Open Your Rollover Ira In 3 Easy Steps We’re Here To Help You Along The Way Too

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Early Retirement Withdrawal Penalties With Iras

Many 401k plans allow participants to retire beginning at age 55. Under the law, these early retirees can take penalty-free withdrawals from their 401k accounts.

IRA account holders who retire and take withdrawals before age 59½ are subject to a federal penalty tax of 10% and possibly state early withdrawal penalty taxes as well.

Rolling Into Your Current Employers 401k Is A Much Better Option

It is nearly always a good idea to roll over your former employers 401k balance or your IRA into your current employers 401k plan, for all the reasons outlined above.

In addition, it is easier to manage your retirement plan nest egg if it is all in the same account. And you will receive more comprehensive investment advice.

As an advocate for 401k plan participants, I am concerned that very little of the information necessary to make a good rollover decision is shared with participants in a manner they can understand.

Most participants only receive information about rollovers from an advisor who is trying to get them to roll over their money and who is therefore conflicted.

As a result, I believe most investors make bad decisions when they decide to roll over their 401k plan accounts to IRAs.

Robert C. Lawton, AIF, CRPS is the founder and President of Lawton Retirement Plan Consultants, LLC. Mr. Lawton is an award-winning 401 investment adviser with over 30 years of experience. He has consulted with many Fortune 500 companies, including: Aon Hewitt, Apple, AT& T, First Interstate Bank, Florida Power & Light, General Dynamics, Houghton Mifflin Harcourt, IBM, John Deere, Mazda Motor Corporation, Northwestern Mutual, Northern Trust Company, Trek Bikes, Tribune Company, Underwriters Labs and many others. Mr. Lawton may be contacted at 828-4015 or

Recommended Reading: Can Anyone Have A 401k

Benefits Of A 401k Vs Ira

A 401k is your retirement plan through your employer. You may also have a 403 plan if you work for a nonprofit or for a government agency. The rules for these two plans are very similar. If you are working, you can have your contributions to your 401k plan automatically deducted from your paycheck. There are a few advantages of a 401k vs IRA like higher contribution limits and employer matching.

Benefits For Early Retirement

If you ever need to withdraw your funds before reaching 59, then you should keep your money in the 401 plan. This is one of the key reasons not to rollover 401 to an IRA. With a 401 plan, you can access your funds at the age of 55. For early withdrawal on an IRA, youll have to pay a 10 percent penalty.

You may also be allowed to make withdrawals from your 401 several times annually after you leave your company. Note that the employer may make rules about the number of times that individuals within this age group can make withdrawals.

However, if you rollover 401 into an IRA, youll not be able to enjoy this privilege. To access your funds without incurring an early withdrawal penalty, youll have to wait until 59 ½ years of age.

Recommended Reading: Can I Open A 401k For Myself

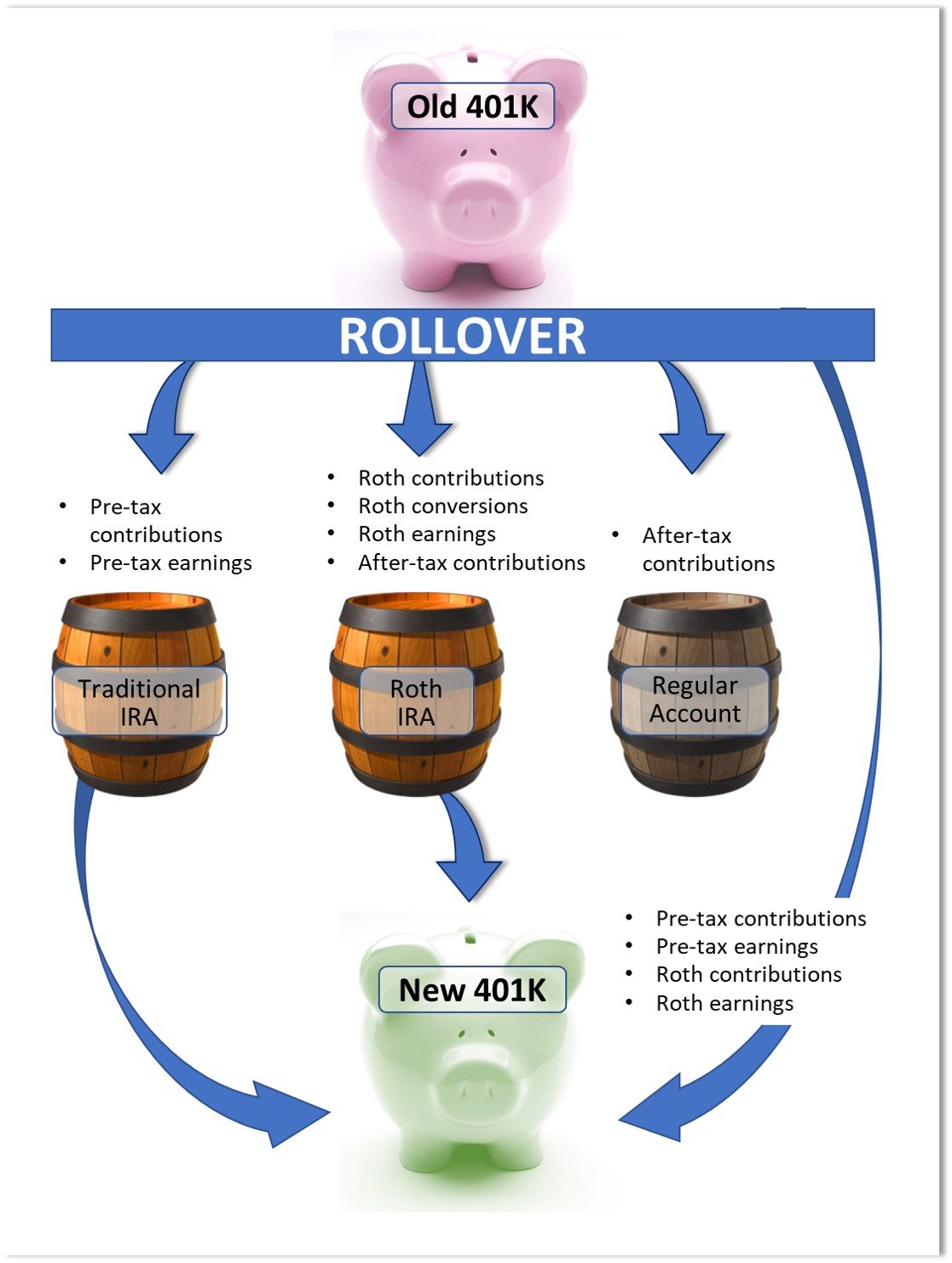

What Are The Choices With A 401 Distribution

When you have a 401 with an employer and you decide to leave the company, you have four basic options:

Cash Out the Plan

If you choose this option, you simply direct the plan trustee to liquidate the account and send you a check.

The account will be closed out, and no further action is necessary.

Advantages: If the balance in the plan is relatively small, like a few thousand dollars, you may decide the money would be better used to pay off debt.

This can make sense if the tax liability on the distribution isnt too high, and the interest youre paying on the debt you intend to pay off is much higher than the investment return in the 401.

Disadvantages: Youll have to pay ordinary income tax on the amount of the distribution, which wont make sense if youre in anything higher than the 12% tax bracket.

But if youre under 59 ½ youll also have to pay the IRS 10% penalty on early distributions.

Keep the 401 with the Previous Employer

This is the simplest choice of all. You decide to do nothing, and leave the account where it is.

Unless the employer has some sort of rule requiring disposition of the account following separation, you can literally leave the money in the plan for the rest of your life.

Advantages: No action is required on your part. If youre satisfied with the investment options in the plan, as well as the plan performance, theres no need to move the money.

Roll the Previous Employer 401 into the New Employers Plan

Do a 401 Rollover to an IRA

Con: Delayed Access To Funds

401 accounts impose a 10% penalty for withdrawals made before you turn 59 ½. However, there is an exemption to this rule: if you retire at 55 years, you can take a penalty-free withdrawal from your 401 account. This exemption does not apply to IRA accounts, and you will have to wait until you are 59 ½ to make withdrawals without paying a penalty.

Read Also: What Is My Fidelity 401k Account Number

Transaction Fees Are Likely With Iras

Many brokerage firms, banks and insurance companies are interested in creating transactional revenue. As a result, not only are IRA rollover account holders investing in higher cost funds, but they are also likely incurring transaction fees on purchases and sales.

Remember that 401k plan participants have access to free, objective investment advice and low-cost investment options. They can make purchases/sales and transfers without any transaction costs.

How To Complete An Ira To 401 Rollover

The first step is checking whether your employers 401 plan accepts IRA rollovers. Not all plans will allow you to roll over IRA assets. If they do, youll want to request a direct transfer to avoid any income tax or the 10% early withdrawal penalty.

If a direct transfer isnt an option, your IRA provider will send you a check for 80% of your accounts value and withhold the remaining 20% for taxes. You must deposit 100% of the value of your IRA into your 401 within 60 days or the transaction will be treated as an early distribution, triggering the 10% penalty and income taxes. The 20% that your IRA provider withheld will serve as a tax credit when you file your tax return.

Don’t Miss: Can You Use Your 401k To Start A Business

Pros And Cons Of Rolling Over 401 To Ira

Find out the pros and cons of rolling over 401 to IRA, and the potential costs that you are likely to save or incur if you consolidate your multiple 401 accounts into one Individual Retirement Account.

When you change jobs and settle in your new workplace, one common question that comes to mind is whether to rollover your 401 to a new Individual Retirement Account or keep the funds in your former employerâs 401.

Most of the time, a new IRA has more benefits in terms of fees, investment options, and tax savings than a 401, but it is important to know the pros and cons of rolling over 401 to IRA before making the switch. The pros of rolling over 401 to IRA include wider investment options, lower fees, penalty-free withdrawals, and an opportunity to consolidate old 401s into one location. The cons of rolling over 401 to an IRA include limited creditor protection, lost access to 401s loans and delayed access to funds until you are 59 ½.

How To Rollover A 401 To A Traditional Ira

When you want to roll over your 401 to an IRA, there are certain steps that you must follow to avoid penalties and to ensure that you don’t trigger a tax event.

Many companies proactively send out a letter informing an ex-employee of their retirement plan options, but not all do this. After you have left the company, you can request a rollover from the company’s retirement plan to your desired retirement plan.

There are three ways to complete a rollover:

Investors who transfer cash into their new retirement account must choose how to allocate their investments. Most IRA accounts offer a much greater variety of investment choices than a 401, so the process can be overwhelming for some investors. Many investors decide to choose investments on their own, while others benefit from having professional advice.

Recommended Reading: How To Manage 401k Investments

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Performance Differentials Are Substantial

According to the Center for Retirement Research, the average return in an IRA for the 12-year period of their study was 2.2%. The average return in a 401k-plan account for the same period was 3.1%.

Although neither of these returns will allow anyone to retire anytime soon, there is a huge difference between the two. The return 401k plan participants experienced was nearly 41% greater.

Study results like this prompted President Barack Obama to ask the Department of Labor to issue fiduciary regulations governing IRA rollovers. Unfortunately, those regulations were subsequently rolled back.

Read Also: How To See How Much Is In My 401k

How To Transfer A Traditional Ira Into A 401

If youve weighed the choices and decided youd like to combine retirement plan balances inside your 401 and your 401 plan provider is ready and willing to take those IRA assets there are steps you need to take to do it right.

First, know that you cant roll a Roth IRA into a 401 not even into a Roth 401. Were specifically talking about pretax money in a traditional IRA here.

As with a 401 rollover, the easiest way to roll a traditional IRA into a 401 is to request a direct transfer, which moves the money from your IRA into your 401 without it ever touching your hands. Contact your 401 plan administrator for instructions on how to do this following its guidance will allow you to avoid taxes and penalties.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

Read Also: Can I Transfer My Ira To My 401k

Avoid The Net Investment Income Tax

When your modified adjusted gross income exceeds $200,000 , you’ll pay a 3.8% Medicare tax on regular and investment income over that amount. If you convert a large portion of your 401 into a Roth IRA all at once, your income could exceed this threshold and you’ll owe additional taxes on regular income, dividends, interest, passive income, annuities, royalties, and capital gains.

Should You Roll Over Your 401 Into Another 401

There are some situations that might make an IRA rollover the wrong move for you. Heres what to consider before completing a 401 rollover.

Retirement account protection. In general, 401 accounts offer better protections from creditors than IRAs.

Rule of 55. With a 401, you can actually start withdrawing funds at age 55 penalty-free if you leave your job. You dont have that advantage when you roll your 401 to an IRA, though you can emulate it by taking subsequently equal periodic payments from your IRA

Performance. If you like your current plan, and its performing well, theres no reason to complete a rollover.

You can always choose to roll your old 401 balance into your new employers 401 plan. If you value the simplicity of having everything in one place, you like the features of the plan at your new job or you want to maintain the legal protections of a 401, it may make more sense to roll your old 401 into a new 401.

Don’t Miss: How Many Percent Should I Put In 401k

Why You Might Not Want To Combine Your Ira With Your 401

On the flip side, there are plenty of areas where a traditional IRA has a leg up on a 401 that is, of course, why so many people roll a 401 into an IRA. Here are the biggest you should know:

-

Wider investment selection: Within an IRA, you can invest in nearly anything under the sun not just the mutual funds, index funds and exchange-traded funds that show up in 401 plans, but also individual stocks and even options . You can also shop around for the absolutely lowest-cost funds, which can save you money. As noted above, you should look closely at your 401 plan and its investments to see if youd save money by leaving your funds in your IRA.

-

More loopholes for early withdrawals: Aside from the aforementioned loans, a 401 may allow hardship withdrawals in certain situations the IRS defines hardship as an immediate and heavy need, which means things like unreimbursed medical expenses, funeral expenses or disability. Those will waive the 10% penalty on early distributions youll still owe income taxes on the withdrawal. But a traditional IRA casts a wider net, allowing early distributions without penalty but with taxes still owed for higher education expenses and a first-time home purchase .

-

Low-cost options for investment management: If your 401 plan doesnt come with anything in the way of investment advice, and you want that sort of thing, youll have more options for getting it on the cheap within an IRA if youre open to a robo-advisor. .)

How Do I Avoid Tax On Ira Withdrawals

Contents

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

- Avoid the early payout penalty.

- Roll over your 401 with no tax withholding.

- Remember the required minimum distributions.

- Avoid two distributions in the same year.

- Start recordings before you have to.

- Donate your IRA distribution to charity.

Can I Withdraw Money From My IRA Without Paying Taxes? Once you reach age 59½ you can withdraw money without a 10% penalty from any type of IRA. If its a Roth IRA and youve had a Roth for five years or more, you dont owe income tax on the withdrawal. If not, you will. Once you reach age 72, you must take a distribution from a traditional IRA.

You May Like: Can You Take A Loan From 401k For Home Purchase

Moving Your 401 To Your New Employer

You can still benefit from the negotiated fees and advice that comes with a 401 without having to keep your account with your old employer â as long as your new employer offers a 401 as well. You can simply move the money from your 401 at your old job to your 401 at your new job.

âMoving the money to a new employerâs plan can be a good option if the investments are solid and costs are reasonable,â Wohlner said. âThis can also be a good way to consolidate 401 accounts giving you one less account to worry about.â

Youâll get largely the same benefits from moving to a new employerâs 401 as you would by keeping the plan with your old employer. But another big benefit, according to LeVitre: âyour old and new retirement money will be consolidated in one retirement account.â

The downside: You may have had different investment options at your old employer versus your new one, which would give you more opportunities to pick different investments. âLimited investment options and diversification,â are a con of rolling your plan over, LeVitre said.