Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

You May Like: How To Rollover Fidelity 401k To Vanguard

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but you’ll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

Read Also: How To Open 401k For Individuals

Key Options For A 401 Rollover

As youre considering where to roll over your 401, youll want to consider the advantages of each account type, the drawbacks, your own financial situation and the tax implications.

Depending on how much you have invested in your plan, you may have a limited time to make this decision, and in some cases your former company can make the decision for you:

- If you have less than $1,000, your ex-employer can just cash you out. You can still roll over the money into another account, but you typically must do so within 60 days.

- If you have between $1,000 and $5,000, your ex-employer can move the money into an IRA of its choice. If you dont like that IRA, you can always move it.

- If you have more than $5,000 in your 401, your company must await your instructions on how to proceed. You could continue to leave your money in your old 401.

The specific rules vary from employer to employer, and the rules that apply to your old 401 can be found in the plans documents. So check there first, if youre unsure how to proceed.

Transfer Money Directly Into The Tsp

Transfers or direct rollovers occur when the eligible plan sends your money to the TSP.

Tax-deferred amounts should be transferred into the TSP using TSP rollover Form TSP-60, Request for a Transfer Into the TSP. You can transfer Roth money into the TSP by completing Form TSP-60-R, Request for a Roth Transfer.

Don’t Miss: Can I Move 401k To Ira

Keep Your 401 With Your Previous Employer

In this instance, you wont change a thing. Just make sure that you actively monitor your investments in the plan for performance and remain aware of any significant changes that occur.

If you really like your current investment options and are paying low fees on the investments, this might be the right choice for you.

Can You Rollover Multiple 401 To Ira

You can rollover multiple 401s to an IRA within a year. Use Beagle to find your old 401s left with former employers, and seamlessly rollover the old 401s to an IRA. You can rollover all your 401s to an IRA without worrying about the once-per-year rollover limit- 401 rollovers are excluded from this rule. An IRA has multiple benefits over an IRA, and you get a wider pool of investments and greater flexibility with your money.

Tags

Read Also: Can You Move Money From 401k To Roth Ira

Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

Rolling 401 Assets Into An Ira

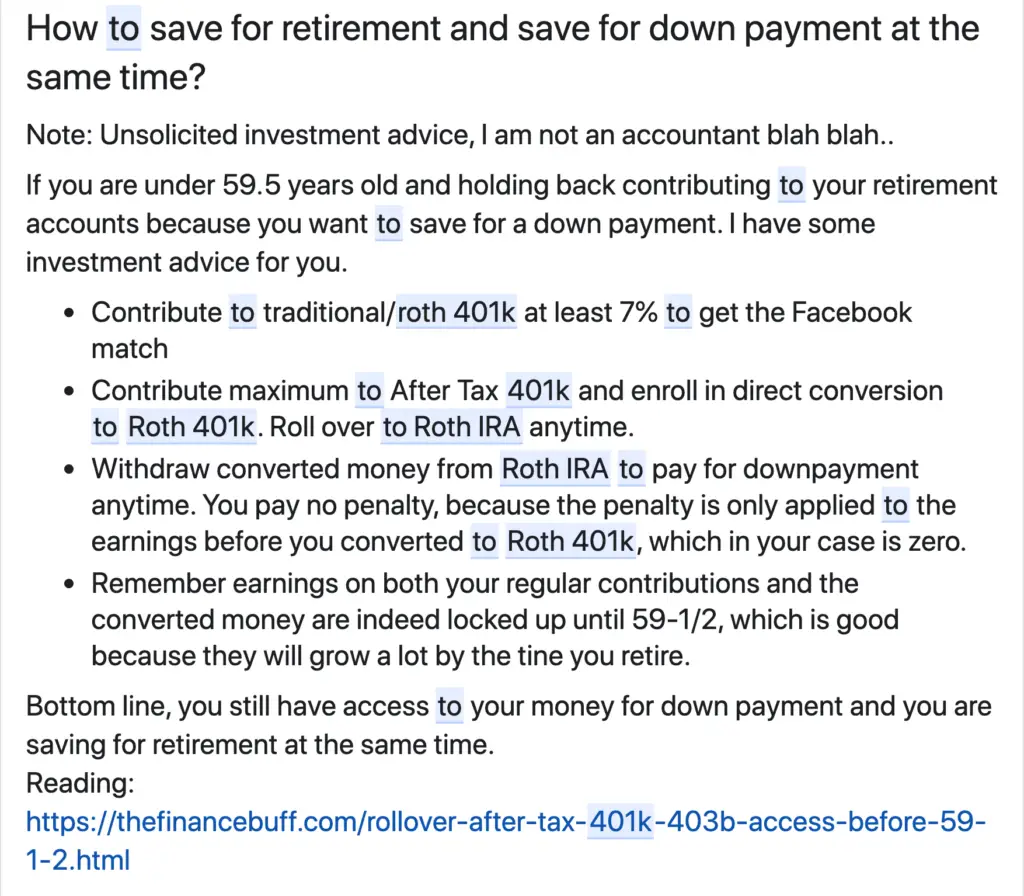

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

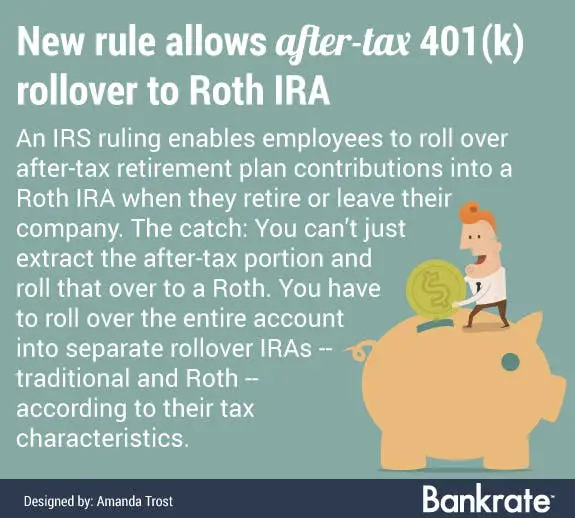

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Also Check: Can I Retire With 500k In My 401k

What Are The New Rules For Early Withdrawals From Retirement Accounts

The Secure 2.0 Act of 2022 includes several rule changes that will benefit Americans who need to withdraw money early from their retirement accounts. Normally, withdrawals from retirement accounts made before the owner of the account reaches 59 and a half years old are subject to a 10% penalty tax.

First, Congress added a basic exception for emergencies. Account holders who are younger than 59 and a half can withdraw up to $1,000 per year for emergencies and have three years to repay the distribution if they want. No further emergency withdrawals can be made within that three-year period unless repayment occurs.

The new law also specifies that employees will be allowed to self-certify their emergencies — that is, no documentation is required beyond personal testimony. The law will also eliminate the penalty completely for people who are terminally ill.

Americans impacted by natural disasters will also get some relief with the changes. The new rules will allow up to $22,000 to be distributed from employer plans or IRAs in the case of a federally declared disaster. The withdrawals won’t be penalized and will be treated as gross income over three years. The rule will apply to all Americans affected by natural disasters after Jan. 26, 2021.

Avoid Taking The Cash

When times get tough, it can be easy to see the cash in your retirement account and consider tapping that to help get you through. In fact, in a recent Bankrate survey, about one in four Americans said that they had hit up their retirement savings or planned to do so as a result of the coronavirus-related economic decline.

Taking an early withdrawal comes with a heavy cost. If you take money out of a 401 before retirement age , the IRS will hit you with a 10 percent bonus penalty on top of the taxes that youll already owe. In addition, you may have to sell investments at low prices, and youll lose any potential appreciation over your working years, hitting your nest egg still more.

If you must tap your retirement account, see if your plan allows you to borrow against the money in the account. Youll have to repay the funds, of course, but you may be able to avoid the taxes, which is a win in itself. You may also see if you can take a hardship withdrawal.

Don’t Miss: How Do You Take Money Out Of 401k

Other Things To Know About Rollovers

The following three factors should be considered when deciding whether to roll over your 401 when leaving a job:

These types of rollovers have different rules, so it is important to remember that. Usually, a rollover wont trigger taxes or cause complications as long as you stay within the same tax category.

You should check your 401 balance and decide what you want to do when you leave your job. In the case that your former employer sends you a check that you did not reinvest in time, you may be left with a trail of retirement accounts at different employers or even nasty taxes.

Rollover To Another 401

If you value the simplicity of having all your retirement funds in one place, are looking to minimize account maintenance fees or want to prepare yourself to take advantage of the Rule of 55, a 401-to-401 rollover can be a good choice. By rolling over an old 401 into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though, to make sure there arenât high fees and that the investments available work for you.

Read Also: How To Manage My Own 401k

More Information For 401 And Ira Contributors

The Secure 2.0 Act of 2022 will introduce several broad changes for retirement in America in general. One of the biggest will be a mandate for the Department of Labor to create a national, searchable database of retirement plans to help people find lost or misplaced accounts. The agency will be required to launch the database within two years.

The Employee Retirement Income Security Act of 1974 will also get an update. ERISA establishes minimum standards for administrators of private retirement plans, including communication with participants.

The ERISA rule change will require private retirement plans to provide participants with at least one paper statement a year unless the participant opts out. The rule won’t take effect until 2026, however, and won’t impact the other three quarterly statements required by ERISA.

Roll It Into A New 401 Plan

The pros: Assuming you like the new plan’s costs, features, and investment choices, this can be a good option. Your savings have the potential for growth that is tax-deferred, and RMDs may be delayed beyond age 72 if you continue to work at the company sponsoring the plan.

The cons: You’ll need to liquidate your current 401 investments and reinvest them in your new 401 plan’s investment offerings. The money will be subject to your new plan’s withdrawal rules, so you may not be able to withdraw it until you leave your new employer.

Recommended Reading: How Do You Find Out About Your 401k

What Is A Partial 401 Rollover

A partial rollover simply means that you transfer some, but not all, of your 401 money to an IRA at another provider.

The key when doing any type of rollover is to ensure that the money youre moving ends up in an account with similar tax treatment as the original account. This ensures you arent paying any unnecessary tax along the way.

For example, say you have a traditional, pre-tax 401 at your former employer. Youll want to ensure that you roll this into a traditional, pre-tax IRA. If, on the other hand, you have a Roth 401 at your former employer, any rollovers should find their way to a Roth account at another provider.

This is not to say its impossible to move money to accounts with different tax treatments, but youll need to be especially careful before you do it more on this later.

Youre Retiring Between The Ages Of 55 And 595

You can take money out of a 401 without incurring an early withdrawal penalty once youve reached 55 years of age. The age limit for penalty-free withdrawals from an IRA account is 59.5.

Thus, if you retire between 55 and 59.5 you might want to roll over part of your 401 to your IRA to take advantage of the investment opportunities there while keeping part of the money in your 401 so you can withdraw it without penalty to pay for living expenses in the meantime.

You May Like: What 401k Funds Should I Invest In

How Long Do I Have To Roll Over My 401

You can roll over a 401 at any point after you switch jobs or retire. Bear in mind, though, that the IRS gives you just 60 days after you receive a retirement plan distribution to roll it over to an IRA or another plan. And youre only allowed one rollover per 12-month period from the same IRA.

If you miss the 60-day deadline, the taxable portion of your 401 distribution will be taxed. And if you are under the age of 59½, there will be an additional 10 percent tax penalty.

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover ChartPDF summarizes allowable rollover transactions.

You May Like: Does 401k Limit Include Employer Match

Rollover To A Traditional Ira

Transferring funds between a traditional 401 and a traditional IRA or between a Roth 401 and a Roth IRA is relatively straightforward. In many cases, you can do a direct rollover, also called a trustee-to-trustee transfer. This involves your 401 provider wiring funds directly to your new IRA provider. Alternatively, your 401 provider may send you a check that you then deposit into your new IRA.

Look out for any taxes your provider may have preemptively deducted. You shouldnât owe any taxes or penalties as long as you deposit money in a tax-advantaged retirement account within 60 days.

Tips For Retirement Investing

- Consider finding a financial advisor to steer you in the right direction in terms of savings and investments. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre starting to plan for retirement, you should consider the tax laws of the state you live in. Some have retirement tax laws that are very friendly for retirees, but others dont. Knowing what the laws apply to your state, or to a state you hope to move to, is key to getting ahead on retirement planning.

Read Also: Can You Rollover A 401k To Another 401 K

Also Check: How To Open A 401k With Fidelity