How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward. Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use the forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Pick The Financial Services Company You Will Work With

Pick one firm that will serve as the custodian for your retirement account. If you manage your own investments, you might pick Vanguard, Fidelity, or Charles Schwab. If you work with a financial advisor, they will have a brokerage firm or custodian they use and will open the account you need there.

Some people mistakenly think they need to spread their money across multiple companies to be diversified. That is not true. You can open an account at one company and inside that account, spread your money across multiple types of investments.

Using a well-established custodian helps you protect your accounts from numerous types of fraud, and having your money with one firm makes managing your retirement money and retirement distributions much easier.

Recommended Reading: What Happens To A 401k When You Leave A Company

Transferring Your Old 401 Funds Into A New 401 Isnt Always Possible

Rolling over into a new 401 is not always possible or as easy as rolling over into an IRA. The new company youre going to might not offer a 401 or have restrictions on rolling over 401 accounts from previous employers. There can also be a lag before you start a new job and when a 401 account is made available to you at that new job.

If it is possible then its definitely worth considering. Just be aware that youll eventually need to roll over into an IRA when you leave the new employer, or down the line.

IRAs on the other hand, are never tied to your employer. Rolling your 401 over into an IRA allows you to continue growing your retirement savings in a tax-effective way, while also giving you more control over your investments.

REASON 3

Con: Should You Rollover To An Ira

When deciding whether or not to rollover your 401 to IRA, you should weigh the pros and cons of rolling over 401 to IRA to determine the option that protects your assets. Remember, the funds in your 401 are your retirement savings, and you should make a decision that preserves your savings in your golden years. If you are ready to make the switch, use Beagle to find your 401 and see how much you can save by moving to a better IRA.

Tags

Recommended Reading: How Can I Invest My 401k

Which Types Of Distributions Can I Roll Over

IRAs: You can roll over all or part of any distribution from your IRA except:

Retirement plans: You can roll over all or part of any distribution of your retirement plan account except:

Distributions that can be rolled over are called “eligible rollover distributions.” Of course, to get a distribution from a retirement plan, you have to meet the plans conditions for a distribution, such as termination of employment.

How To Roll Over Your 401 To An Ira

The easiest and safest way to roll over your 401 into an IRA is with a direct rollover from the financial institution that manages your 401 plan to the one that will be holding your IRA. Note there are three key types of rollovers from a 401 to an IRA:

Your plan administrator can guide you through the process, and the financial institution where your money is going will usually be more than happy to assist. In many cases, your plan administrator will give you a check made out to your new IRA custodian for you to deposit there. Thus, open your new IRA first, then contract the plan administrator for of your former employer.

Recommended Reading: How To Find Out How Much 401k I Have

Tax Consequences Of A 401

As mentioned above, you generally wont have to pay any taxes on your 401-to-IRA rollover. The only time youll have to deal with taxes is if you have a traditional IRA and want to roll over to a Roth IRA.

One other tax consideration: You can choose to do a direct or indirect rollover. For a direct rollover, your old plan sends the money directly into your new IRA. In an indirect rollover, your old plan sends you a check with the cash and withholds 20% of your funds. These withheld funds are a taxable distribution unless you make up the difference out of pocket. Youll likely have to pay a 10% fine for the early withdrawal. This rule only applies if the check is sent directly to you, though. It doesnt matter if your old plan sends you a check to forward to your new IRA.

What You Contribute To A 401 Is Yours To Keep

All the money you’ve contributed to a company retirement plan is still yours. If you were eligible for an employer match, you may also have rights to your employer’s contributions, depending on your vesting schedule. A company may require up to five years before granting you complete ownership to its contributions.

Read Also: How To Generate Income From 401k

What Happens With A 401 Loan When I Move To A Different Company

Most 401 retirement plans allow you to take out loans, which usually must be repaid within five years. If you change employers, however, the clock speeds up and a loan youve taken out from your 401 may be due in full very quickly. Even worse, you may face serious tax consequences if you cant repay it.

Also Check: How Long Does A 401k Rollover Take

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

Recommended Reading: How Do I Start My Own 401k

Roll Over Your 401 To A Roth Ira

If you’re transitioning to a new job or heading into retirement, rolling over your 401 to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free.2

- Pros

-

- You can roll Roth 401 contributions and earnings directly into a Roth IRA tax-free.2

- Any additional contributions and earnings can grow tax-free.2

- You are not required to take RMDs.

- You may have more investment choices than what was available in your former employer’s 401.

- Your Roth IRA provider may offer additional services, such as investing tools and guidance.

- You can consolidate multiple retirement accounts into a single Roth IRA to simplify management.

- Cons

-

- You can’t borrow against a Roth IRA as you can with a 401.

- Any Traditional 401 assets that are rolled into a Roth IRA are subject to taxes at the time of conversion.

- You may pay annual fees or other fees for maintaining your Roth IRA at some companies, or you may face higher investing fees, pricing, and expenses than you did with your 401.

- Some investments offered in a 401 plan may not be offered in a Roth IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

Ira Rollover Benefit : Lower Fees

In addition to limited investment options, some employer-sponsored 401 plans have high administrative fees. These fees are not enough to make contributing to the plan a bad deal, but it makes more sense to keep those retirement assets growing in a similarly tax-advantaged option. IRAs tend to have lower fees, if any, depending on where and how you open the accountsay, a banking institution or online bank, or through a financial advisor.

Recommended Reading: Is A 401k A Defined Benefit Plan

Contact Your Current 401 Provider And New Ira Provider

Ideally, you want a direct rollover, in which your old 401 plan administrator transfers your savings directly to your new IRA account. This helps you avoid accidentally incurring taxes or penalties. However, not every custodian will do a direct rollover.

In many cases, youll end up with a check that you need to pass on to your new account provider, Henderson says. Open your new IRA before starting the rollover so you can tell the old provider how to make out the check.

The goal, Henderson says, is to avoid having to ever put the money into your personal bank account.

You only have 60 days to complete the transaction to avoid it being a taxable event, and its best to have everything set up before getting that check, Henderson says.

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Read Also: How To Set Up A 401k Account

Option : Cashing Out Your 401

While withdrawing your money is an option, in most circumstances, it means those funds will not be there when you need them in retirement. In addition, cashing out your 401 generally means you’ll have to pay taxes on the withdrawal, and there’s typically an additional 10% tax penalty if you’re younger than 59½, unless you left your employer in the calendar year you turned 55 or older.

Net unrealized appreciation: special considerations for employer stockIf you own stock in your former employer and that stock has increased in value from your original investment, you may be able to receive special tax treatment on these securities. This is referred to as net unrealized appreciation . If you roll the employer stock into a traditional or Roth IRA or move it to your new employers plan, the ability to use the NUA strategy is lost. NUA rules are complex. If you’re considering NUA, we suggest consulting with a tax professional prior to making any decisions on distributions from your existing plan.

Should I roll over my 401?The decision about whether to roll over your 401 is dependent on your individual situation. A financial advisor will work with you to help identify your goals and determine what’s important to you. By understanding your investment personality, he or she will be able to advise if rolling over your 401 is the best option for you.

Con: Loss Of Access To Credit Facilities

Generally, 401 plans cap the number of times account holders can make withdrawals from their accounts. However, if you need funds urgently, you can take a 401 loan and use the retirement savings as collateral. This privilege is lost when you transfer your funds to an IRA, which does not offer loans. However, you can take an early distribution to pay certain expenses without paying taxes or early-withdrawal penalties.

Recommended Reading: Can I Borrow Against 401k

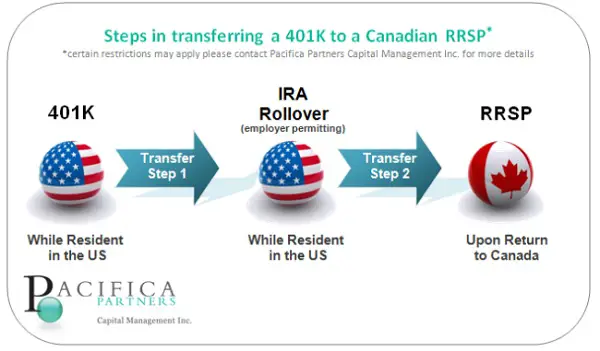

Transferring A 401 Or Ira To Canada

Issues and strategies for Canadians thinking about transferring their U.S.-based retirement plans

Clients who lived and worked in the United States may have accumulated retirement savings in U.S. plans. Or they may have inherited a U.S. plan on the death of a spouse or received a portion of a U.S. plan from a former spouse. As a result, theyre probably considering whether to consolidate the U.S.-based plan with their RRSP.

This article focuses on issues and strategies for Canadian residents who arent U.S. citizens, green-card holders or otherwise considered U.S. persons for U.S. tax purposes. Should they transfer their U.S.-based retirement plans specifically a 401 or individual retirement account to Canada?

Roth 401 To Roth Ira Conversions

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

However, you should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

Read Also: Can You Have A Roth Ira And A 401k

Why Would You Convert Your Ira Or 401k Account To A Roth

Carefully consider the reasons whether to convert your IRA or 401k account to a Roth.

getty

Are you worried that federal income taxes will increase in the future due to the burgeoning federal debt? If that possibility concerns you, you might be thinking you should convert your traditional IRA and 401k retirement savings accounts to a Roth account to save money on your taxes.

Before you decide, youll want to consider the good reasons people choose to convert part or all of the money in their traditional 401k and IRAs to a Roth account and whether those reasons will work in your favor.

First, lets look at the key features of traditional vs. Roth IRAs and 401k accounts.

Key features of Roth vs. traditional 401k and IRAs

With traditional IRAs and 401k accounts, you arent taxed on the money you save each year, and you wont be taxed on your investment earnings until you make withdrawals. When you begin withdrawing from those accounts in retirement, the money you withdraw is subject to federal income taxes. You might also have to pay state income taxes depending on your state of residence. For many states , their tax rules follow the federal income tax rules.

When you reach age 72, the required minimum distribution rules require you to withdraw minimum amounts from any traditional IRA and 401k accounts you have and include the withdrawal amounts in your total taxable income.

In addition, Roth IRAs arent subject to the RMD rules, but Roth 401k accounts are.

How To Transfer Old 401s To An Ira

Elizabeth Waugh / Photolibrary / Getty Images

As you get near the point where you need income from your retirement accounts, it is likely you will want to transfer old 401s to an IRA to simplify the process of managing your retirement money.

Many people are not aware they can combine most of their retirement accounts into a single IRA.

If you have a 401 plan that you need to transfer to an IRA, here are the steps to take.

Recommended Reading: How Much Does 401k Cost Employers

How To Roll Over An Old 401

8 Minute Read | September 27, 2021

Back in the old days, it was pretty common for someone to work for the same company for 40 years before retiring with a nice pension and a gold watch. Well, those days are long gone.

A recent study found that the youngest baby boomers worked 12 different jobs over the course of their careers.1 Did you hear that? Twelve! And younger generations are even more likely to look for greener employment pastures. In fact, almost a third of millennials say they would quit their jobs as soon as possibleif they could.2

But in the process, many American workers are leaving behind a trail of forgotten 401s, sometimes with thousands of dollars in retirement savings left behind!

Theres even a name for those retirement accounts that are left behind: orphan 401s. Even the name is sad! Its time to stop for a minute and think about giving the money in those long-forgotten accounts a new home.

Thats where rollovers come in.