How Are The Solo 401k Contribution Limits Calculated

The 2020 Solo 401k contribution limits are $57,000 and $63,500 if age 50 or older . The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Who Does A Solo 401 Make Sense For

A Solo 401 is well suited for those with self-employment income, stable cash flow, no employees , and no plans to hire any in the foreseeable future. While having self-employment income and no employees are requirements, ensuring that there is sufficient cash flow to make contributions is also important.

The plan can also be a fit for those who are self-employed, but only on a part-time basis, and still earn W-2 income from a corporate employer. As a result, contributions can be made to both a Solo 401 and company 401 plan as long as each employer is substantially unrelated. There are also contribution limits that apply.

Recommended Reading: Can You Buy A House With 401k

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $19,500 in 2020 and 2021, or $26,000 in 2020and 2021 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $57,000 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Looking To Reduce Excessive 401k Fees

Sign up for Personal Capital for free and use their Portfolio Fee Analyzer tool. The tool will show you how much in fees youre paying. I had no idea I was paying $1,700 in 401 fees four years ago until I ran the tool.

Now Im only paying about $300 a year in fees. Excessive fees is one of the biggest drags on making more money and retiring earlier.

You can also use Personal Capital to track your net worth, track your cash flow, and optimize your investments.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Filed Under: Entrepreneurship

I started Financial Samurai in 2009 to help people achieve financial freedom sooner, rather than later. Financial Samurai is now one of the largest independently run personal finance sites with 1 million visitors a month.

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

In 2012, I left banking after negotiating a severance package worth over five years of living expenses. Today, I enjoy being a stay-at-home dad to two young children and writing online.

Current recommendations:

Recommended Reading: Can You Withdraw Your 401k If You Quit Your Job

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

You May Like: Can You Get A Loan Using Your 401k As Collateral

Extension Apply To Both Contribution Types Question:

Self-directed 401k contributions deadlines are based on the type of entity sponsoring the solo 401k so you are correct. Please see the following.

- If the entity type is a Sole Proprietorship, the annual solo 401k contribution deadline is April 15, or October 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as an S-Corporation , the annual solo 401k contribution deadline isMarch 15, or September 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as a Partnership , the annual solo 401k contribution deadline isMarch 15, or September 15 if tax return extension is timely filed.

- If the entity type is a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an C-Corporation , the annual solo 401k contribution deadline is April 15, or September 15 if tax return extension is timely filed.

Who Is Eligible For A Solo 401

Solo 401 plans are intended for the self-employed. If you have employees and are looking for a retirement plan, then you have other options such as the or SIMPLE IRA, both of which allow you to provide tax-advantaged benefits to your employees. A lesser-known program called a SIMPLE 401 also allows businesses to set up retirement plans.

While solo 401 plans are intended for one-person businesses, there is an exception. The spouse of the business owner can also participate in the plan. With a spouse in the plan, your small business can really stash away cash for retirement. A qualifying couple could save as much as $114,000 annually in the plan, and even more if they were eligible for catch-up contributions.

Read Also: How Much Does 401k Cost Per Month

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $19,500 in 2020 and 2021.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

Calculations For A Sole Proprietorship Partnership Or An Llc Taxed As A Sole Proprietorship

The annual Solo 401k contribution consists of a salary deferral contribution and a profit sharing contribution. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. The 2021 Solo 401k contribution limit is $58,000 and $64,500 for those age 50 or older.

Don’t Miss: When Can You Start Drawing From Your 401k

Solo 401 Early Withdrawal Rules

Early withdrawal rules for Solo 401s depend on which type of account you have. With a few exceptions, you must pay a 10% penalty tax on withdrawals from a traditional Solo 401 account made before you turn 59 ½, plus income taxes on the amount withdrawn.

With a Solo Roth 401, early withdrawals of contributions are free of the 10% tax penalty and income tax payments, but you pay the penalty and income tax on earnings. You cannot withdraw contributions exclusively from a Roth Solo 401, meaning you will have to pay taxes and a penalty on at least part of your early withdrawal.

What Sole Business Owners Need To Know About Solo 401 Plans

As a sole business owner, a Solo 401 allows you to pay yourself up to $58,000 as both an employee and an employer.

Running your own business is like running a marathon. You may have coaches and people to lend support, but at the end of the day, it all rests on your shoulders.

Thankfully, there are a few benefits to being a lonely entrepreneur: one being a solo 401. These plans are ideal for individuals in charge of their own businesses who want to save more money for retirement. Read on for more details on why a solo 401 could be perfect for you and your business.

Read Also: Can You Use 401k To Buy Investment Property

Total Annual 401 Contribution Limits

Total contribution limits for 2021 are the following:

- $58,000 total annual 401 if you are age 49 or younger

- $64,500 total annual 401 if you are age 50 or older

The dollar amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

Where Did This Answer Come From

With a solo 401, you are allowed to make contributions in the role of employee and the role of employer. Specifically, you are allowed to make:

In this case, your net earnings from self-employment is defined as your businesss profit , minus the deduction for one half of your self-employment tax .

However, there are an assortment of limitations to the above contributions.

Important notes:

- Various amounts in this explanation may be off slightly due to rounding of cents.

- Solo 401 plans are complicated, so its likely a good idea to consult with your tax professional.

Welcome

to read more, or enter your email address in the blue form to the left to receive free updates.

My Latest Book

Don’t Miss: What Happens To My 401k After I Quit

Is A Solo 401k Right For You

You probably won’t miss much when you say goodbye to your traditional 9-to-5, but one of the things that you might regret leaving behind is your 401k. You could struggle to save enough for your future if all you have is an IRA. But there is another option: a solo 401k. These accounts are similar to traditional 401ks, but they’re specifically designed for self-employed workers with no employees.

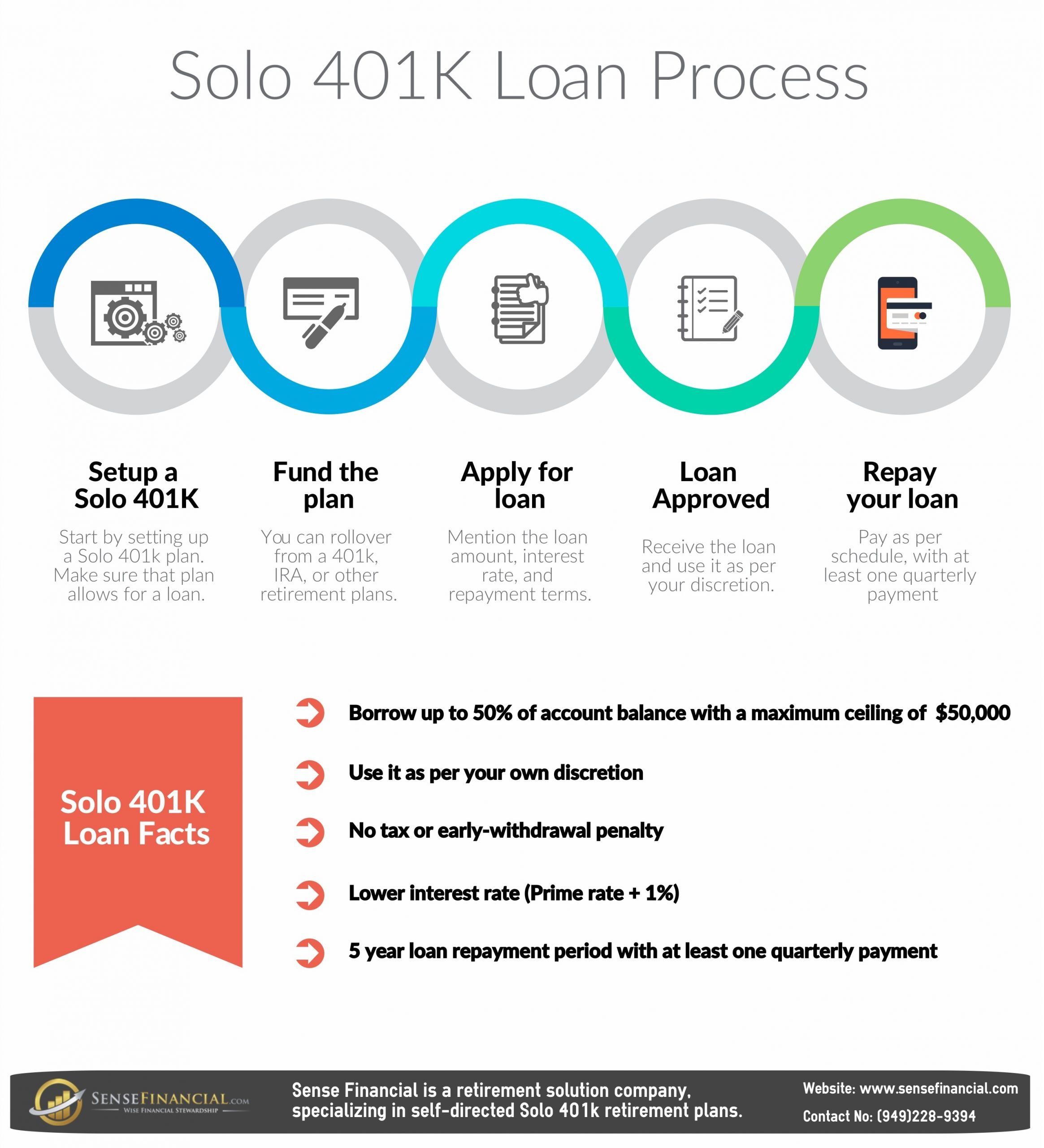

You Can Take A Loan From Your Solo 401

Most Solo 401 providers let account owners take out loans from their accounts. This option is not available with SEP IRAs. With a Solo 401, you can borrow up to the lesser of 50% of the plan value or $50,000. You must pay the loan back in five years or less, unless its used to buy a primary residence. Then you have up to 30 years.

Just because youre borrowing from yourself doesnt mean it wont cost you. Youre required to pay your account interest comparable to what youd pay for a similar non-401 loan. Youll also miss out on potential returns that money would have earned if it had stayed invested. While you will eventually earn what you borrow back, plus interest, that interest rate may be less than the returns the money would have earned if you had left it untouched and invested in the stock market.

You May Like: How Much Can One Contribute To 401k

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

Merrill Edge Individual 401k

Merrill Edge is a Bank of America subsidiary offering an individual 401k.

Fees include $100 for setup and a monthly fee of $20 for businesses with plan assets under $250,000. For businesses above that threshold, the monthly fee is $25.

Merrill Edge allows for loans and has a Roth 401k option. The provider lets you invest in mutual funds or model portfolios from Morningstar Investment Management.

| Broker |

| Yes |

Recommended Reading: What Employees Can Be Excluded From A 401k Plan

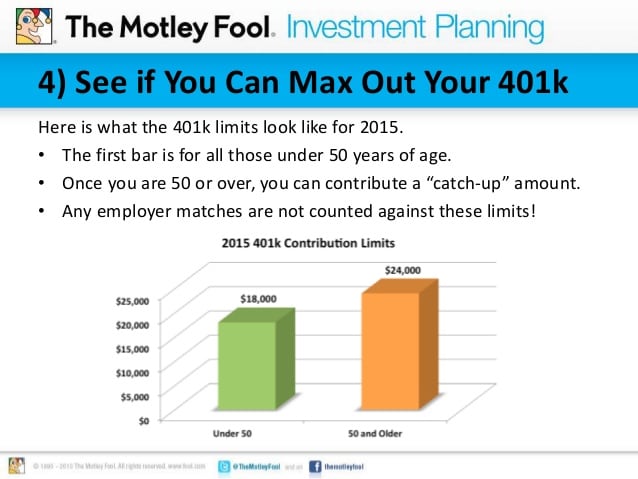

Solo 401 Contribution Limits For 2020

The maximum amount a self-employed individual can contribute to a solo 401 for 2020 is $57,000 if he or she is younger than age 50. Individuals 50 and older can add an extra $6,500 per year in “catch-up” contributions, bringing the total to $63,500. Whether you’re permitted to contribute the maximum, though, will be determined by your self-employment income.

You can sock away so much because you’re allowed to make contributions as both an employee and an employer, though each type of contribution to a solo 401 has its own IRS rules.

For instance, you can contribute up to $19,500 for 2020 as an employee , even if that is 100% of your self-employed earnings for the year. Contributions are made on a pre-tax basis, although some solo 401 providers also offer a Roth 401 option that allows you to invest some or all of your contributions on an after-tax basis. Pre-tax contributions and their earnings will be taxed as regular income when withdrawn in retirement Roth contributions will be tax-free in retirement.

In addition, you effectively can contribute up to 20% of your net self-employment income as an employer , though those contributions must be made with pre-tax dollars. These pre-tax contributions lower your taxable income and help cut your tax bill.

Employee contributions generally must be made by the end of the calendar year, but you have until the tax-filing deadline to make employer contributions.

Solo 401 Contribution Limits For 2019

The maximum amount a self-employed individual can contribute to a solo 401 for 2019 is $56,000 if he or she is younger than age 50. Individuals 50 and older can add an extra $6,000 per year in “catch-up” contributions, bringing the total to $62,000. Whether you’re permitted to contribute the maximum, though, will be determined by your self-employment income.

You are allowed to sock away so much because you can make contributions as both an employee and an employer, though each type of contribution to a solo 401 has its own IRS rules.

For instance, you can contribute up to $19,000 for 2019 as an employee , even if that is 100% of your self-employed earnings for the year. Contributions are made on a pre-tax basis, although some solo 401 providers also offer a Roth 401 option that allows you to invest some or all of your contributions on an after-tax basis. Pre-tax contributions and their earnings will be taxed as regular income when withdrawn in retirement Roth contributions will be tax-free in retirement.

In addition, you effectively can contribute up to 20% of your net self-employment income as an employer , though those contributions must be made with pre-tax dollars. These pre-tax contributions lower your taxable income and help cut your tax bill.

Employee contributions generally must be made by the end of the calendar year, but you have until the tax-filing deadline to make employer contributions.

You May Like: Does Maximum 401k Include Employer Match