Resist The Temptation To Tap Your 401

When youre contributing funds to your 401 account month after month, there will be times when the market flags and you see the value of your investments steadily decline. You may face the urge to withdraw money from the market during downturns, its essential that you resist the temptation.

Especially for young investors, its important to remind people to stay the course even when the market is volatile, said Taylor. People who are younger have time to ride out market swings.

What Is A 401 Company Match

A company match is an employer benefit in which the employer will add contributions to your 401, generally based on your own contribution rate.

Company matches can take several forms. The most common is a 50% match up to a 6% of salary contribution by the employee . Others will do a 100% match, but generally cap it at 3% of your salary.

The company match can be higher, particularly in certain industries where competition for talent is high. In fact, the main reason employers offer a match is to draw talent. In an industry where the match is common, and employer will almost have to offer it just to keep up with the competition.

Its a powerful benefit, too.

For example, lets say you contribute 6% of your salary to the 401 plan. Your employer provides a 50% match of 3%. That gives you a combined annual contribution to the plan of 9%.

Other important considerations with a 401 company match:

Tax treatment of matching contributions

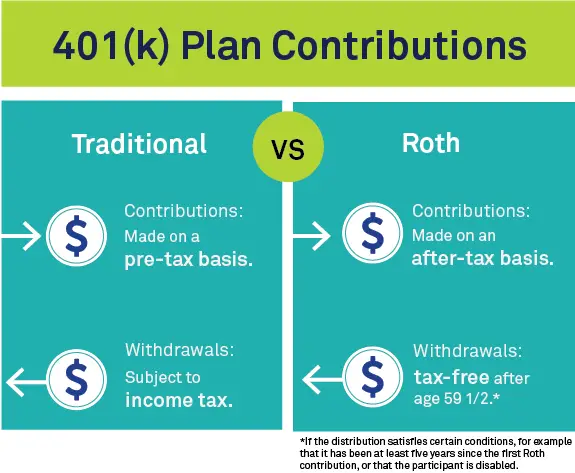

As a tax-deferred retirement plan, you can take a tax deduction for your own contributions to a 401 plan.

But since its your employer who makes the match, they will get the tax deduction for that portion of the contribution.

Matching contribution on Roth 401 plans

An increasing number of employers are offering the Roth 401 option.

But if they provide a company match on that plan, the match must go into a traditional 401 plan. Thats because the Roth portion must contain only nondeductible contributions.

Safe Harbor 401 Plans

A safe harbor 401 plan is similar to a traditional 401 plan, but, among other things, it must provide for employer contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees, regardless of whether they make elective deferrals. The safe harbor 401 plan is not subject to the complex annual nondiscrimination tests that apply to traditional 401 plans.

Safe harbor 401 plans that do not provide any additional contributions in a year are exempted from the top-heavy rules of section 416 of the Internal Revenue Code.

Employers sponsoring safe harbor 401 plans must satisfy certain notice requirements. The notice requirements are satisfied if each eligible employee for the plan year is given written notice of the employee’s rights and obligations under the plan and the notice satisfies the content and timing requirements.

In order to satisfy the content requirement, the notice must describe the safe harbor method in use, how eligible employees make elections, any other plans involved, etc. Income Tax Regulations section 1.401-3 , contains information on satisfying the content requirement using electronic media and referencing the plan’s Summary Plan Description.

Both the traditional and safe harbor plans are for employers of any size and can be combined with other retirement plans.

Recommended Reading: Can 401k Be Transferred To Roth Ira

A Taxable Investment Account

Once youve contributed enough to max out your IRA , then you can keep going with a normal taxable investment account, sometimes called a brokerage account. They dont come with the same special tax benefits, but that doesnt mean you cant use them to invest for retirement.

There are also no contribution limits. Which begs the question how much should you contribute to your taxable account after youve maxed out your IRA?

The short answer: Enough to get you on track for the retirement youre dreaming of . To figure that out, first you have to do the dreaming part. What does that goal retirement look like? Do you want to move somewhere warm? If so, whats the cost of living there? What will you do each day, and how much do those things cost? Will you work part time? If so, how much income will that add? And so on. Then you can start to figure out how much youll need each year, and that can lead to how much you should aim to have saved total.

Ellevests online investing platform can also help you figure out if youre on track. We use details from your real life like your salary, education, current savings, and, importantly, gender in order to project how much we think youll be making per year right before you retire . Then we calculate how much youll need in order to pay yourself 90% of that salary per year after you retire.

What Are The Benefits Of A 401k

401 tax benefits are hard to dispute, as they can offer workers a lot of financial security, including:

-

Employer match

In fact, let’s dig into 401k benefits a little deeper.

401k employer match

Do you like free money? Good, now that we’ve got that out of the way, a company-matched 401k is basically that. Many employers offer to match employee contributions, either dollar for dollar or 50 cents to the dollar, up to a set limit. So, for example, say you make $100,000 a year and your employer offers a 401k matching of 50% up to the first 6% you elect to contribute. If you contribute 6% of your annual earnings , your employer would contribute an additional 50% of that amount. So, 3,000 free dollars.

It’s up to your employer to decide what percentage they will match, but many companies do offer a dollar-for-dollar match.

401k tax breaks

The tax benefits of 401ks are like the triple-crown of finances. First, contributions are pre-tax. You dont pay taxes on the money until you withdraw it when you retire.

Second, your 401k contributions are not counted as income, which could put you in a lower tax bracket. The result: your tax bill will be smaller for your having squirreled away money for your later years.

401k shelter from creditors

If your finances take a turn for the worst, you won’t have to worry about creditors coming for your 401k. Your qualified retirement plan is protected by the Employee Retirement Income Security Act of 1974 from claims by judgment creditors.

Recommended Reading: Can You Convert Your 401k To A Roth Ira

Could You Invest Just 2 Percent More

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even 2 percent more from your pay could make a big difference. Enter information about your current situation, your current and proposed new contribution rate, anticipated pay increases and how long the money might be invested, as well as your own assumptions about the growth rate of your investments, and see the difference for yourself*. For additional information, see How to use the Contribution Calculator.

*This calculator is intended to serve as an educational tool, not investment advice. It enables you to enter hypothetical data. The variables you choose are not meant to reflect the performance of any security or current economic conditions. The examples are intended for illustrative purposes only and are not a prediction of investment results.

Calculations are based on the values entered into the calculator and do not take into account any limits imposed by IRS or plan rules. Also, the calculations assume a steady rate of contribution for the number of years invested that is entered.

How To Fund A Retirement Account

So you know how much you need to save for retirement and which accounts you can open. Now you have to fund those accounts without your employers help. The first step you can take is to set up direct deposit. You can set it so that a portion of your paycheck automatically deposits into your IRA or other account. You may also set up automatic transfers from a bank account to your retirement savings account. That way, you can set it and forget it.

You may also want to set aside any tax refunds, windfalls or bonuses you get. Its easy to deposit those funds into an account right away. That way, you can pretend that you never had access to that money anyways.

Its important to know that putting money into your IRAs or solo 401 isnt all you need to do. Youll also need to choose your investments. Luckily, you wont be limited to the funds your employer has selected to provide. A good place to start is with an S& P 500 index ETF and an intermediate term bond index fund. Youll need to make sure your investments are well-diversified and optimized. You dont need to do this all on your own, though. If you need help, there are a ton of financial advisors or robo-advisors out there who can help you manage your accounts.

You May Like: How To Borrow From 401k For Home Purchase

How Much Should I Contribute To My 401 If No Match

Before the economic downturn that occurred in 2008, it was a no-brainer to invest in your companys 401k program because your employer would typically match your contribution, possibly dollar for dollar or 50 cents on the dollar for the first 3 percent to 6 percent. As a way to stay competitive or to stay in business, matching your 401k contributions is one of the first programs employers cut. Contributing to your 401k might be your best bet, but it doesnt hurt to explore your other options.

Take Advantage Of Other Benefits

Startups may offer other options, such as buying stock options instead of a retirement account. This can allow you to benefit from the growth of the company in the first few years. It’s a good option when it’s managed right.

Make sure your portfolio is highly diversified. A startup could fold without warning. Owning this type of stock is riskier.

There are also rules for how soon you can sell your stock after purchasing it so this should not be your whole retirement plan. These rules can vary by company.

Some companies offer deferred compensation programs that allow you to defer pay until some future date, such as when you retire. This option lets you reduce your taxable income now. You’ll save money on income taxes, earn interest on the money, then take the money as either a lump sum or over a period of time when you decide you want it.

The rules for participating in such a program, and for how these programs are operated, can be tricky. Consult with a qualified retirement planning specialist before you enroll.

Read Also: How To Find Out If Someone Has A 401k

Crank Up The Investments Available

- Contribute more Put a higher percentage of your income into your existing retirement plan. Since it lowers your taxable income, it may be cheaper than you think.

- Try other tax-deferred options Consider opening an individual retirement account if youve reached the maximum contribution level in your employer-sponsored plan.

- Consider getting taxed up front Money placed in a Roth IRA is taxed now, but qualified Roth earnings are never taxed. This can save you more money in the long run.

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

You May Like: What Should I Do With My Old Company 401k

While You Can’t Invest In A 401 That Isn’t Sponsored By Your Employer There Are A Couple Of Exceptions To The Rule

Photo: 401kcalculator.org via Flickr.

A 401 is the most common type of retirement plan private-sector employers offer. However, many employers don’t offer a 401, or any type of retirement plan at all. If you are in this group, can you still take advantage of the many benefits of a 401?

The short answer: not really By definition, a 401 is an employer-sponsored retirement plan designed to encourage employees to save money for retirement and employers to help them do it. So to take advantage of this type of an account, you need to have an employer, and the employer needs to be the sponsor of the plan.

Some specific rules:

- You can’t invest in a 401 if you’re unemployed.

- You can’t invest in a 401 if your employer doesn’t offer one, or you don’t meet the qualifications for your employer’s plan .

- You can’t invest in an employer’s 401 if you aren’t that employer’s employee.

But just as with many other topics in finance, there are exceptions. Here are two major exceptions to the 401 rules.

Exception 1: You are the employerIf your income comes from self-employment, you can start a retirement savings account known as a Solo 401 or Individual 401.

Essentially, this gives you all the benefits of an employer-sponsored 401, as well as the ability to invest in any stocks, bonds, or mutual funds you want — not just in a small, specific basket of funds such as those that most employer-sponsored 401 plans offer.

Employer Match Does Not Count Toward The 401 Limit

There are two sides to your contribution: what you provide as the employee and the match from your employer . You can only contribute a certain amount to your 401 each year. For 2019, that limits stands at $19,000. In 2020, the limit is expected to rise to $19,500. This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401 on a pre-tax basis.

The good news is that this limit does not include employer match contributions. If you contribute, say, $18,000 toward your 401 and your employer adds an additional $5,000, youre still within the IRS limits.

However, there is another limit which applies to overall contributions your employer match contributions are taken into account for this overall contribution limit. For 2019, that limit stands at $56,000. This means that together, you and your employer can contribute up to $56,000 for your 401. If you contribute the max of $19,000, your employer can contribute up to $37,000 for 2019. For 2020, you and your employer can contribute up to $57,000. Note, though, that most employers are not this generous with their contributions, so youre likely in little danger of exceeding this limit.

Also Check: How To Take Out 401k Money For House

Invest In A Business Startup

The thrill of funding the next big thing makes investing in a startup exciting, however, it also includes a high degree of risk. Crowdfunding or focused investment platforms are a few ways that startups reach out to both potential investors and future customers.

Key benefits: Low investment threshold, rapid growth could lead to a corporate buyout and a large financial gain.

Drawbacks: High failure rates, may take a long time for the investment to pay off and/or to liquidate the investment.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: What Happens To My 401k When I Leave My Job

Thats The Power Of Peppermint

What is a PEP?

Pooled Employer Plans allow small business owners to pool retirement resources with other employers and make retirement plans lessexpensive and easier to manage.

Does my business qualify?

Companies of any size can join a Pooled Employer Plan AND employers starting a new plan may be eligible for SECURE Act tax credits of up to$15,000 over three years.*

Why should I sign up with peppermint?

With peppermint as your plan sponsor, you can give your employees the retirement plan options they want without the cost, risk, and administrative burden of a traditional 401k. Improve employee satisfaction, retention, and recruitment while helping your team save for the future.

Take Advantage If Your Employer Does Match Your Contribution

After that, you can circle back to that 401kif your company provides a match. If you get an employer match, you should absolutely cash in on the free money that your company is paying you. I consider this amount, whatever it may be in your case, to be part of my salary, I just need to save a little bit for my own retirement in order to unlock that portion of what is owed to me.

If your employer does not offer a company match, it still doesnt hurt to contribute a small amount of your paycheck to get the ball rolling. Even 1%, which you are likely to not even notice or miss, ensures that the account is set up and ready for you when you are in a position to increase your contributions.

Read Also: Is Spouse Entitled To 401k In Divorce In Ny