How Do I Transfer An Old 401 To My New Job

Even if youre happy at your job, its always a good idea to keep your options open. If youre considering a move to a new company, one of the first things youll need to do is figure out what to do with your old 401. Fortunately, transferring an old 401 to your new job is usually a pretty straightforward process.

So, if youre planning a job change, dont forget to take care of your retirement savings. With a little effort, you can ensure that your hard-earned money stays right where it belongs in your pocket.

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year.

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if youre leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employers 401

- Withdrawal from your 401, which would trigger a 10% penalty if you arent 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesnt offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration wont allow you to stay invested for some other reason

- Your new employers 401 plan charges high fees, offers limited investments, or has other drawbacks

- Youd prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an NUA strategy that could save you a lot of money.)

If these downsides arent deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

You May Like: How Much Is Taxed On 401k Early Withdrawal

Don’t Miss: Is 401k Rollover To Ira Taxable

Eligibility And Procedures For Cash Withdrawals And Loans

Following is information on when you may qualify for a loan from your U-M retirement plans, when you may qualify for a cash withdrawal, and the procedures to request a loan or cash withdrawal.

-

Loans may be available from your retirement accounts as follows:

-

Basic Retirement Plan No loans are available at any time.

-

403 SRA You may borrow from your 403 SRA at any time, for any reason, regardless of whether your employment is active or terminated. However, loans are not available from TIAA once you have retired or terminated employment from U-M.

-

457 Deferred Compensation Plan You may borrow from your 457 Deferred Compensation Plan account at any time, for any reason, regardless of whether your employment is active or terminated. However, loans are not available from TIAA once you have retired or terminated employment from U-M.

To arrange for a 403 SRA or 457 Deferred Compensation Plan loan, contact TIAA or Fidelity and request a loan application. University authorization is not needed to take a loan.

Read Also: Can Roth 401k Be Converted To Roth Ira

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will likely trigger a lump-sum distribution.

If you do not need your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

Don’t Miss: Where Does Your 401k Go When You Leave A Job

What Happens To My 401 If I Quit My Job

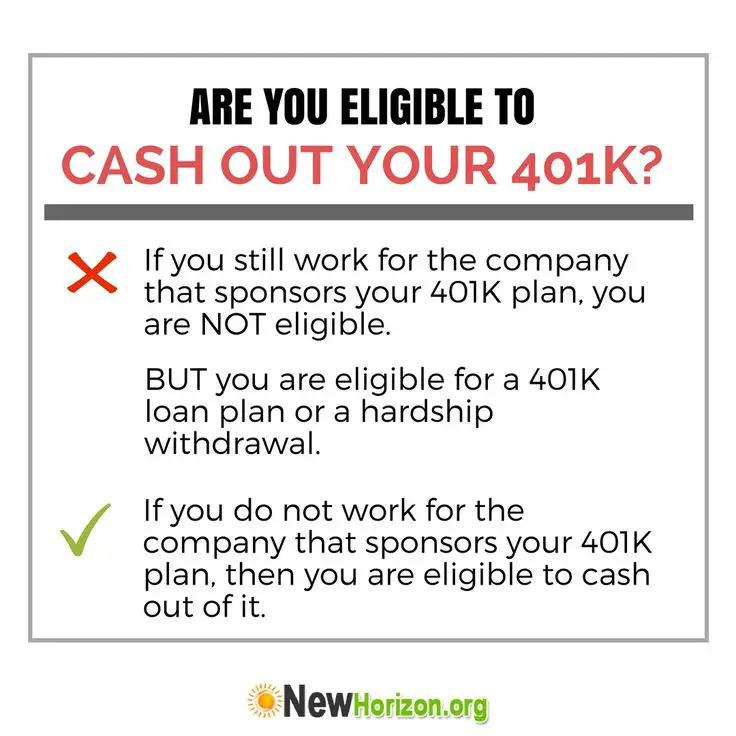

When you leave a job, you have several options for what to do with your 401.

You can cash it out, leave it with your old employer, or roll it into an IRA. Each option has different tax implications, so choosing the one thats best for your situation is important.

If you cash out your 401, youll have to pay taxes on the amount you withdraw. You may also be subject to a 10% early withdrawal penalty if youre younger than 59 1/2. If you decide to leave your 401 with your old employer, youll still be subject to taxes and penalties if you withdraw the money before retirement. However, leaving your money in a 401 can be a good way to keep it invested and grow over time.

Rolling over your 401 into an IRA is another option. With an IRA, youll have more control over how your money is invested. And, if you roll over your 401 into a Roth IRA, your withdrawals in retirement will be tax-free. Talk to a financial advisor to find out which option is best for you.

- You can keep your 401 with your former employer or transfer it to a new employers plan.

- You can also convert your 401 into an Individual Retirement Account via a 401 rollover.

- Another choice is to withdraw your 401, which may result in a penalty and taxes on the entire amount.

A 401 Is More Secure From Creditors

What happens to your retirement money in the event of a bankruptcy or an adverse lawsuit? The 401 is more secure from creditors than the IRA.

The real advantage of a 401 is that in most states the 401 is protected from creditors and lawsuits, except for the IRS and a spouse, says Lackwood. Otherwise, the individual is protected and should keep funds in a 401 until the lawsuit or any concerns are removed.

Individuals can roll over a 401 into an IRA when they leave an employer, but many may choose not to do so, because of the relative lack of security in an IRA, says Lackwood.

Read Also: How Do I Get A 401k Loan

Don’t Miss: How To Get Money Out Of My 401k Plan

Which Assets Should You Draw From First

You may have assets in accounts that are taxable , tax-deferred s, and tax-free . Given a choice, which type of account should you withdraw from first?

The answer isâit depends.

- For retirees who dont care about leaving an estate to beneficiaries, the answer is simple in theory: withdraw money from taxable accounts first, then tax-deferred accounts, and lastly, tax-free accounts. By using your tax-favored accounts last, and avoiding taxes as long as possible, youll keep more of your retirement dollars working for you.

- For retirees who intend to leave assets to beneficiaries, the analysis is more complicated. You need to coordinate your retirement planning with your estate plan. For example, if you have appreciated or rapidly appreciating assets, it may be more advantageous for you to withdraw from tax-deferred and tax-free accounts first. This is because these accounts will not receive a step-up in basis at your death, as many of your other assets will. A step-up in basis is used to calculate tax liabilities for your beneficiaries.

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Read Also: Can I Cash In My 401k

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Traditional And Roth Iras

What do you do if you have maxed out your 401 but want to save even more? Thankfully, there are options available to you, including traditional IRAs and Roth IRAs.

You can contribute up to $6,000 to either type of IRA in 2022 and $6,500 to either type of IRA in 2023. If youre age 50 or older, you can add a $1,000 catch-up contribution.

Traditional IRAs and 401s are funded with pre-tax contributions. You get an upfront tax deduction and pay taxes on withdrawals in retirement. The Roth IRA and Roth 401 are funded with after-tax dollars. That means you dont get an upfront tax break, but qualified distributions in retirement are tax-free.

If you or your spouse is covered by a retirement plan at worksuch as a 401the tax deduction for your traditional IRA contributions will be limited. With Roth IRAs, the amount you may contribute will be limited by the amount of your annual earnings.

Recommended Reading: How Do You Find Out About Your 401k

Withdrawing From A 401 After Leaving The Company Without A Penalty

In any of the following situations, you may qualify for early withdrawal without being subjected to any penalty:

-

If you leave a company the same year you turn 55 years old

-

If you suffer from total or permanent disability

-

If you cash out in equal installments spread over an expected period of your remaining lifetime

-

If you need to pay for medical expenses, which are more than 10% of your income

-

If as a military reservist, you have been called to active duty

How Service Providers Get Paid From Plan Assets

Most people dont know how 401 plan service providers get paid, and they may even assume their plan is free. Even with increased fee disclosure, its not always clear where the money comes from and where it goes. How does it happen? This page will give you a basic understanding of how 401 plan assets turn into revenue for service providers, and why its important to watch asset based fees over time.

Dont Miss: What To Do With 401k When You Retire

Read Also: How Does A 401k Benefit The Employer

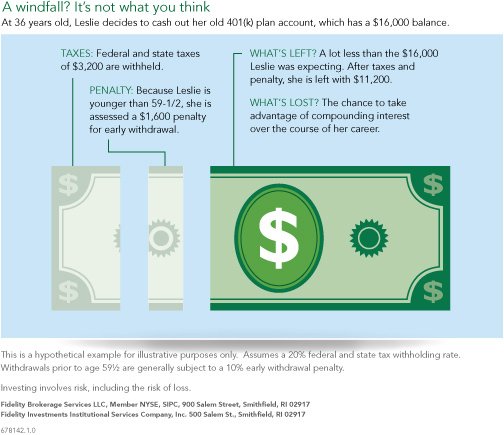

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59.5 is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

Receiving Your Money Takes Time

It often takes several weeks to cash out a 401 plan. Some plans for smaller companies have the right to allow account distributions only once per quarter or once per year. There is a 401 summary plan description document that will spell out the rules for your plan. The plan must follow its own rules.

It can feel as though your former employer is making it difficult for you to cash out your 401 plan, but there are strict rules they must follow, along with having all of the proper paperwork completed before they can distribute your money to you.

Read Also: Can You Cash Out A 401k After Quitting

Most People Have Two Options:

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

It Can Be Done But Do It Only As A Last Resort

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If your employer allows it, its possible to get money out of a 401 plan before age 59½. Taking that route is not always advisable, though, as early withdrawals deplete retirement savings permanently and, minus a few exceptions, carry a 10% penalty and a substantial income tax bill.

If you have no better alternatives and decide to proceed, youll need to get in touch with your human resources department. Theyll give you some paperwork to fill out and then ask you to provide some documentation. Once thats done, you should eventually receive a check with the requested funds.

Recommended Reading: Can You Invest 401k In Stocks

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Can You Withdraw Money From A 401 Early

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

If the answer is yes, you will need to determine the type of withdrawal that you want to make, fill out the necessary paperwork, and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Don’t Miss: How To Select 401k Investments

Consult With A Financial Advisor

Before making any decisions about your 401k, its important to consult with a qualified financial advisor. A financial advisor can help you understand your options and make sure you are making wise decisions. The advisor can also help you understand the fees associated with different types of 401k plans and the tax implications of cashing out.

When consulting with a financial advisor, be sure to ask questions such as: What are my options for accessing my 401k funds? What are the potential risks associated with cashing out my 401k? What other strategies could I use to access the funds I need?