Plan Balances By Generation

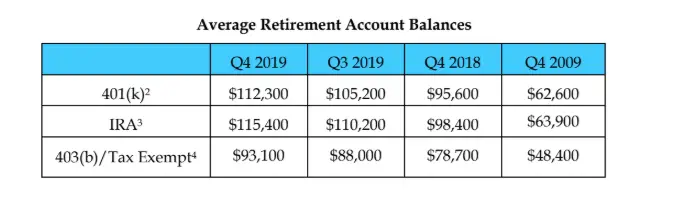

The good news is that Americans have been making an effort to save more. According to Fidelity Investments, the financial services firm that administers more than $9.8 trillion in assets, the average 401 plan balance reached $112,300 in the fourth quarter of 2019. That’s a 17% increase from $95,600 in Q4 2018.

It’s worth noting that the Q1 2020 amounts will likely be different based on the economic volatility caused by the coronavirus pandemic.

How does that break down by age? Here’s how Fidelity crunches the numbers.

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

Don’t Miss: How Do I Find Previous 401k Accounts

Save More On Taxes With The Secure Act

The SECURE act offers businesses the ability to establish a retirement plan and lower their tax liability. Your business can take advantage of tax credits of up to $5,500 per year, which includes a $500 credit for implementing automatic enrollment in the plan, for three years, if you meet eligibility requirements. These start-up tax credits go towards the costs of starting a new 401 plan. Only new plans are eligible for these tax credits.

How Can I Find My Old 401 Account

Ask previous employers whether theyre maintaining any accounts in your name. If the company no longer exists, contact the plan administrator. If you dont know the name of the plan administrator, search the Department of Labor website for the companys Form 5500 , which will list their contact information. You might also check the states unclaimed property database via the National Association of Unclaimed Property Administrators .

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new brokerage or IRAs, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

Don’t Miss: How To Take Out 401k Money For House

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

You May Like: How To Do A Direct 401k Rollover

Next Steps For Your Money

If your old 401 plan is still with a former employer, one option is to leave the money there. But you may not pay as much attention to the account, which could lead to a portfolio thats not appropriate for your age and risk tolerance.

If youre still working and have a 401 at your new job, another option is to roll over the funds into your existing plan, assuming your employer allows it. Another option is to roll the money into an IRA. Having your savings in one place will make it easier to manage your investments.

If youve lost track of a pension, request a pension benefits statement from the plan administrator. Give the administrator your address and phone number so it can reach you to begin payments. You may need to prove your work history and eligibility for the pension you can do so by providing the plan administrator with old W-2 forms or an earnings statement from Social Security, which you can get by filing Form SSA-7050. You can get this form at www.socialsecurity.gov/online/ssa-7050.pdf or by calling Social Security at 800-772-1213.

How Can I Find Out My 401k Balance

Over $5.3 trillion is held in 401 plans as of September 2017, according to the Investment Company Institute. If you’re using a 401 to help you save for retirement, it’s important to know how much you have in your plan so you can determine if your savings are in line with the amount you’ll need to fund your golden years. If you don’t receive paper statements with your 401 balance, there are other ways you can check how much you’ve saved.

Also Check: How Can I Get Money Out Of My 401k

There Are Plenty Of Reasons To Check Your Investments And Your Approach:

If youve made it this far and youre thinking Will they please tell me how often I should check my investments?!, hopefully everything youve read so far has made enough sense. So here you go: you should check your investments enough to be familiar with the direction that youre going, confirm that your account is up-to-date on any plan changes, and that you have adjusted for any life/employment changes that may impact your plan. If youre losing sleep over weekly or monthly performance youre probably checking it too often. If youre wondering why the S& P 500 is up 13% and your globally diversified portfolio that is 20% bonds is only up 7.5%, then you are not familiar enough with the intention of your portfolio

Never forget this is your account, youre in charge, even if someone is helping you with it. Advisors, including blooom, are only here to help incorporate their philosophies into your portfolio. There are plenty of items that you can control and plenty others that you cant. Identifying these early on and taking advantage of the opportunities that you do have will lead to the greatest probability of success. Keep up the great work gang. Final thought: if you have questions or are fretting over your portfolio choices, reach out! After all, thats what we are here for and wed love to help however we can.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Also Check: Where Can I Get 401k Plan

How To Check Your 401

First things first, how do you even check your 401 account online? Start by going to the website of your 401 provider. If youre not sure who your 401 provider is, go onto your employer intranet and it should be listed under a HR resources section. Once youre on their website, if you get stuck hit forgot username. If youve never set up an online profile this process will alert you to that pretty quickly. Itll take a couple of steps to get your username and password retrieved / set up. Once you have this bookmark the page and save your username / password either through a password manager or somewhere you can reference later.

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

You May Like: Can You Roll Over 401k From One Company To Another

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

What Happens If I Have Unclaimed 401 Funds From A Previous Job

The majority of unclaimed money comes from brokerage, checking, and savings accounts, along with annuities, 401s, and Individual Retirement Accounts. Once an account is considered inactive or dormant for a period of time , companies are required by law to mail abandoned funds to the owners last known address. If theyre returned, or the owner cant be reached, the assets must be relinquished to the state.

Read Also: What’s The Maximum Contribution To A 401k

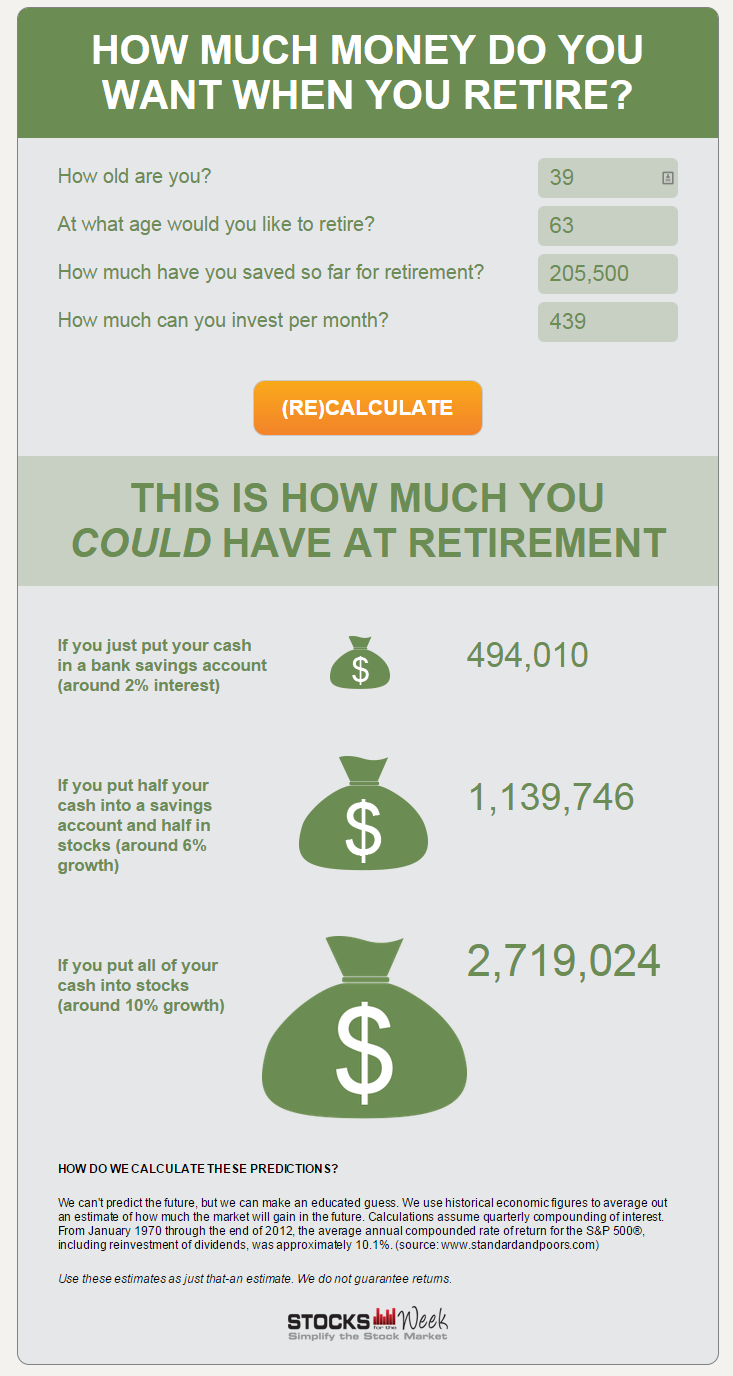

How To Turn It Around

The sad but true part is that most Americans dont have nearly enough savings to sustain them through retirement.

How do you avoid that fate? First, become a student of the retirement savings process. Learn how Social Security and Medicare work, and what you might expect from them in terms of savings and benefits.

Then, figure out how much you think you’ll need to live comfortably after your nine-to-five days are over. Based on that, arrive at a savings goal and develop a plan to get to the sum you need by the time you need it.

Start as early as possible. Retirement may seem a long way away, but when it comes to saving for it, the days dwindle down to a precious few, and any delay costs more in the long run.

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

You May Like: Can I Invest My 401k In Gold

Your Primary Source For 401k Information

Do you know enough about your 401K?

If you are counting on your 401k plan for retirement beware! The current financial crisis and stock market collapse are troubling enough, but what many retirement savers dont know is that their 401k plans may not be up to the task.

401ks have become the predominant retirement funding tool in the U.S. Twenty-five years ago. traditional defined benefit pensions were the primary type of retirement plan covering more than 60% of the workforce that had pension plan coverage. Today, defined contribution plans are the primary retirement plan for 63% of the covered workforce. Only about 17% of the covered workforce remains in traditional pension programs.

For the worker, this has meant a seismic shift in responsibility: where once the employer was responsible for seeing that workers contributed to the pension and that pension investments performed well enough to provide promised benefits, in the DC world, 401k planning responsibilities fall on squarely the worker. The best 401k plan sponsors provide generous matches, strong retirement/investment education support and other plan features to help out. Workers who take full advantage of these plans stand a good chance of accumulating adequate retirement savings.

But for many others, their 401k is a minimal retirement plan that offers only a weak chance of providing a decent stream of income to workers when they retire.

How do you know how your 401k plan compares?

Your 401 Plan When You Change Employers

Your employer can remove money from your 401 after you leave the company, but only under certain circumstances, as the Internal Revenue Service explains.

If your balance is less than $1,000, your employer can cut you a check for the balance. Should this happen, rush to move your money into an individual retirement account . You typically have just 60 days to do so or it will be considered a withdrawal and you will have to pay penalties and taxes on it. Note that the check will already have taxes taken out. You can reimburse your account when you reopen it.

If your balance is $1,000 to $5,000, your employer can move the money into an IRA of the companys choice.

You May Like: Do Employers Match Roth 401k

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

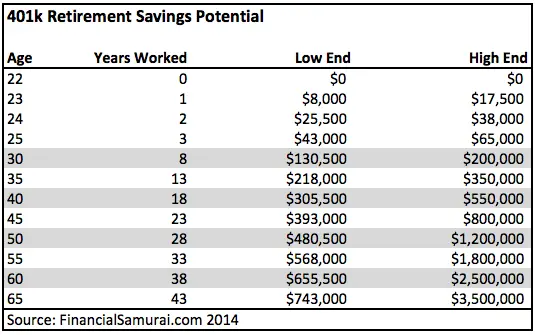

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement. The 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way to help maximize your retirement dollars.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

Do you have enough in your 401k to retire when you want? You can find out using Personal Capitals free and secure Dashboard, which includes a Retirement Planner for testing different scenarios.

As American households face the financial fallout of the COVID-19 pandemic, many have put retirement saving on the back burner. In a recent Personal Capital survey, only about 50% of people reported currently contributing to their 401k every paycheck. Around 49% said they receive the maximum match from their employer.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

Don’t Miss: What Is The Best Fund To Invest In 401k