How Do You Withdraw Money From A 401 After Retirement

To withdraw money from your 401 after retirement, you’ll need to contact your plan administrator. Depending on your company’s rules, you may be able to take your distributions as an annuity, periodic or non-periodic withdrawals, or in a lump sum. Your plan administrator will let you know which options are available to you. You can typically have funds deposited into an account or have your plan send you a check.

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

Best For Hardship Protection: Alliant Credit Union

Alliant

Alliant, a credit union available nationwide specializes in short-term loans at extremely competitive rates. But perhaps its strongest claim to fame is its repayment terms: Should some sort of emergency or unexpected event impair your ability to pay bills, you can suspend monthly paymentsor even the entire loan balancewithout penalty or extra interest. This optional Debt Protection program, as Alliant dubs it, does incur a small monthly fee if you join it.

-

No origination fee or prepayment penalty

-

Low APRs: Rates max out at 10.24%, vs. some other lenders’ ceilings of almost 36%

-

Fast process: same-day deposit in many cases

-

Membership in credit union required

-

Debt protection costs extra: monthly fee based on size of loan balance

-

No long-term loans: 5-year maximum length

Other important information:

- Maximum/minimum amount you can borrow: $1,000 to $50,000

- 6.24%10.24%

- Fees: No origination fee or prepayment penalties

- Recommended minimum credit requirements: Not Available

- Other qualification requirements: A monthly fee is charged for the Debt Protection program

- Repayment terms: 12 to 60 months

- Time to receive funds: Typically same day

- Restrictions: Credit union membership required

Calculating The Withdrawal Amount

There are three different methods you can choose for calculating the value of your withdrawals:

A trusted financial advisor can help you determine which method is most appropriate for your needs. Regardless of which method you use, youre responsible for paying taxes on any income, whether interest or capital gains, in the year of the withdrawal.

The Hardship Withdrawal Option

A hardship withdrawal can be taken without a penalty. For example, taking out money to help with economic hardship, pay college tuition, or fund a down payment for a first home are all withdrawals that are not subject to penalties, though you still will have to pay income tax at your regular tax rate. You may also withdraw up to $5,000 without penalty to deal with a birth or adoption under the terms of the SECURE Act of 2019.

A hardship withdrawal from a participants elective deferral account can only be made if the distribution meets two conditions.

- It’s due to an immediate and heavy financial need.

- It’s limited to the amount necessary to satisfy that financial need.

In some cases, if you left your employer in or after the year in which you turned 55, you may not be subject to the 10% early withdrawal penalty.

Once you have determined your eligibility and the type of withdrawal, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but once all the paperwork has been submitted, you will receive a check for the requested fundsone hopes without having to pay the 10% penalty.

How Much Money Can You Take Out Of Your 401k Without Penalty

Individuals affected by COVID-19 can withdraw up to $100,000 from employee-sponsored retirement accounts like 401s and 403s, as well as personal retirement accounts, such as traditional individual retirement accounts, or a combination of these. The 10% penalty will be waived for distributions made in 2020.

Loans Versus 401 Distributions: Which To Choose

With these new rules, the lines between a 401 loan and withdrawal can become a bit blurred. Both let you access up to $100,000 of your retirement funds penalty- and tax-free, but there are slight differences.

If you take a withdrawal:

-

Repayment isnt required.

-

Theres no withdrawal penalty.

-

It will be taxed as income initially, though you can claim a refund if you pay back the distribution in three years.

-

You have tax options.

A Means Of Avoiding High

You may consider finding quick financial relief by putting expenses on a credit card or taking out a loan. Know that both of these options require you to pay back the amount with interest, which could make the amount you owe much greater than you originally needed . Alternatively, withdrawing from retirement accounts in a disaster situation gives you a cushion of three years to pay the amount back, interest-free.

Borrowing From And Rolling Over Your 401

Cashing out isn’t the only way for those who need it to get money out a 401. Many plans also allow employees to take loans from their 401 to be repaid with after-tax funds at pre-defined interest rates. The interest proceeds then become part of the 401 balance. The benefit of this type of loan is that the borrower repays himself — by eventually putting the borrowed money back into the 401 — rather than a bank.

If loans are permitted under terms of the 401 plan, the employee may borrow up to 50 percent of the vested account balance up to a maximum of $50,000 without the money being taxed. The borrower must repay the loan within five years unless the loan is used to buy a primary residence, and loan repayments must be made at least quarterly in substantially level amounts. If the borrower defaults on the loan, the money becomes a taxable distribution with all the same tax penalties and implications of a withdrawal.

401 holders looking for extra cash should keep all these options in mind when considering whether to tap into retirement savings early. Other savings tools may also provide penalty-free ways to get at money, depending on the holder’s circumstances. For more information on 401s and retirement savings strategies, check out the related articles and links on the next page.

Use A Professionally Managed Fund Or Get Advice

Investing too conservatively could also jeopardize your lifestyle or cause you to run out of money. Striking the right balance sometimes requires professional management. Your 401 plan may offer professionally managed fund options, such as target-date funds, for retirees. And your 401 provider might offer personalized investment advice. Ask your provider about your options for getting help. And if you think face-to-face advice might be better for your needs, find a financial professional with experience helping retirees.

Best For Fair Credit: Upstart

Upstart looks at factors other than just your credit score when looking at your application using their artificial intelligence technology. Factors include education, occupation, and income. Applicants should have a minimum credit score of 600 and typical rates are between 6.76% to 35.99%.

-

Conducts soft credit inquiry when checking initial rate

-

Receive proceeds as soon as the next business day

-

Make extra payments without incurring a penalty

-

Origination fees as high as 8%

-

Can only choose from three or five year terms

Other important information:

- Maximum/minimum amount you can borrow: $1,000 to $50,000, based on credit, income, and other information considered in your application

- Typical APR range: 6.76%35.99%

- Fees: 0% to 8% origination fee

- Minimum recommended credit score: 600+

- Other qualification requirements: Applicants need to be at least 18+ in most states

- Repayment terms: 36 or 60 months

- Time to receive funds: As soon as the same business day, two business days if you accept the offer past 5pm EST

- Restrictions: No bankruptcies and/or delinquencies on credit report allowed

Read the full review: Upstart Personal Loans

Withdrawals After 59 1/2

To encourage retirement saving, the IRS slaps you with a 10 percent penalty if you siphon money from your 401 before reaching 59 1/2, even if you can prove a financial hardship. This is on top of regular income taxes on the withdrawal. While the penalty disappears after 59 1/2, you’ll still be liable for the income taxes. If you have a Roth 401 account, the contributions are made with after-tax dollars. Roth withdrawals are tax-free, as long as you’ve had the account open at least five years.

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

How To Cash Out Your 401k And What To Consider

4-minute readMay 18, 2021

One of the surest ways to create a comfortable retirement for yourself is to begin saving early on in your career. A 401 plan a type of financial contribution plan which allows you to put a percentage of your salary into an account whose investment gains remain tax-free until funds are withdrawn presents one of the most popular vehicles for doing so. Even better, employers will often match the amount of money set aside up to a certain amount, effectively guaranteeing you free income.

However, in the event that access to money is needed, especially in the wake of a large or unexpected expense, its not uncommon to wonder how to cash out your 401 as well. Here, well take a closer look at the process of cashing out a 401 early, how long it takes to get access to money, and the pros and cons of doing so, including how much early withdrawal before retirement may cost you.

Do You Pay Tax On 401 Contributions

A 401 is a tax-deferred account. That means you do not pay income taxes when you contribute money. Instead, your employer withholds your contribution from your paycheck before the money can be subjected to income tax. As you choose investments within your 401 and as those investments grow, you also do not need to pay income taxes on the growth. Instead, you defer paying those taxes until you withdraw the money.

Keep in mind that while you do not have to pay income taxes on money you contribute to a 401, you still pay FICA taxes, which go toward Social Security and Medicare. That means that the FICA taxes are still calculated based on the full paycheck amount, including your 401 contribution.

The 5 Different 401k Retirement Options

Next, lets look at what choices Owen will have when he retires. The decision will largely be his. The law allows for five different alternatives for a 401k account at retirement. The options include lump-sum distribution, continue within the plan, roll the money into an IRA, take periodic distributions, or use the money to purchase an annuity. Owens particular plan will allow for some or all of them.

The fastest way for Owen to get his big wad of money is to take a lump-sum distribution. Hell get the money quickly. But there are two disadvantages. First, hell pay ordinary income taxes on the entire amount withdrawn. Second, the money will no longer be growing tax-free.

If Owen does take a lump-sum distribution, hell be subject to 20% withholding. That means the IRS will take 20% of the money distributed now and apply to his tax bill next April. Owen can thank the Unemployment Compensation Amendments Act of 1992 for that idea.

Owen could decide to leave the money in the account. It will continue to grow tax-free. That can make a big difference in how much is available to him during retirement. Many retirees choose to live off of and spend taxable accounts first saving IRAs and 401ks until they need the money or are forced by law to begin distributions.

Another possibility would be to roll the 401k into an IRA. That would give Owen the largest number of investment options. He could still withdraw the money when he wants or choose to let it grow tax-free.

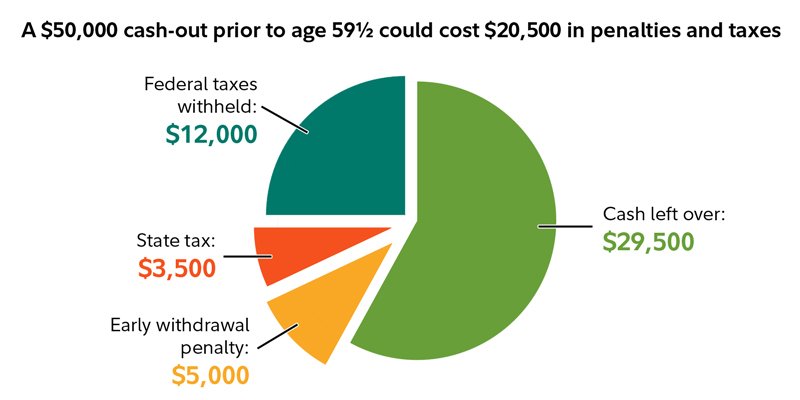

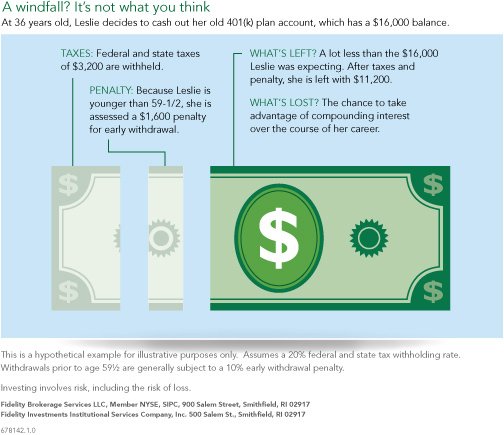

Risks Of 401 Early Withdrawals

While the 10% early withdrawal penalty is the clearest pitfall of accessing your account early, there are other issues you may face because of your pre-retirement disbursement. According to Stiger, the greatest of these issues is the hit to your compounding returns:

You lose the opportunity to benefit from tax-deferred or tax-exempt compounding, says Stiger. When you withdraw funds early, you miss out on the power of compounding, which is when your earnings accumulate to generate even more earnings over time.

Of course, the loss of compounding is a long-term effect that you may not feel until you get closer to retirement. A more immediate risk may be your current tax burden since your distribution will likely be considered part of your taxable income.

If your distribution bumps you into a higher tax bracket, that means you will not only be paying more for the distribution itself, but taxes on your regular income will also be affected. Consulting with your certified public accountant or tax preparer can help you figure out how much to take without pushing you into a higher tax bracket.

The easiest way to avoid these risks is to resist the temptation to take an early 401 withdrawal in the first place. If you absolutely must take an early distribution, make sure you withdraw no more than you absolutely need, and make a plan to replenish your account over time. This can help you minimize the loss of your compound returns over time.

Continued Growth Vs Inflation

Remember that your retirement savings accounts don’t grind to a halt when you begin retirement. That money still has a chance to grow, even as you withdraw it from your 401 or other accounts after retirement to help pay for your living expenses. But the rate at which it will grow naturally declines as you make withdrawals because you’ll have less invested. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

You also need to take inflation into account. This increase in the cost of things we purchase typically comes out to about 2% to 3% a year, and it can significantly affect your retirement money’s purchasing power.

How We Chose The Best Small Personal Loans

Investopedia is dedicated to providing consumers with unbiased, comprehensive reviews of personal loan lenders for all borrowing needs. We collected over twenty five data points across more than fifty lenders including interest rates, fees, loan amounts and repayment terms to ensure that our content helps users make the right borrowing decision for their needs.

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

Youll Still Need To Be Mindful Of Taxes

Youll still owe income tax on your distribution from any tax-deferred retirement account. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

Also worth noting: The income can be claimed all at once in 2020 for tax purposes, or spread evenly over the next three years. In many cases, dividing it evenly over three years may result in a better tax situation, as its less likely to bump you into a higher tax bracket in any single year.

If your income is expected to be lower in 2020 than the subsequent two years, though, it could make sense to claim all of the income on your 2020 tax return. Not only might this minimize the effective tax rate you pay on this income, but youll also have two years to pay back the distribution and ultimately get a refund.

Keep in mind that if you have a Roth IRA, it may still be a better choice for withdrawals than your 401 or IRA. Thats because savers can always withdraw contributions from their Roth IRA penalty- and tax-free.