New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

Your Taxes Are Withheld

When you prematurely withdraw from your retirement account, your first consideration should be that youll have to pay normal income taxes on that money first. This means youre losing at least roughly 30 percent of your savings to federal and state taxes before additional penalties.

Even if you only have $10,000 you want to withdraw, consider that youre automatically giving $3,000 of your cash to the government. In the best case scenario, you might receive some money back in the form of a tax refund if your withholding exceeds your actual tax liability.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How To Transfer 401k From Old Job

Can I Take Money Out Of My 401k

The IRS allows you to borrow against your 401k, provided your employer permits it. Its important to note that not all employer plans allow loans, and they are not required to do so. If your plan does allow loans, your employer will set the terms.

What reasons can you withdraw from 401k without penalty?

- Unreimbursed medical bills.

- If you owe the IRS.

- First-time homebuyers.

- Higher education expenses.

- For income purposes.

Can you withdraw money from a 401k? Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This is because the dollars you contribute are after tax.

Can I take money out of my 401k early?

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

Recommended Reading: Can I Open A 401k Without An Employer

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

It Doesnt Matter Why Your Employment Ended

It doesnt matter whether you were fired, quit or were laid off. As long as you are no longer employed by the company maintaining the plan, and your employment was terminated during or after the year you turned 55, you will qualify for penalty-free early withdrawals from that 401.

Additionally, you dont even need to be retired to avoid paying taxes or penalties. If you have a 401 with Company ABC and quit at age 57, youll be able to access those savings without penaltyeven if you immediately take a job with Company XYZ.

Read Also: Why Rollover Old 401k To Ira

Choose Which Type Of Ira Account To Open

A 401 rollover to an IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you won’t incur taxes if you roll to a Roth IRA.

Crowdfunding A Down Payment

Sites like FeatherTheNest.com and HomeFundIt.com let you build an online profile and raise money for a down payment.

FeatherTheNest works like a gift registry where contributions to your down payment can be funneled into a linked bank account. The service seems particularly suited for engaged couples and newlyweds.

CMG Financial, a mortgage-banking firm, provides the HomeFundIt service. To use HomeFundIt, you have to get prequalified for a mortgage from CMG Financial first. Then you can use its crowdfunding tool to raise money for a down payment. You also have an opportunity for a $1,500 closing costs grant with free home buyer education.

The drawbacks: Watch out for fees or obligations when using a crowdfunding strategy. The transaction and credit card processing fees for FeatherTheNest total 7.9% plus 30 cents on each donation. HomeFundIt doesnt charge fees, but you can’t shop around for a mortgage lender you must use CMG Financial.

You May Like: How To Invest In A 401k Plan

You Might Have Other Options

If youre still employed at the company that sponsors your 401, you might be able to borrow up to 50% of your balance instead of cashing it out. Although your money wont grow while the loan is outstanding, you wont pay taxes on the amount you borrow, and any interest you pay goes right back into your account. Just be aware that youll have to repay the loan within five years or immediately if you leave your employer. Otherwise, the outstanding funds will be treated like an early withdrawal.

John Csiszar contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content thats accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates processes and standards in our editorial policy.

How To Withdraw From A 401/ira Early And Not Pay A Penalty

Most people are unaware of the available strategies on how to withdraw from a 401, 457, 403, TSP, IRA and not pay the penalty if you want to retire before age 59 1/2.

If youre looking to retire early and youve put enough money away in your 401, one of the most important questions to answer is:

How am I going to pay for my early bird dinners at 4:30 in the afternoon?

You cant collect social security until age 62 . The imperial federal government wants to protect you from going broke by hitting you with a penalty if you take money out of retirement accounts before age 59 1/2.

But smart people like you arent relying on the government to take care of them. And neither should you rely on the government to do your retirement or early retirement planning.

There are ways to take early withdrawals from your 401 without paying the 10% penalty before age 59 1/2. Ill share with you how to do it.

WARNING WARNING WARNING1) broke2) paying huge penalties

How To Get Started Investing

The international bestseller by CERTIFIED FINANCIAL PLANNER Scott Alan Turner. Choose the right accounts & investments so your money grows for you automatically. No jargon, confusion, or pie in the sky promises. Just a proven plan that works.

Don’t Miss: Why Choose A Roth Ira Over A 401k

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

How To Access Military Retirement Funds Early

Please note that this article is not to be considered financial advice. Consult a finance professional before making decisions about accessing military retirement funds.

What follows is a description of a program that permits veterans to access military retirement funds early, and should not be confused with encouragement to do so. That is a decision only the consumer can make based on careful review of circumstances, current financial need, and future financial planning.

All early-access programs for retirement money carry with them large potential for tax liabilities, indebtedness, loss of principal, or other issues. Always consult a financial expert or tax professional to understand the implications of accessing retirement funds ahead of schedule.

You May Like: What Is The Difference Between A Pension And A 401k

Disadvantages Of Closing Your 401k

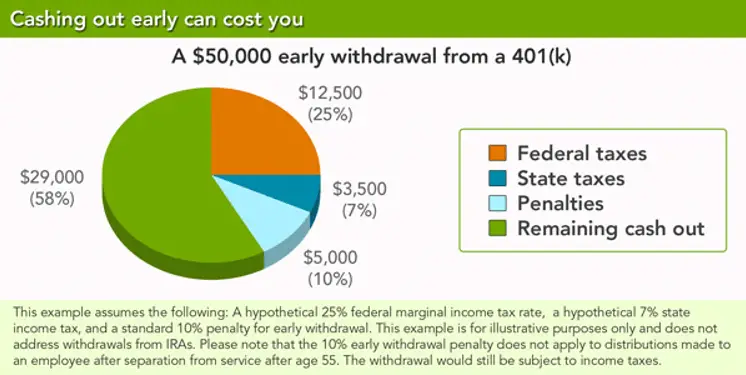

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

The 401 Withdrawal Rules For People Older Than 59

Most 401s offer employer contributions. You can get extra money for your retirement, and you can keep this benefit after you change jobs as long as you meet any vesting requirements. Thats an important advantage that an IRA doesnt have. Stashing pre-tax cash in your 401 also allows it to grow tax-free until you take it out. Theres no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty.

You can choose a traditional or a Roth 401 plan. Traditional 401s offer tax-deferred savings, but youll still have to pay taxes when you take the money out. For example, if you withdraw $15,000 from your 401 plan, youll have an additional $15,000 in taxable income that year. With a Roth 401, your contributions come from post-tax dollars. As long as youve had the account for five years, Roth 401 withdrawals are tax-free.

Recommended Reading: How To Cash Out Nationwide 401k

What You Need To Know To Avoid Costly Mistakes

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

You May Like: How Do I Know Where My 401k Is

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know

What Are The Penalties For Withdrawing From My 401 Before Age 59

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

Also Check: How To Grow 401k Fast

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.