Rollover Iras Consider Simplifying Your Retirement Accounts By Combining Into One Ira

If youve worked at several jobs, you may have a few 401k-type plans from previous employers plus your own IRA accounts. Managing all those accounts can be a real challenge. You may want to consider a direct transfer of your account balances under these plans into a single IRA – without paying taxes on the transaction, if done properly. Once in the new IRA, your money has the opportunity to continue to grow federal income tax-deferred.

View Important Information About Our Fees And Commissions

-

3. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.

Schwab ETFs are distributed by SEI Investments Distribution Co. . SIDCO is not affiliated with Charles Schwab & Co., Inc.

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the type of account you have, there are different rules for withdrawals, penalties, and distributions. Please understand these before opening your account.

Taxes Due From Your 403b Rollover

So what sort of tax consequences do you trigger with a 403b rollover to a Roth IRA?

Youll have to pay income taxes on any amount you roll over, unless of course, you made non-deductible contributions, such as with a Roth 403b .

But assuming you have a typical 403b plan, youre going to owe income taxes on the full amount of the rollover distribution, with the applicable tax rate being the same as what you would pay on your regular income.

For tax purposes, you simply add the full amount of the rollover distribution to your adjustable gross income .

But dont worry about your rollover pushing you into a higher tax bracket. The tax rate you pay is based on your pre-rollover AGI, not your post-rollover AGI.

For instance, lets say you have a 403b with $225,000, an annual salary of $37,000, and youre in a 20% tax bracket.

Even though you file a tax return with $262,000 in adjustable gross income, you remain in the 20% tax bracket. So your total tax liability is $52,400.

Dont Miss: How To Max Out 401k Calculator

Also Check: How Does A 401k Work When You Change Jobs

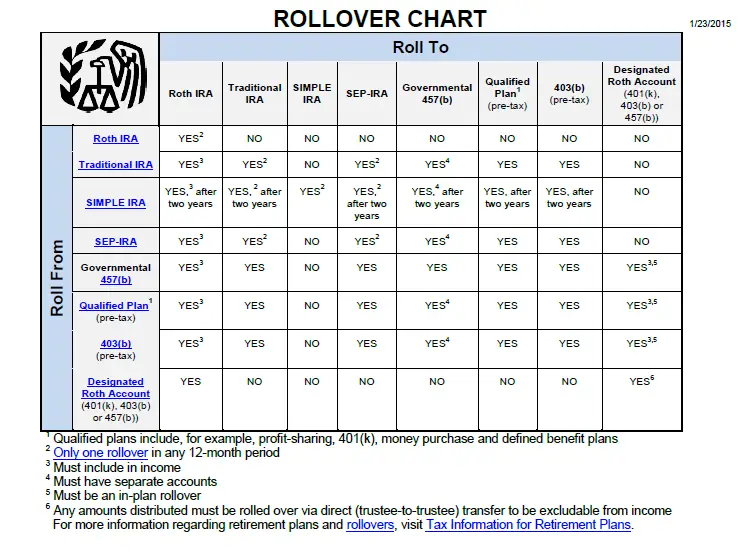

Lines Ask The Experts Can A 401 Plan Account Be Rolled Into A 403 Plan

Reported by

I recently left the employ of a public school system where I had a 401 account. I will now be teaching at a private school that offers a 403 plan. I am receiving conflicting advice about whether I can rollover tax free my 401 funds into my new employers 403 plan. Can the Experts help? Thanks!Stacey Bradford, Kimberly Boberg, David Levine and David Powell, with Groom Law Group, and Michael A. Webb, vice president, Retirement Plan Services, Cammack Retirement Group, answer:Of course we can! But the Experts will need for you to check with your current employer to confirm one item whether or not their 403 plan accepts rollovers from other retirement plans . If it does NOT accept rollovers, then you cannot rollover your 401 account to your current employers 403 plan.

However, if it does accept rollovers plans do indeed accept rollovers), then you can roll over funds from your 401 plan to your new employers 403 plan, as rollovers are permitted from 401, 401, governmental 457 and other 403 plans to a 403 plan. Whether the 403 plan in question is a public or private school 403 plan is irrelevant for this purpose.

However, there are a few other issues about which you should be aware as you complete your rollover, as follows:

2) Some 401 plans charge a fee for rolling money out of the plan to a new plan, so you will want to confirm with your 401 provider as to whether or not this is the case.

Best of luck with your new job and your rollover!

Tags

Are Early Distributions From Roth Ira Taxable

For example, payments from traditional IRAs are generally considered regular income and may be subject to income tax, as well as an additional early allocation penalty if the payment is made when the IRA holder is below 59. The Roth IRA, on the other hand, allows for qualified distribution with no taxes or penalties.

Recommended Reading: Can You Pull From 401k To Buy A House

What Is A Rollover Ira

A rollover IRA is an individual retirement account often used by those who have changed jobs or retired. A rollover IRA allows individuals to move their employer-sponsored retirement accounts without incurring tax penalties and remain invested tax-deferred. Consolidating multiple employer-sponsored retirement accounts can make it easier to monitor your retirement savings.

*Note: If you have an existing rollover or traditional IRA at Prudential, you can roll your assets into that account.

Decide Where You Want The Money To Go

If youre making a rollover from your old 401 account to your current one, you know exactly where your money is going. If youre rolling it over to an IRA, however, youll have to set up an IRA at a bank or brokerage if you havent already done so.

Bankrate has reviewed the best places to roll over your 401, including brokerage options for those who want to do it themselves and robo-advisor options for those who want a professional to design a portfolio for them.

Bankrate has comprehensive brokerage reviews that can help you compare key areas at each provider. Youll find information on minimum balance requirements, investment offerings, customer service options and ratings in multiple categories.

If you already have an IRA, you may be able to consolidate your 401 into this IRA, or you can create a new IRA for the money.

Recommended Reading: How To Know If I Have 401k

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Considering A 401 Rollover Consider Your Options First

If you decide a 401 rollover is right for you, we’re here to help. Call a Rollover Consultant at .

One great thing about a 401 retirement savings plan is that your assets are often portable when you leave a job. But what should you do with them? Rolling over your 401 to an IRA is one way to go, but you should consider your options before making a decision. There are several factors to consider based on your personal circumstances. The information provided here can help you decide.

Don’t Miss: Is It A Good Idea To Borrow From Your 401k

Compare Your Options For Rollovers And Direct Transfers

Following are overviews of your options for rollovers or direct transfers for each plan type. For details, see Eligibility and Procedures for Rollovers and Direct Transfers.

| Rollovers | ||

|---|---|---|

| At any age | ||

| Former Employee |

Employee contributions and earnings at any age, university contributions and earnings at age 55 or older |

At any age |

| Current Employee |

At age 59½ disability |

At any age |

|---|

A direct transfer allows you to move your U-M retirement savings plan accumulations between TIAA and Fidelity Investments, tax-free. Direct transfers are available to current and former employees at any age, at any time. U-M authorization is not needed for a direct transfer.

A direct transfer is different from a rollover in that it occurs between two investment companies under the same employer retirement plan. You cannot make a direct transfer to an IRA, to another employers retirement plan, or to an investment company that is not TIAA or Fidelity. Likewise, you cannot make a direct transfer between U-M plans SRA and 457 Deferred Compensation Plan accounts).

Open Your Rollover Ira In 3 Easy Steps We’re Here To Help You Along The Way Too

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Also Check: How Do You Repay A 401k Loan

Do I Have To Pay Taxes When I Roll Over My Funds

To avoid mandatory federal income tax withholding on the distribution, be sure to have your former employer send the money directly to the IRA custodian. If you dont, your former employer must withhold 20% for federal income taxes. When the money is sent directly to you, you have 60 days to put the funds into an IRA including the 20% that was withheld, which must be made up with other assets or it will count as a distribution and could be subject to federal income taxes and a 10% additional federal tax, if youre under age 59½ and no exception applies.

What Are The Benefits Of A 403 Rollover

The prime benefit of rolling over a 403 is to avoid taking a taxable and possibly penalized distribution from the account. Since 403 plans are funded with pre-tax money, anything you take out of your 403 is fully taxable. By rolling over your account, you keep your money in a tax-advantaged wrapper and face no tax consequences.

An exception to this rule is if you roll over your 403 into a Roth account, either in an IRA or in a qualified plan. Because Roth accounts are nondeductible and funded with after-tax dollars, any rollover to a Roth account will trigger income tax on the entire rollover amount.

You May Like: How To Cash Out 401k Without Penalty

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Advantages Of A 401 Or 403 Rollover

First, you can pick an IRA provider who is known for their commitment to low fees and investment variety.

Certain IRA providers like Vanguard, Blackrock, and Schwab are known for their transparency and commitment to low fees. Many charge no administrative fees on IRAs with over $10,000 and offer expense ratios less than 0.2% on a large variety of investments.

In addition, while a 401 or 403 will offer a curated list of investing options, an IRA will give you access to a much larger list of funds.

The going wisdom used to be that the buying power of a large 401 plan would get you better pricing than going it alone. However, in a world where there are NO-fee mutual funds, you dont need your employer to get access to cheap investment options.

Plus, if you want to invest in socially good funds or other specific accounts, you probably wont have access through an employer plan like you will through an IRA.

Second, you can see all your money in one place.

As noted above, most financial experts advise that you invest in risky assets like stocks when youre young and shift to more conservative investments like bonds as you get closer to retirement.

Its much easier to make sure your money is invested strategically and that your savings are on track for retirement when its in one account with one password and one fee disclosure.

Third, even if your 401 or 403 is performing well, you can probably get that same growth at a lower cost in an IRA.

Read Also: What Age Can You Collect 401k

Contribution Limits For 403 And 401 Plans

The 403 and 401 plans have the same contribution limits for 2020 and 2021, which is $19,500 per year, meaning that is the maximum amount you can contribute annually. In 2022, this amount rises to $20,500. However, those aged 50 and older can contribute an additional $6,500 per year as a catch-up contribution in all three years.

Also, the total contribution limit to the plan for both the employee and employer must be the lesser of $58,000 in 2021 or 100% of the employee’s most recent yearly salary. In 2022, the amount rises to $61,000.

However, it’s important to note that a rollover from one plan to another is not a contribution but merely a transfer from one type of retirement plan to another.

Direct And Indirect Rollovers

Direct rollovers, trustee to trustee, are not subject to tax withholding. A direct rollover is when the retirement plan administrator makes the payment directly to another retirement plan or an IRA. It’s important to note that the administrator may issue a check made payable to the new account, which must be deposited within 60 days. No taxes will be withheld from the transfer amount, but there could be a penalty if the money is not re-deposited into the new IRA within the 60-day period.

The safest way to process a direct rollover is to have the administrator process a trustee-to-trustee transfer, which electronically transfers the funds from the old plan to the new one. The IRA owner does not receive a check, and there are no taxes withheld nor any penalties.

Indirect rollovers are when the check is made out to and sent directly to the plan participant. An indirect rollover is subject to 20% withholding. For an indirect rollover to remain completely untaxed, the participant has to make up the withheld amount.

Don’t Miss: How Do I See How Much Is In My 401k

Contact Your Current Plan Administrator And New Plan Administrator

The easiest 401 rollover option is to get your old plan administrator to transfer your balance directly to your new account. This is called a direct 401 rollover, and it frees you from having to worry about tax consequences or early withdrawal penalties.

Speak with your new plan provider about getting an account number, then provide the information to your current 401 administrator. Theyll take care of the rest.

Be aware that not every plan administrator will perform a direct 401 rollover. In this case, the plan administrator cuts you a check for the balance, and its up to you to send the funds to your new 401 plan provider. You have just 60 days to redeposit the balance in your new plan. Otherwise its treated as an early withdrawal that incurs a penalty and income tax liabilities.