Understanding Early Withdrawal From A 401

The method and process of withdrawing money from your 401 will depend on your employer and the type of withdrawal you choose. Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It’s really a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available. If it is, then you should check the fine print of your plan to determine the type of withdrawals that are allowed or available.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds. For a $10,000 withdrawal, once all taxes and penalties are paid, you will only receive approximately $6,300. There are some non-penalty options to consider, however.

Before deciding upon taking an early withdrawal from your 401, find out if your plan allows you to take a loan against it, as this allows you to eventually replace the funds. You may also want to consider alternative options for securing financing that could hurt you less in the long run, such as a small personal loan.

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55. Your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

The retirement rule regarding age 55 and up won’t apply if you roll your 401 plan over to an IRA. The earliest age at which you can withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2 if you’re still working, but you may not have the same access to the funds at the company for which you currently work if you’ve changed jobs.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Don’t Miss: How Do I Transfer 401k To New Employer

Remember Required Minimum Distributions

While you don’t need to start taking distributions from your 401 the minute you stop working, you must begin taking required minimum distributions by April 1 following the year you turn 72. Some employer-sponsored plans may allow you to defer distributions until April 1 of the year after you retire, if you retire after age 72, but it is not common. Keep in mind that this exception does not apply to plans you may have with previous employers that you no longer work for.

If you wait until you are required to take your RMDs, you must begin withdrawing regular, periodic distributions calculated based on your life expectancy and account balance. While you may withdraw more in any given year, you cannot withdraw less than your RMD.

The age for RMDs used to be 70½, but following the passage of the Setting Every Community Up For Retirement Enhancement Act in Dec. 2019, it was raised to 72.

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Recommended Reading: How To Diversify 401k Portfolio

Tips For Planning Your Retirement

- Switching from saving for retirement to spending your nest egg is a tough transition. A financial advisor can help you figure out which accounts to draw down first, when to start taking Social Security and more. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If the idea of a protected stream of income that you cant outlive sounds good, you may want to look into buying an annuity. These insurance products are pretty complex though, and theres a wide variety and selection. In other words, youll want to do your homework. You can start by reading up on the pros and cons.

Things To Consider When Withdrawing From Your 401 At Age 55

A common question people ask is, When can I withdraw money from my 401? After all, you worked hard for many years, and its only natural to want to know when you can reap the benefits of that time and effort.

You can technically withdraw money out of your 401 at any age. But if you take out money before youre at least age 59 ½, then your withdrawal will incur a 10% penalty in addition to the income taxes you must already pay.

However, you do have an opportunity to dig into your 401 starting at age 55 and not pay penalties on that withdrawalprovided you meet two criteria:

- You are no longer employed by the company with whom the 401 is affiliated

- You left that employer during or after the calendar year in which you reached age 55

Keep these four things in mind if youre thinking about taking 401 withdrawals from an old employer planbetween the ages of 55 and 59 ½:

You May Like: How To Take Money From 401k Without Penalty

Cashing Out A 401 In The Event Of Job Termination

In case you are fired, you can cash out your 401 plan even if you are below the age of 59 ½ years. You just need to contact the administrator of your plan and fill out certain forms for the distribution of your 401 funds. However, the Internal Revenue Service may charge you a penalty of 10% for early withdrawal, subject to certain exceptions.

How Much Money Do You Need

The CARES Act allows any qualified individuals whove been negatively affected by the coronavirus pandemic to withdraw up to $100,000 from eligible retirement plans until December 30, 2020, and avoid the usual 10-percent penalty.

You will also have three years to pay the federal taxes on money withdrawn this year. For example, if you take a $15,000 coronavirus-related distribution in 2020, you could report $5,000 in income on your federal income tax returns for each of the 2020, 2021, and 2022 tax years.

If you do opt to withdraw some of your funds, youre best off only taking what you absolutely need to stay afloat. Withdrawing retirement funds early means that they miss out on growth. And, even though you wont have to pay a penalty, you will generally still have to pay taxes on that withdrawal.

Also Check: Which 401k Investment Option Is Best

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Cashing Out Your 401 After Leaving A Job

Based on the amount of money in your 401 account, your employer may allow you to leave the account with them. However, you will not be able to contribute any more to your old account.

Leaving your account with the old employer may not be prudentespecially when you have access to more flexible Individual Retirement Account plans from most brokers. You may roll over your 401 account to your new employer or transfer the funds into an IRA. If you meet the age criteria, you may start taking distributions without having to pay any penalty for early withdrawal.

You May Like: What Is An Ira Account Vs 401k

Leave The Account Alone

If your 401 investment balance is more than $5,000, most plans allow you to just leave it where it is. This is often the simplest choice. If you dont urgently need the money, leaving your 401 account alone allows it to continue growing from investment gains.

It may make sense to roll over the 401, though, if youre paying high fees for the management of the account where it is, or if you want more control over how your money is invested.

If the account balance is less than $5,000, your old company may also opt to distribute the money to you. Then its largely on you to roll it over into a new retirement account if you want to avoid having to pay taxes on it nowand possibly a penalty.

Rules About 401 Required Minimum Distributions

Again, the minimum age for RMDs was changed in recent years. Before, you had to start taking them either when you retired or when you turned 70.5. However, this age requirement still holds for anyone who turned 70.5 in 2019 or earlier. Anyone who has yet to turn 70.5 can wait until April 1 of the year after theyre 72 to start taking RMDs.

The year in which April 1 is your RMD deadline is your starting year. After the starting year, the deadline shifts to December 31. So your second year and thereafter, you must take your RMD by December 31.

If you wait until April 1 of your starting year to take your RMD, you will have to take two years worth of RMDs the same year. You should avoid this, as it will increase your income for that year, likely putting you in a higher tax bracket. If you fail to take any RMD or you dont take a large enough RMD as required by the IRS, you may have to pay a 50% penalty on the money you should have withdrawn.

Read Also: What Is The Interest Rate On A 401k

Is Your 401k A Security Blanket

Most of us look at our 401k as a security blanket â something that we intend to pull out when we are suffering in the cold. There are a number of financial hardships that might tempt you to consider taking an early withdrawal:

- Urgent medical emergencies

- Rising college tuition costs

- Pressing home improvement needs

This 401k withdrawal calculator will help you decide whether to take a lump-sum distribution or to rollover to a tax-deferred account. Its side-by-side comparison of data gives you the information you need to make a decision that is right for you.

How Do I Close My Merrill Lynch 401k Account

4.6/5closeMerrill Lynch accountcloseaccount

You should send a closure request to the broker by logging into the Merrill Edge site and using the internal messaging system. You could also call the broker at 1-877-653-4732 and speak with a live agent. If you’re outside the United States, you should call 1-609-818-8900 instead.

Beside above, how do I contact Merrill Lynch 401k? If you do not receive your User ID, or have any questions, please the Merrill Lynch Retirement and Benefits Contact Center at 1-866-820-1492 or 609-818-8894 .

Similarly, you may ask, how do I withdraw my 401k early from Merrill Lynch?

To start your withdrawal you’ll need a One Time Distribution form from Merrill Lynch. You must fill it out with your personal information, including your name, date of birth, phone number and Merrill Lynch retirement account number. This information must be accurate to avoid delays in getting your funds.

How long can an employer hold your 401k after termination?

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you haven’t reached 59 1/2 years of age. This includes any money you’ve contributed and any vested contributions from your employer — plus any investment profits your account has generated.

You May Like: How To Find Out If You Have An Old 401k

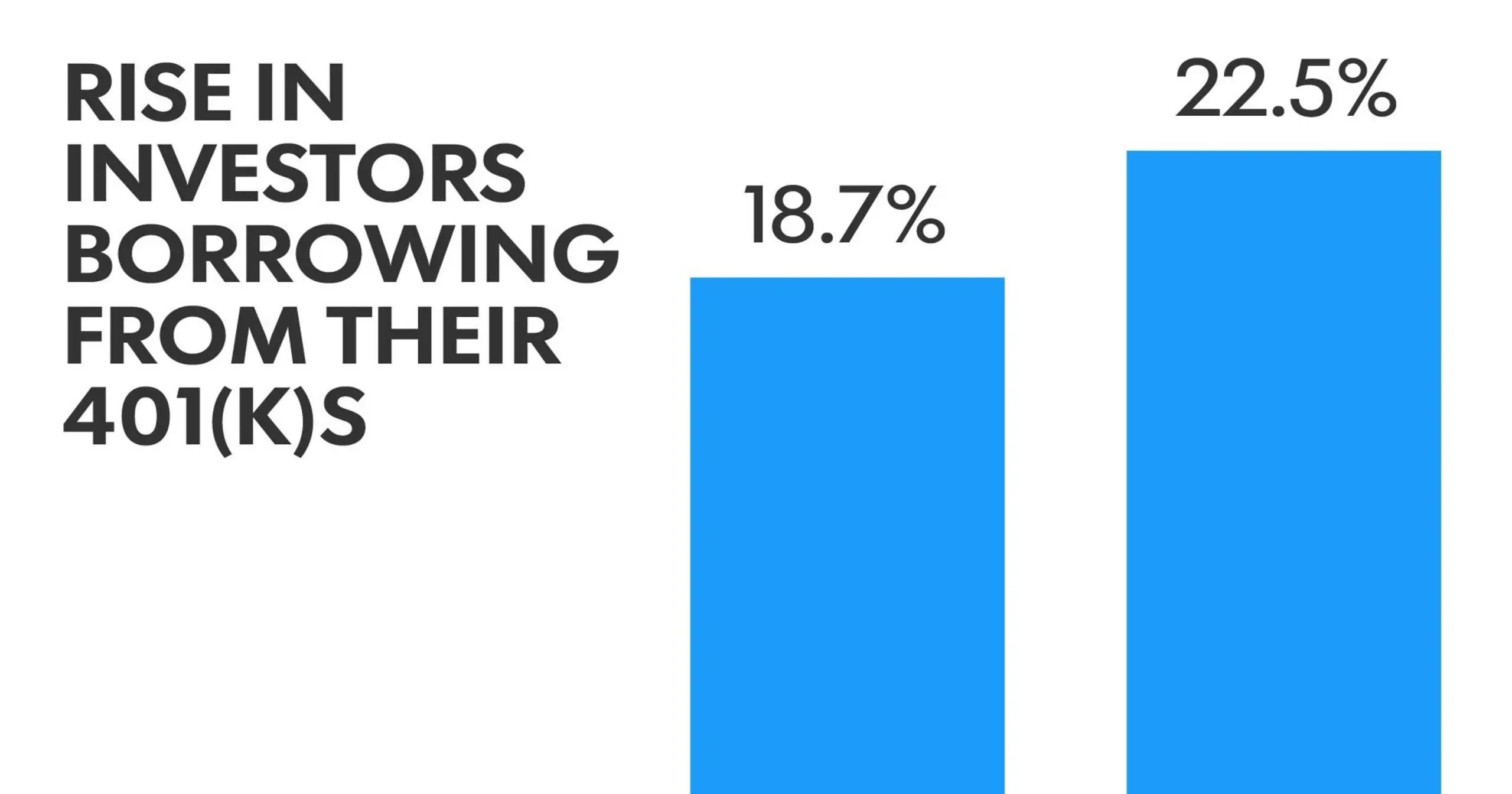

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

More From The New Road To Retirement:

Here’s a look at more retirement news.

Also be aware that if your balance is low enough, the plan might not let you remain in it even if you want to.

“If the balance is between $1,000 and $5,000, the plan can transfer the money to an in the name of the individual,” Hansen said. “If it’s under $1,000, they can cash you out.

“It’s up to the plan.”

Your other option is to roll over the balance to another qualified retirement plan. That could include a 401 at your new employer assuming rollovers from other plans are accepted or an IRA.

If under $1,000, they can cash you out. It’s up to the plan.Will HansenExecutive director of the Plan Sponsor Council of America

Be aware that if you have a Roth 401, it can only be rolled over to another Roth account. This type of 401 and IRA involves after-tax contributions, meaning you don’t get a tax break upfront as you do with traditional 401 plans and IRAs. But the Roth money grows tax-free and is untaxed when you make qualified withdrawals down the road.

If you decide to move your retirement savings, you should do a trustee-to-trustee rollover, where the transfer is sent directly to the new 401 plan or IRA custodian.

Also, while any money you put in your 401 is always yours, the same can’t be said about employer contributions.

Read Also: Why Choose A Roth Ira Over A 401k

If You Get Terminated From Your Job You Have The Option Of Cashing Out Your 401 However This Is Probably Not The Smartest Move

Image source: Andrew Magill.

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you haven’t reached 59 1/2 years of age. This includes any money you’ve contributed and any vested contributions from your employer — plus any investment profits your account has generated. However, you may face a 10% early withdrawal penalty from the IRS for cashing out early, so this might not be the best option. Here’s what you need to know to make an informed decision about your 401 after you’re no longer with your employer.

How to cash out and the implications of doing soThe procedure for cashing out is usually rather simple. All you need to do is contact your plan’s administrator and complete the necessary distribution paperwork. However, there are a few things you need to keep in mind, especially regarding the tax implications of cashing out.

Unless your 401 is of the Roth variety, all of the money you withdraw will be treated as taxable income, no matter how old you are or the reason for the withdrawal. So, even if you are older than 59 1/2, it’s important to consider how cashing out will affect your tax status for the year. If you have a large 401 balance, cashing out could easily catapult you into a higher tax bracket. Your plan provider will be required to withhold 20% of the amount you cash out for taxes , and will also file a form 1099-R to document the distribution.