How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

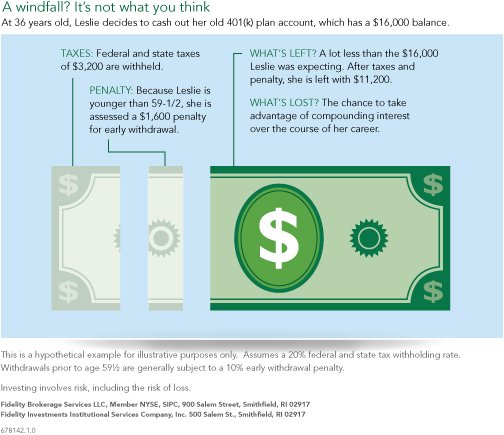

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which youd need to put in a retirement account within 60 days to avoid taxes and penalties.

Also Check: When Can I Take My 401k Out Without Penalty

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Consider Converting Your 401 To An Ira

Individual retirement accounts have slightly different withdrawal rules from 401s. So, you might be able to avoid that 10% 401 early withdrawal penalty by converting your 401 to an IRA first. s and IRAs, of course.) For example:

-

Theres no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You still have to pay the tax when you file your return, though. So if youre in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds.

Also Check: Can You Move Money From 401k To Ira

Taxes On Rolling Over A 401 Account

There are a few instances where you may want to transfer funds from an employers 401 into another account. The most common situation is when you leave an employer and want to transfer funds from your previous employer into your new employers 401, or into your own individual retirement account .

Whenever you withdraw money from a 401, you have 60 days to put the money into another tax-deferred retirement plan. If you transfer the money within 60 days, you will not have to pay any taxes or penalties on your withdrawals. You will need to say on your tax return that you made a transfer, but you wont pay anything. If you dont make the transfer within 60 days, the money you withdrew will add to your gross income and you will have to pay income tax on it. You will also pay any applicable penalties if you withdraw before age 59.5.

If you dont want to worry about missing the 60-day deadline, you can make a direct 401 rollover. This means the money goes directly from one custodian provider) to another without ever being in your hands.

Finally, note that if youre rolling over a 401 into a Roth IRA, youll need to pay the full income tax on the rolled-over amount. However, theres no 10% penalty for doing this before age 59.5.

Taxes Owed On A Traditional 401

If you have a 401, your contributions are funded with pre-tax dollars and are not taxed. However, in the future, you will pay ordinary income taxes on a 401 withdrawal once you start taking the money out.

Such an example underlines the importance of paying close attention to when and how you withdraw money from your 401.

Dont Miss: Is 401k Divided In Divorce

Recommended Reading: Can I Transfer My Ira To A 401k

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How To Use My 401k To Start A Business

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

Withdrawal Rules Frequently Asked Questions

If you participate in a 401 plan, you should understand the rules around separation of service, and the rules for withdrawing money from your account otherwise known as taking a withdrawal. 401 plans have restrictive withdrawal rules that are tied to your age and employment status. If you dont understand your plans rules, or misinterpret them, you can pay unnecessary taxes or miss withdrawal opportunities.

We get a lot of questions about withdrawals from 401 participants. Below is a FAQ with answers to the most common questions we receive. If you are a 401 participant, you can use our FAQ to understand when you can take a withdrawal from your account and how to avoid penalties.

Read Also: Can You Have A Traditional Ira And 401k

Take An Early Withdrawal

Perhaps youre met with an unplanned expense or an investment opportunity outside of your retirement plan. Whatever the reason for needing the money, withdrawing from your 401 before age 59.5 is an option, but consider it a last resort. Thats because early withdrawals incur a 10% penalty on top of normal income taxes.

While an early withdrawal will cost you an extra 10%, it will also diminish your 401s future returns. Consider the consequences of a 30-year-old withdrawing just $5,000 from his 401. Had the money been left in the account, it alone would have been worth over $33,000 by the time he turns 60. By withdrawing it early, the investor would forfeit the compound interest the money would accumulate in the years that follow.

What Exactly Is An Espp

An employee stock purchase plan, or ESPP, is a benefit program in which companies offer their employees stock at a discounted price or a match.

Employees contribute to ESPPs via payroll deductions, which will accumulate the offering period to purchase the discounted shares.

At the end of these periods, your employer will use your funds to purchase the company shares at a discount, allowing you to sell them at market value and earn a profit.

Don’t Miss: How To Open Up A 401k

How Do You Withdraw Money From Your 401 After Retirement

There are a few different ways that you can withdraw money from your 401 after retirement. The most common way is to take out a loan from the account. This is usually the easiest and quickest way to access your funds. Another option is to roll over the account into an IRA. This can be a good choice if you want to keep the money invested for growth. Finally, you can cash out the account entirely. This is usually not recommended, as you will be subject to taxes and penalties on the withdrawal.

Borrowing Money From My 401k

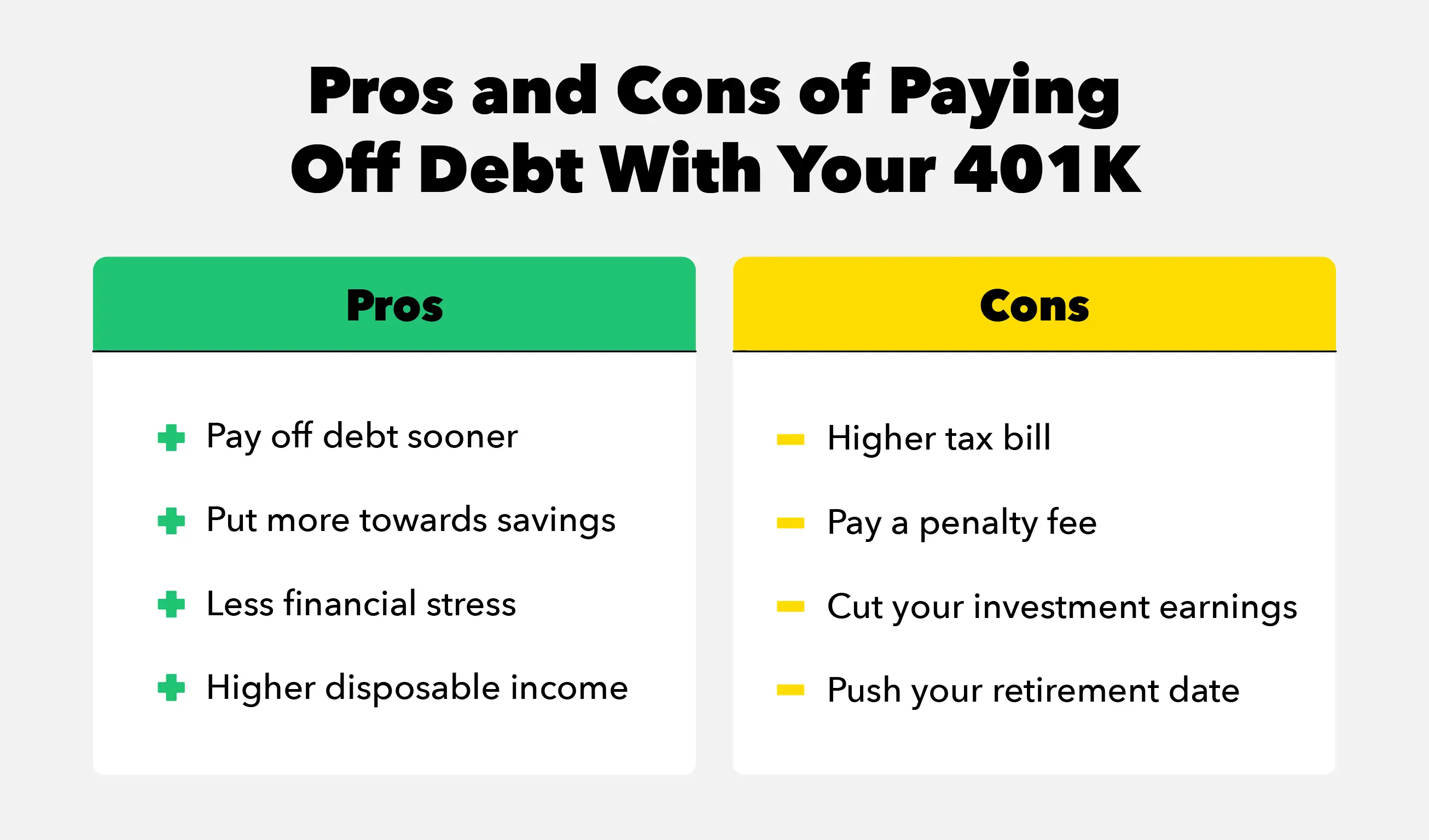

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Recommended Reading: Can I Invest My 401k In Gold

The Rules For Accessing Your Money Are Determined By Your Employer’s Plan

Getty Images/iStockphoto

Whether you can take regular withdrawals from your 401 plan when you retire depends on the rules for your employers plan. Two-thirds of large 401 plans allow retired participants to withdraw money in regularly scheduled installments — say, monthly or quarterly. About the same percentage of large plans allow retirees to take partial withdrawals whenever they want, according to the Plan Sponsor Council of America , a trade association for employer-sponsored retirement plans.

Other plans offer just two options: Leave the money in the plan without regular withdrawals, or take the entire amount in a lump sum. ‘s summary plan description, which lays out the rules, or call your company’s human resources office.) If those are your only choices, your best course is to roll your 401 into an IRA. That way, you won’t have to pay taxes on the money until you start taking withdrawals, and you can take money out whenever you need it or set up a regular schedule.

If your company’s 401 allows periodic withdrawals, ask about transaction fees, particularly if you plan to withdraw money frequently. About one-third of all 401 plans charge retired participants a transaction fee, averaging $52 per withdrawal, according to the PSCA.

Can I Leave My Money In My 401 Plan After I Terminate Employment

It depends upon your account balance and the terms of your 401 plan. The IRS allows 401 plans to automatically cash-out small account balances defined as less than $5,000 without the owners consent upon their termination of employment. Under these rules, account balances between $1,000 and $5,000 must be rolled over into a personal IRA for the benefit of the employee. Amounts below $1,000 can be paid out by check.

To find the cash-out limit applicable to your 401 plan, check your plans Summary Plan Description . If your account exceeds this limit, you can postpone withdrawals until the date you must start taking Required Minimum Distributions.

Read Also: How To Buy Individual Stocks In 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

When Can You Withdraw From A Roth Ira

You can withdraw the contributions you’ve made to a Roth IRA at any time. If you withdraw earnings before age 59 1/2, they’re subject to income taxes and a 10% tax penalty. You can withdraw earnings without a penalty under certain circumstances, including using it for a first-time home purchase and for qualified educational expenses.

You May Like: How To Cancel My Fidelity 401k

Withdrawing From A 401 After Leaving The Company Without A Penalty

In any of the following situations, you may qualify for early withdrawal without being subjected to any penalty:

-

If you leave a company the same year you turn 55 years old

-

If you suffer from total or permanent disability

-

If you cash out in equal installments spread over an expected period of your remaining lifetime

-

If you need to pay for medical expenses, which are more than 10% of your income

-

If as a military reservist, you have been called to active duty

What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

Don’t Miss: How Much Money Should I Put In My 401k

What Happens If My Company Does Not Offer In

No problem! Our model is built on the assumption that youll use Lendtable for many years until you leave your employer. You do not need to pay your Lendtable Balance until you leave your employer, hit retirement age and are able to withdraw your funds, or choose to cancel your Lendtable service. No matter how long you use Lendtable, our 20% profit-share rate stays the same.

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

career counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

Read Also: What Is The Deadline For Setting Up A 401k Plan