What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

When You Havent Started Saving For Retirement

No matter how far you are from retirement, dont beat yourself up for not starting sooner. The important thing is to get started.

Take the first step by setting aside a small amount of money. Then increase it over time when you can afford it. Read 5 steps to creating your retirement plan to help you get started.

Of course, if your employer offers a matching contribution in its 401 plan, try to set aside enough to get that match by increasing your contribution rate, says Heather Winston, assistant director of financial advice and planning at Principal®. The company can help to grow your nest egg, and that free money can flow from them to you.

Employer 401 Contribution Limits For 2020

While the IRS doesnât directly limit employersâ 401 matching contributions, there is a limit to how much they can contribute.

Falling back on the total 401 contribution amount, the limit for employer matching contributions canât exceed $57,000 minus the employeeâs contributions in 2020.

If the employee maxes out their 2020 contribution limit of $19,500, the maximum amount an employer can contribute towards their 401 is $37,500.

Since the average employer 401 match is 3.5% of employeesâ salaries, itâs unlikely an employer would contribute that much.

Recommended Reading: How To Lower 401k Contribution Fidelity

Contribution Limits In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

401 plans are an excellent way to save for retirement, but because 401s are tax-advantaged, the IRS sets a contribution limit on how much you and your employer can put into your 401 per year.

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

Recommended Reading: Can I Rollover 401k To Ira While Still Employed

Are There Separate Limits For Roth 401s

No. Roth 401s have the same contribution limit as regular 401s. For 2021, that limit is $19,500. You can contribute to both a traditional 401 and a Roth 401 account in the same year, as long as your total contributions dont exceed that amount. If youre choosing between the two, learn about the differences between a Roth and traditional 401.

|

career counseling plus loan discounts with qualifying deposit |

Promotionno promotion available at this time |

Promotionof free management with a qualifying deposit |

Your Raise Or Bonus Pushed Your Contributions Over The Limit

Setting up automatic contributions to your employer-sponsored 401 is a great way to make sure youll max out your 401 without putting in a lot of effort. But you could go over if you get a pay bump or bonus.

When you get a bonus, any traditional deductions such as taxes are withdrawn like normal, and so are any contributions to your 401. If youre maxing out your salary contributions, a bonus might put you over the limit.

A salary increase can put you over the limit as well. You may have set up your auto-contributions to max out throughout the year. If you get a pay bump, your contribution will go up as well. You may miss this increase and forget to adjust your auto-contributions.

Also Check: How Can I Get Money Out Of My 401k

Next Steps To Consider

A distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, qualified first-time home purchase, or death.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Total Annual 401 Contribution Limits

Total contribution limits for 2021 are the following:

- $58,000 total annual 401 if you are age 49 or younger

- $64,500 total annual 401 if you are age 50 or older

The dollar amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

Don’t Miss: Should I Roll My 401k Into An Annuity

Roth 401 Income Limits

Unlike Roth IRAs who are limited to those who make less than $140,000 individually and $208,000 combined for married couples, Roth 401s arenât limited by the participantâs income levels.

Still limited not to exceed the Roth 401 participantâs total income however, employees can still contribute to a Roth 401 regardless of how much they make annually.

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2017, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $99,000 but less than $119,000 for a married couple filing a joint return or a qualifying widow,

- More than $62,000 but less than $72,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

You May Like: How To Find My 401k Money

Employer Match Does Not Count Toward The 401 Limit

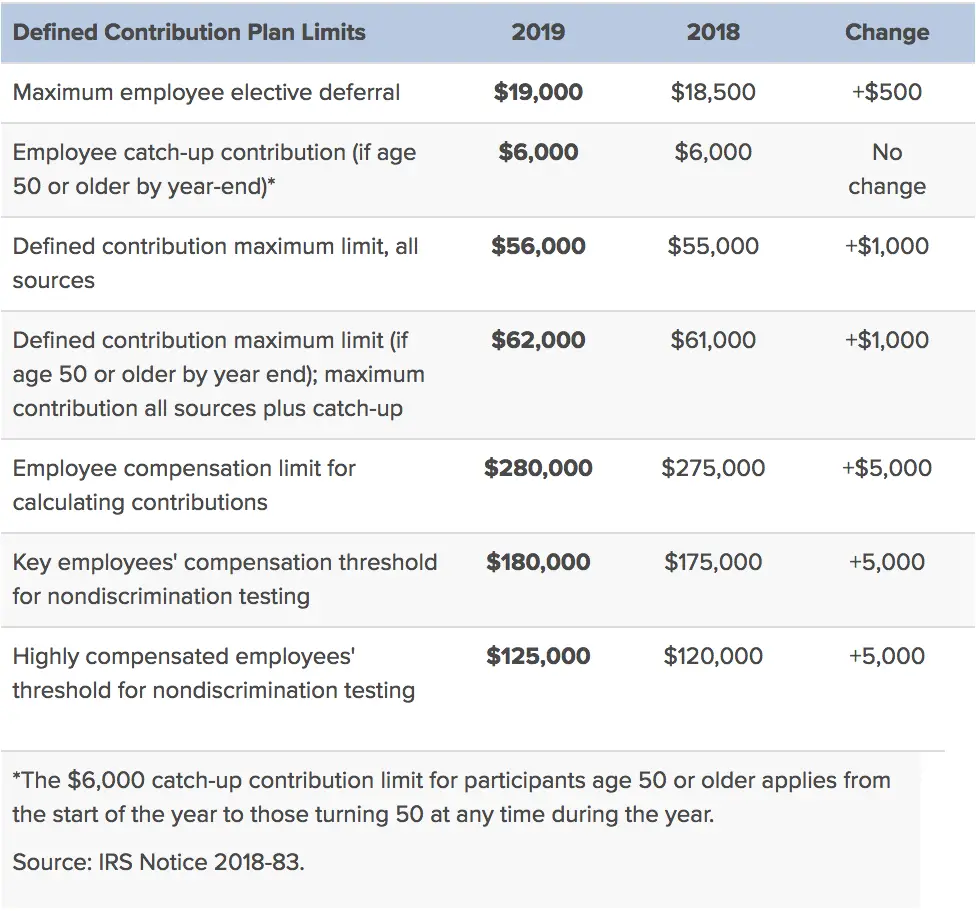

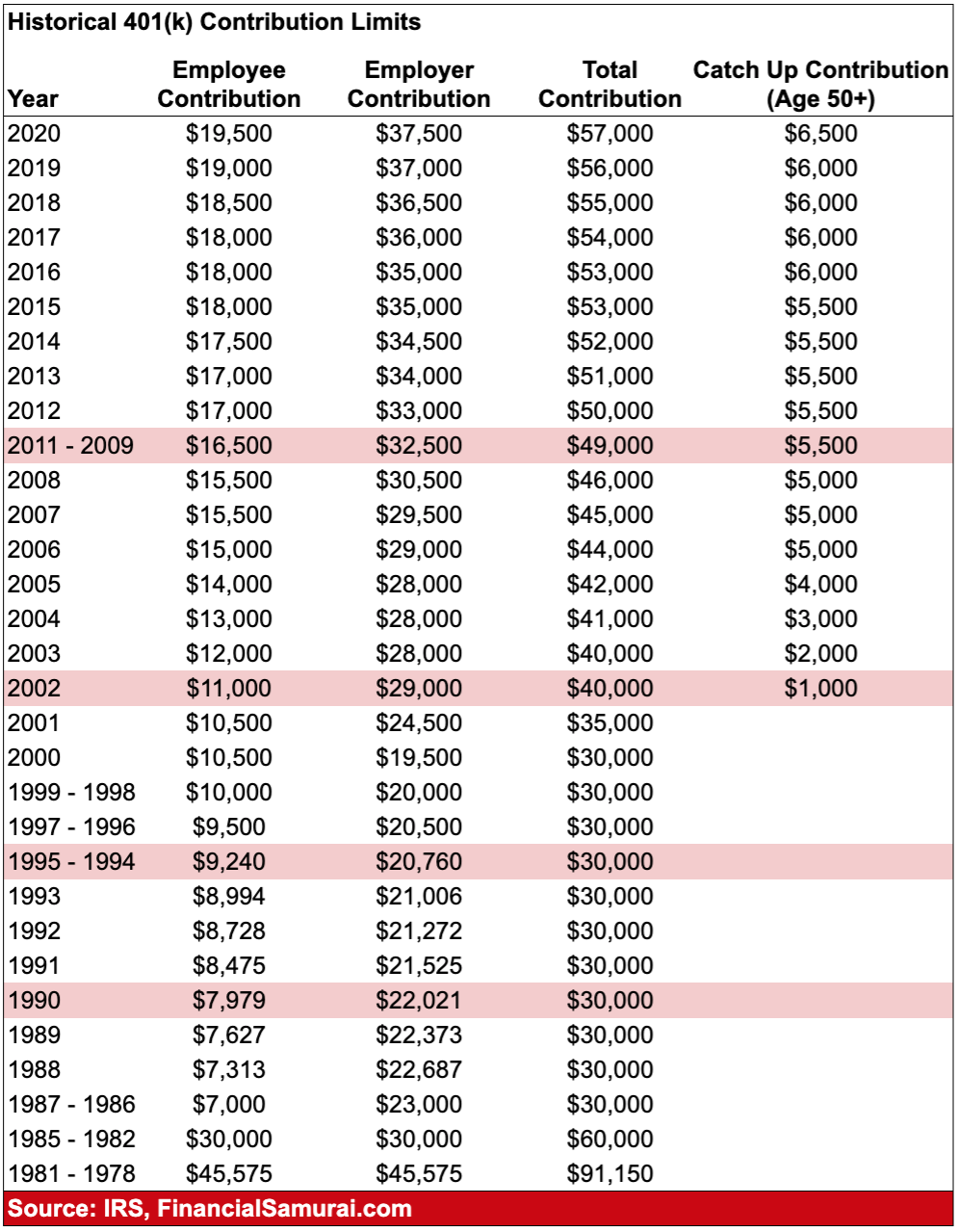

There are two sides to your contribution: what you provide as the employee and the match from your employer . You can only contribute a certain amount to your 401 each year. For 2019, that limits stands at $19,000. In 2020, the limit is expected to rise to $19,500. This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401 on a pre-tax basis.

The good news is that this limit does not include employer match contributions. If you contribute, say, $18,000 toward your 401 and your employer adds an additional $5,000, youre still within the IRS limits.

However, there is another limit which applies to overall contributions your employer match contributions are taken into account for this overall contribution limit. For 2019, that limit stands at $56,000. This means that together, you and your employer can contribute up to $56,000 for your 401. If you contribute the max of $19,000, your employer can contribute up to $37,000 for 2019. For 2020, you and your employer can contribute up to $57,000. Note, though, that most employers are not this generous with their contributions, so youre likely in little danger of exceeding this limit.

Who Should Make After

Your employer may allow you to make after-tax 401 contributions. These are not tax-deductible like your regular 401 contributions, but you can make after-tax deferrals beyond the annual 401 contribution limit. Plus, the earnings from these extra contributions grow tax-free. This retirement strategy also opens the door for rollover opportunities that will provide you with even more tax breaks. However, making after-tax 401 contributions may not be the best decision for everyone. Consider talking to a financial advisor if you have specific questions about your situation.

You May Like: Can You Pull From 401k To Buy A House

Highly Compensated Employees In 2021

If you havent set up a 401 Safe Harbor plan yet, you may be considering one if youve failed nondiscrimination testing in the past or if you have a lot of highly compensated employees who want to maximize their retirement savings without reprisal.

For 2021 the same as 2020 a Highly Compensated Employee is defined as someone making more than $130,000 a yearor owning more than 5% of the business in the previous year. If the average employee puts 4% of their income into the retirement plan, a highly compensated employee generally cannot put more than 6% of their income in. Key employees must own less than 60% of the total assets in the plan, so the plan is not considered top-heavy.

To pass the IRS fairness testing easily, business owners may adopt a safe harbor plan and agree to make contributions on behalf of all employees. The deadline to adopt a new Safe Harbor 401 plan in 2021 is . The deadline to adopt the amendment necessary to convert a traditional 401 plan into a 3% nonelective safe harbor plan for 2021 is .

Hsa Contribution Limits Increase

If youre already maxing out your 401 or other retirement contributions, you might consider putting pre-tax dollars toward an HSA , if you have one. An HSA helps those with high-deductible health plans save taxes on money earmarked for medical expenses not covered by the plan.

Unlike a flexible spending account , which has a use it or lose it provision, the assets you contribute to an HSA are yours for the long term and can be rolled over each year. Plus, it offers a triple tax advantage: money put in isnt taxed, it grows tax-free, and youre not taxed when you take money out to pay for qualified medical expenses.

Taking advantage of the increased 2021 HSA contribution limits may help you pay for health-related expenses down the line in retirement.

| Coverage type |

|---|

| $7,200 |

Also Check: Can I Roll Over My 401k To An Ira

What About Employer Contributions

Employers are not obligated to match your Roth contributions, but if they do, the match is a pre-tax contribution. The funds will go into a separate pre-tax account, and funds from it will be subject to tax when distributions are made at retirement.

Your employers contribution does not count towards your individual maximum permitted contribution, but they do count towards the overall limit. Currently, the maximum amount that you can put into all your 401 plans, Roth or traditional and including employer contribution, is $57,000 for individuals under 50 or $63,500 for those aged 50 and over.

K Withdrawal Rules And 401k Contribution Limits

401k plans are great savings vehicles for retirement. Many plans offer matches from employers and they all provide tax free growth of capital for account holders. While 401ks are a really useful tool, they do have their limitations. Here are a few of the 401k withdrawal rules and 401k contribution limits.

Recommended Reading: What’s The Max You Can Put In A 401k

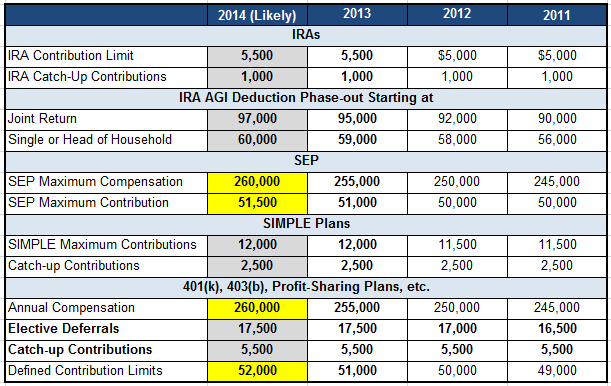

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $19,500 in 2021 and 2020 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Learn More About The Benefits Of The Solo 401k

- Solo 401k Information, Rules and Frequently Asked Questions about the Solo 401k.

- Solo 401k Eligibility Learn about the eligibility rules and find out who is eligible and who is ineligible to establish a Solo 401k plan.

- Solo 401k Loan A 401k loan up 50% of the total value of the 401k up to a maximum loan of $50,000 is permitted with a Solo 401k plan.

- Solo Roth 401k There is an option to make Roth 401k contributions with the salary deferral portion of the Solo 401k. Contributions into a Roth 401k are not tax deductible, but withdrawals are tax free after age 59 ½.

- Solo 401k Rollover You can rollover your 401k, 403b, 457, TSP and Defined Benefit Plan from a previous employer. You can also rollover a Traditional IRA, SEP IRA, Rollover IRA, SIMPLE IRA and Keogh plan.

- Solo 401k Providers Learn about the 3 main types of Solo 401k providers and the investment options available with each Solo 401k provider.

- Self Employed Retirement Plan Comparison Compare the Solo 401k, SEP IRA, Defined Benefit Plan and Simple IRA.

Also Check: How To Rollover 401k From Empower To Fidelity

What Happens If I Exceed My 401 Limit By Mistake

If you contribute too much to your 401 and notice your mistake before April 15, you can probably correct it with your employer. Youll need to notify your plan administrator. Theyll return the excess money to you, and youll get a new W-2 and pay taxes on your new total taxable wages.

If you dont catch the mistake before tax day, you may have to pay taxes twice on the amount you contributed over the limit. Thats because the excess contribution cant be deducted from your taxes in the year it was made, and because the IRS will still count that money as taxable when its distributed too.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Special Considerations For 401k 2019 Limits

Catch-up contributions

While $19,000 is the standard contribution limit for 2019, of course there are some exceptions to the rule. For example, the IRS allows individuals that are 50 years or older to make contributions in excess of the $19,000 limit so that theyre able to speed up their savings as they near retirement. This is called a catch-up contribution. For 2019, the catch-up contribution limit for those 50 years old and over is $6,000, but Mercer projects that this limit will also increase in 2020 by $500.

Highly compensated employees

Contrary to catch-up contributions, there are also some circumstances that might limit your retirement contributions even further than the standard rule. According to the IRS, highly compensated employees are those that earn more than $125,000 per year. If you fall into this category, your 401k contribution limits may depend on how much other employees within your company are contributing to their retirement plans. The IRS imposes these additional restrictions to ensure that a company is not favoring their highly paid employees in regards to pension plans. Well discuss the purpose of contribution limits in a more general sense a little later on in this post.

Don’t Miss: What Is Qualified Domestic Relations Order 401k

Savers Ages 50 And Older Can Put Away An Extra $6500 This Year

by Adam Shell, AARP, Updated January 11, 2021

En español | In a year of gloomy economic news, one bright spot is that workers who participate in a 401 at work can still sock away $19,500 in their workplace retirement plan.

And that’s good news: The number of companies that offer a traditional pension has dwindled, and workers are increasingly reliant on their own savings to fund their retirement. Last year, only 13 companies in the Fortune 500 offered a traditional pension, or defined-benefit plan, down from 236 companies in 1998, according to advisory firm Wilson Towers Watson. 401s, in contrast, have mushroomed. In 2018, more than 58 million American workers had a 401, or defined-contribution plan, and there were more than 580,000 401 plans offered, according to the Investment Company Institute.

A traditional 401 is a tax-advantaged retirement account that lets employees save pre-tax dollars that can grow tax-free until the funds are withdrawn in retirement. When you take distributions after the age of 59 1/2, your money will be taxed as ordinary income. However, 401 participants who start withdrawing their savings from the plan before the age of 59 1/2 will generally incur a 10 percent early withdrawal penalty.