Changing Your Asset Allocation

The most common reason for changing your asset allocation is a change in your time horizon. In other words, as you get closer to your investment goal, youll likely need to change your asset allocation. For example, most people investing for retirement hold less stock and more bonds and cash equivalents as they get closer to retirement age. You may also need to change your asset allocation if there is a change in your risk tolerance, financial situation, or the financial goal itself.

But savvy investors typically do not change their asset allocation based on the relative performance of asset categories – for example, increasing the proportion of stocks in ones portfolio when the stock market is hot. Instead, thats when they rebalance their portfolios.

Example #1 The Safety First’ Portfolio

We recommend this option for retirement investors who want to play it as safe as possible while on the verge of retirement. While this portfolio may seem as though it’s not that diverse, it actually doesn’t need to be, because the few investments that it contains are very low risk and can help you protect and extend your retirement savings.

Furthermore, the simplicity of it makes it less confusing and more welcoming to inexperienced, cautious investors. The Safety First’ portfolio is based on bonds/securities and annuities that provide predictable, inflation-adjusted income, with the rest of the portfolio being devoted to precious metals.

With this portfolio you’ll have the security of knowing that you’ll be earning X amount of money every month, and you’ll have X amount of money stored in gold or other precious metals as a backup.

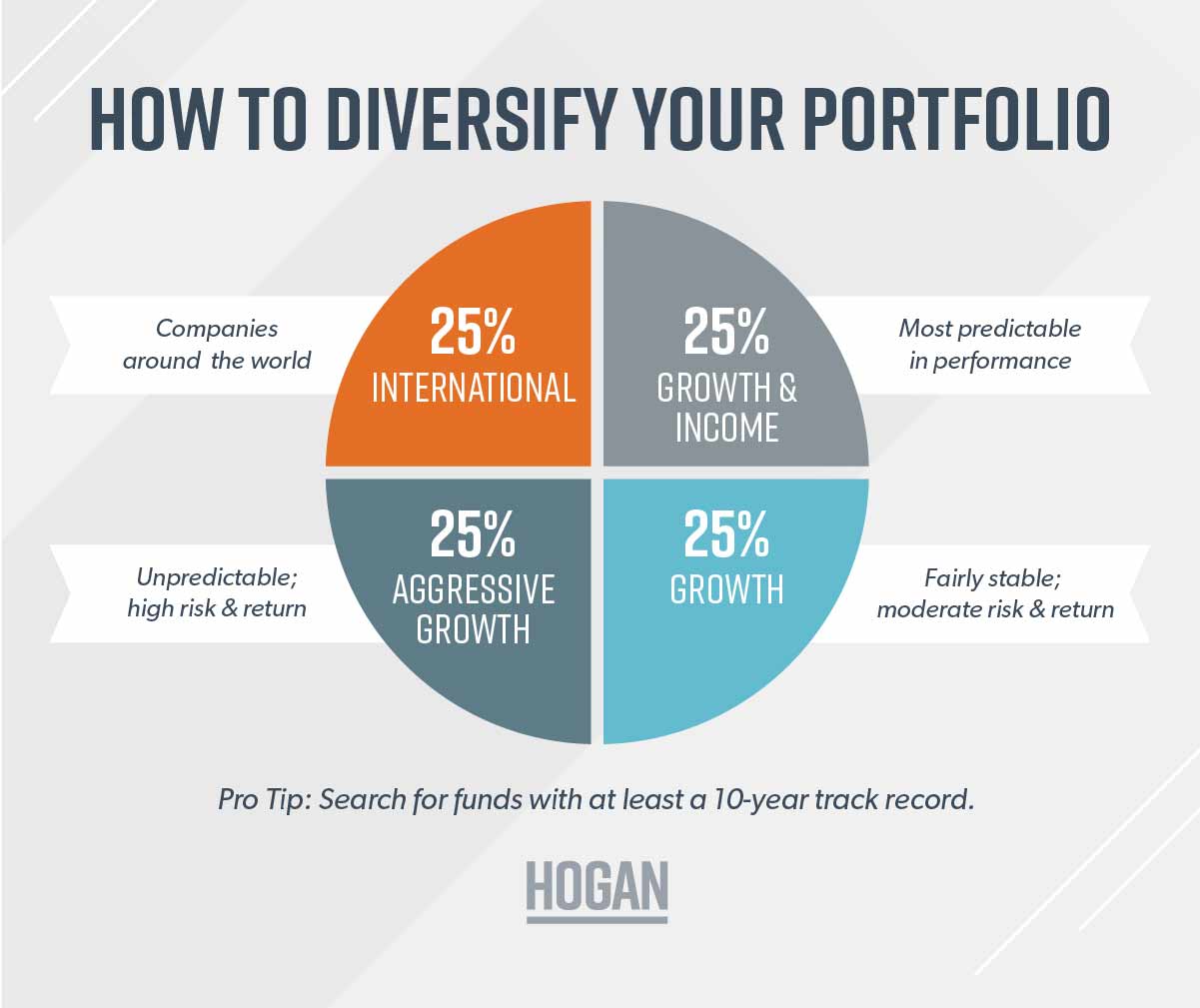

Pie Chart of the Safety First’ Portfolio:

Why Should You Diversify Your Portfolio

An investment diversification strategy helps you manage risk and reduces volatility from overexposure to a single market, industry, or individual stocks and bonds. There will always be some risk when youre investing and diversification is not a proven strategy for preventing loss. Instead, the goal of an investment diversification strategy is to improve the potential for returns on your portfolio no matter what your risk tolerance is.

Many different types of investments suffered losses during the 2008 2009 bear market. However, portfolios that were well diversified were able to contain their losses better than portfolios that were heavily exposed to a single asset class. Diversification is one important component of staying invested when the market fluctuates.

Even if you are a high-risk investor that wants to allocate 100% of your investment portfolio towards stocks. Its nearly impossible to sort through every publicly-traded company and pick the one that will deliver the best returns. It makes more sense to spread your money between several companies within different sectors. This way, if one company or industry suffers a loss, but another one youve invested in performs well youre well-positioned. In this example, diversification can help even the riskiest investors maximize their long-term gains.

You May Like: How To Set Up A 401k Account

Work With An Investment Professional

Okay, you’ve probably got lots of questions about how to get started diversifying your portfolio. Thats a good thing! As you figure this out, we want you to work with an investment professional like a SmartVestor Pro.

Dont go it aloneyour financial future is too important for guesswork! An investment professional can help you make sure your investments and assets are mixed to create a balanced plan for retirement.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Consider Index Or Bond Funds

You may want to consider adding index funds or fixed-income funds to the mix. Investing in securities that track various indexes makes a wonderful long-term diversification investment for your portfolio. By adding some fixed-income solutions, you are further hedging your portfolio against market volatility and uncertainty. These funds try to match the performance of broad indexes, so rather than investing in a specific sector, they try to reflect the bond market’s value.

These funds are often come with low fees, which is another bonus. It means more money in your pocket. The management and operating costs are minimal because of what it takes to run these funds.

One potential drawback of index funds is their passively managed nature. While hands-off investing is generally inexpensive, it can be suboptimal in inefficient markets. Active management can be very beneficial in fixed income markets, especially during challenging economic periods.

Recommended Reading: How Does Taking Money Out Of 401k Work

You Need Cash Soon But Your 401 Doesnt Have Any

If you know youre going to need cash in the next few years, your 401 needs to be factoring that in. That doesnt mean you need to sell everything and go to cash now, but you can leave new contributions in cash or move them into lower-risk bond funds, slowly reducing aggressiveness.

To gauge your plans aggressiveness, use the rule of 100, suggests Chris Keller, partner at Kingman Financial Group in San Antonio. With this rule, you subtract your age from 100 to find your allocation to stock funds. For example, a 30-year-old would put 70 percent of a 401 in stocks. Naturally, this rule moves the 401 to become less risky as you approach retirement.

Pointing to the importance of a 70-year-old reducing risk, Keller says, Losing half of your portfolio while at this age might have a huge impact on what your retirement looks like.

Contribute Invest And Repeat

You’re officially no longer clueless about your 401 investments. Don’t feel intimidated about making these choices — it’s most important to contribute to your account and then invest in something — anything other than money market funds. Keep doing those two things and you’ll see your nest egg grow over time.

You May Like: How To Take Out 401k Money For House

Entirely Avoided Certain Asset Classes

Some investors might limit their investment choices unnecessarily. For example, they may consider only allocating stocks and fixed investments . In the process, they might entirely avoid asset classes that can perform well in certain market situations.

Examples could be real estate investment trusts or resource investments, such as energy and precious metals. In certain markets, these asset classes could outperform both stocks and fixed income assets. But if you only diversify between stocks and fixed-income investments, you can miss out on these opportunities.

Determine Your Goals And Time Horizon

If retiring in 30 years is your goal, you can and should emphasize growth or even aggressive growth. You have time to recover losses and the gains on growth-type investments can be spectacular. On the other hand, if you plan to save money to buy a house in five years, youll want to be more conservative since you cant afford to take a loss that will cut into your investment principal. Income or growth and income should be your preference.

Read Also: How To Withdraw My 401k From Fidelity

Buy This Different Etf

In September 2017, I picked some of the best and worst alternative investments for retail investors to own. One of the ETFs I put on the best list was MNA IQ Merger Arbitrage ETF , which charges 0.77% annually, and makes bets on global arbitrage opportunities.

MNA makes money on the spread between the share price that a buyer pays for an acquisition target and the price MNA pays for the target stock after the news of the acquisition becomes public. Its betting that a deal will take place. The spreads are razor-thin, so it has to bet on a large number of targets. It currently has 58 stocks in its portfolio.

If you compare MNA to the S& P 500 Index, youll walk away thinking its a terrible investment. The reality is that this ETF gives you bond-like security only better because it uses equities instead of bonds to lower the volatility, I wrote on Sept. 11, 2017.

Since inception, its worst year was -1.83% in 2010 and its best year was 6.54% in 2013. If youre looking for a turtle to win the race long-term, this is the alternative investment to do it.

So far, in 2020, it has a total return of -0.60% through March 4, which is 220 basis points better than the SPDR S& P 500 ETF . Its not going to make you rich, but it will help reduce your downside risk.

Add Real Property Investments For Higher Income

Historically, real estate investors have enjoyed a combination of asset growth, steady income, and tax advantages. Though results have been lackluster in recent years due to speculation and over-building, real estate ownership remains attractive. Investors in or nearing retirement should consider placing a portion of their investment portfolio into direct ownership of rental property, either commercial or residential.

Joe of Retire By 40, purchased a duplex in 2014 and expects to make about $5,000 per year on this investment. Joe is actively involved in managing his investment, a responsibility not everyone is capable of or desires to assume.

Investors looking for a passive investment should consider:

Read Also: How To Avoid Penalty On 401k Withdrawal

Choose Your Investments As Part Of A Diversified Portfolio

Once your account is open, you’ll want to select investments to build a diversified portfolioTooltip A diversified portfolio contains different asset classessuch as stocks, bonds and cash and cash investments. It also contains diversity within assets classes. For example, within stocks you can buy stocks that represent large companies , small companies , international and everything in between. And within those divisions, it may be best to have stocks in different sectors and different industries within the sectors. . Heres how to create one:

Focus On Technology & Biology Etfs

Study after study has questioned whether an individually managed portfolio of common stock can out-perform an unmanaged exchange-traded stock index fund , especially when management and transaction fees are included. Equities have historically been one of the best vehicles for long-term growth, combining liquidity, choice, and consumer regulation to be the foundation of most retirement funds. Picking individual winners among the thousands of securities traded worldwide is a difficult task for the average nonprofessional investor. As a consequence, an ETF is the perfect vehicle for retirement plans.

At the same time, we are in the midst of a technological and biological revolution driven by an increasing pace of new discoveries with the capacity to transform every aspect of human life. Investing in a broad selection of companies in these industries increases the chance that investors have a stake in the specific companies that will be super-successful. Technology and biotech ETFs can provide this opportunity.

You May Like: How To Open A Solo 401k

Go For Variety Not Quantity

Having a lot of investments does not make you diversified. To be diversified, you need to have lots of different kinds of investments. That means you should have some of all of the following: stocks, bonds, real estate funds, international securities, and cash.

Investments in each of these different asset categories do different things for you.

- Stocks help your portfolio grow.

- Bonds bring in income.

- Real estate provides both a hedge against inflation and low “correlation” to stocksin other words, it may rise when stocks fall.

- International investments provide growth and help maintain buying power in an increasing globalized world.

- Cash gives you and your portfolio security and stability.

Diversify Across Different Sectors

Seasoned investors will also look to diversify across multiple sectors. This is especially important when investing in the stock markets as certain sectors will often perform better or worse than others.

For example, in the midst of the coronavirus pandemic in March 2020, it was technology-based stocks that led the way for the rest of the year. The likes of Apple, Amazon, Facebook, and Alphabet all enjoyed tremendous double-digit growth.

On the flip side, other sectors such as oil and gas, retail, and aviation all suffered significant losses during the same period. With this in mind, its important that your portfolio, at least in the case of stocks, is well-diversified across multiple sectors.

As a side note, the S& P 500 is home to 11 main market sectors, which you will find below for reference:

- Energy

- Utilities

- Real Estate

To take things to the next level, you can also diversify across specific industries, which we cover in the section below.

Also Check: How Do I Transfer My 401k To A Roth Ira

Diversify Your Assets: An Example Of Stock Vs Bond Mutual Funds

Dont put all your eggs in one basket is the fundamental principle of investing diversification. By investing in various types of financial assets, such as stock and bond mutual funds, you protect yourself from drastic swings in your investment value. Youre also less likely to .

Heres how it works:

Jasper had 100% of his $100,000 investments in stock mutual funds. In 2008, when the , the value of his investments fell to $63,450. Jasper, afraid of losing any more money, panicked and sold all of his stock funds. He was completely out of the stock market in 2009 when the S& P 500 returned 25.94% and in 2010 when the annual market return was 14.82%.

Imagine that Jaspers investments were better diversified and he had 70% of his assets in stock funds and 30% in bond funds. During that same year, the 10-year treasury bond returned 20.10%. In 2008, with a 70%-30% mix of stocks and bonds, instead of falling 36.55%, Jaspers investment portfolio would have dropped a more tolerable 19.56% to $80,445. The calculations: .

With the smaller decline in his investments, Jasper would be better able to hang on during the market decline and could have profited from the subsequent 7-year bull market.

Historically, stock returns outperform those of bonds. But stock returns are more volatile. By combining stock and bond funds you profit from solid investment returns and fewer ups and downs in price. This will help you stick with your asset allocation plan.

Faqs: How To Diversify Your Portfolio

Below, you will find a list of commonly asked questions from those exploring portfolio diversification.

Why Do You Need to Diversify Your Portfolio?

Ultimately, this is with the view of ensuring you are overexposed to a small number of assets, So, you are reducing your long-term investment risk.

Can Too Much Diversification Hurt My Returns?

There is always the potential that too much diversification can hurt your long-term growth potential. After all, by investing in too many assets, you are increasing the likelihood that you will be adding low-quality instruments to your portfolio.

What Is a Good Diversified Portfolio?

A well-diversified portfolio will initially involve thinking about what your long-term financial goals are and how much risk you feel comfortable taking. A good way of doing this is to review the asset allocation models we discussed earlier in this guide.

For example, lets suppose you elect to take a balanced approach via a 50/50 split of stocks and bonds. In this instance, you then need to niche down further by thinking about which type of stocks and bonds to add to your portfolio.

This might include a collection of growth and blue-chip stock ETFs, alongside a basket of corporate and government bonds.

Which Types of Investments Can Make up a Diversified Portfolio?

What Is an Example of a Diversified Portfolio?

Don’t Miss: Why Cant I Take Money Out Of My 401k

Diversification Is Not A One

Once you have a target mix, you need to keep it on track with periodic checkups and rebalancing. If you don’t rebalance, a good run in stocks could leave your portfolio with a risk level that is inconsistent with your goal and strategy.

What if you don’t rebalance? The hypothetical portfolio shows what would have happened if you didnt rebalance a portfolio from 2000 to 2020: The stock allocation would have grown significantly.

How an investment mix can change over time

Past performance is no guarantee of future results.

The resulting increased weight in stocks meant the portfolio had more potential risk at the end of 2020. Why? Because while past performance does not guarantee future results, stocks have historically had larger price swings than bonds or cash. This means that when a portfolio skews toward stocks, it has the potential for bigger ups and downs.2

Rebalancing is not just a volatility-reducing exercise. The goal is to reset your asset mix to bring it back to an appropriate risk level for you. Sometimes that means reducing risk by increasing the portion of a portfolio in more conservative options, but other times it means adding more risk to get back to your target mix.

Start With Your Plan Document

The best place to start making your 401 selections is your companys Plan Document. This document gives you all the important details specific to your companys retirement plan, like the employer match and vesting schedule.

Whats a vesting schedule? Its an outline for when the money your company contributes to your 401 is completely yours. The money you put into the 401 and its growth are always yours. But many companies require you to remain employed a certain number of years before the money they contribute to your 401 is 100% yours. With each year of employment, an increased percentage of the employer match is yours to take with you if you leave your job.

Many companies require you to remain employed a certain number of years before the money they contribute to your 401 is 100% yours.

The Plan Document also includes information about the fees related to your 401, the services available to you, and how to make changes to your 401 portfolio.

Your Action Step: The more you understand about the specifics of your 401 plan, the more confident youll be. If you dont have a copy of your Plan Document, contact your HR department. They should be able to give you a copy or tell you where to find one.

Also Check: How To Withdraw Money From My Fidelity 401k