How Do I Avoid Tax On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Contact Your 401 Provider

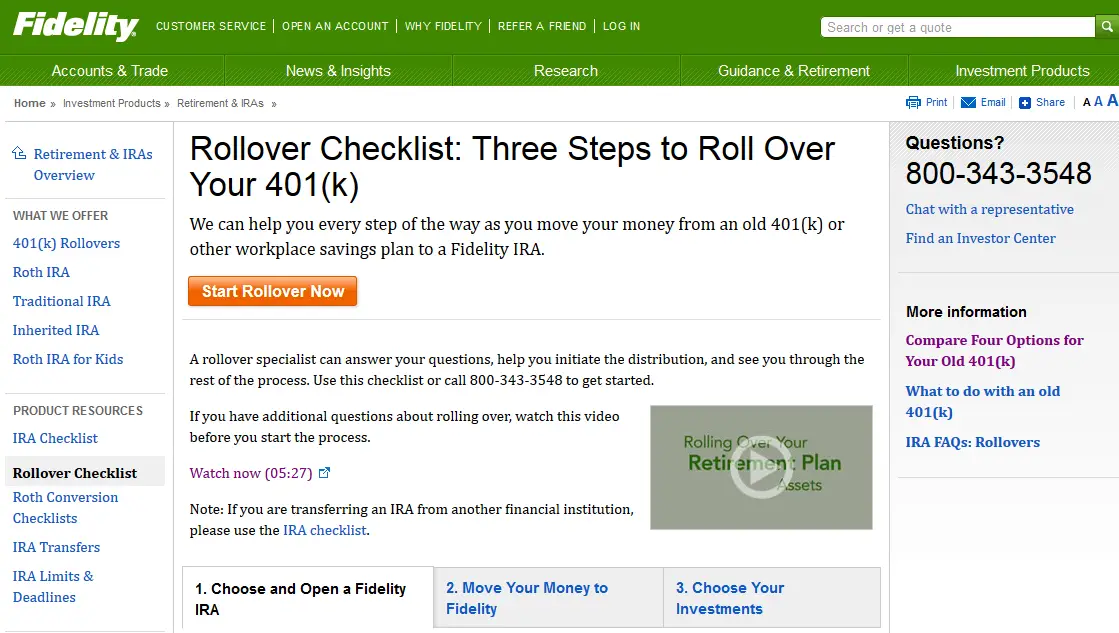

Youre making great progress. You know where your 401 is and you have an IRA at Fidelity to transfer your money into. The next step is to initiate your rollover by contacting your 401 provider.

Often, the easiest way to do this is by phone. Your 401 providers phone number should be visible on an old account statement.

In order for your call to go smoothly, follow these tips:

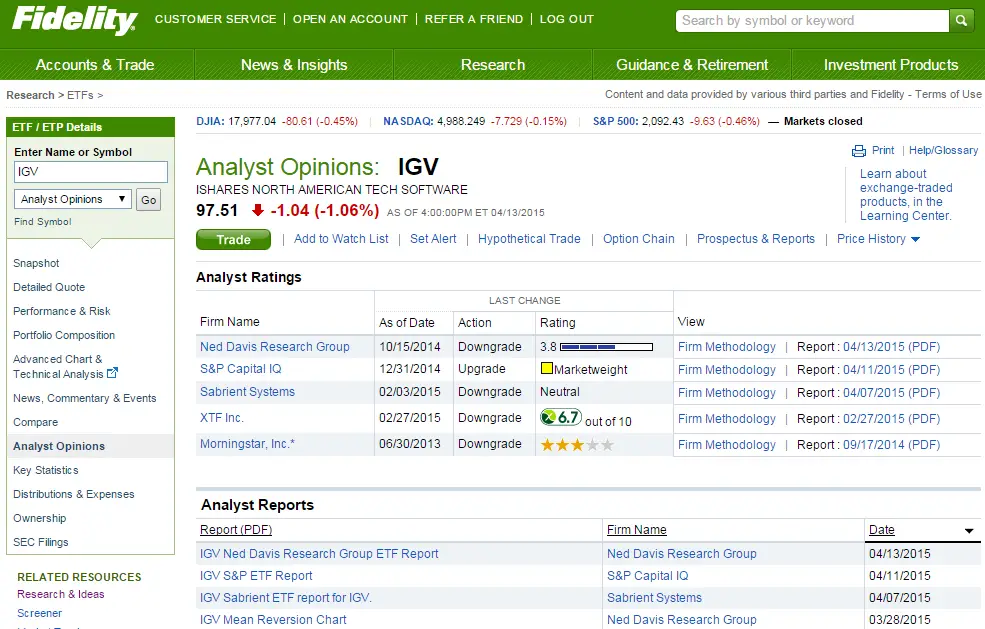

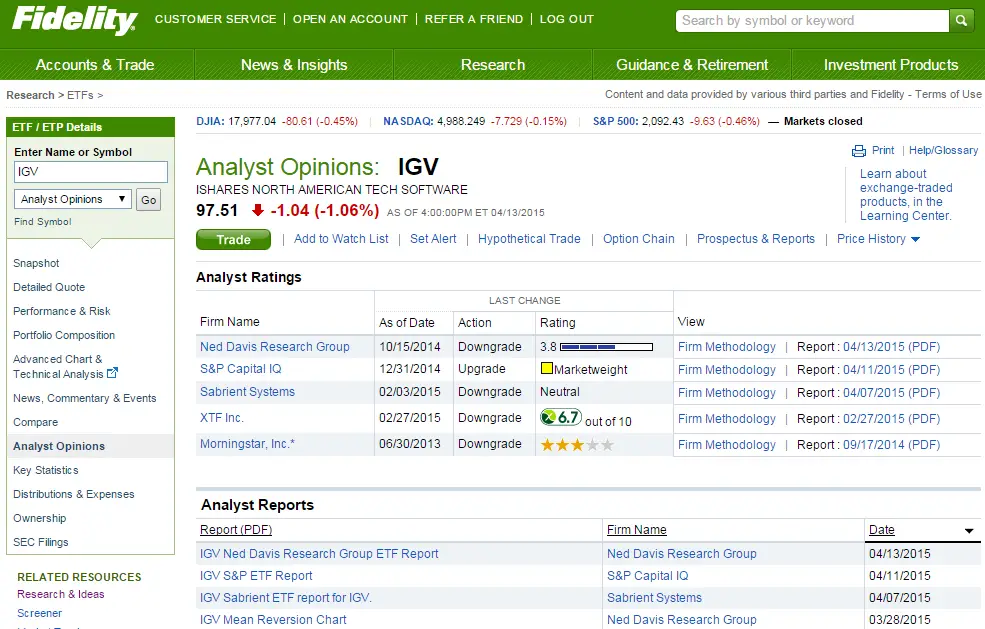

Fidelity Vs Vanguard: Comparing 401 Providers

Fidelity and Vanguard are among the largest fund companies in the world, and both offer 401 plans as parts of their services. Since 401 plans operate under the same tax laws and regulations, there are three main areas of comparison: the companies themselves, the funds offered, and provider features.

Recommended Reading: What Is The Best Fund To Invest In 401k

Advantages And Disadvantages Of Doing A 401 Rollover

Weve already discussed some of the benefits of doing a 401 rollover from an old employer plan to a new one. In this section, lets focus on the advantages and disadvantages of doing a 401 rollover into an IRA.

Advantages:

- Youre an experienced investor, and would prefer to manage your own retirement assets.

- The benefits and costs of using a robo-advisor to manage your money are better than those of the current plan.

- Youre not happy with the investment options in your current plan.

- You have several 401 plans from previous employers, and you want to consolidate them into a single IRA.

- Your new employer either doesnt permit a rollover of an old 401 plan, or doesnt provide the investment options youre looking for.

Disadvantages:

- Youre satisfied with the current plan and the returns its providing.

- By moving retirement funds from a 401 plan to an IRA, youll be giving up certain protections 401 plans provide from creditors and lawsuits.

- You have an immediate need for the funds, due to disability, medical costs, or other distributions that will exempt you from the 10% early distribution penalty.

Contact Your Old 401 Provider

First, identify the provider of your old 401. If you aren’t sure who your old 401 provider is, the name should be on your account statements. If you have trouble finding this information, call your former employer.

Is your old 401 with Fidelity? If so, you can do the entire rollover through your NetBenefits®. account. You don’t need any additional paperwork, and the money can be directly transferred.

Is your old 401 with a different provider? If so, they will need to start the rollover process, so you’ll need to either call them or initiate the process online. They may need some paperwork, such as a Letter of Acceptance from Fidelity, or their own paperwork completed and signed by you or a Fidelity representative. If you have multiple accounts or employers, you may need more than one LOA.

Here are some questions to ask when you contact them. If you’d like to have a Fidelity rollover specialist on the line with you when you call, call us first at 800-343-3548.

Covington, KY 41015-0037

Do you own company stock?

If you have shares of company stock, it’s easiest to give us a call at 800-343-3548 and one of our rollover specialists can help you understand your options and take action.

Recommended Reading: Should I Get A 401k

Fast And Easy Rollover From Schwab 401k To Fidelity Ira

October 22, 2019Keywords: 401k, Fidelity, IRA, rollover, Schwab

Now that my income isnt too high that requires a backdoor Roth , I finally rolled over my 401k from the former employer to an IRA. The 401k money was 100% Traditional. It went into a Traditional IRA. Charles Schwab as the 401k administrator and Fidelity as the IRA custodian did a great job. I was able to complete the rollover in only two days.

This is not a sponsored post. Neither Schwab or Fidelity paid me to write it. Im sharing my personal experience to show how easy it is to do a rollover. If you also wanted to rollover and consolidate but you dread the hassle, you will see its not difficult or time-consuming at all. If someone tells you it will take a few weeks to complete the rollover, thats not normal. It should only take a few days, not a few weeks.

When you transfer from one IRA to another IRA, you start from the receiving end because the financial industry has standardized the transfer process. When you do a rollover from a 401k, you start from the sending end because each plan has its own process and requirements. Some 401k administrators take the request online. Some administrators require a signed paper form. Some even require a signature from someone at your former employer.

You need to find out from the receiving IRA custodian how they want the check made out to. I was rolling over to an IRA at Fidelity. Fidelity says on their website:

Say No To Management Fees

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Read Also: Can You Pull From 401k To Buy A House

Roll Over Traditional Money Into The Tsp

A rollover is when you receive eligible money directly from your traditional IRA or plan and then you later put it into your TSP account. You cannot roll over Roth money into the TSP and you must complete your rollover within 60 days from the date you receive your funds. Use Form TSP-60, Request for a Transfer Into the TSP, to roll over eligible traditional money.

Fidelity And/or Vanguard To Tiaa

Transfer funds from Fidelity and/or Vanguard fund into a TIAA fund

Also Check: How To Transfer 401k Accounts

Tiaa To Fidelity And/or Vanguard

Transfer funds from TIAA fund into a Fidelity and/or Vanguard fund

Transferring Dividend Stocks From Td Ameritrade To Fidelity

My retirement accounts are now completely transferred from Vanguard to Fidelity. But I still have additional taxable accounts with TD Ameritrade and the no-fee broker, M1 Finance. These two accounts are the focus of my .

At this stage, I am planning to transfer the TD Ameritrade account to Fidelity when Im ready.

My TD Ameritrade dividend growth portfolio has also grown to a six-figure account. But Im not an active trader. I buy stocks and collect dividends. Then I reinvest the dividends into more dividend-paying stocks. Ive almost always been happy with them.

I dont need a fancy trading platform. My priority now is to simplify my life a bit. Fidelity is an equally capable online brokerage for my needs, so it makes sense to move my money there.

Fidelity charges $4.95 per stock trade while TD Ameritrade charges $6.95 is now commission-free as of October 2019!

The only hesitation I have is the cost basis data on record at TD Ameritrade. When I transferred my decades-old DRIPs , I had to update the cost basis from my records. Since these were DRIPs, there were dozens of transactions for each.

Im afraid that when I transfer my holdings, the cost basis will not be transferred correctly or at all. Ive seen this screwed up many times. I will back up my cost basis very carefully in case I have to resubmit the data.

Read Also: Can You Take Out Your 401k To Buy A House

Confirm A Few Key Details About Your 401 Plan

First, get together any information you have on your old 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following three items:

What Do You Need To Know About Empower 401k Contribution

Since HUB 401 is an employer sponsored plan, all plan membership accounts will be migrated to Empower. Your HUB sponsored account will be migrated automatically and you will not be able to continue with Fidelity. However, all of your individual retirement accounts will remain with Fidelity. Will the range change?

Don’t Miss: When Leaving A Job What To Do With 401k

The Process Was Dead Simple

This part really surprised me. As I thought about how to start the process, I decided to call Vanguard to see what information about my Rollover IRA I would need to give Fidelity. I already had the IRA account from a rollover six years ago, but had long forgotten the actually steps needed to get the process moving.

My call was routed to a department that does nothing but handle rollovers. The rep walked me through the process, and then offered to call Fidelity with me. So he dialed up Fidelity and did all the talking. I guess Vanguard really wanted my money!

We did hit one snag. According to the Fidelity representative, my old employer still had my status as an active employee. So I had to call my employer to get my status changed. That took a few days, and then the three of us got back on the phone to complete the rollover. It took all of five minutes.

You can check out an even more detailed description of the 401k rollover process here.

Warning: Watch Out For 401 Loans

No discussion of 401 plan rollovers would be complete without considering the implications of IRS 401 loan provisions.

Millions of people have loans through their 401 plans. You can borrow up to 50% of the value of your plan, up to a maximum of $50,000. The loan must generally be repaid within five years. However, if your employment ends and you still have a 401 loan outstanding, there may be tax consequences.

Under a typical 401 plan loan provision, the employer may allow you up to 60 days from termination to repay the loan, though some may extend that to 90 days. But if you fail to make repayment within the required timeframe, the plan administrator will declare the unpaid loan balance to be a distribution.

Once again, the distribution that will be added to your regular income, subject to ordinary income tax, plus the 10% early distribution penalty if youre under 59 ½.

Read Also: How To Know If I Have 401k

Is It Better To Take A Lump Sum Pension Or Monthly Payments

If you take a lump sum available to about a quarter of private-industry employees covered by a pension you run the risk of running out of money during retirement. But if you choose monthly payments and you die unexpectedly early, you and your heirs will have received far less than the lump-sum alternative.

To What Kinds Of Fidelity Accounts Can I Transfer Assets From Another Institution

You can transfer assets from another institution to most kinds of Fidelity accounts. However, the account you are transferring assets from must be the same type of account to which you are transferring funds. For example, you can transfer assets from a Roth IRA to another Roth IRA with the same owner, but not from a non-retirement account to an IRA.

Read Also: Do You Need A Tpa For A Solo 401k

Who Is The Owner Of The Empower Retirement Fund Reviews

Empower Retirement is a retirement plan registration company based in Denver, Colorado. It is part of GreatWest Life & Annuity Insurance Company and is an indirect wholly owned subsidiary of GreatWest Lifeco. Empower is chaired by President Edmund F. Murphy III, who reports to Robert L. Reynolds, CEO and President of GreatWest Financial.

The Potential Tax Consequences On Retirement Plan Distributions

Apart from my own rollover, and according to the IRS, there are three permitted methods for doing a rollover of any kind:

Also Check: How To Do A Direct 401k Rollover

How To Roll Over A 401

Perhaps you’ve left your job but still have a 401 or Roth 401 with your former employer you’re retiring and are wondering if leaving your money in a 401 is the best option or perhaps you simply want to diversifynow what? The infographic, below, explains four options to consider: leave your assets in a previous employer’s plan, cash out your 401, initiate a 401 rollover into a new employer’s plan, or rollover into an IRA .

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employer’s 401, certain steps are necessary.

Recommended Reading: Should I Borrow From My 401k