Will Dh1 Million Be Enough To Retire Anywhere Also What If I Dont Have 30 Years Left To Retire

Now, Dh1 million may not necessarily be enough for retiring, but Dubai-based financial planners reiterate it is definitely a good start and its much more than most people end up with.

So if youre 37 years old or younger, start investing your Dh740 per month today to get on track to a seven-figure nest egg. And if youre older, figure out a number that works for you and get your money to start working so you can have the financial security becoming a millionaire provides.

If you start earlier, you could reduce the amount you must save to hit your Dh1 million target. Someone who starts saving at 25 and who wants to retire at 67 would need to invest just Dh273 per month.

But, even if youre well beyond your 20s, saving just Dh740 per month still makes it possible to achieve your Dh1 million goal. If youre older than 37, of course, youll need to bump up the amount youre investing.

Lets use any interest rate calculators that are freely available online to calculate how Dh740 grows during the 30-year period at a modest 8 per cent return.

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

I Wish I Hadnt Worked So Hard

This came from every male patient that I nursed. They missed their childrens youth and their partners companionship. Women also spoke of this regret, but as most were from an older generation, many of the female patients had not been breadwinners. All of the men I nursed deeply regretted spending so much of their lives on the treadmill of a work existence.

Read Also: How To Find My 401k Money

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employer’s plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Protecting Your 401 From A Stock Market Crash

Any time you put your money in the stock market or other investments, you always run the risk of losses. While you can make largely educated decisions, things dont always go to plan. Also, because youre talking about something as important as your retirement, emotional decision-making can come into play.

Despite the above, there are many strategies, simple and complex, you can use to mitigate risk. For instance, spreading your assets across multiple types of investments and areas of the market can allow you to avoid the volatility that comes with stock-picking and concentrated investment positions.

Everyone has short-term expenses that periodically arise. For example, you might need to repair your car, replace a broken household appliance or pay for a medical procedure. Long-term expenses are even more prevalent, including student loans and mortgages. However, the best thing you can do is treat your retirement savings just as importantly as all of your other needs. This will ensure your pool of retirement funds will continue to grow over time.

Below are some of the most influential strategies you can use to minimize losses in your portfolio, even if a stock market crash comes around. Just remember that you can never fully avoid risk, though.

Read Also: How To Know If You Have A 401k

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Also Check: How Do You Take Money Out Of 401k

How Can I Save Money By Switching To Wealthsimple Invest

We charge a fraction of the fees that traditional mutual fund investors pay. Our management fee is 0.5% , plus underlying fund fees of about 0.1%. The average mutual fund investor pays 2% in fees.

Our smart technology helps keep your portfolio on track with auto-deposits, automatic rebalancing, and dividend reinvesting. And, we have a team of experienced financial advisors available to answer your questions and provide advice – whenever you need it.

Note: the total savings above, calculates the what you’d save if you were investing with Wealthsimple Invest compared to a traditional mutual fund investor. We compare the growth of your current savings between now and your retirement based on the rate of return selected. All figures are for illustrative purposes only, actual results will vary and fees among other factors are subject to change.

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the bank or brokerage firm with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your employer is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Also Check: Can I Roll My Roth 401k Into A Roth Ira

Use Target Date Funds To Retire On Your Terms

A target-date fund is a fund geared toward people who plan to retire at a certain timethe term “target date” means your targeted retirement year. These funds help you maintain diversification in your portfolio by spreading your 401 money across multiple asset classes, including large-company stocks, small-company stocks, emerging-markets stocks, real estate stocks, and bonds.

Youll know your 401 provider offers a target-date fund if you see a calendar year in the name of the fund, such as T. Rowe Price’s Retirement 2030 Fund.

Target date funds make long-term investing easy. Decide the approximate year you expect to retire, then pick the fund with the date closest to your target retirement date. For example, if you plan to retire at about age 60, and that will be around the year 2030, pick a target-date fund with the year “2030” in its name. Once you pick your target-date fund, it runs on auto-pilot, so there is nothing else you need to do but keep contributing to your 401.

Reinvest Extra Money In An Indexed Fund

You can provide an additional layer of protection by automatically reinvesting extra cash in an indexed fund.

For instance, you can invest dividends or bank account interest in an S& P 500 indexed fund. Thus, you could lock in a 10% growth rate for at least part of your money.

Therefore, you can make compound interest part of your 401K and ensure that some of your money is growing. Moreover, you can enhance compound interest by combining it with the S& P 500, which has a long history of growth.

Recommended Reading: How To Withdraw My 401k From Fidelity

Dont Overlook Your Beneficiary Designation Form

Anyone whos filled out a life insurance application is familiar with a beneficiary form. This is where you state who will receive your 401 money in the event of your death. If youre married and have kids, this probably wont be a tough decision.

However, this is one form people tend to truly fill out and forget. In many of cases, people have divorced and are remarried, but their 401 would go to their ex if they died. Other times, the investor may have had children, but neglected to add them to the form.

Your Action Step: If its been a while since you filled out your 401 beneficiary form, contact your 401 plan manager to make sure those funds end up where you want them.

Use Model Portfolios To Allocate Your 401 Like The Pros

Many 401 providers offer model portfolios that are based on a mathematically constructed asset allocation approach. The portfolios have names with terms like conservative, moderate, or aggressive growth in them. These portfolios are crafted by skilled investment advisors so that each model portfolio has the right mix of assets for its stated level of risk.

Risk is measured by the amount the portfolio might drop in a single year during an economic downturn.

Most self-directed investors who aren’t using one of the above two best 401 allocation approaches or working with a financial advisor will be better served by putting their 401 money in a model portfolio than trying to pick from available 401 investments on a hunch. Allocating your 401 money in a model portfolio tends to result in a more balanced portfolio and a more disciplined approach than most people can accomplish on their own.

You May Like: How Do I Transfer 401k To New Employer

How To Get Retirement Ready

Open a retirement account. If you have access to a GRSP, you should at the very least contribute the amount of money your employer is willing to match. You should also open a RRSP if you don’t already have one. A RRSP is one of the most popular ways to save for retirement in Canada and it comes with nice tax benefits. Learn more about RRSPs and GRSPs.

Avoid paying high fees. Fees are like savings termites they’ll chew right through your savings. When you invest with Wealthsimple, we charge a 0.5% management fees when you invest up to $100,000 and 0.4% when you deposit more than $100,000. That’s significantly less than the 2% fees paid by traditional mutual fund investors in Canada.

Make smart moves. Begin saving for retirement as early as you can and take advantage of the power of compounding. Create a budget that includes retirement savings, learn how investing works, discover smart retirement strategies and understand what it takes to retire early.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Don’t Miss: Can I Buy Individual Stocks In My 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

What Is A 401

A 401 is an investment account offered by employers to their workers. These accounts are designed and managed by financial services firms that are contracted by the employer.

Charles Schwab, Bank of America, and Fidelity Investments rank among the highest satisfaction in group retirement plans as of 2020, according to J.D. Power.

These accounts are designed to use the power of compounding interest to earn returns. They can be built from many types of investments. You will likely see greater returns if you start investing in a 401 as soon as you have the chance. Your money will have more time to grow.

It helps to have a handle on your personal risk tolerance before you decide how much you should save to and how you should diversify your 401 portfolio. Know what your risk tolerance means for choosing investment options within your 401k that are right for you.

Don’t Miss: When Leaving A Company What To Do With 401k

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people get tripped up: According to a 2014 Charles Schwab survey, more than half of 401 plan owners wish it were easier to choose the right investments.

Heres what you need to know about investing your 401.

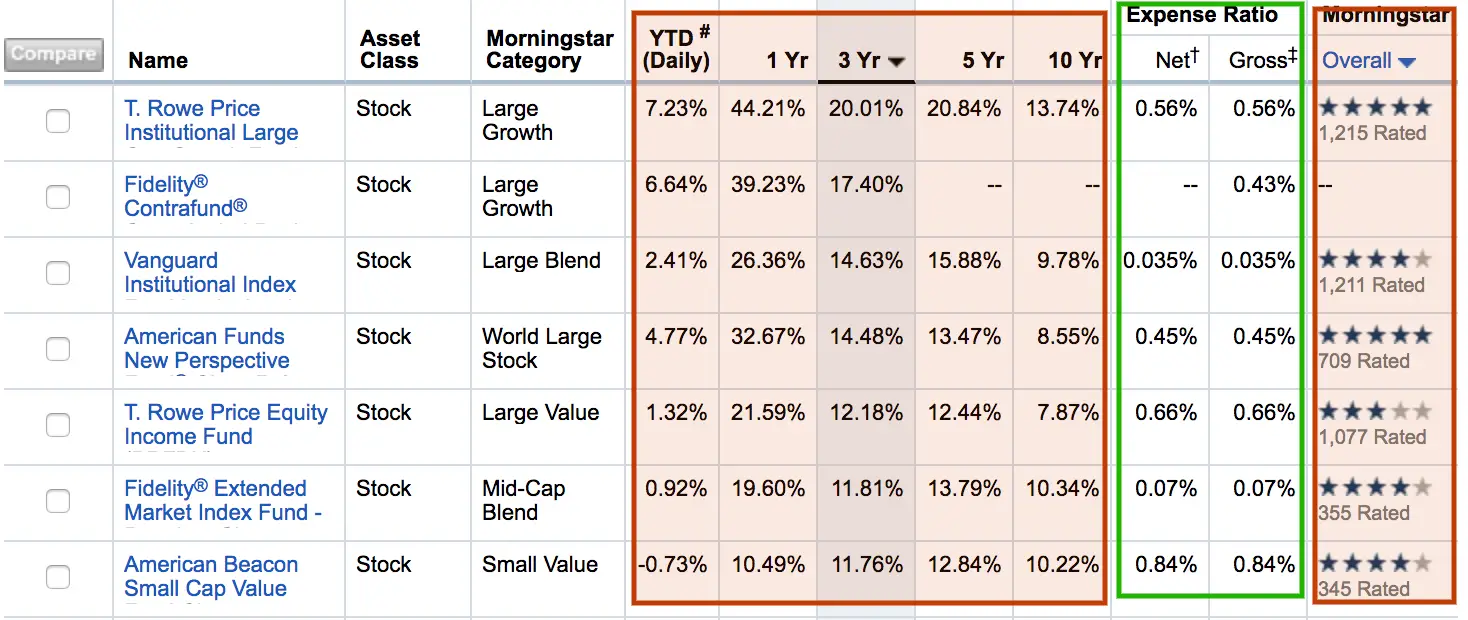

Take Fees Into Consideration

Heres a golden rule of investing: past performance does not guarantee future performance.

You cant control how well your investments will do, but you can control how much you pay to invest. Yes, it costs money to invest. You pay annual fees, an expense ratio, based on the percentage of the assets. This is why I ignore stats like past performance and ratings, and only pay attention to the Expense Ratio column .

Looking at the chart, paying a fee like 0.84% seems like nothing, and the most expensive option in the example, 1.02%, sounds totally reasonable. But fees can make a drastic difference in your returns.

When comparing expense ratios, also be sure to note the decimal points. At a quick glance, 0.7% and 0.07% can easily look the same.

Lets compare how those fees can play out over time. If you started with $10,000, and invested $5,000 each year for 30 years with a 6% return, heres how much each will cost you.

A 0.63% difference can end up costing you almost $50,000 more over a span of 30 years. To me, anything over 1% is expensive. Generally, my benchmark for funds are ones that cost less than 0.5%, but it all depends on what options you have in your 401k plan. If many of them are expensive, then you may have a crappy 401k plan.

Besides expense ratios, there are other fees you can incur, like load fees and redemption fees, but they arent in this specific example. Anyway, I avoid those, too.

Recommended Reading: How To Open A Solo 401k