anything in Canadian tax law and can be exploited to not only transfer deferred assets to a second generation, but to significantly take advantage of the immense power of compound investing. Imagine how much a $100,000 IRA gifted to a 15 year old will grow throughout their lifetime. This benefit would be eliminated if the IRA were transferred to an RRSP.

Recommended Reading: How To See How Much 401k You Have

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

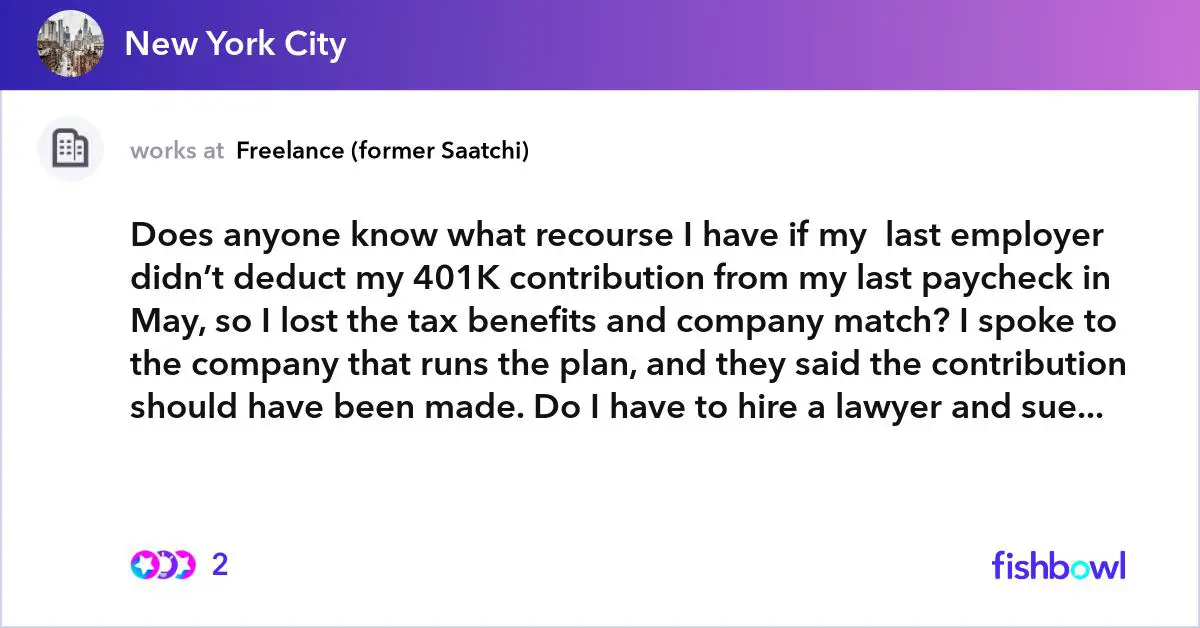

What Happens When You Borrow

The rules about 401 plans can seem confusing to workers. While employers aren’t required to offer the plans at all, if they do, they are required to do certain things but also have discretion over how they run the plan in other ways. One choice they have is whether to offer 401 loans at all. If they do, they also have some control over which rules to apply to repayment.

According to Michelle Smalenberger, CFP, Your employer may refuse to let you contribute while repaying a loan. Smalenberger is the cofounder of Financial Design Studio, a fee-only financial planning and wealth management firm. When an employer chooses what plan they will offer or make available to their employees, they have to choose which provisions they will allow.

If you cant contribute while repaying, remember that your employer is giving you a benefit by allowing the loan from the plan in the first place, Smalenberger adds.

And if you cant make contributions while youre repaying your loan, be aware that a higher amount of your paycheck will go to income taxes until you resume contributions.

If your employer does allow plan loans, the most you can borrow is the lesser of $50,000 or half the present value of the vested balance of your account, minus any existing plan loans. You must repay the loan within five years. And taking a loan puts you at risk of facing the obligation to repay it within a narrow time limit, typically 60 days or less, if you are laid off or quit.

You May Like: How Do You Take Money Out Of 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

You May Like: How To Collect My 401k Money

Other Ways To Find Lost Money

If you are hoping to find lost money, you might want to start by creating a comprehensive and detailed retirement plan. This enables you to:

- Document what you have right now.

- Take stock and think about what might be missing.

- Learning about what you need for a secure retirement is a great way organize your financial life.

- Discover opportunities to make more out of what you have. People who use the NewRetirement retirement planner typically improve their plans by thousands of dollars in their first session with the tool.

Traditional And Roth Iras

Like 401s, contributions to traditional IRAs are generally tax-deductible. Earnings and returns grow tax-free, and you pay tax on withdrawals in retirement. Contributions to a Roth IRA are made with after-tax dollars, meaning you dont receive a tax deduction in the year of the contribution. However, qualified distributions from a Roth IRA are tax-free in retirement.

You May Like: How Do I Find Out Where My Old 401k Is