Can I Manage My Own 401

Yes, in the sense that you are often responsible for choosing from the among the investment options offered in your company’s 401 plan. These are usually a selection of mutual funds and ETFs, and may also include company stock. You cannot, however, invest in securities not offered by the plan, which means you cannot usually pick single stocks or bonds.

Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

Read Also: What Happens When You Roll Over 401k To Ira

Tip : Consider All Your Income Sources

As you put together your retirement portfolio, you also need to think about the role your savings will play in your overall income plan. For example, how much income do you expect from guaranteed sources like annuities, pensions, and Social Security?

If these guaranteed income streams will generate enough income to cover the majority of your expenses, you might be able to maintain a more aggressive stance with your portfolio well into retirement, Rob says. Conversely, if youll rely on your portfolio for the majority of your income, youll need to take a more balanced approach with your investments.

Also Check: How Can I Start My Own 401k

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Important Plan Provision Changes: New plan loan provisions are no longer offered in the TD Ameritrade Individual 401 plan. All outstanding plan loans must be paid off by May 31, 2022 to continue to use the TD Ameritrade plan document. Roth 401 deferral contributions in the Individual 401 plan will no longer be accepted as of December 1, 2022.

Pick A Diversification Mix Based On Your Age

Weve provided rough estimates of how you can diversify your portfolio in this article, but remember that this is just an estimate. For instance, if youre in your 20s, you might put 60 percent of your portfolio in domestic stocks, 40 percent in foreign stocks, and nothing in bonds. To do this, it will require you to know a little bit about each of the funds offered by your 401 provider.

Read Also: How To Get A Hardship Loan From My 401k

Saving For Retirement If Youre Self

Okay, if youre self-employed and donât have any employees, a one-participant 401also known as a solo 401may be right up your alley. Contributions are tax-deductible, and you can contribute up to $20,500 in 2022 . Then, on top of that, you can put in up to 25% of your incomeas long as what you contribute is less than $61,000 per year.6

Another option is the are primarily used by small-business owners who want to help their employees with retirement, but freelancers and the self-employed can also use this option. You can contribute to your own retirement this way, but again, you cant exceed either 25% of your income or $58,000 .7

Tip #6 Hire A Financial Advisor

Another option you have is to get targeted investment advice by hiring a financial advisor. But I would not recommend that route. In my opinion, thats the old-school way of having your money handled. It can be confusing and expensive .

Please know that this not a knock on financial advisors. I just feel that its more work than its worth to learn that information. A friend of mine has a financial advisor who manages her 401. She has to meet with him multiple times per year to review their finances. No thanks. Id stick with the roboadvisor.

If you are interested in using a robo-advisor, I obviously would recommend blooom, especially if you want to focus on your 401. However, its always a good idea to research multiple options so you can find the right fit for you. So Ill give you another robo-advisor that I think is worth checking out and thats Wealthfront.

Wealthfront offers a number of retirement investment options including a traditional IRA, Roth IRA, SEP IRA, and 401 rollover. Its super easy to create a custom investment portfolio using their expertly vetted ETFs. You can choose to include the ETFs that you feel passionate about like its socially responsible investing options. And, all of the heavy lifting is done for you. It will automatically rebalance your portfolio, reinvest your dividends, and even use tax-loss harvesting to ensure you pay the smallest amount of taxes as you invest.

Also Check: Which Fidelity 401k Fund Is The Best

Why Managing Your Own Retirement Portfolio Is A Good Idea

In 1956 Alice B. Morgan published the book, Investors Road Map. The book grew out of a series of investing classes that Morgan gave over the years to people in Bristol, Rhode Island.

The classes Mrs. Morgan gave were free, and the book was a summation of her tips, a source of advice for those who couldnt get to the class. Whats especially interesting, however, isnt the advice itself. Mrs. Morgan was a plain-spoken Yankee of the old school and her rules were appropriate for the market as it ran in the 1950s. What was unique was the length to which she went to convince the women who made up a large part of her classes that they could actually do investing on their own.

One big reason for managing your own retirement portfolio is that nobody cares more about your money than you do. So why would you leave it in the selections you made when you funded your IRA in 1980? Or why would you pay someone else to decide where you invest it?

Theres less mystery surrounding investing on your own these days. With so much information at your fingertips, do-it-yourself investing is much easier than it was 70 years ago or even 10 years ago.

Read Also: What Is Ira And 401k

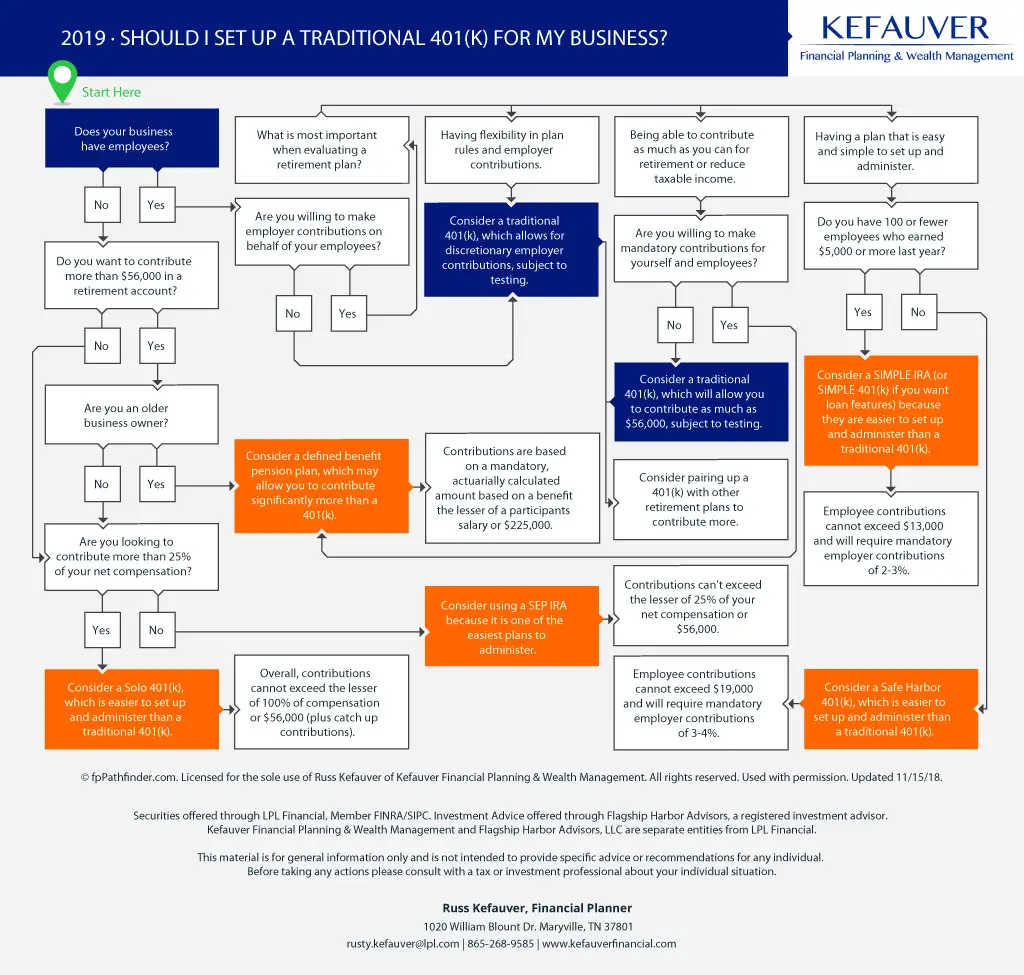

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

Recommended Reading: How To Diversify 401k Portfolio

How To Make Your 401 Selections

8 Minute Read | September 27, 2021

If you value your companys 401 benefit, the day you receive your enrollment package is an exciting one. Soon youll be building your retirement nest egg with the help of your employers 401 match and the right investment selectionsyou cant wait to get started!

So you rip open your envelope and glance over the contents: forms, a nice-looking brochure, and maybe a letter from your employer welcoming you to the companys 401. Once youve read the letter, however, the rest of the materials simply dont make a lot of sense. Theres information about vesting, beneficiaries, equities, risk assessments, and 401 selectionsbut nothings clicking.

The only thing that seems clear is that investing in a 401 is important business. Your ability to retire depends on you getting it right. But how can you make such major, long-term decisions when you dont even understand what the choices are?

Understanding your workplace 401 is the first step toward the retirement of your dreams, so lets get started.

Manage 401k Contribution Limits

Employees can contribute up to $17,500 . Here is how you can maximize your contributions: first determine how much of your salary you are able to contribute to retirement plans, then determine where to allocate contributions. Depending on your tax bracket now and expected tax bracket in retirement, you may be better off contributing enough in your 401k plan to receive the maximum company match, then contributing to a Roth IRA. If you are able to contribute enough to cover the company match and max out your Roth IRA , then consider increasing your 401k contributions.

Recommended Reading: How Do I Move My 401k To An Ira

Work With A Financial Expert Who Knows About Education Members Compensation

The total amount you withdraw from your RRIF is taxable at year-end. In addition, withdrawals above your established minimum will be hit with a withholding tax. So its important to get tax advice from someone who truly understands your source of retirement income in order to minimize the tax implications.

For example, you most likely know that the Old Age Security benefit will increase your taxable income. However, did you know that part of your OAS is clawed back if your income exceeds $73,637? Therefore, if youre going to be in a lower tax bracket before age 65, it may make sense to withdraw more from your RRSP.

Tip: As a member of the education community, you need to think twice about the pension-income tax credit.

Read Also: Can I Roll Over 401k Into Ira

Is Using An Adviser For Your Self

What many workers dont realize is that most are already paying management fees for their companys 401, without getting personalized guidance. Many employer 401 plans are managed by registered investment advisers, who act as fiduciaries to the plan and select the investment options for the plan, as a whole. Their obligation is to the plan sponsor meaning your employer, not you and they cannot manage or advise individual participants.

Read Also: Is A 401k Good To Have

What To Do With This Information

One of the most effective things you can do for your financial health is to gain a basic understanding of investing through free resources. A 1% fee might not sound like a big deal, but the numbers clearly tell a different story. For those seeking objective advice, the best route is to find an experienced, fee-only, fiduciary advisor that will charge based on the service provided as opposed to the amount of money you have. Heeding this simple advice will allow you to keep the returns you rightfully deserve.

Dont Miss: Why Cant I Take Money Out Of My 401k

Can You Lose Money In A 401

Its possible to lose money in a 401, depending on what youre invested in. The U.S. government does not protect the value of investments in market-based securities such as stocks and bonds. Investments in stock funds, for example, can fluctuate significantly depending on the overall market. But thats the trade-off for the potentially much higher returns available in stocks.

That said, if you invest in a stable value fund, the fund does not really fluctuate much, and your returns or yield are guaranteed by private insurance against loss. The tradeoff is that the returns to stable value funds are much lower, on average, than returns to stock and bond funds over long periods of time.

So its key to understand what youre invested in, and what the potential risks and rewards are.

Also Check: What Percent Of Paycheck Should Go To 401k

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Managing Cash When You Take Your Rmds

For many retirees, estimating and taking Required Minimum Distributions once you reach age 722 plays a big role in managing cash in retirement. If youre planning to spend your RMDs to cover your ongoing retirement expenses, says Iskoz, you may want to consider having the money sent directly to a cash management or bank account that provides helpful cash management tools.

RMD distributions can also be a time to rebalance your asset allocation. For example, as you get older, youll likely want to sell off higher risk investments and take proceeds from RMDs and put them into more conservative investment options.

Ordinarily, you have until December 31 each year to take your RMD. You can opt to take one-time distributions for your RMDs year after year, but the easiest way to satisfy your RMD is by setting up automatic withdrawals and potentially avoid paying penalties if you forget to take your RMD.

Read Viewpoints on Fidelity.com: Smart strategies for required distributions

You May Like: What Is A 401k Vs Ira

Blue Sky 401k Portfolio Scenario

Portfolio Assumptions: Lets contribute $17,000 a year, receive a $17,000 match/profit sharing from our employer, and earn a 7% annual return. Please note for 2021, the maximum contribution is $19,500.

We arent Warren Buffet. Therefore, 7% will have to do to account for large double digit returns and losses throughout the years. Remember, its still better to be conservative in a Blue Sky scenario. You dont want to come up short in retirement.

Advice On Keeping 401 Fees Low

Gottfried noted that there tends to be a few different ways 401 fees can come out of the money you put in. The one that you have the most direct control over is the fee associated with the individual investment vehicles, he said.

But the other fees to keep an eye on are paid either by you or your employer to the 401 provider. Sometimes, those are flat-dollar fees that are charged to you on a monthly basis. Sometimes, its annual fees. Sometimes its an assets-under-management fee, Gottfried said.

If those fees add up to more than a half a percent of your balance or exceed $7 or $8 a month with a flat dollar fee, Gottfried advised, talk to your employer about this. Your employer is obligated to make sure that those fees are reasonable, he said.

Savage, a nationally syndicated personal finance columnist and author of The Savage Truth on Money, noted that 401 fees are often higher for employees of small businesses. According to The 401 Book of Averages, she said, a company with 2,000 employees has a 0.7% expense ratio, on average, but a small business plan with 50 employees has an average expense ratio of 1.14%.

Read Also: Is It Worth Rolling Over A 401k

A Clear Picture Helps You Keep Tabs On Your Finances Throughout Retirement

Finally, the retirement cash management system you create with your providers should offer a comprehensive view of your finances. Being able to access concise, up-to-date reports on your cash balances, transactions, and assets is a basic requirement and can help prevent unpleasant cash flow surprises.

Now that youre retired, take advantage of ways to streamline how you manage cash and pay bills. Your cash needs will change over the course of your retirement, so working with your Fidelity advisor to think through the what ifs of future cash management also means making decisions about how to use your financial resources during a retirement that may stretch 30 years or more.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options arent usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Also Check: Can You Rollover A 401k Into A 403b