Finish Any Last Transfer Steps

Chances are that by this stage youre done, and your 401 provider has initiated the process of rolling over your 401 into your new Vanguard IRA. If so, congrats on getting to the finish line!

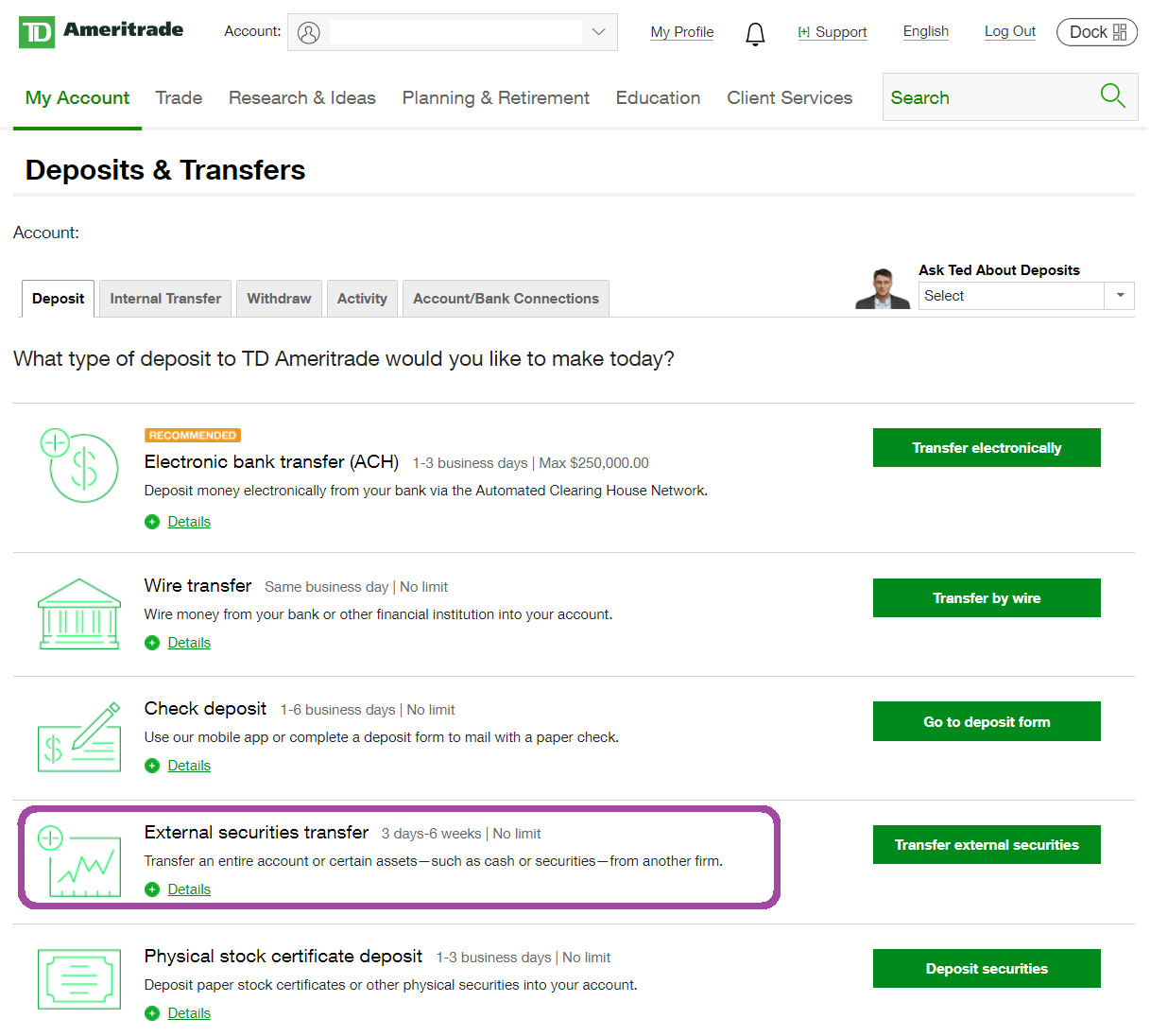

But there can sometimes be a small extra step at this stage. Thats because some 401 providers will only distribute your 401 funds to you, not to another institution. If thats the case then theyll send a check with your money to your mailing address. Its then up to you to deposit the check to your Vanguard account. Vanguard offers a few methods for depositing a check:

Advantages And Disadvantages Of Doing A 401 Rollover

Weve already discussed some of the benefits of doing a 401 rollover from an old employer plan to a new one. In this section, lets focus on the advantages and disadvantages of doing a 401 rollover into an IRA.

Advantages:

- Youre an experienced investor, and would prefer to manage your own retirement assets.

- The benefits and costs of using a robo-advisor to manage your money are better than those of the current plan.

- Youre not happy with the investment options in your current plan.

- You have several 401 plans from previous employers, and you want to consolidate them into a single IRA.

- Your new employer either doesnt permit a rollover of an old 401 plan, or doesnt provide the investment options youre looking for.

Disadvantages:

- Youre satisfied with the current plan and the returns its providing.

- By moving retirement funds from a 401 plan to an IRA, youll be giving up certain protections 401 plans provide from creditors and lawsuits.

- You have an immediate need for the funds, due to disability, medical costs, or other distributions that will exempt you from the 10% early distribution penalty.

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Donât Miss: How To Pull From 401k

Read Also: How Much Does A Solo 401k Cost

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

Dont Miss: How To Transfer 401k To Another 401 K

You May Like: How Do I Access My Wells Fargo 401k

Whats The Difference Between 2020 And 2021 Rmd Requirements

Last year, the RMD age increased from 70½ to 72 as a result of the Setting Every Community Up for Security Enhancement Act, and RMDs were waived by the CARES Act. The temporary waiver applied to:

- 2020 RMDs from traditional IRAs, inherited IRAs, and employer-sponsored plans.

- 2019 RMDs due by April 1, 2020, for individuals who turned 70½ in 2019 and didnt take their RMDs before January 1, 2020.

There is no longer an RMD waiver for 2021. As a result, anyone age 72 or older as of December 31, 2021, must take their RMD by year-end to avoid the 50% penaltyunless this is their first RMD, in which case they have until April 1, 2022.

Are There Tax Implications Of Ira Rollovers

Depending on how you move your money, there might be tax implications. If you move your money into an account with the same tax treatment as your old account, there shouldnt be issues as long as you deposit any checks you receive from your 401 into a tax-advantaged retirement account within 60 days. However, if you move a traditional 401 into a Roth IRA, you could end up with a tax bill. Check with a tax professional to find out how you may be affected.

Recommended Reading: How Can I Take Money Out Of My 401k

How To Withdraw Money From Vanguard Bottom Line

Vanguard withdrawal is free of charge in most cases. However, you can only do it via bank transfer other convenient options such as withdrawal to credit/debit cards or electronic wallets are missing.

To see how Vanguards withdrawal fees and options stack up against the rest of the brokerage market, check out our broker comparison tool.

Roth 401 Pros And Cons

|

Pros |

|

|

|

You May Like: Do I Need An Ira If I Have A 401k

Contact The Company Holding Your 401

Next, contact the company that is currently holding your 401 funds. If its a larger company, you should be able to call the phone number provided on your statement. The number may also be available via Google. You can then inform the company that you want to rollover your 401 into an IRA. Theyll take you through the necessary steps.

If its a smaller company or a government agency that holds your money, you may need to contact your former employers benefits department or HR department. There will be some paperwork that you will have to fill out to indicate that you want to rollover your 401 to your IRA.

Are There Any Downsides To 401

You might lose some protection against creditors. Additionally, you forfeit the ability to access 401 money penalty-free if you separate from your employer at 55 or older. You can, however, still access money for certain eligible purchases and life events, regardless of whether its in a 401 or IRA.

You May Like: How Much 401k Should I Have At 35

Moving Your Assets To Vanguard

If you want to transfer your assets to Vanguard, heres how to get started. First, head over to Vanguard.com and select the Personal Investor option on their homepage.

Next, click on Open an Account to get the whole process started.

And again Click open an account.

On the next page, you will tell them you are moving funds to Vanguard from another financial firm.

If you dont already have a Vanguard account select No here. If you do have an account you can log in.

Then, select that youre funding the account by transferring the money from another financial institution. Vanguard will then ask where the assets are that youd like to transfer. Youll select With your brokerage firm or financial institution.

Vanguard will then tell you that you need to know the name of the other institution where your assets currently are, your account number, the type of account youre transferring and the types of investments in the account . All of this information can be found on your statement from your financial advisor. If you are having trouble finding it you can call your advisor and ask for it.

Thats as far as we can take you in the process with screenshots without actually opening an account. If you get stuck on any question you can call Vanguard for assistance. They will walk you through the process. Or maybe even do it for you.

Related Articles

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employerâs 401, certain steps are necessary.

Read Also: Why Cant I Take Money Out Of My 401k

Recommended Reading: Can I Rollover My 401k To A Brokerage Account

How To Withdraw Money From Vanguard Vanguard Withdrawal Options

Withdrawal via bank transfer is by far the most common option. It is available at basically all brokers, and Vanguard is no exception.

However, bank transfer is the only withdrawal option available at Vanguard, putting it at a slight disadvantage over brokers that also offer withdrawal to credit/debit cards or electronic wallets.

Speed also matters. Unlike some deposit options, withdrawal is rarely instant. It usually takes at least 1 business day, but often several business days for your money to arrive.

We tested withdrawal at Vanguard and it took us 2 business days, which is considered fairly average.

To withdraw money from Vanguard, you need to go through the following steps:

- Log in to your account

- Select Withdrawal or Withdraw funds from the appropriate menu

- Select the withdrawal method and/or the account to withdraw to

- Enter the amount to be withdrawn, and, if prompted, a short reason or description

- Submit your request

Move Money Into The Tsp

Whether youre a civilian employee, a member of the uniformed services, or a separated participant, you can move money from other eligible plans to your existing TSP account. However, you cannot open a TSP account by transferring money into it.

Things to know:

We will accept both transfers and rollovers of tax-deferred money from traditional IRAs, SIMPLE IRAs, and eligible employer plans such as a 401 or 403 into the traditional balance of your account.

We will accept only transfers of qualified and non-qualified Roth distributions from Roth 401s, Roth 403s, and Roth 457s into the Roth balance of your account. If you dont already have a Roth balance in your existing TSP account, the transfer will create one.

We will not accept Roth rollovers that have already been paid to you and will not accept transfers or rollovers from Roth IRAs.

Don’t Miss: Can Roth 401k Be Converted To Roth Ira

Open Your Vanguard Account

Already have an IRA open at Vanguard? Great skip this step

In order to move the money out of your 401 account, youll need to have an account opened for that money to move into. If youve decided to move your funds to Vanguard, you have two main options:

Weve written a full guide on the five key differences between 401s and IRAs if youre trying to understand all of the differences.

Ultimately, most people who roll over an old 401 do so into an IRA for a few key reasons:

Think of your IRA as helping you do two key tasks:

The good news? Opening an IRA at Vanguard can be done online and should take you less than 10 minutes, if you dont already have one.

My Experience Rolling Over To Vanguard

Like many, I have been with several employers since I finished school and started in the workforce. And because I have always been pretty good about contributing to my retirement accounts, at one point I had a Roth IRA, two 401ks, a 457b and my own individual stock account. Trying to manage so many accounts was daunting, so I ended up doing what a lot of us do ignoring them and just letting things sit. While this isnt terrible it goes against the idea of rebalancing and diversifying your portfolio. So, after reading my brothers blog for the last year, I was finally motivated to try to consolidate the accounts so I could take a more active role in managing my portfolio.

I chose Vanguard basically because I had heard a lot of good things about their no/low load funds and good performance. I started by calling the number on their Personal Investors website, quickly got through to a live person and explained that I wanted to rollover my IRA from a former employer to Vanguard. I was transferred to a concierge transfer specialist who then walked me through the process of creating an account online, which took about 5 minutes. He also verified that I wanted to do a rollover IRA and asked what type of investments I wanted to place the money in once it reached Vanguard. I opted for a money market holding fund until I could do more research on their offerings.

Read Also: How Do I Take Money Out Of My Voya 401k

You May Have Accumulated

There are many factors to keep in mind when considering a 401 rollover, including where you’re at in your career, your current financial status, and your tax and investment preferences. You should consider all of your options before making a decision, and can use the information provided here to help. If you decide a rollover is right for you, contact a Schwab Rollover Consultant at .

How To Transfer Your Plan To Vanguard

You can follow these steps to get started.

Step 1

Gather your information

Here’s what you’ll need to prepare for your transfer:

- A plan statement dated within the past 90 days from the company that currently holds your account.

- The plan number and dollar amount currently invested in the plan.

- The type of plan you want to transfer ).

- Your Vanguard account number .

Step 2

When youre ready to get started, give us a call at 800-992-7188.

- Well guide you through the process to ensure its as seamless as possible.

- A qualified representative will let you know which documents are required to complete the transfer and answer any questions you have.

Step 3

Track your transfer

- Once we receive your request, well initiate the transfer and send you an email that explains how you can track the status of your transfer online.

- Once your transfer is complete, well send you an email confirmation.

Read Also: How To Start My 401k

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

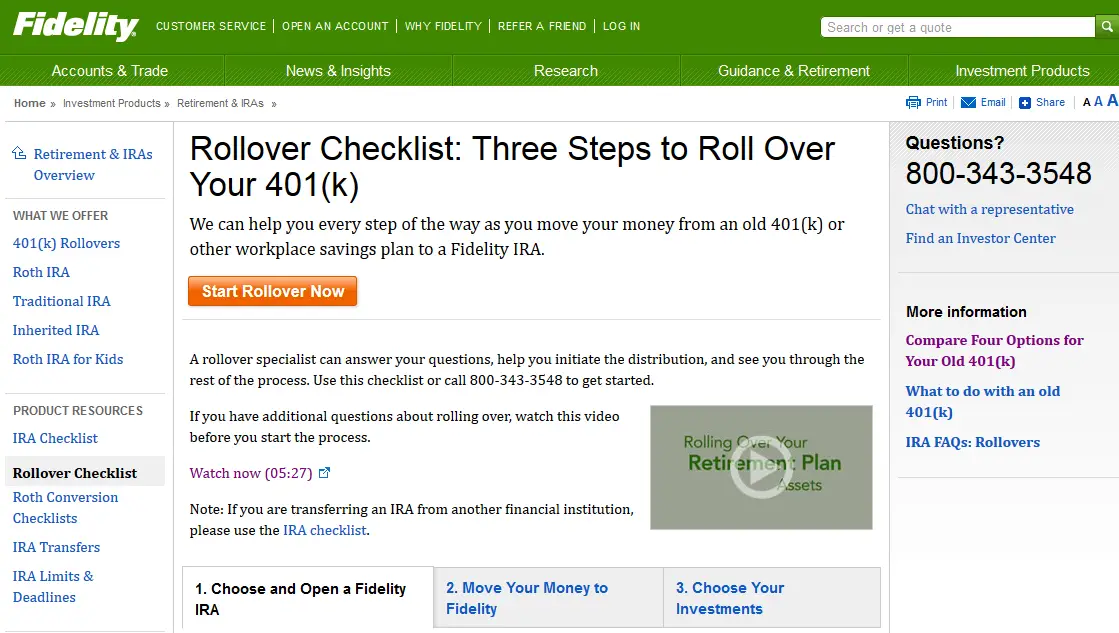

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

A financial advisor like me can guide you through the process if you have questions.

What to Say

Where to Deposit

Indirect vs. Direct Rollovers