Will My Credit Score Be Impacted If I Withdraw Early

Withdrawing funds from your 401 early won’t impact your credit directly since the credit bureaus don’t track activity on your retirement accounts.

Making an early withdrawal can indirectly affect your credit when you use the money to pay down outstanding debt. It may seem like an easy way to ease a debt burden or boost your credit, but in most cases, this shouldn’t be the only reason to withdraw funds from your 401. Such a move should only be considered in a financial emergency when you have exhausted all other options.

Here Are The 401 Rmd Rules For 2021 And 2022

401 accounts are workplace retirement savings plans that employees can contribute to with pre-tax dollars, sometimes receiving matching contributions from employers.

Those who contribute to workplace 401s must know the rules for 401 required minimum distributions, or RMDs, since RMD rules mandate that accountholders begin withdrawing money at age 72 or face substantial IRS penalties equal to 50% of the amount that should have been withdrawn.

This guide will explain why RMDs exist, what the RMD rules are for 401 plans, what exceptions exist, how RMDs can be avoided, and how RMDs affect you if you inherit a 401.

How To Calculate Required Minimum Distribution For An Ira

To calculate your required minimum distribution, simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec. 31st each year. Every age beginning at 72 has a corresponding distribution period, so you must calculate your RMD every year.

For example, Joe Retiree, who is age 80, a widower and whose IRA was worth $100,000 at the end of last year, would use the Uniform Lifetime Table. It indicates a distribution period of 18.7 years for an 80-year-old. Therefore, Joe must take out at least $5,348 this year .

The distribution period also decreases each year, so your RMDs will increase accordingly. The distribution table tries to match the life expectancy of someone with their remaining IRA assets. So as life expectancy declines, the percentage of your assets that must be withdrawn increases.

If you need further help calculating your RMD, you can also use Bankrates required minimum distribution calculator.

RMDs allow the government to tax money thats been protected in a retirement account, potentially for decades. After such a long period of compounding, the government wants to be sure that it eventually gets its cut in a clear timeframe. However, RMDs do not apply to Roth IRAs, because contributions are made with income that has already been taxed.

You May Like: How To Avoid Taxes On 401k

Read Also: How Do I Get My 401k

What Are The Consequences To Employees If I Make Excess Contributions

Excess contributions are included in employees gross income. Employees who withdraw the excess contribution before the due date for their federal return, including extensions, will avoid the 6% excise tax imposed on excess SEP contributions in an IRA. Excess contributions left in the employees SEP-IRA after that time will be subject to the 6% tax on the employees IRAs, and the employer may be subject to a 10% excise tax on the excess nondeductible contributions. If youve contributed too much to your employees SEP-IRA, find out how you can correct this mistake.

You May Like: How Do I Transfer My 401k To A Roth Ira

Planning With The New Rmd Starting Age

While any delay in the forced distribution of funds from IRAs and other retirement accounts will, no doubt, be welcome news for many individuals particularly the clients of financial advisors who tend to have sizable retirement account balances the reality is that the majority of retirement owners will see little to no benefit from this change.

As its important to remember that an RMD is a required minimum distribution, it doesnt prevent people from taking more than the required amount, or from taking distributions from their retirement accounts before they are mandated to do so. Which in practice is what many people do, simply because they need the money .

To that end, earlier this year, as part of Proposed Regulations to update the Life Expectancy Tables that individuals use to calculate RMDs, the IRS indicated that according to its own numbers, only about 20% of people take just the required minimum amount. And if someone is already taking more than the minimum, theyll likely continue to do so regardless of whether the RMD age is age 70 ½ or age 72. Its unlikely that theyll suddenly find enough other money to be able to delay taking distributions.

For such individuals, pushing back the RMD starting age from 70 ½, all the way to 72 may seem like only a minor change, but whenever Congress cracks open a planning window, its best to make the most of it, no matter how small that crack may be.

Read Also: How To Roll 401k Into New Job

You May Like: How To Roll Over 401k From One Company To Another

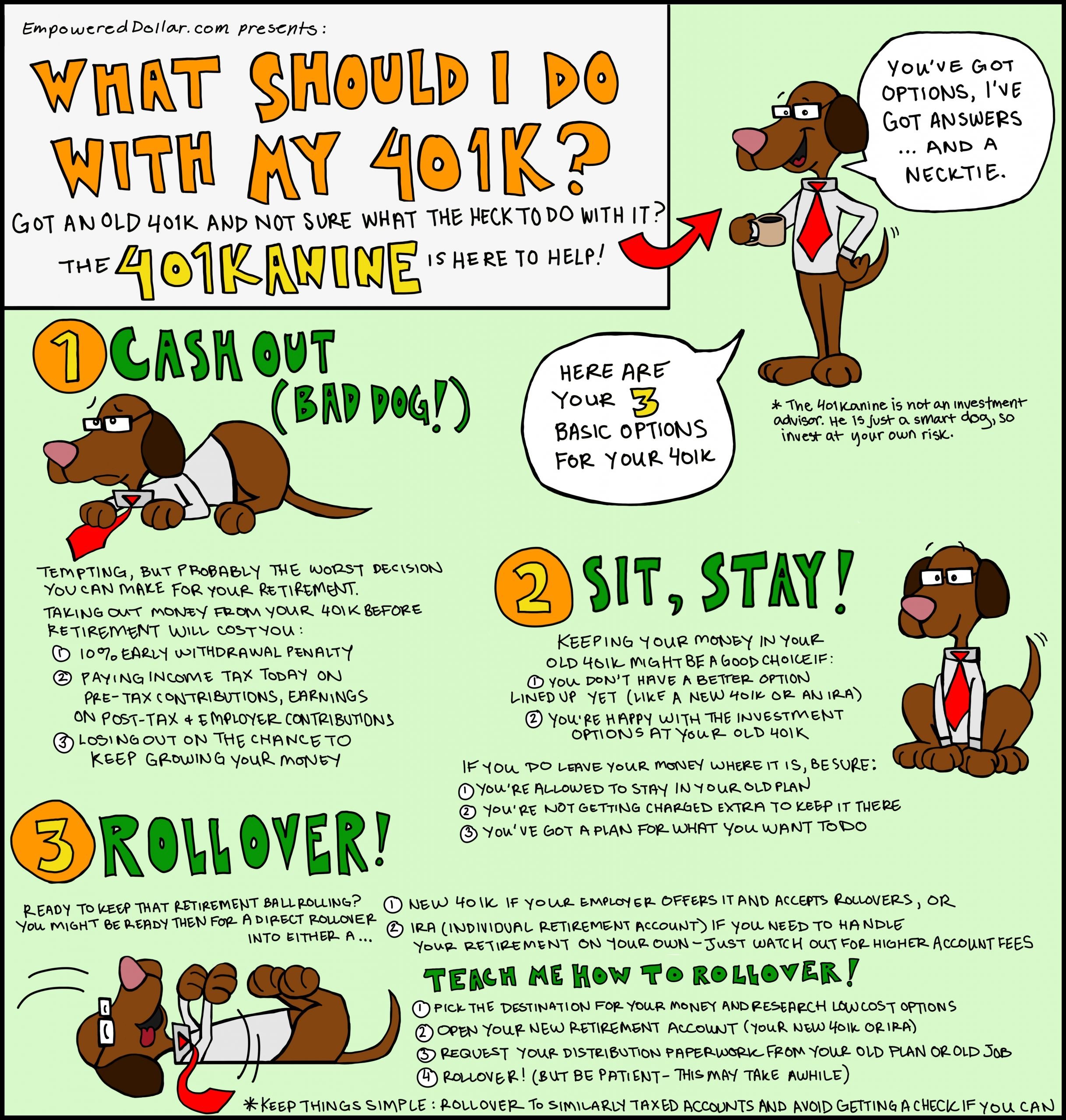

Inaction Can Lead To Automatic Cashing Out

It may seem odd, but you can choose to do nothing.

Many employers allow former employees to leave 401 accounts invested in the companys plan. You will not be able to make future contributions to this specific account, but the investment portfolio will otherwise continue as normal. It will grow based on its underlying investments. You can make changes to the assets based on the rules and preferences of this specific 401 account. And the existing account manager will continue to oversee these investments. Most companies use an outside financial firm to manage their 401 accounts, so your ongoing relationship would be with that firm rather than with your former employer.

Not every employer allows this though. If you have a relatively small amount of money in your account, some employers will close out your 401 automatically when you leave.

If you have less than $1,000 in your account, the IRS allows your employer to automatically cash you out of its plan. In this case you will receive a check for the account balance. Your employer will withhold income taxes, but you will not pay early withdrawal penalties as long as you place this money into a qualified retirement plan, generally an IRA, within 60 days.

If you have more than $5,000 in your account, many employers will allow you to keep your account in place. However, even then they may apply onerous terms such as high maintenance fees and access restrictions. Plans like this are rarely a good option for retirement savers.

When Should You Start Collecting Social Security Benefits

We’ll help you decide whether you should retire now and begin collecting your benefits or hold off for a few more years.

You don’t have to wait until you hit 67 to begin collecting benefits. Yes, the full retirement age is currently 67, but you can begin collecting benefits as early as 62.

When you decide to start collecting your Social Security benefits is something that can affect your finances for the rest of your life. And with the big cost-of-living adjustment increase that arrived in 2023, you might want to know whether it’s a good idea to start collecting your benefits now. We’ll answer all those questions and more below.

There are advantages and disadvantages, whether you decide to retire early or wait a few more years. The best place to start your decision is by examining your current financial situation, including any other money you’ve saved over the years through your 401, IRA or other retirement investments to determine what’s best for you.

We spoke with an expert and took the Social Security Administration’s advice into consideration to help you determine the best time to collect your benefits. For more about Social Security, learn how you can pause payments to get more money later.

Also Check: Where To Find My 401k

Make A Plan Before Changing Investments

If you don’t need to make withdrawals from your 401 immediately after you retire, it’s possible that your investment mix won’t need much adjusting. You don’t want to outlive your money, so shifting too early to an investment mix that is too conservative may not be suitable for your situation. Of course, investments cannot guarantee growth or sustainment of principal value they may lose value over time. Past performance is not an indication of future results.

I’ve Finally Retired What Happens With My 401 Now

After retirement you can start withdrawing the money you have accumulated over the years in your 401. However, a number of rules govern retirees 401 distributions. For instance, in most cases to avoid penalties you have to wait until after age 59.5 to retire and start taking money out. At any age, retirees owe federal income taxes on distributions from regular 401 accounts, although Roth 401 distributions escape taxation. Another rule is that, after age 70.5 or 72, depending on when they were born, retirees must start taking mandatory minimum distributions from their 401 plans every year. A financial advisor can help you decide how to tap your retirement funds.

Basics of 401 Distributions

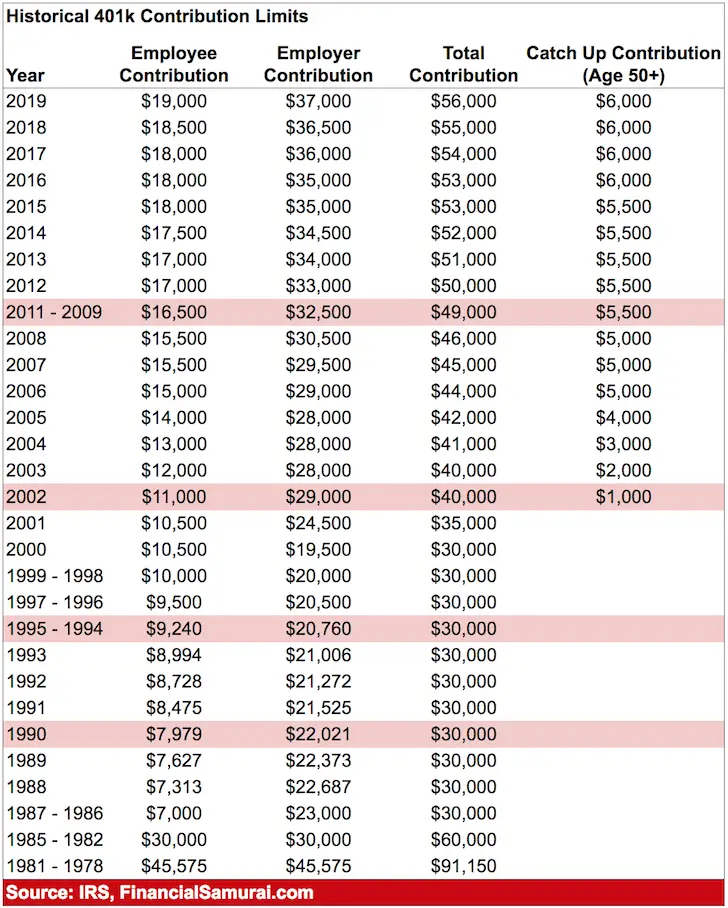

If your employer offers a 401 retirement plan you can contribute to it with pre-tax earnings while you are working and get valuable tax deductions. Many employers match your contributions, which can significantly boost a retirement savings plan. Investment gains from assets in a 401 also accumulate tax-free.

However, like most matters related to taxation, you have to follow a lot of rules when withdrawing from a 401. The IRS encourages following these rules by imposing penalties for violations. Some penalties can be exceptionally burdensome, so it pays for someone contemplating retirement to understand in advance the rules for withdrawing from 401 accounts.

How 401 Distributions Work

Age Considerations with 401 Distributions

Required Minimum Distributions

The Bottom Line

Retirement Tips

Recommended Reading: How To Check How Much You Have In 401k

Why Required Minimum Distributions Exist

The government provides a tax break for retirement savings by allowing workers to contribute to a 401 with pre-tax funds and enjoy tax-free growth on investments within a 401.

Uncle Sam wants to collect its piece of the money eventually, though, so RMD rules exist to make sure those who have invested in a 401 begin taking the money out during retirement.

RMDs ensure workers take out a set minimum amount of money each year based on their life expectancy. Withdrawals that follow RMD rules are taxed as ordinary income.

How Much Do I Have To Withdraw Each Year

The amount changes each year, according to your age. Start by calculating how much you had in all your tax-deferred accounts as of December 31 of the previous year. Next, find your age on the IRS uniform lifetime table and the corresponding distribution period. The distribution period is an estimate of how many years youll be taking RMDs. If youre 72, for example, the distribution period is 25.6 years, based on your life expectancy. Then divide your balance by the distribution period. Lets say you have a combined $100,000 in your tax-deferred retirement accounts. $100,000 divided by 25.6 is $3,906.25, which is the amount you must withdraw. If you are in the 25 percent combined state and local tax bracket, youll owe $976.56 in taxes on your RMD.

You can take your RMD out of one account, or take bits from each one, so long as you withdraw the required minimum.

Join today and save 25% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Recommended Reading: What Is A Roth Ira Vs 401k

You Can Still Withdraw Early Even If You Get Another Job

You arent locked in to early retirement if you choose to take early withdrawals at age 55. If you decide to return to part-time or even full-time work, you can still keep taking withdrawals without paying the 401 penaltyjust as long as they only come from the retirement account you began withdrawing from.

Ira 705 Irs Withdrawal Rules

An IRA can be a useful retirement planning tool.

When you own a traditional IRA you benefit from a number of tax advantages. Your contributions may qualify for a tax deduction , and investment earnings in the plan accumulate tax free. You only pay tax when you begin taking withdrawals.

One major restriction is that you are forced to take distributions once you reach age 70.5. Failure to do so can result in a hefty 50 percent penalty from the IRS.

Also Check: How Do I Rollover My 401k To My New Job

You May Like: What Does It Mean To Rollover A 401k

Cover Any Gaps In Health Insurance

You have a couple of options.

- COBRA continuation coverage: You and your family can continue to have health insurance for a while after losing your coverage through work. Because you pay the full premium, it can be pricey, but going without coverage, even for a short time, can be a risk. Previous dental and/or vision insurance is included as part of COBRA, too.

- A Health Insurance Marketplace plan: Cost varies based on your household income and available plans vary from state-to-state. Visit healthcare.gov to learn more.

- A spouse/partner insurance plan: Usually you need to sign up within 30 days of your last day on the job.

When Does The Rule Not Apply

The Rule of 55 doesn’t apply to any retirement plans from previous employers. Only the 401 you’ve invested in at your current job is eligible. Additionally, the Rule of 55 doesn’t work for individual retirement accounts , including traditional, Roth and rollover accounts. You’ll have to wait until age 59½ to access those assets without penalty.

There’s a way around this, however: You could roll over the funds from your former 401 and IRA plans into your current 401. Note that the process can be complicated, and not all employers accept rollovers. Before initiating a transfer, talk to your human resources representative and consult with a tax advisor to avoid unnecessary headaches. If you are allowed to make the transfer, all the funds in your current 401, including the transferred amount, will be available if you take early distribution using the Rule of 55.

You May Like: How To Convert My 401k To Gold

Rmds When You Have Multiple Accounts

If you have multiple accounts e.g. a 401 and two IRAs you would have to calculate the RMD for each of the accounts to arrive at the total amount youre required to withdraw that year. But you would not have to take that amount out of each account. You can decide which account is more advantageous and take your entire RMD from that account, or divide it among your accounts by taking smaller withdrawals over the course of the year.

Only Your Current Employers 401

Here is an important thing to keep in mind: The delayed RMD provision applies only to your current employers plan . If G.S. had a 401 with another employer, he would have had to start his RMDs from that 401 at age 70 1/2 Act, signed by the president on Dec. 20, 2019, changed the RMD age to 72). Also, if the current plan permitted rollovers, he could have rolled the old plan into his current employers 401 to allow for the still working RMD delay that applied to his current 401.

Also Check: What Can You Do With Your 401k

Date For Receiving Subsequent Required Minimum Distributions

For each year after your required beginning date, you must withdraw your RMD by December 31.

For the first year following the year you reach age 70½ , you will generally have two required distribution dates: an April 1 withdrawal ) and an additional withdrawal by December 31 ). You can make your first withdrawal by December 31 of the year you turn 70½ instead of waiting until April 1 of the following year which would allow the distributions to be included in your income in separate tax years.

Example: John reached age 70½ on August 20, 2019. He must receive his 2019 required minimum distribution by April 1, 2020, based on his 2019 year-end balance. John must receive his 2020 required minimum distribution by December 31, 2020, based on his 2020 year-end balance.

If John receives his initial required minimum distribution for 2019 on December 31, 2019, then he will take the first RMD in 2019 and the second in 2020. However, if John waits to take his first RMD until April 1, 2020, then both his 2019 and 2020 distributions will be included in income on his 2020 income tax return.

Example: Paul reached age 70½ on January 28, 2020. Since Paul had not reached age 70½ before 2020, his first RMD is due for 2021, the year he turns 72. Pauls first RMD is due by April 1, 2022, based on his 2020 year-end balance. Paul must receive his 2022 required minimum distribution by December 31, 2022, based on his 2021 year-end balance.

What Is The Rule Of 55

Under the terms of this rule, you can withdraw funds from your current jobs 401 or 403 plan with no 10% tax penalty if you leave that job in or after the year you turn 55. It doesnt matter whether you were laid off, fired, or just quit.

The distributions are not completely tax-free: Like all withdrawals from a traditional 401 or 403, you do have to pay income tax. Only the 10% tax penalty is bypassed in this scenario.

In addition, note that employers are not obliged to allow early withdrawals and, if they do allow them, they may require that the entire amount be taken out in one lump-sum withdrawal. This could expose you to a higher income tax.

This rule applies to current not former 401 or 403 plans. The government does not permit penalty-free withdrawals before 59.5 from plans you had with a previous employer. If you want access to that money under the rule of 55, you would have to transfer those funds into your current 401 or 403 plan.

Recommended Reading: Can I Roll My Ira Into My 401k