Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

Can You Lose All Your Money In An Ira

The most likely way to lose all of the money in your IRA is by having the entire balance of your account invested in one individual stock or bond investment, and that investment becoming worthless by that company going out of business. You can prevent a total-loss IRA scenario such as this by diversifying your account.

It Depends On Whether Your Funds Are In A Traditional Or Roth 401

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

When you withdraw funds from your 401or “take distributions,” in IRS lingoyou begin to enjoy the income from this retirement mainstay and face its tax consequences. For most people, and with most 401s, distributions are taxed as ordinary income. However, the tax burden youll incur varies by the type of account you have: traditional or Roth 401, and by how and when you withdraw funds from it.

You May Like: What Is A Pension Vs 401k

Start With Your Old 401k

When you want to do a 401K rollover, start with your old employer and the company that managed your 401K with your old employer . We start here as each 401K plan has its own rules and processes. Some have an online process, some require you to send an email to the plan provider, and some require signed forms from different parties in the process.

If you have an online portal that you used to see your 401K account information, find the contact information for somebody at the provider to reach out to and tell them you want to begin a rollover. Even emailing the general email inbox at the custodian typically works as these companies are very familiar and comfortable with their clients performing a rollover. If you are unsure about an online portal or dont have your account information, reach out to an HR representative at your old employer and tell them you want to do a 401K rollover and they will help you get started.

At this point, you are mostly in information-gathering mode. When you talk to an HR representative or 401K custodian, tell them you want to do a rollover and ask the following:

-

What is their process for completing a rollover?

-

What forms and signatures do they require?

-

What will you need from your old employer and from your current employer?

-

How quickly can they complete the rollover?

In some cases, you will be required to fill out a paper form and fax it to your old employer for signatures.

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Read Also: Should I Borrow From My 401k

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

Annuity Vs : Reasons To Rollover A 401 To An Annuity

Often debated among financial experts is whether an annuity should ever be used in a tax-qualified 401. Like a 401k, annuities provide income tax deferral. Therefore, it may at first seem redundant to place an annuity inside a qualified retirement plan.

That might be true if the onlybenefit an annuity offered is tax deferral. But, the fact is, annuities offer many advantages, whether held inside or outside of a 401.

Annuities are flexible investment products that can help you achieve your long-term financial goals and provide a source of retirement income. Tax deferral alone is not a sufficient reason to use an annuity in a tax-qualified plan. But income options, death benefit protection, investment selections and services, and flexibility are benefits an annuity can bring to any 401.

Read Also: How Do You Take Money Out Of 401k

Paying Taxes On Your Contributions

The point of a Roth IRA is that the money gets taxed as income upfront, then grows tax-free. But the money in your 401 was shielded from taxes. So youll now need to pay income tax on that money so that it qualifies for a Roth.

The funds you roll over are added to your taxable income for the year you do the rollover. Income taxes you owe will be calculated from that new total. Since the income from your IRA isnt coming from a paycheck, though, the tax you owe on it wont be withheld. Itll have to come out of your pocket, and to avoid a penalty, you may need to make an estimated tax payment before filing your taxes for the year.

Youll need to make an estimated tax payment if the taxes withheld from your paycheck arent enough to cover at least a) 90% of the taxes youll owe for the tax year of your rollover or b) 100% of the taxes you paid for the previous tax year . Once you know your estimated payment, you can either pay it all at once or split the amount between the quarters remaining in the tax year. Quarterly estimated tax payments are due on or before April 15, June 15, Sept. 15 and Jan. 15 of the next year.

If you overestimate how much your tax bill is going up and overpay your estimated tax payments, thats OK. Youll get a refund if you end up paying more than you owe.

Can I Withdraw From My 401k If I Have An Outstanding Loan

Most 401 plans allow participants to tap into their retirement savings. Find out if you can withdraw from your 401k if you have an unpaid 401 loan.

When contributing to a 401 plan, most people have every intention of accumulating a sufficient retirement nest egg that they can live off in retirement. However, when heavy financial emergencies occur and you do not have an emergency fund, you could be forced to raid your retirement savings to settle the urgent financial needs.

Most 401 plans allow you to take a 401 loan against your retirement savings, or a hardship withdrawal if you are below 59 ½. However, there are circumstances when you can withdraw from your 401 if you have an unpaid loan. For example, if you leave your job or are fired, you could rollover your 401 to an IRA or the new employerâs 401 even if you have an outstanding 401 loan. When this happens, the outstanding 401 balance will not be rolled over, and you will have until the tax due date to pay off the loan balance.

Don’t Miss: Can I Roll My Roth 401k Into A Roth Ira

Protection From Market Downturns

In a fixed annuity or fixed index annuity, you will not lose money due to market downturns. If the markets have a down year, you earn zero interest. In exchange for this protection, you are limited on the upside you can get each year, unlike an individual stock through a mutual fund.

A variable annuity will provide unlimited upside potential with no protection from volatile market conditions. However, adding a Guaranteed Lifetime Withdrawal Benefit can protect the annuitant from running out of money due to a stock market crash.

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around just got easier. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. When you leave the company and want to move your money, allocating these retirement funds to new plans becomes tricky.

The new allocation rules take effect beginning in 2015, but taxpayers can choose to apply them to distributions beginning on September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula. This resulted in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You now can choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Also Check: How To Diversify 401k Portfolio

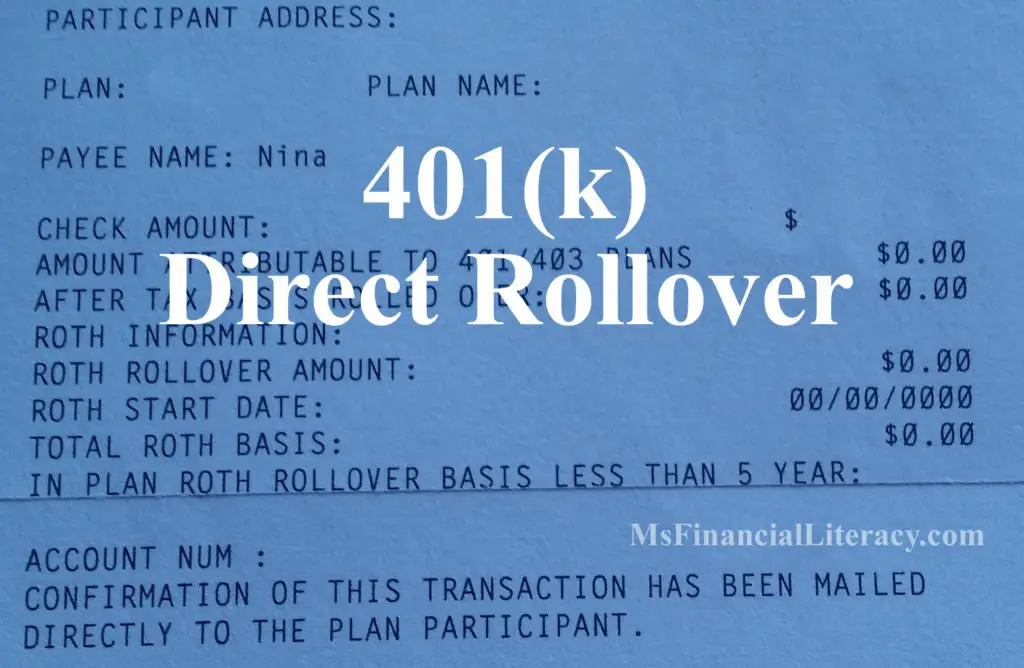

What Is A 401 Rollover

A 401 Rollover is when a person directs the transfer of funds in a retirement account to a new plan or IRA. The IRS gives sixty days from the date an IRA or retirement plan distributes to roll it over into another plan or IRA. Individuals are allowed only one rollover per 12-month period from the same IRA. This one time allotment does not apply to plan-to-plan rollovers and certain other kinds of rollovers.

There Are Tax Consequences For 401 Rollovers To A Roth Ira

If you roll your 401 into a Roth IRA, you will have to pay taxes on that money. Unlike a pre-tax 401 and traditional IRA accounts, a Roth IRA is a post-tax account. This means that you pay taxes on the funds before you put them in the Roth IRA. A big advantage of the Roth IRA over the traditional IRA is that you can make withdrawals without paying additional taxes since the money has already been taxed.

Don’t Miss: Can A Qualified Charitable Distribution Be Made From A 401k

What You Can Do

- Roll over a traditional 401 into a traditional IRA, tax-free.

- Roll over a Roth 401 into a Roth IRA, tax-free.

- Roll over a traditional 401 into a Roth IRAthis would be considered a “Roth conversion,” so you’d owe taxes. Note: A Roth conversion that happens at the same time as your rollover may not be eligible for all plans. We can usually complete the Roth conversion once your pre-tax assets arrive into your Vanguard IRA account, though.

Avoid Paying Additional Taxes And Penalties By Not Withdrawing Your Funds Early

First and foremost, you want to avoid withdrawing money from a traditional IRA before age 59.5. There is a 10% early withdrawal penalty on top of the income tax owed. However, if you leave your job at age 55, you may be able to at least take a penalty-free 401 withdrawal from that particular job under the Rule of 55, though youll still be hit with income tax.

You may be eligible to take out a fixed five-year loan worth up to 50 percent of your balance without incurring additional taxes as long as you pay the money back on-time. Alternatively, you may qualify for a hardship exemption that absolves you from having to pay an IRS penalty at the very least.

Recommended Reading: How Much Money Should I Put In My 401k

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent, on any appreciation. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

How Long Do I Have To Rollover My 401 From A Previous Employer

When leaving a job many ask, âHow long do I have to rollover my 401?â Usually, your previous employer will rollover a 401 for you. If you receive a check youâll have 60 days to roll it over to avoid penalties.

Leaving a job can be a stressful time. Tying up loose ends and preparing for your next venture can cause certain things to fall through the cracks. Namely, forgetting to bring your 401 with you. There are a few things to remember when you go to rollover your 401 from a previous employer.

If your previous employer disburses your 401 funds to you, you have 60 days to rollover those funds into an eligible retirement account. Take too long, and youâll be subject to early withdrawal penalty taxes.

However, there are alternatives to your previous employer cashing out your 401 when you leave that can make the process much easier.

You May Like: How To Borrow From 401k For Home Purchase

Avoid Taxes And Traps And Know When A Rollover Doesnt Pay

- Print icon

- Resize icon

Chances are youll have to roll over a retirement account at least once in your lifetime. Most likely, it will be when you leave your current employer and take your 401 balance with you. Heres what you need to know to avoid tax pitfalls.

Avoiding the 20% tax withholding trap

Leaving your current job? Then youve got a great opportunity to roll over your 401 into an IRA. This will give you many more investment options than either leaving the money in your old 401 or rolling it over into your new employers plan.

If you ask, your company plan administrator will be only too happy to send you a check for the full vested balance of your account. If the plan makes the check out to you, however, it is required to withhold 20% for federal income tax. That leaves you between a rock and a hard place. Youll have to come up with the missing 20%, or pay income taxes . You wont get the withheld money back until you file your taxes the following year .

To meet the 60-day rule, start counting on the day after you receive the check and include the day you deposit the money into your IRA. For example, if you get the check on Sept. 1, you must get the money into your IRA on or before Oct. 31. Theres no extension for weekends or holidays.

When an IRA rollover doesnt pay

What comes out must go back in

Rollovers to split IRAs in a divorce

First, the split of your IRA assets must be required pursuant to your divorce settlement agreement.

Also see