How To Liquidate A Simplified Employee Pension Plan Ira

Your 401k contains cash for your golden years, but you may end up closing your account long before you quit work. You can close your account when you retire, change jobs and, in some instances, while still employed. When you terminate a 401k plan, though, you have to contend with taxes and penalties.

How To Get My Money If I Want To Cancel My 401

After 59 1/2, you can cancel your 401 whenever you want without penalty.

If you stashed money in a 401 plan but are wishing you hadnt put it in, you might be stuck wishing you could get it back, depending on your age and financial circumstances. The Internal Revenue Service has fairly strict rules limiting when you can get the money out, and, even if you can access your money, when extra tax penalties apply.

How To Roll Over A 401 While Still Working

Your 401k contains cash for your golden years, but you may end up closing your account long before you quit work. You can close your account when you retire, change jobs and, in some instances, while still employed. When you terminate a 401k plan, though, you have to contend with taxes and penalties.

Also Check: What Percentage Should I Be Putting In My 401k

Don’t Miss: Should I Open An Ira If I Have A 401k

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

How Do I Transfer An Old 401 To My New Job

Even if youre happy at your job, its always a good idea to keep your options open. If youre considering a move to a new company, one of the first things youll need to do is figure out what to do with your old 401. Fortunately, transferring an old 401 to your new job is usually a pretty straightforward process.

So, if youre planning a job change, dont forget to take care of your retirement savings. With a little effort, you can ensure that your hard-earned money stays right where it belongs in your pocket.

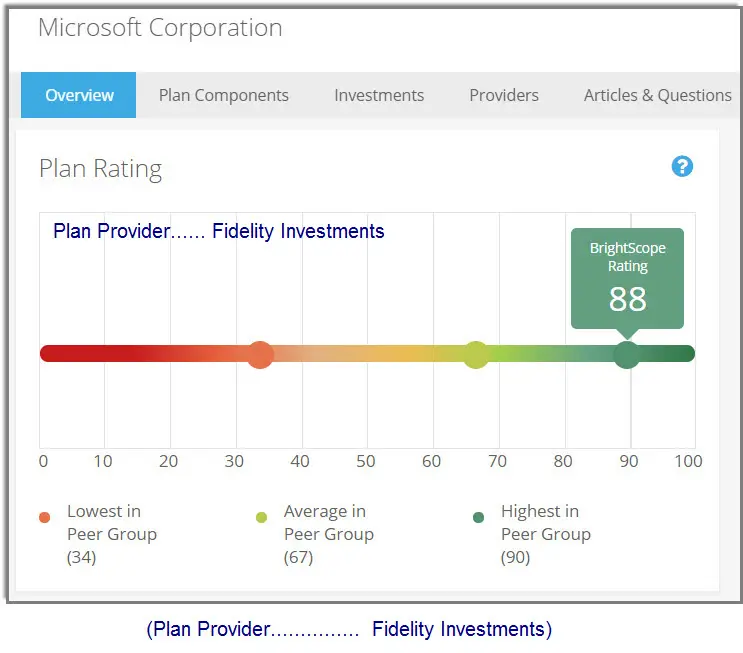

Recommended Reading: Which Fidelity 401k Fund Is The Best

Please Enter You New Phone Number

An error occurred while processing your request. Please try again later. An error occurred while processing your request. Please try again later. An error occurred while processing your request. Please try again later. Your account has been temporarily locked because of too many failed login attempts. Please try again later. The code entered has expired. Please request a new code to continue. The code entered is not valid. Please request a new code to continue. Email address format is not valid. Your account has not been verified. Please check your email for instructions on how to verify your credentials. Your account has been disabled. An error occurred while processing your request. Please try again later. That user does not exist. This account has reached its limit for daily password resets. Please try again in 24 hours. Password does not meet password strength requirements. Please try again. That password was recently used. Please enter a new one. An error occurred while processing your request. Please try again later. An error occurred while processing your request. Please try again later. The account information you provided does not match our records. This account is not authorized to perform the request youâve initiated. An error occurred while processing your request. Please try again later. An error occurred while processing your request. Please try again later. An error occurred while processing your request. Please try again later.

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Also Check: When Can I Get My 401k Without Paying Taxes

How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

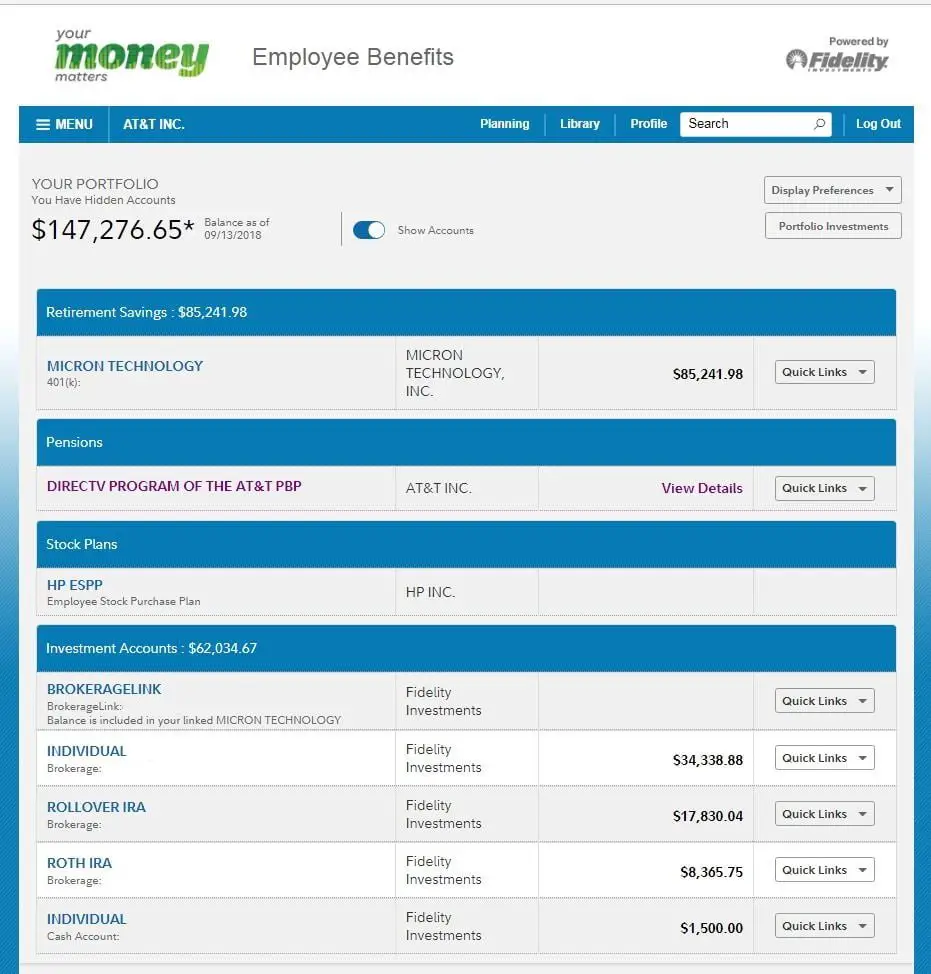

How To Find Old 401 Accounts

To corral all your accounts, you first must locate all your retirement plans. This is often the most time-consuming step in the process of organizing and streamlining your retirement portfolio, as youll sometimes have to do a bit of legwork to identify and find your old plans. The more jobs youve held, the more work youll need to do if you havent already rolled over those plans into other retirement accounts.

These suggestions can help you figure out how to find your 401k.

Read Also: Can You Move Money From 401k To Roth Ira

Read Also: How To Claim 401k From Previous Employer

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

How Do I Find An Old 401

If you left a 401 behind when changing jobs, the first place to look for it is your previous employer. Your human resources representative or benefits coordinator may be able to tell you where your money is and how to access it. If the company has closed down completely, you may be able to contact the plan administrator to ask about your savings. Should that fail, you can try the U.S. Department of Labors abandoned plan database to try to find your old 401.

Recommended Reading: Where Can You Cash A 401k Check

What You Can Do Next

To keep track of your retirement accounts, you first must know where they all are. Once you gather all your old accounts in one place and make sure they are properly balanced, its about sticking to the same investment principlesensuring your money is in diversified, low-cost fundsthat you would follow for your current company retirement plan.

For Compliance Use Only:1020356-00003-00

Are There Tax Penalties For Closing My Ira Account

Not if it’s done properly, but make sure you follow the rules

There are no tax penalties for closing an Individual Retirement Account as long as it’s done properly.

You can transfer the money into another IRA. Or, if you have an employer-sponsored 401, you can roll over the money into it. plan administrator permits this.)

In either case, your money will still be reserved for your retirement future, and any income tax you owe on it will be deferred.

Read Also: What Is A Good 401k Match

If My Company Closes What Happens To My 401

When a company shuts down, it raises questions for employees about what will happen to their 401 accounts. The good news is that defined-contribution plans, including 401s, are protected under federal law. If your company shuts down, goes bankrupt, terminates your plan, or merges it with another plan, the money youve saved for retirement doesnt just disappear. You may, however, have to do a little homework to track it down.

What Happens To My 401 If I Quit My Job

When you leave a job, you have several options for what to do with your 401.

You can cash it out, leave it with your old employer, or roll it into an IRA. Each option has different tax implications, so choosing the one thats best for your situation is important.

If you cash out your 401, youll have to pay taxes on the amount you withdraw. You may also be subject to a 10% early withdrawal penalty if youre younger than 59 1/2. If you decide to leave your 401 with your old employer, youll still be subject to taxes and penalties if you withdraw the money before retirement. However, leaving your money in a 401 can be a good way to keep it invested and grow over time.

Rolling over your 401 into an IRA is another option. With an IRA, youll have more control over how your money is invested. And, if you roll over your 401 into a Roth IRA, your withdrawals in retirement will be tax-free. Talk to a financial advisor to find out which option is best for you.

- You can keep your 401 with your former employer or transfer it to a new employers plan.

- You can also convert your 401 into an Individual Retirement Account via a 401 rollover.

- Another choice is to withdraw your 401, which may result in a penalty and taxes on the entire amount.

Also Check: How To Get A 401k Without An Employer

Does A 401k Loan Count As Income

401 loans are not reported on your federal tax return unless you default on your loan, at which point it will become a distribution and be subject to the rules of early withdrawal. Distributions taken from your 401 before age 59 1/2 are taxed as ordinary income and subject to a 10% penalty for early withdrawal.

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Recommended Reading: How Much Do I Need To Withdraw From My 401k

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

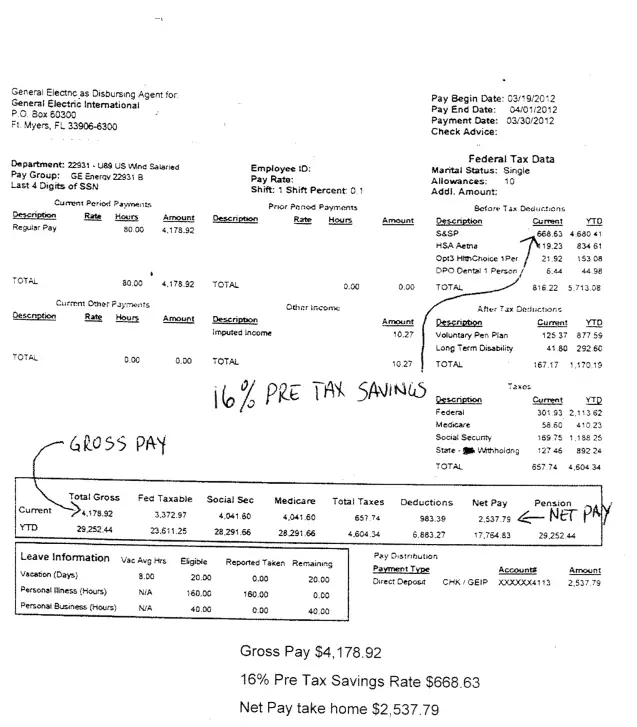

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

You may lock in your losses. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona. That may mean less money for your future.

How Long Do You Have To Move Your 401 After Leaving Your Job

Theres no time limit on how long you can keep your 401 after leaving your job. You can leave it in your former employers plan, roll it into an IRA, or cash it out. Each option has different rules and consequences, so its important to understand your choices before making a decision.

If you leave your 401 in your former employers plan, youll still be able to access your account and make changes to your investment choices. However, you may have limited options for withdrawing your money and may be subject to higher fees.

Rolling your 401 into an IRA gives you more control over your account and typically lower fees. Youll also be able to access your money more easily. However, youll need to roll over the account within 60 days to avoid paying taxes and penalties.

Cashing out your 401 should be a last resort. Youll have to pay taxes on the money you withdraw, and you may also be hit with a 10% early withdrawal penalty if youre under age 59 1/2. Cashing out will leave you without the tax-deferred savings to help you reach your retirement goals.

Also Check: How To Take Loan Out Of 401k

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the new financial institution with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your plan administrator is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Can I Take A Withdrawal Before I Terminate Employment

In general, you cant take a withdrawal from your 401 account until one of the following events occurs:

- You die, become disabled, or otherwise terminate employment

However, a 401 plan can also permit withdrawals while you are still employed. These in-service withdrawals are subject to the following conditions:

- 401 deferrals , safe harbor contributions, QNECs and QMACs cant be distributed until age 59.5

- Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

- Employee rollover and voluntary contributions can be distributed at any time.

- 401 deferrals , non-safe harbor contributions, rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time.

To find the in-service withdrawal rules applicable to our 401 plan, check your plans Summary Plan Description .

You May Like: How Do You Transfer 401k

Recommended Reading: Can I Rollover My Roth 401k To A Roth Ira