How Do 401k Loans Work

To find the answer to the question, Can I take a loan from my 401k, you must first know if your employer sponsored plan allows for it.

While loans have become a popular option, not every plan features the ability to take one out.

Want to know a secret? Finding out if a loan is available to you is probably the hardest part of the entire process. Things only get easier from there.

In other words, the 401k loan process so ideal because there are no hoops to jump through.

Approval for a 401k loan does not require much other than being approved by your plan administrator .

Once youre approved for the loan, you receive the money. Its that simple.

Inevitably, the question that follows can I take a loan from my 401k is how much?

You should be aware that there is a limitation on the amount you can borrow.

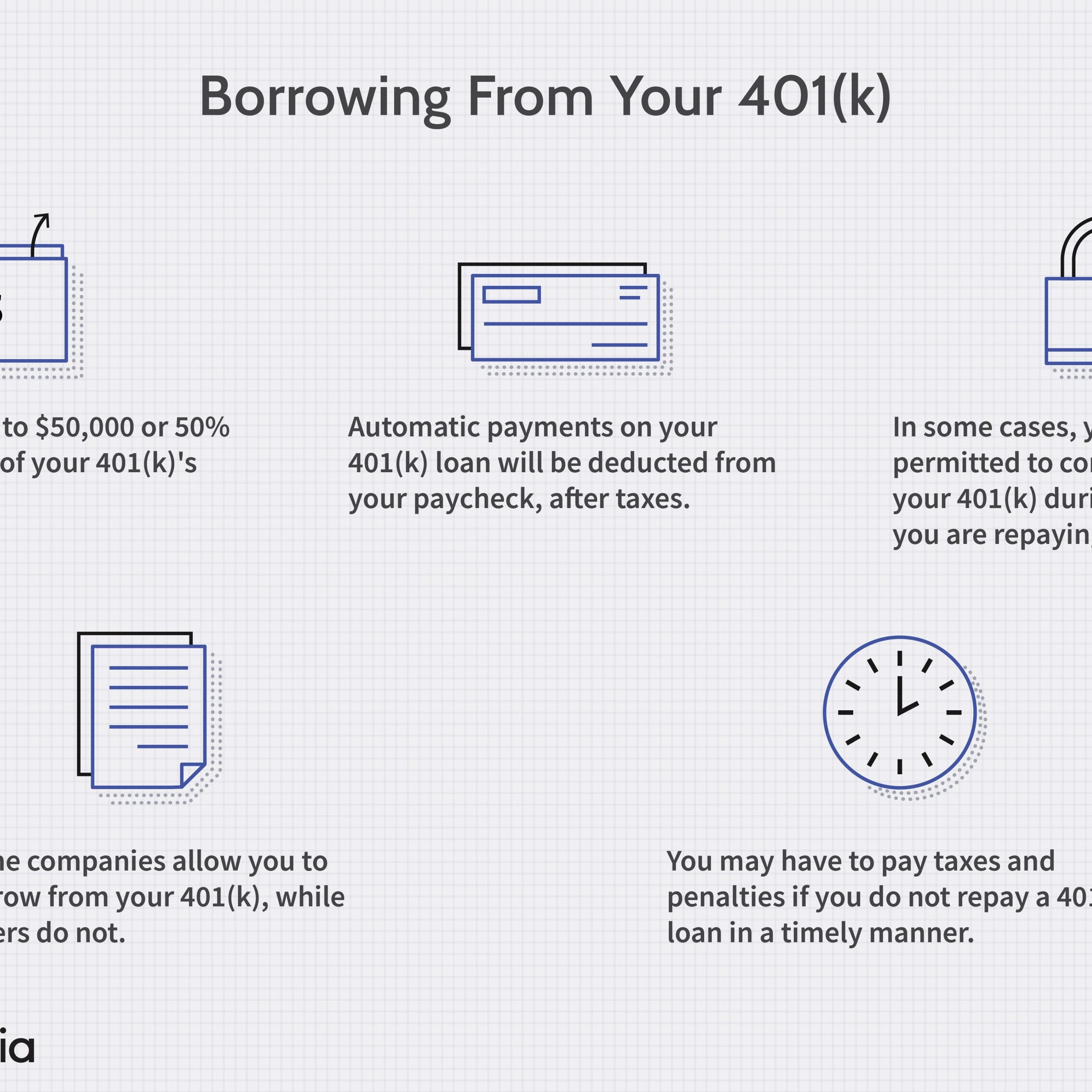

You can only borrow half of the vested amount in your account, or a maximum of $50,000, depending whichever is less.

Also, dont forget that you typically have five years to repay the loan, so borrow only what you can pay off within that time frame.

Should You Use Your 401 To Buy A House

There are good reasons for not using your 401 to buy a house. Even if youre comfortable with the 10% early withdrawal penalty, you will still be incurring long-term consequences by reducing your savings. That, in turn, will damage your future growth potential.

Taking out $10,000 from a $20,000 401 account, for instance, leaves you with only $10,000 that will continue accruing interest. With a 7% annualized rate of return, that $10,000 could become $54,000 over 25 years compared to $108,000 had you not withdrawn $10,000.

Withdrawing from your 401 account is essentially taking out a loan against yourself. If you want to pay it back, you also need to pay interest, and the time spent paying it back is time that could have been spent on growth.

You May Like: Can Rollover 401k To Roth Ira

Heres What Happens When You Take Out A Loan On Your 401

Dipping into a 401k can be tempting…

Most of todays workers wont have pensions to fall back on in older age. Given that were on our own in funding our retirement, why are so many of us sabotaging our future security by borrowing from our 401k plans?

Just over one in four, or 26%, of 401k participants has a loan outstanding, according to a recent report from Aon Hewitt, a benefits consulting and administration firm. While that study didnt capture the reasons why, a separate one conducted last year by TIAA-CREF found paying off debt to be the primary reason why people took out a loan, followed by paying for an emergency expenditure.

While 401k borrowers are borrowing from themselves, this isnt a harmless transfer of money from one pocket to another, experts say. The best spin you could put on it is its the lesser of several evils, said Greg McBride, chief financial analyst for Bankrate.com.

After all, most Americans arent sitting on 401k balances that they can afford to skim. According to Fidelity, the average 401k balance was $91,300 at the end of 2014. That sum wont even cover the average retirees health-care costs, according to Fidelitys own estimates.

Weighing the options

The Internal Revenue Service generally limits a participants plan loans to a total of $50,000 or half of the participants vested balance, whichever is smaller. Generally, repayments must occur within five years, with interest that the participant pays to himself.

Recognizing the pitfalls

Recommended Reading: How To Start A 401k For My Small Business

Don’t Take A 401 Loan Without Reading This

Borrowing money from a 401 is a common strategy used to get through hard times.

There are some perks to it, including the fact that you don’t need good credit to qualify for a 401 loan and you pay interest to yourself instead of a creditor. Some Americans decide these advantages outweigh the considerable downsides such as passing up potential investment gains on the borrowed money.

If you’re in the process of deciding whether borrowing from your retirement account makes sense, here are seven things you need to know.

You Are About To Retire

If you have a year or two remaining before retirement, the plan administrator may deny you a 401 loan. Usually, most 401 loans have a repayment period of five years, and if your loan is approved, the repayment period could stretch to the period after retirement.

Once you retire, you will be solely responsible for making timely loan payments, and this increases the risk of default. Once your name is struck out of payroll, your employer cannot make payroll deductions to repay the loan. Hence, your employers will reject your 401 loan request to avoid the risk of loss.

Recommended Reading: What’s A Good Percentage For 401k

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

What Other Options Are There If You Need Cash

- If you have a Roth IRA for five years, you can withdraw your original contributions at any age, free of federal taxes and penalties.

- For education expenses, explore scholarships or student loans. You can borrow for school but not for retirement.

- You can borrow against the value of your home with a home equity loan or home equity line of credit.

Also Check: Can I Contribute To A Roth Ira And A 401k

Home Equity Loan Or Heloc

If you own a home with equity built up, a home equity loan or home equity line of credit can be a low-interest alternative to a personal loan. This type of loan is often referred to as a second mortgage because the loan is secured by your home. In other words, if you default on the loan, your lender may have a right to foreclose on your home.

One of the major benefits of a home equity loan or HELOC over a personal loan is the interest rate. Loans that are secured by homes including mortgages, home equity loans, and HELOCs often have some of the lowest interest rates on the market. As a result, the loan will cost you less money over the long term.

Its important to proceed with caution if youre considering a home equity loan or HELOC. As we mentioned, these loans are secured by your home. If you cant make your monthly payments, you risk having the lender take your home. As a result, you should avoid this option if you think for any reason you may not be able to repay the loan on time.

Its Quick And Convenient

A person can easily procure 401K loans. They generally do not require any sort of application or credit check and therefore do not negatively affect your credit score. In addition, many 401Ks allow you to request a loan easily on their website, with funds available to you within a few days.

Some companies have even implemented the use of debit cards, making your loans available instantly. As long as you follow all 401K withdrawal rules, you will avoid a penalty for withdrawing from the 401K early.

You May Like: Can I Rollover My Ira To A 401k

Does Borrowing From Your 401 Hurt Your Credit

Going through all these hoops may worry you that it will slap you with a red flag on your permanent record. In reality, this loan is just between you and yourself plan acting as a witness). That leaves the usual suspects out of the picture.

As per my experience, 401 loans wont necessitate a credit check or show up as debt on your credit record, says Holmes. Since credit bureaus wont record the default, you wont have to worry about it harming your credit score if youre forced to default on the loan.

Using 401 Loan To Buy A Home

If you are cash-strained and you are looking for ways to fund the purchase of your house, taking a 401 loan can help you pay these costs. Usually, IRS rules require participants to pay 401 loans on an amortizing basis for not more than five years. However, if you plan to use the 401 loan to buy a primary residence, you may be allowed a longer repayment period. The repayment terms are determined by the plan administrator, and you could be allowed to repay the money for a longer period than the prescribed 5 years.

You can borrow up to $50,000 to pay the down payment for your primary residence or the closing costs. The loan will not appear on your credit report, and it will not have any impact on your credit score or debt-to-income ratio, since you are borrowing your own money. However, taking a 401 loan to completely finance the purchase of a house may not be feasible compared to using a mortgage loan. 401 loans do not allow tax deductions for interest payments, and you would be better off with a mortgage loan to get tax deductions and lower your tax bill. Also, taking a larger loan could affect the future potential for growth since the loan will be paid over many years.

You May Like: How To Self Manage Your 401k

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an IRA rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

SEPP withdrawals are not the best idea if your financial need is short term. When starting SEPP payments, you must continue for a minimum of five years or until you reach age 59½, whichever comes later. Otherwise, the 10% early penalty still applies, and you will owe interest on the deferred penalties from prior tax years.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the IRS: fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Don’t Miss: How Do I Pull From My 401k

When Can I Take Money Out Of My 401

During your working years, it may be possible to take a loan from your 401 depending on what your plan allows. Loans must be paid back within five years with interest and are typically capped at half of your savings up to $50,000 in a 12-month period. While this can be an option, itâs typically only something to consider as a last resort as funds in a 401 are meant for retirement.

It may also be possible to withdraw 401 funds, however, if you do so prior to age 59½, you will typically owe a 10 percent penalty on top of income taxes unless you qualify for an exception. Once you turn age 59½, youâre allowed to take money out of your 401 â technically known as a distribution â as you wish, without owing a penalty.

But just because you can take out the money penalty-free starting at that age, the real question is, should you? Your 401 will likely be one of your essential sources of retirement income, so itâs important to have a financial plan that lays out how youâre going to draw down from it â particularly if youâre planning to take out the money early.

How To Take 401 Distributions

Depending on your companys rules, you may elect to take regular distributions in the form of an annuity, either for a fixed period or over your anticipated lifetimeor to take nonperiodic or lump-sum withdrawals.

When you take distributions from your 401, the remainder of your account balance remains invested according to your previous allocations. This means that the length of time over which payments can be taken, and the amount of each payment, depending on the performance of your investment portfolio.

Don’t Miss: When Do You Need A 401k Audit

Which Assets Should You Draw From First

You may have assets in accounts that are taxable , tax-deferred s, and tax-free . Given a choice, which type of account should you withdraw from first?

The answer isit depends.

- For retirees who dont care about leaving an estate to beneficiaries, the answer is simple in theory: withdraw money from taxable accounts first, then tax-deferred accounts, and lastly, tax-free accounts. By using your tax-favored accounts last, and avoiding taxes as long as possible, youll keep more of your retirement dollars working for you.

- For retirees who intend to leave assets to beneficiaries, the analysis is more complicated. You need to coordinate your retirement planning with your estate plan. For example, if you have appreciated or rapidly appreciating assets, it may be more advantageous for you to withdraw from tax-deferred and tax-free accounts first. This is because these accounts will not receive a step-up in basis at your death, as many of your other assets will. A step-up in basis is used to calculate tax liabilities for your beneficiaries.

Read Also: Can You Transfer A 401k Into A Roth Ira

Withdrawals Are An Alternative To 401 Loans

A 401 loan is generally preferable to a 401 withdrawal if you must use the funds in your retirement accounts to meet your immediate needs. A loan is a better alternative because:

- You avoid the 10% early withdrawal penalty that applies if you take money out of your 401 before age 59 1/2.

- You’ll repay the money to your 401 so it will not permanently lose out on all of the investment gains it could have earned between the time of the withdrawal and the time you retire.

Before considering a 401 withdrawal and incurring both the penalties and losing gains for the remainder of the time until retirement, you should seriously think about taking out a loan instead if your plan allows it.

Don’t Miss: How To Get Your 401k From Walmart

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.