National Registry Of Unclaimed Retirement Benefits

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

How To Find An Old 401k Account From A Previous Employer

How to find an old 401k account from a previous employer is the question that many retirees face. Retirees have assets, including investments, held by their former employers and not managed by a current employer. If a retiree does not continue to make payments on their account and chooses to liquidate their assets, they will need to determine how to find their old 401k account from a former employer. Usually, if a former employer does not offer a statement to their retired employees, they can still open one for them. Some retirement plans provide an option for a former employee to keep their account and pay a fee each year to maintain it.

How To Find Missing Or Lost Retirement Accounts

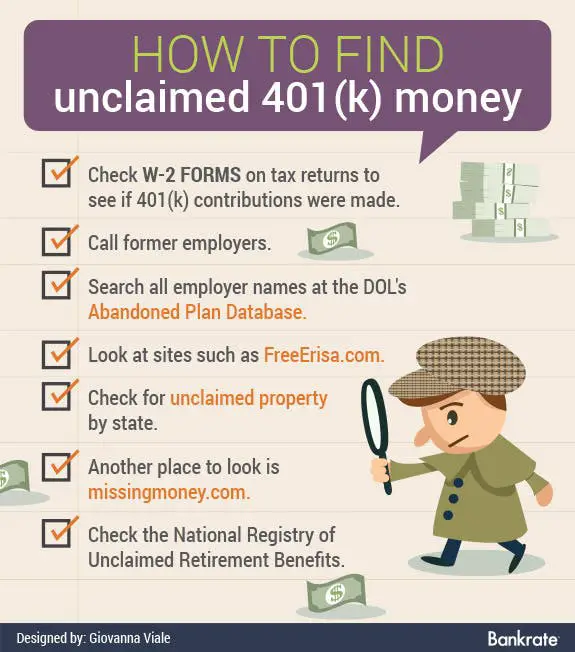

Americans have reportedly lost or abandoned more than $1 trillion in retirement benefits from previous employers. Fortunately, if youve misplaced retirement account funds, there are more ways than ever to find and claim your money.

In this article, Ill walk you through the steps to take if youre looking for retirement funds. Ill also provide you with resources to help you locate missing 401 accounts and pension plans.

Read Also: How Do I Transfer My 401k To A Roth Ira

Fund Selection And Fees

Ideally, you want low-cost fund options with no administrative fees. Consider the choices available with different brokerages to minimize the administrative or brokerage fees you may pay.

When it comes to fund selection, the sheer volume of choices can feel overwhelming. Beginner or hands-off investors may benefit from target date funds or robo-advisors that manage retirement funds for you based on your risk profile.

If you prefer to manage investment choices on your own, most advisors recommend beginners start with a simple portfolio of a broad U.S. stock index fund, a broad international stock fund and a U.S. bond fund. For more on how to invest for retirement, check out our guide.

How To Find Your 401 With Your Social Security Number

Knowing how to find your old 401s with your social security number can save a lot of time and headache. There are tools you can use to find your 401 and roll them over.

If you’re like most, you’ve changed jobs quite a bit during your career. According to a Department of Labor study, the average American will have had about 12 jobs during their career. All of that moving around is bound to cause some things to get lost in the shuffle. And if you’ve participated in any company-sponsored 401 plan, your retirement money may have been left behind. Luckily, there are ways to find your 401s using your social security number.

The sad fact is billions in retirement funds are left behind in 401 plans where the participant no longer works for that company.

401s that have been left behind with former employers can be cumbersome at best to find. However, it’s vital in building your retirement to locate your old funds and bring them back into your active portfolio.

The first step would be to contact your former employer’s human resources department. If you can get in touch with them, they should have the best route to getting a hold of your old 401s.

Next would be to reference your old 401s summary plan description. In that, you should be able to find your plan administrator’s contact information and what they do with former employees’ 401s.

You May Like: Can You Roll A Traditional 401k Into A Roth Ira

If You Find The Money

What to do with your 401 funds when you find the account largely depends on where you find it.

If the account resides in your employer’s plan, you do have the option to leave the money and the account there — just note you can no longer contribute money to it.

To get back in the game with your sidelined 401, roll it over into an individual retirement account or a current employer’s 401 plan. That way you can put the fund money to work by investing in stocks, bonds and funds that appreciate in value and accumulate more money for your retirement, on a tax-efficient basis.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Should I Roll My 401k Into An Annuity

Check Whether Your Former Company Has Merged

When a company goes through a merger, it loses its previous identity and takes the identity of the acquiring company. In such cases, your old retirement account may also get merged with that of the acquiring company. If you are unable to track your old company, you may want to browse the news to see if it has merged with another company. You can then contact the acquiring company for your account details.

Check With The Department Of Labor

The U.S. Department of Labor operates the Employee Benefits Security Administration. Its a federal organization that can help you find lost 401 or pension benefits.

You can search for your old employers Form 5500 here. Certain retirement plan administrators are required to file that form, which gives details on companies defined benefit plans.

Don’t Miss: Should I Convert My 401k To A Roth Ira

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

Recommended Reading: Which 401k Investment Option Is Best

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Recommended Reading: Can I Take Money Out Of My Fidelity 401k

Automatic Ira Rollovers For Non

When employees leave a company with a defined contribution retirement plan such as a 401, the majority rollover plan benefits to other tax-qualified accounts themselves. A significant number neglect to do so, however, allowing assets to remain in the plan after employment ends. The Economic Growth and Tax Reconciliation Act of 2001 amended the IRS code to allow plan sponsors to establish Rollover IRAs for missing and non-responsive plan participants with balances less than $5000.

In 2004, the U.S. Department of Labor published guidelines establishing safe harbor provisions for rollover distributions that would satisfy the plan sponsor’s fiduciary responsibilities to participants under ERISA. The plan sponsor must provide information about the automatic rollover process in the Summary Plan Description or Summary of Material Modification given participants. They must enter into a written rollover agreement with an IRA provider stipulating the amount of the initial investment, as well as services to be provided, fees and expenses.

The rollover IRA must be established at a state or federally regulated financial institution, such as a bank or credit union, trust or insurance company. The IRA must be rolled over to an investment vehicle that preserves principal, minimizes risk

How To Locate A 401 From A Previous Job

If youre trying to locate an old 401 plan from a previous job, youre not alone. Not by a long shot. Roughly $850 million in plan assets owned by 33,000 employees are orphaned each year, held by a financial institution without an employer to oversee the plan . Thats a lot of money being left on the tableroughly two percent of all 401 plan assets.

The good news is that the Department of Labor has established rules for protecting money put into a 401, so the money isnt necessarily lostjust waiting for someone to claim it. However, that doesnt mean your old 401 account will always be easy to track down. It may take some digging, but there are a variety of ways you can find it.

Don’t Miss: Do Employers Match Roth 401k

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

You dont meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you cant meet, or they might not provide the services you want.

Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isn’t a good example of that mindset.

Exhibit “A” is the U.S. Department of Labor’s Abandoned Plan Database. The database can tell you if your company’s old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plan’s name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

Don’t Miss: How Do I Know If I Have A 401k

How To Find Previous 401 Accounts

Using an employer-sponsored 401 plan can be a great way to save for retirement. The downside of 401s, though, is that they are tied to a specific employer. As a result, when you switch jobs, your 401 money wont automatically switch with you. Rather, in many cases, it will stay in your account. Below, well run through various ways to locate 401 money from previous employers.

Contact your old employer The most obvious way to find previous 401 accounts is to contact your old employer directly. The employers human resources department should have records of your current retirement-plan account and what assets are inside it. Your former employer will also be able either to get you the forms necessary to roll over your retirement money to a different 401 or to an IRA, or to give you contact information for any outside financial institution overseeing the plan on your employers behalf. By following the appropriate instructions you get, youll be able to move your retirement money where you want.

Refer to an old statement If you dont have contact information for your old employer, another possibility is to look through your records to find an old 401 statement. Statements will typically have the information you need to get in contact with either your employer or a plan administrator. Then, you can inquire about your options for moving money and get the information you need to do so.

GE-111930

Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

You May Like: How Do You Max Out Your 401k

How To Find Old 401s

A 401 plan helps you save for your retirement. However, because these plans are employer-specific, the money doesnt transfer automatically when you change your job. The money either continues to remain in your old 401 account or goes into unclaimed funds of the state government if you do not transfer it to your new account.

Apart from brokerages and savings and checking accounts, most of the unclaimed funds come from a 401, annuities, and retirement accounts. The law requires companies to send unclaimed 401 funds to your address. However, if the funds cant be delivered, they are handed over to the state.

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash out at age 24 leads to a $23,000 difference , in your projected account balance at age 67, so even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

Also Check: How To Open A Solo 401k

Leave Your Money In The Former Employers Plan

You wont be able to make contributions anymore, but this is an option. This is acceptable as a temporary solution while you look for a new job or research where to open your rollover IRA. But its not recommended for the long term, because the company may change their investment options over time, and it wont be easy to ask questions or make changes if youre no longer working there. If your account balance is less than $5,000, the company may not allow you to leave your money in their plan at all.

Cash out. WARNING! If you take a lump-sum distribution instead of rolling your retirement savings account over to an IRA or a new employers plan, you will have to pay income taxes on the money. You will also pay a 10% early withdrawal penalty if youre under age 59 ½. Not only do you lose money, but you lose valuable time in building savings, and may never catch up.