> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

S To Roll Over 401k To Ira

The process is simple:

You May Like: When Can You Rollover A 401k Into An Ira

How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

What About The Roth 401k

If your employer offers a Roth 401k and you were savvy enough to take part, the path to a rollover will be much easier. When youre converting one Roth product to another, there is simply no need for a conversion. You would simply roll the Roth 401 directly into the Roth IRA with the help of your plan provider.

Roll Your 401 by Following These Steps

Read Also: How Do I Transfer My 401k To A Roth Ira

What Are Your Investment Options With A Rollover Ira

Once youve made the decision to do a 401 Rollover into an IRA, the next decision is how you want to invest your account.

If you plan to engage in self-directed investing, buying and selling individual stocks, options, funds, bonds, real estate investment trusts and other securities, it will come down to selecting the broker to hold your IRA with.

Popular investment brokers that offer nearly unlimited investments and charge no trading fees on many of them include:

|

Product |

|---|

|

on Noble Gold website |

If you prefer to invest in mutual funds or ETFs, Vanguard may be the broker of choice.

They offer trading in stocks and other securities but they do charge trading fees on those.

However, they offer thousands of fee-free ETFs and mutual funds for you to invest in.

Given that Vanguard funds are found in most professionally managed portfolios, you can take that as a hint of how good their funds are.

Choosing a Managed Option: Robo-advisors

If you want a fully managed IRA account, you can opt for a robo-advisor.

Theyll create a portfolio of stocks, bonds and other asset classes for you, based on your risk tolerance, investment goals and time horizon.

After that, theyll fully manage the portfolio for you, including reinvestment of dividends, and periodic rebalancing to make sure your portfolio maintains its target allocations.

Popular robo-advisors include:

Betterment and Wealthfront will manage your IRA for a fee of just 0.25% per year .

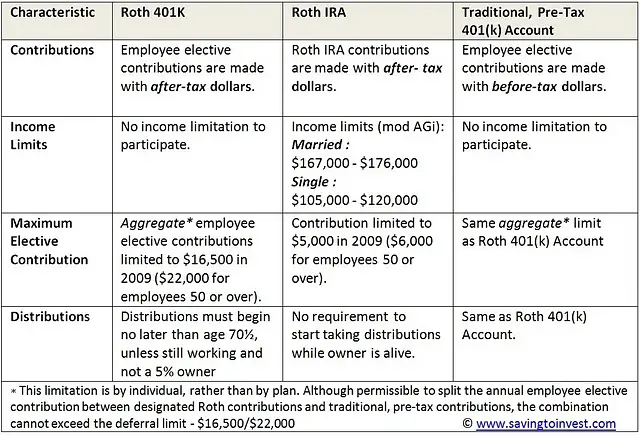

Types Of Individual Retirement Accounts

There are several types of IRAs. The Roth IRA allows you to make after-tax contributions and affords tax-free withdrawals in retirement. A traditional IRA allows you to make pre-tax contributions into a tax-deferred account, and withdrawals are subject to taxes in retirement .

Take note that after-tax and pre-tax refers to your income. When it comes to a Roth IRA, it wont be taxed because you already paid taxes on your money , and with a traditional IRA, since your money hasnt been taxed yet, you pay later.

Either way, both the traditional and Roth IRAs are independently managed. You can choose whichever financial institution youd like to manage and service your retirement account, whether its an international bank or a local investment firm. The IRA owner can choose to place the retirement savings that constitute his IRA funds into the care of a plan administrator or choose to manage their own self-directed IRA.

A self-directed IRA should not be confused with a SEP IRA, which is an IRA geared toward self-employed individuals and may or may not be under the care of an IRA custodian.

You May Like: How Much Money Do I Have In My 401k

Take Caution With Indirect Rollovers

Rollovers may be done as direct or indirect, but they are not managed the same.

Direct – A direct rollover is where the funds are transferred directly from one retirement account to another as the owner you never touch the funds. Doing a direct rollover avoids this negative consequence that may come with an indirect rollover.

Indirect â As the owner you can receive a distribution of your account balance from the plan instead of arranging for a direct rollover. This might not be the best idea. If you take a distribution, the plan administrator typically withholds 20% of the distributable amount for federal income taxes. The 20% is returned in the form of a tax credit in the year the rollover process was completed. When you do this indirect rollover, you can increase the rollover amount, from your own funds, equal to the 20% withholding amount. If you roll over the amount of the check you receive without adding that 20% back, then the amount withheld will be treated as a taxable distribution. You will generally have to pay income taxes on that amount as well as a 10% penalty tax if you are younger than 59 1/2. Also, when you take the cash directly, the IRS only allows you 60 days from the date of receipt of the funds to rollover the funds to another plan or IRA.

Additional rollover caveats

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

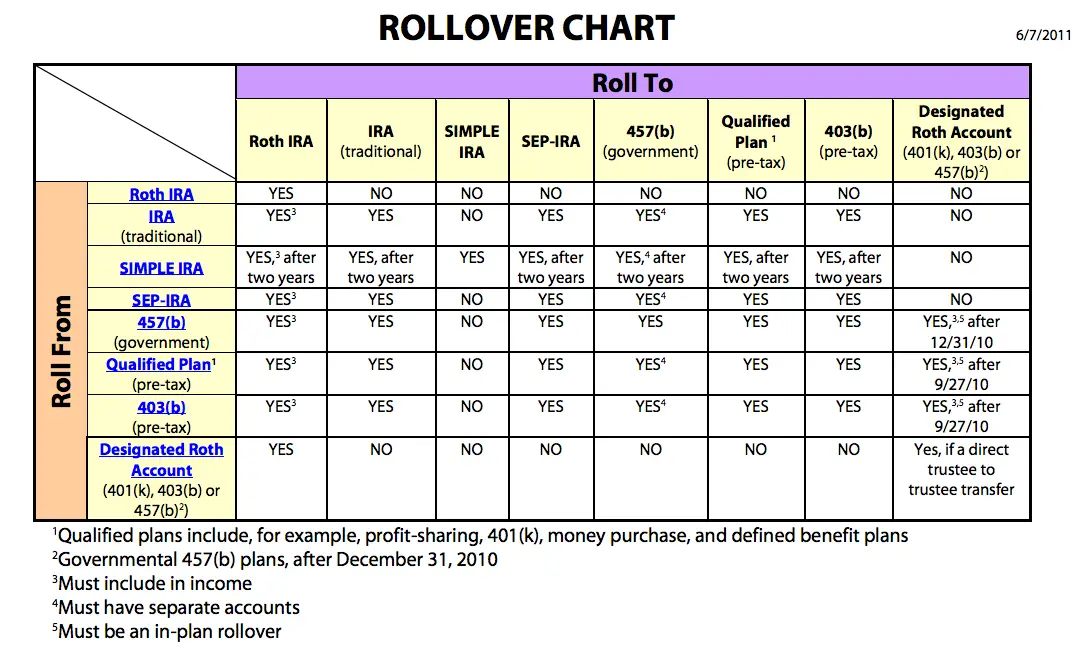

The Rollover Chart PDF summarizes allowable rollover transactions.

Read Also: Can I Rollover 401k To Ira While Still Employed

Protect Yourself From Inflation Risk

Inflation risk is another reason why you should think about investing in the precious metals market. Inflation could cause an increase in the price of goods and services. The value of gold has been known to rise along with inflation. If you invest in the future, its good to be protected from financial risks that are beyond your control.

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Sign up for Bankrates myMoney today to track your finances in one place.

Don’t Miss: What Should I Invest In 401k

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

How To Roll Over A 401 To An Ira In 4 Steps

If you decide to do a 401 rollover to an IRA, typically the money from an old 401 must go into the new IRA account within 60 days. There are four steps to do a 401 rollover into an IRA.

Choose which type of IRA account to open

Open your new IRA account

Ask your 401 plan for a direct rollover or remember the 60-day rule

Choose your investments

You May Like: Should I Do Roth Or Traditional 401k

You Expect To Pay Higher Taxes In The Future

Since Roth IRAs use after-tax dollars, youll have to pay taxes upfront on any funds you roll over. However, you wont have to pay taxes on your distributions, which could be extremely beneficial if youre taxed at a higher rate when you reach retirement. Youll pay taxes either way now or later. But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

Tax Consequences Of The One

Beginning in 2015, if you receive a distribution from an IRA of previously untaxed amounts:

- you must include the amounts in gross income if you made an IRA-to-IRA rollover in the preceding 12 months , and

- you may be subject to the 10% early withdrawal tax on the amounts you include in gross income.

Additionally, if you pay the distributed amounts into another IRA, the amounts may be:

- taxed at 6% per year as long as they remain in the IRA.

Don’t Miss: How Can You Take Out Your 401k

Move Money Into The Tsp

Whether youre a civilian employee, a member of the uniformed services, or a separated participant, you can move money from other eligible plans to your existing TSP account. However, you cannot open a TSP account by transferring money into it.

Things to know:

We will accept both transfers and rollovers of tax-deferred money from traditional IRAs, SIMPLE IRAs, and eligible employer plans such as a 401 or 403 into the traditional balance of your account.

We will accept only transfers of qualified and non-qualified Roth distributions from Roth 401s, Roth 403s, and Roth 457s into the Roth balance of your account. If you dont already have a Roth balance in your existing TSP account, the transfer will create one.

We will not accept Roth rollovers that have already been paid to you and will not accept transfers or rollovers from Roth IRAs.

Disadvantages Of A 401 Rollover Into An Ira

Rolling over a 401 into an IRA does have some disadvantages, so youll have to weigh these against the advantages.

Don’t Miss: How Do I Know Where My 401k Is

Is It Better To Roll Over A 401 To An Ira

If you like your former employers 401 plan the investment options and the expense ratios on the investments then it wont necessarily be better to roll it over into an IRA. But you may find that if you roll your 401 into an IRA, you may have more investment options. Compare expense ratios and fees to see which option is best for you.

Kaleb Paddock, a certified financial planner at Ten Talents Financial Planning in Parker, Colorado, says a typical 401 plan only has approximately 20 to 40 mutual funds available. But an IRA could give you access to thousands of exchange-traded funds and mutual funds.

Another reason might be, if you want to invest in socially responsible funds or funds that invest according to a certain set of values, those funds may not be available in your 401 or your prior employer 401, Paddock says.

But by rolling it over to one of these large custodians, youll likely be able to access funds that may be socially responsible or fit your values in some fashion and give you more options that way, he says.

Plus, rolling over your 401 to an IRA may result in you earning a brokerage account bonus, depending on the rules and restrictions that the brokerage has in place.

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Also Check: How To Find Out If I Have An Old 401k