Learn How Much You Can Deposit Into These Savings Vehicles

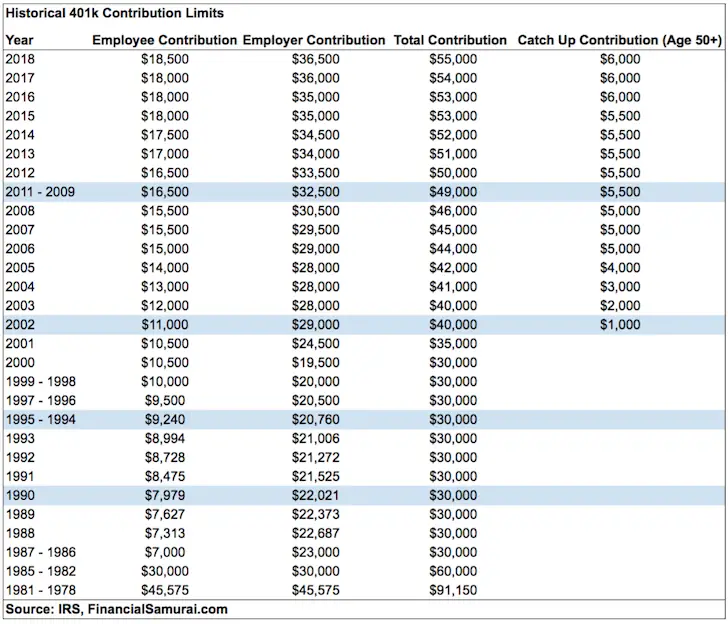

The contribution limit for a designated Roth 401 increased $1,000 to $20,500 in 2022. Accountholders who are age 50 or older may make additional catch-up contributions of up to $6,500. This means the total contribution can reach as much as $27,000.

Employers can make contributions to a Roth 401 by matching employee contributions up to a certain percentage or dollar amount. They can also make elective contributions that don’t depend on employee contributions.

The Internal Revenue Service adjusts contribution limits each year based on inflation. For 2022, the limit on employee and employer contributions is $61,000 or 100% of employee compensation, whichever is lower. Workers who are age 50 and over can add a $6,500 catch-up contribution for a total of $67,500.

How Much Should You Save For Retirement

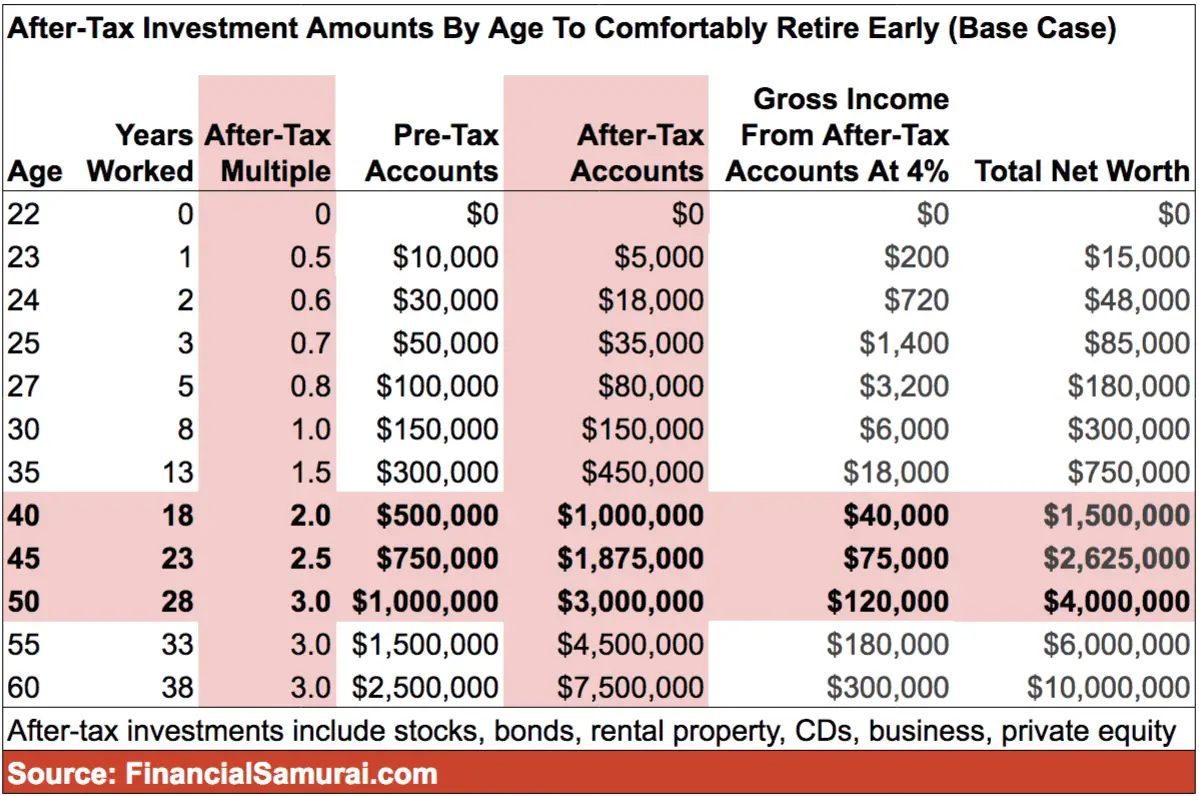

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

What Percent Should I Contribute To A 401

Brewer suggests that your contributions should be based on a percentage of your income, depending on your age. She recommends that you stash away between 10 percent and 15 percent of your gross income if youre in your 20s and 30s, or if you started saving during those years. If youre behind in retirement savings in your 40s and 50s, Brewer encourages you to set aside between 15 percent and 25 percent of your income.

If youre not saving anything for retirement right now and want to get started, start with at least 3 percent to get going, Brewer says. Increase your contribution by at least 2 percent each year and do a larger increase in years where you get a big raise until you hit your target savings percentage.

Read Also: What Is The Difference Between A Pension And A 401k

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

Highlights Of Changes For 2020

The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan is increased from $19,000 to $19,500.

The catch-up contribution limit for employees aged 50 and over who participate in these plans is increased from $6,000 to $6,500.

The limitation regarding SIMPLE retirement accounts for 2020 is increased to $13,500, up from $13,000 for 2019.

The income ranges for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements , to contribute to Roth IRAs and to claim the Saver’s Credit all increased for 2020.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or his or her spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. Here are the phase-out ranges for 2020:

Read Also: How To Check My 401k Balance

How Much Should You Save For Retirement In A 401

Experts recommend that workers save at least 15% of their income for retirement, including any employer match. For instance, if your employer contributes 3% then you would need to save an additional 12%.

If you arent saving that much right now, increase your contribution each year until you reach that goal. For example, if you are saving 3% now, increase that to 5% in 2022 then bump that up to 7% in 2023 and so on util you reach 15%.

How Much Should You Contribute To Your 401

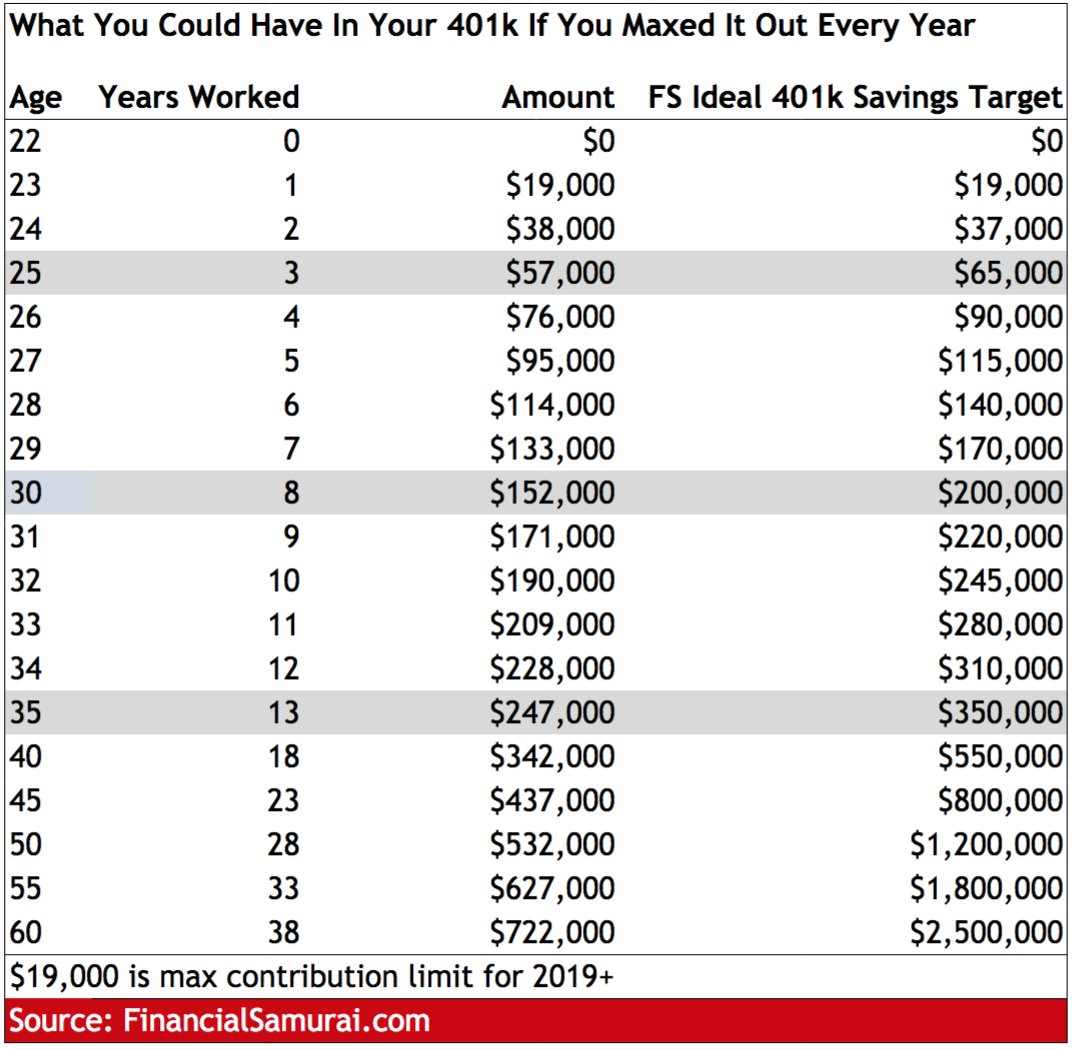

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2019 is $19,000, and those age 50 or older can contribute an extra $6,000. In 2020, you can contribute a maximum of $19,500. Those age 50 or older will be able to contribute an additional $6,500. However, you can use our 401 calculator to figure out how much you can expect to earn based on any contribution amount you choose.

Recommended Reading: Can I Roll My 401k To A Roth Ira

Next Steps To Figuring Out How Much To Put In Your 401

If youre unsure about how much you can afford to contribute to your 401, check out our paycheck impact tool that can help you calculate an exact number based off your salary and employer match options. If your employer doesnt offer a 401 matching plan, dont fret. There are still many ways you can save for retirement.

Get The Maximum Match

If your company matches, you should always contribute at least enough to get the full match amount every year. Heres an example of what that might look like:

If your company has a 100% up to 5% match, this means they will match you dollar for dollar, up to 5% of your pay that you deposit into your 401 account. If you make $100,000, you will need to contribute at least $5,000 to get the maximum match of $5,000 annually. If you dont contribute at least $5,000, you will be leaving money on the table that otherwise would have been yours. Dont cheat yourself out of this money! Your future self will thank you.

If you are only contributing the minimum to get the maximum match, keep aware of any increases your company may make to their matching contributions. If you can, you should increase your contributions accordingly to continue to receive the maximum match.

You May Like: What Is The Max Percentage For 401k

Don’t Have A 401 Option To Begin With

If your job doesn’t offer a 401 plan, making consistent IRA contributions is a good retirement goal for the new year. The IRA contribution limit has not changed, as individuals can still contribute up to $6,000 total between their traditional IRA and Roth IRA accounts. IRA savers ages 50 and older can make an annual catch-up contribution up to $1,000 in 2022 , or $7,000 total.

The Contribution Limits Also Apply To Roth 401 Contributions

Contribution limits for Roth 401 contributions are the same as they are for traditional 401 contributions. That means you can contribute up to $19,500 per year to either a regular 401 plan, or a Roth 401 plan.

More likely, you will want to contribute to both, in which case youll have to allocate how much of the $19,500 limit will go into each part of your 401.

Not coincidentally, the 401 limits are virtually the same as the limits for both the 403 plan and the Thrift Savings Plan .

In addition, any employer matching contributions to the plans are not included in the employee contribution limits listed above.

Your employer can contribute a matching contribution that exceeds the $19,500 regular contribution limit, or even the combined $26,000 limit if you are age 50 or older. It is always a good idea to figure out whether a Roth 401k vs Roth IRA is best for you.

You May Like: Should I Transfer 401k From Previous Employer

How Much Can A Highly Compensated Employee Contribute To 401k

If you qualify as a highly compensated employee and it limits your 401 contributions more than youd like, you can always use a different type of retirement account. You can instead open an individual retirement account , but your contributions are limited to $6,000 or $7,000 if youre 50 or older.

When You Can Withdraw Money From A 401

You generally must be at least 59 1/2 to withdraw money from your 401 without owing a 10% penalty. The early-withdrawal penalty doesn’t apply, though, if you are age 55 or older in the year you leave your employer.

Your withdrawals will be subject to ordinary income tax. And once you reach age 72, you’ll be obligated to take required minimum distributions. One exception: If you’re still working when you hit that age and you don’t own 5% or more of the company you’re working for, you don’t have to take an RMD from the 401 that you have through that job.

Recommended Reading: How To Rollover 401k When You Change Jobs

Save For Health Care Costs

Contributing to a health savings account can reduce out-of-pocket cost for expected and unexpected health care expenses. For 2020, eligible individuals can contribute up to $3,550 pre-tax dollars for an individual plan or up to $7,100 for a family plan.

The money in this account can be used for qualified out-of-pocket medical expenses such as copays for doctor visits and prescriptions. Another option is to leave the money in the account and let it grow for retirement. Once you reach age 65, the funds are tax-free when you use them for qualified medical expenses. If you spend the funds in other ways, they are taxed as income with no penalties.

What Are Roth 401 Contribution Limits

Contribution limits for Roth 401 plans are the same as traditional 401 plans

-

Maximum salary deferral: $20,500 in 2022

-

Catch up contributions : $6,500 in 2022, 2021, and 2020

While contribution limits are the same for Roth and traditional 401 plans, a Roth 401 is treated as a separate account within a traditional plan and allows for the contribution of after-tax dollars. Employers can contribute to an employees Roth 401 with matching contributions up to a certain dollar amount or percentage but it will always be through pre-tax contributions. Employers can decide to make elective contributions that arent dependent on employee contributions.

You May Like: When Can You Start Drawing From Your 401k

Retirement Contribution Limits At A Glance

First, the IRS increased the max contribution for 401s and other plans you may have through your employer. Meaning your 401 can hold more money. IRA contribution limits didnt increase, but you can still make good progress toward retirement.

If youre 50 or older, you can continue to set aside more money in your employers plan to help reach your retirement goal. Learn how these catch-up contributions work.

| Account | Catch-up limit |

|---|---|

| Employer-sponsored plans: |

Not ready to max out your accounts? Learn how to gradually increase your contributions.

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2020 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

Also Check: What Is The Best Percentage To Put In 401k

Is It Smart To Start A 401k

While it is ideal to start saving early, the next best time is to invest in retirement right now. If your employer offers a 401 plan, its the smartest place to start investing because of tax benefits, experts say.

Is a 401k a ripoff?

While 401 is not a scam, it is not an option for everyone. Many employers 401 plans come with unfavorable terms, and some workers may not have access to one at all.

Is a 401k ever a bad idea?

Is a 401 a good idea? In short, no. 401k is a terrible investment for most Americans.

How much do I need to start a 401k?

The Basic Cost of a 401 When you decide to start a 401 plan in your business, you will probably have a one-time fee to set it up. This will cover activities such as creating the new plan and educating your employees about the plan. For these services, you can expect to pay anywhere between $ 500 and $ 2,000.

The Maximum You Can Put Into A 401 In 2021 And 2022

-

If youre under age 50, your maximum 401 contribution iso $19,500 in 2021 and $20,500 in 2022.

-

If youre 50 or older, your maximum 401 contribution is $26,000 in 2021 , because you’re allowed $6,500 in catch-up contributions.

For 2021, your total 401 contributions from yourself and your employer cannot exceed $58,000 or 100% of your compensation, whichever is less. For 2022, that number rises to $61,000.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000 and contribute 5% of your salary and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

Also Check: Do Part Time Employees Get 401k

Dont Cash Out Your 401 Early

Another lesson: Whatever you do, dont cash out your 401 savings. If you leave your job, you are allowed to spend your 401 funds if you pay taxes on the amount, including a 10% penalty tax assessed on most withdrawals made before age 59 ½. You may be tempted to take the cash and spend it on a vacation before you start your next job, but thats not a very good idea.

Roll over that retirement money, sign up for the retirement plan with your new employer and take a nice and affordable staycation instead. Your retired self will be very grateful to your working self for making a small sacrifice that could have a big impact down the line.

Why Does The Irs Impose Contribution Limits

Contributions to 401 plans are made using pretax dollars, which provides significant tax benefits. This means you dont have to pay federal income tax for contributions up to the $20,500 limit , which lowers your taxable income. And because earnings in a 401 account are on a tax-deferred basis, dividends and capital gains arent subject to tax until you withdraw your funds.

However, because of the substantial tax benefits offered by 401 retirement plans, the IRS works to ensure that plans do not unfairly benefit company owners and highly compensated employees over non-highly compensated employees. Thats where contribution limits and cost-of-living adjustments come into play. To ensure a 401 plan is structured fairly and not favoring specific employees, all 401 plans must pass a set of annual compliance tests.

Don’t Miss: How Much Is The Max You Can Contribute To 401k

Benefits Of Contributing To Your 401 Plan

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

Can I Reverse 401k Contribution

Usually, when contributions are made to a 401 plan they cannot be withdrawn, even when a pay reversal is made. Instead they are placed in an unallocated account in the plan, where they can be used to offset future costs and contributions, as long as your plan allows for these payments.

Can employees stop 401k contributions at any time?

Yes. In general, traditional 401 plans do not require employer contributions, and employers are allowed to discontinue or reduce their contribution.

Can you change 401k contributions at any time?

Your employer determines how often you can change your 401 contribution. Some employers may allow you to change only once a year, while others may allow you to change as often as you want. From 2019, the maximum you can contribute to a 401 is $ 19,000 per year or your annual salary, which is less.

What happens if you accidentally contribute to 401k?

Get a new W-2 and pay the fees. The excess refund will be added to your total taxable salary for the past year, so a modified W-2 will be issued. Your tax bill will increase as much as the amount of the excess 401 contribution.

Recommended Reading: When Leaving A Job What To Do With 401k

And 2021 Contribution Limits

If youre an employee, in 2021, you may contribute up to $19,500 of your own money to a 401 and $26,000 if youre 50 or older.

These are the 2020 and 2021 limits for specific retirement plans, including 401, 403, 457, and a Thrift Savings Plan.

The limit on total contributions from both the employee and employer cant exceed the lesser of 100% of the employees salary or $58,000 for employees younger than age 50 and $64,500 for those age 50 or older.