So What Do You Need To Do

First of all, you need to check with your employer to determine how and when they match your contributions. If they do it once a year as a lump sum, then youre most likely in the clear.

If they do it on a paycheck-to-paycheck basis, you just need to do a little math to find the ideal contribution to get the full or close to the full company match.

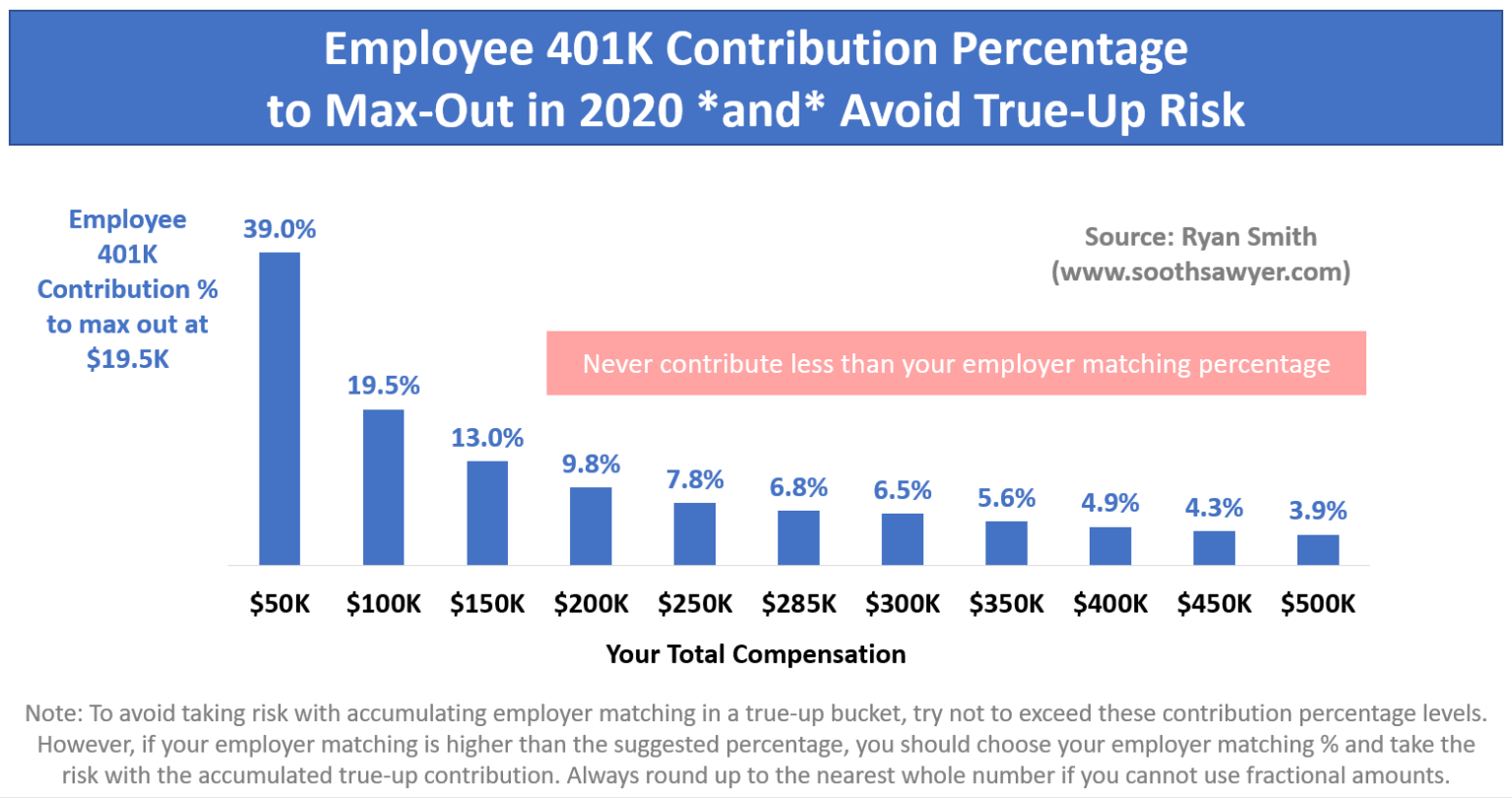

Lets go back to my original example and run some numbers. We need to divide $19,500, the max, by your annual income of $360,000. This comes to about 5.4%. This would be the amount you would want to change it to in order to spread out your contributions over the entire year, ensuring yourself of getting the full $14,400 match may not allow you to contribute a tenth of a percent so I would simply round up to ensure you get the full match…in other words, go with 5% the entire year and then bump it to 9% in December before moving it back down to 5% in January and bumping it to 9% again in December, etc).

And, thats it. THIS ONE SIMPLE CHANGE OF SPREADING OUT YOUR 401 CONTRIBUTIONS OVER THE ENTIRE YEAR COULD SAVE YOU AND BRING YOU HUNDREDS OF THOUSANDS OF DOLLARS IN THE LONG-TERM.

It seems so simple, yet not many of us really think about it because, again, it feels like were going above and beyond if we max out our 401 as early as we can in the year .

Good luck, and go get your full match!

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

The 401 Contribution Deadline Is Dec 31

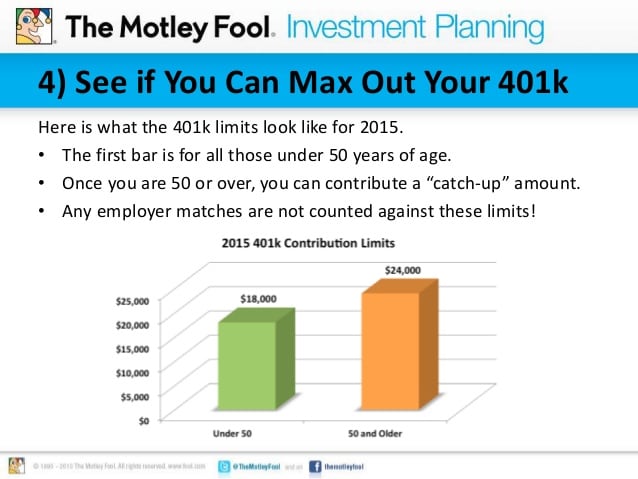

401s and 403s operate on a calendar-year schedule, so the last day to make those contributions for 2020 is Dec. 31. As a reminder, the contribution limit is $19,500.

If you can max out your 401 contributions through your employer, now is the time to do so. End says to contact your retirement plan administrator or human resources representative and find out how much you’ve saved so far this year. From there, adjust accordingly.

“Go in, see what the difference is, and then you can set your deferrals for your last paycheck to make that up,” he adds.

According to Fidelity Investments, the average total savings rate which takes both employer and employee contributions into account for 401s was 13.5% in the third quarter. The total savings rate for 403 accounts was 10.6%.

While you’re already taking care of business, it’s not a bad idea to set your deferrals for next year, too. The maximum 401 contribution for 2021 is $19,500. That divided by 27 paydays, assuming you’re paid biweekly, is about $720 per check if you can afford to set it aside.

End says doing the calculations now is crucial.

“It’s much easier to start and make that budget for the full year than to kick the can down the road for later,” he adds.

You May Like: How To Transfer 401k Without Penalty

Question #: Do You Have An Emergency Fund Of 3

If the answer to that question is no, then it might be a good idea to set your retirement savings to get your employer match, and then focus on building up your emergency savings. Retirement savings are extremely important of course. But an emergency could happen anytime, and its important to be financially prepared if it does. So ensuring youre prepared to pay your bills and take care of yourself and your family for 3-6 months in the event of a job loss, unexpected expense, etc, should generally take priority over maxing out the 401. Question # 3: Do you have other financial priorities in place?

Things like wills, life insurance, disability insurance, and health insurance can protect you and your family from financial catastrophe in the event life doesnt go as planned. If you need these in place, and dont have them, consider prioritizing here before maxing the 401. Question #4: Do you know the investment choices and fees in the 401 account? Are they good ones?

The other perk to putting some money into a Roth IRA if your income is under the income limit, is that Roth IRAs are more flexible when it comes to withdrawals than 401 plans are. So you can take advantage of that flexibility, as well as the tax-free growth that Roth IRAs offer, while also saving for retirement.

Most Retirement Income Projections Don’t Incorporate Market Moves

Basic compounding calculators may be a good starting point, but they omit a key part of the retirement planning equation: markets go up and down. A Monte Carlo analysis takes market volatility and cash flows into account to get closer to determining a risk-adjusted withdrawal rate.

Financial planning is a complex and highly personalized process. Its art and science. To help investors understand some of the factors they should consider, weve run a Monte Carlo analysis in specialized financial planning software for a hypothetical couple to illustrate how maxing out a 401 could translate into retirement income.

Important note: The information contained in this article is for illustrative purposes only and should not be misconstrued as the rendering of personalized recommendations, financial or investment advice, nor is it intended to provide a sufficient basis on which to make any financial or investment decisions. If you have questions about your personal financial situation, consider speaking with a financial advisor.

Assumptions made in the hypothetical analysis:

Results:

You May Like: Can You Have A Solo 401k And An Employer 401k

Don’t Forget The Match

Another big benefit of a 401 plan is that most employers help you save by contributing to your account via matching contributions. These regular employer-paid contributions amount to free cash and help you boost both the amount of money you save and your investment returns. For example, it’s common for employers to match 50 cents for every dollar you put in some match dollar for dollar up to a 6 percent of your salary. It’s an incentive for you to save.

The extra money from your company can add up fast. If you earn $100,000 and your company chips in 50 cents for every dollar you put into your 401 up to 6 percent, you’re getting an additional $3,000 more deposited into your account per year.

“A company match should also be a target for you to be saving each and every year, Foguth says. Company-matched 401 plans are free money, so at a minimum, always make sure you’re putting in up to what your company will match. For example, if your company matches 5 percent, make sure you’re contributing at a minimum of 5 percent to your 401.”

And employers continue to chip in and help with their employees retirement savings, according to Fidelity Investments. Over the last four quarters, a record 88 percent of 401 savers received an employer contribution, with employers contributing an average of $4,030 per account over the last 12 months.

Also of Interest

Please leave your comment below.

You must be logged in to leave a comment.

Featured AARP Member Benefits

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: How To Withdraw My 401k From Fidelity

What Happens When You Max Out Your 401k

In October of that year, I maxed out my 401k plan and Roth IRA contributions for the year. My paychecks were larger because those automatic deductions no longer happened. And of course, my modified adjusted gross income was higher, reducing the amount of tax benefits I usually have in comparison my previous annual deductions.

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

You May Like: Can I Transfer Money From 401k To Ira

Why Slow And Steady Might Work For You

If youre going to max your 401, the alternative to frontloading is to make consistent contributions with every paycheck.

For most people, that means contributing $19,500 over the course of the year. If youre paid every other week, thats $750 per paycheck.

Making consistent contributions to your 401 is the default strategy for most people. It brings its own pros and cons to the table.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

You May Like: How To Switch 401k To Ira

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Taking out a loan.

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn 55 or after

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Last year, due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allows. These withdrawals had to be before the end of 2020. If you took a hardship loan in 2020, you can avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years. Consider consulting with a tax professional as you prepare your taxes if youre in this position, since it involves filing amended returns.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Other Important Financial Goals To Consider

Based on your own unique financial situation, you should keep a few other things in mind as you decide how much to contribute to your 401:

- Do you have a formal estate plan with wills and other critical papers ?

- Can you cover health care expenses? If you have a high-deductible health plan with a health savings account combo, make sure you are putting enough into your HSA to cover medical expensesboth now and in the future.

- Do you have proper disability insurance coverage to protect you and your family if you miss work for six months or more?

- If you’re nearing retirement, do you have long-term care plans in place?

You May Like: How To Do A Direct 401k Rollover

Invest In A Traditional Or Roth Ira

Yep, you may be able to put money into a traditional or Roth IRA even if you have a workplace 401. You can invest $6,000 a year . If you go with a traditional IRA, You might be able to deduct the full amount of the contributions if you or your spouse participated in a retirement plan at work. If thats the case, and you want to contribute to an IRA, you can opt for a Roth IRA instead.

A Roth IRA is funded with money thats already been taxed, so youre not limited by the contributions youve made in other funds. However, not everybody can go the Roth IRA route. If your modified adjusted gross income doesnt exceed IRS limits , you can contribute to a Roth IRA. Thats good for you, since that money grows tax-free and it wont be taxed when you take it out in retirement!

Be Strategic About Big Ticket Expenses

Are you planning a huge blowout vacation? What about a second home? Even though these are right now purchases, they should be thought about in the framework of how theyll impact you long-term, especially if youre looking to max out your 401k contributions. Can you make your vacation into a 2-year plan, giving you more time to save up some cash, or use points-based rewards to upgrade your travel? Or are you thinking about buying a vacation home by assessing what your goals are in making this purchase and how best to leverage financing and tax options. Big purchases are meant to give us joy, and hey, youve earned them. But thinking about them long-term in context of planning for retirement will go a long way when trying to hit that $19,500 annual amount.

Read Also: How To Grow 401k Fast

What Kind Of Investments Are In A 401

401s often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your matching dollars, and then direct any additional retirement savings contributions for the year into an IRA.

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

Read Also: How To Avoid Penalty On 401k Withdrawal