Extra Benefits For Lower

The federal government is so hot to promote retirement savings that it offers another benefit for people who have lower incomes, and it’s not all that low. Called the Saver’s Tax Credit, it can raise your refund or reduce the tax you owe by offsetting a percentage of the first $2,000 that you put into your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year.

The income limits for the Saver’s Tax Credit go up in 2021. For single taxpayers , it’s $33,000 , and for married couples filing jointly it goes up to $66,000 in 2021 from $65,000 in 2020, and for heads of household it maxes out at $49,500 in 2021, up from $48,750 in 2020.

How Much Do You Need To Retire Comfortably

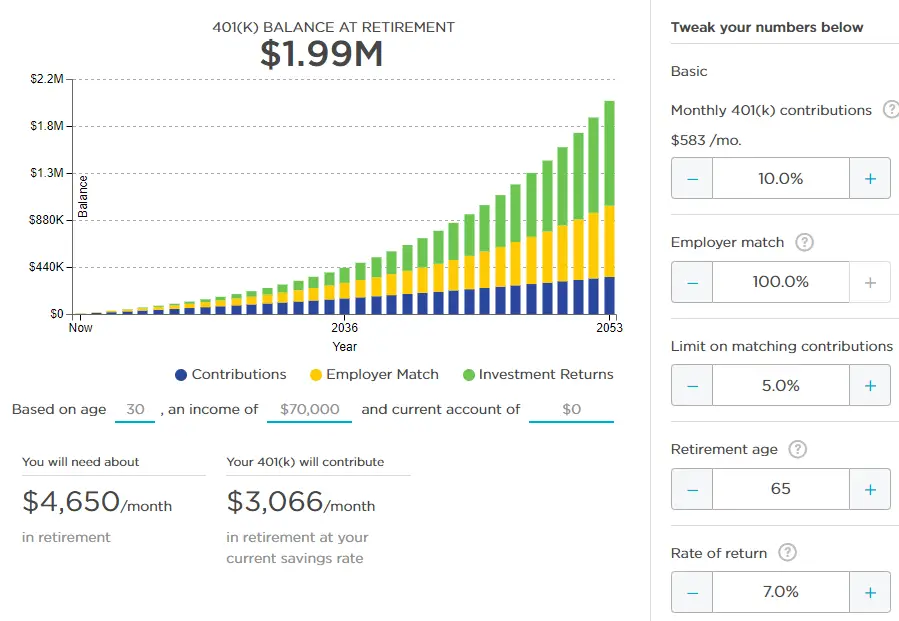

Planning for retirement takes work, and unfortunately, many Americans are woefully under-prepared when it comes to the state of their savings. What you need to retire isnt about hitting a specific dollar amount, instead, youll want to be able to replace enough of your income to live comfortably. This suggestion isnt black and white because the standard of living looks different for each individual consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80% of your salary after retirement to avoid making sacrifices.

Create a post-retirement budget based on the lifestyle youd like to maintain. This will serve as a guideline that determines how much you might spend when you retire. In some cases, it may be beneficial to seek financial advice to make sure you are planning accordingly. Most people hope to enter their retirement years debt free, but for some, this wont be the case. You may need to consider these expenses:

- Monthly debt payments

- Replacement vehicles or repair

- Miscellaneous expenses like travel

What role will Social Security play in your income? Generally speaking, Social Security is designed to replace about 40% of the average seniors income. If youll need roughly 80% of your salary to live comfortably, its up to you to make up the remaining 40%. This may be where your 401k comes into play.

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

You May Like: How To Tell If You Have A 401k

Why Have You Set The Default Life Expectancy Of The Calculator To 95 Years

For starters, people are living longer. Even though the average life expectancy in Canada is 82 years, many people live past this. It’s better to have more money tucked away for retirement than to run out of savings. Extra savings can always be passed down to your beneficiaries. You can change the default life expectancy if you think you’ll live a longer or shorter life.

How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab or Vanguard. You should be able to log into your 401K account online through the website of the broker your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

Recommended Reading: How To Find Old Employer 401k

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Working While Receiving The Cpp Retirement Pension

Youll qualify for the CPP Post-retirement benefit if you work while receiving your CPP retirement pension while under age 70 and decide to keep making contributions.

Each year you contribute to the CPP will result in an additional post retirement benefit and increase your retirement income. We will automatically pay you this benefit the following year. Youll receive it for the rest of your life.

You can choose to stop your post-retirement contributions when you reach age 65. Your contributions will stop when you reach age 70, even if youre still working. We will contact you if we need more information for you to qualify.

Contributions after age 65

If you work after you turn 65 and don’t yet receive the CPP retirement pension, periods of low earnings before age 65 will be automatically replaced with periods of higher earnings after age 65. This will increase your pension amount.

Also Check: How Much Will My 401k Grow If I Stop Contributing

How Much Should You Have In Your 401k By Age

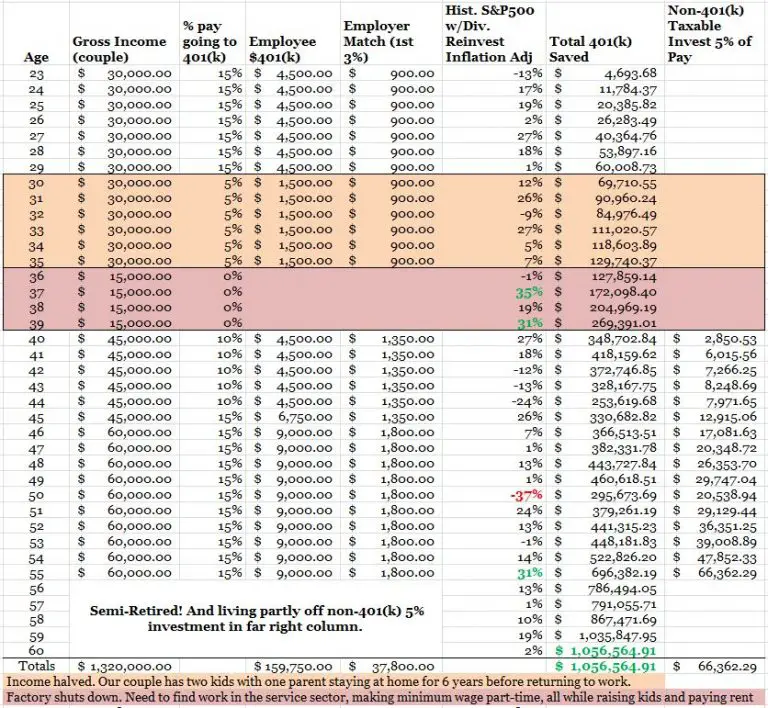

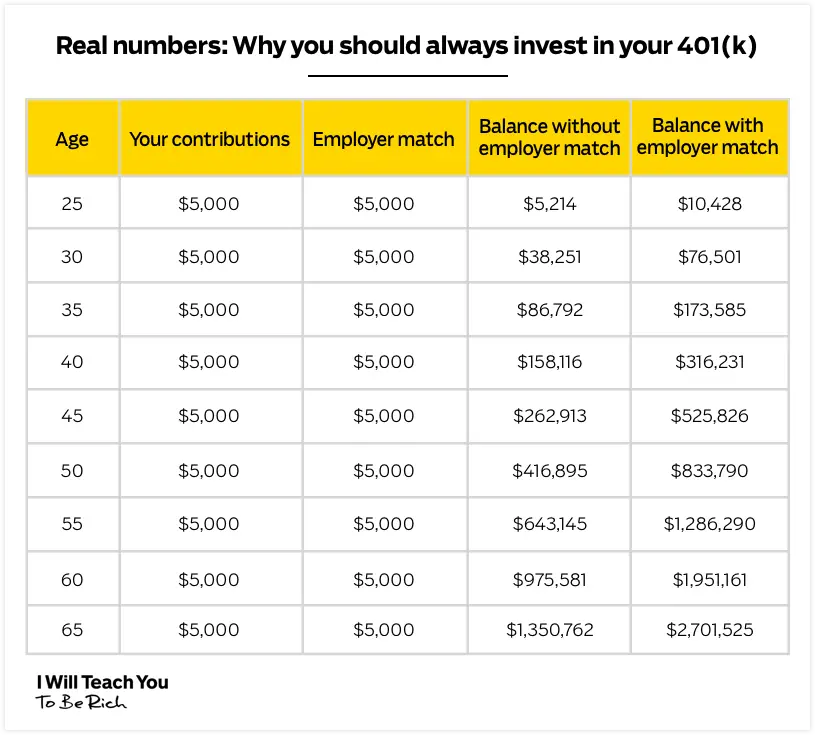

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

Do You Pay Income Tax On 401k Withdrawals

Traditional 401 withdrawals are taxed at an individuals current income tax rate. In general, Roth 401 withdrawals are not taxable provided the account was opened at least five years ago and the account owner is age 59½ or older. Employer matching contributions to a Roth 401 are subject to income tax.

You May Like: Is 401k A Pension Plan

Vested Versus Unvested Amounts

When you find your 401 balance, you might notice that some of the account is vested and some of it isn’t. Amounts that are vested are yours no matter what if you leave the company, you get to take that money with you, but you would lose any unvested amounts. You’re always 100 percent vested in your contributions. However, your employer may make contributions to your 401 plan on your behalf but might put vesting requirements on the money. According to federal law, contributions must vest at least as fast as either the cliff vesting or graded vesting schedules. With cliff vesting, you must be fully vested at the end of three years of service. With graded vesting, you must be 20 percent vested by the end of your second year of service, and must vest an additional 20 percent each year after that, making you fully vested by the end of your sixth year.

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

Recommended Reading: Can I Borrow From My 401k To Start A Business

Continued Growth Vs Inflation

Remember that your retirement savings accounts don’t grind to a halt when you begin retirement. That money still has a chance to grow, even as you withdraw it from your 401 or other accounts after retirement to help pay for your living expenses. But the rate at which it will grow naturally declines as you make withdrawals because you’ll have less invested. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

You also need to take inflation into account. This increase in the cost of things we purchase typically comes out to about 2% to 3% a year, and it can significantly affect your retirement money’s purchasing power.

Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up is free and only takes a couple of minutes.

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

Don’t Miss: How To Contribute To 401k Without Employer

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $58,000 for 2021 . This limit increases to $64,500 for 2021 $63.500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $290,000 in 2021 .

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

Also Check: How To Rollover My 401k To New Employer

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

How Much Can You Spend From Your Savings

The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. Not an easy task! This is a very tricky calculation, since you don’t know what you’ll earn in any given year, nor what the rate of inflation will be, nor how long you’ll live.

Conventional wisdom in retirement planning claims a conservative withdrawal rate should be 4% annually adjusted for inflation. Reputable sources argue this is too aggressive during periods of low interest rates and/or high market valuations, thus advocating a more conservative 3% annually adjusted for inflation.

You can decrease the risk of spending more than your assets can support by recalculating your withdrawals annually based on your current savings and investments balances. By implementing this strategy, your spending levels will vary annually introducing some uncertainty, but you will also dramatically increase the chances that your savings will last at least 30 years.

Don’t Miss: Where To Invest 401k Now

How Much Should You Save For Retirement

How much do you need to have saved up before you retire? The answer to that question used to be pretty straightforward. With $1 million in savings, at a 5% interest rate, you could be reasonably assured of having $50,000 in annual income by investing in long-term bonds and simply living off the income. If you saved $2 million, you could expect to have a six-figure yearly income without having to dip into principal.

Unfortunately, interest rates have been on a steady decline for roughly three decades now. Back in 1980, nominal Treasury bill rates were approximately 15%, but as of June 2021, a 30-year Treasury is yielding 1.91%. Lower bond yields have made the investing equation in retirement more difficult. It was only exacerbated by the , which complicated how individuals save enough to live off in retirement.

Read Also: How To Start A 401k Self Employed

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $19,500 in 2021 and 2020 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Don’t Miss: Do Employers Match Roth 401k

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Recommended Reading: What Happens To 401k When You Leave Your Job

How To Calculate Your 401k Fees In Under 5 Minutes

Do you know how much you are paying in fees each year with your 401K plan? Most investors dont. I certainly didnt always know this information. But over the last few years, Ive discovered that 401K fees can be fairly significant, and can vary greatly based on the 401K administrator and the individual investments you are using.

How significant? Well, if your 401K fees are just a percentage point higher, it could literally mean hundreds of thousands of dollars of difference in the total return your retirement account generates. This also applies to you if youre running your own small business and trying to find a small business 401K plan for you and your employees. Its important to know what your paying. But before we delve into calculating your 401K fees, lets look why these fees are so hard to pinpoint.

Pro tip: You can sign up for a free 401k analysis through Blooom and they will help you understand if youre paying too much in fees. They will also look into how diversified your portfolio is and whether you have the right asset allocation.

Recommended Reading: How Do I Know If I Have A 401k