Time For Depositing Elective Deferrals

Employers must deposit employee contributions to the retirement plans trust or individual accounts as soon as they can reasonably be segregated from the employers general assets. The Department of Labor provides a 7-business-day safe harbor rule for employee contributions to plans with fewer than 100 participants.

If you havent deposited employees elective deferrals as soon as you could have, find out how you can correct this mistake.

Be Sure To Layout A Retirement Budget

Deacon Hayes, Owner & Founder of WellKeptWallet

Everyone’s life and circumstances are unique. Therefore, what works for one person is not going to be a magic formula that works for all. That being said, it’s always better to save more than you need rather than less.

Start by determining the age you would like to retire. Then, create a post-retirement budget to help you determine how much money you will need to save up ahead of time. Don’t forget to include vehicles, insurance, taxes, and other expenses that are not always monthly.

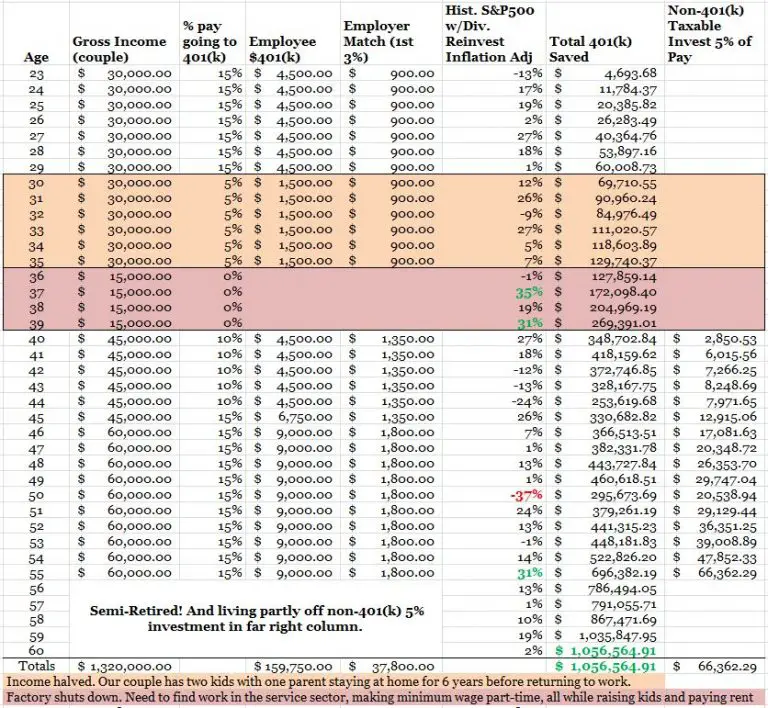

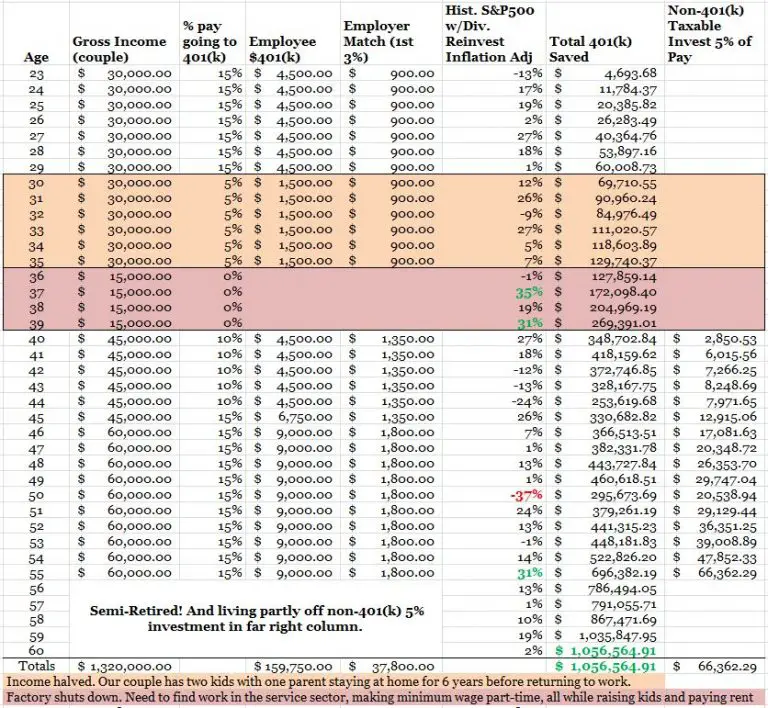

You can use a 401 calculator to assist you in determining how much money you should be investing at any age. However, here is a general guideline :

- At age 30 a minimum of one year’s salary

- At age 35 at least two years salary

- At age 40 three years salary or more

- At age 45 four years salary at minimum

- At age 50 at least five years salary

- At age 55 six years salary if not more

- At age 60 seven times your annual salary

- At age 65 at least eight times your yearly salary

Contributing To Your 401

You can contribute a portion of your earnings to a 401 account tax-free each pay period, subject to annual limits set by the Internal Revenue Service . Some employers even offer matching programs, where they contribute an equal amount to help grow your fund. It’s clear to see how it makes sense to put in as much as possible and maximize your 401.

But there may be reasons to hold back. Your financial situation should play a role in how much you decide to put in an employer-sponsored retirement plan. So should the specifics of the plan. Consider whether your company’s 401 is high in quality with solid growth rates and company matching. Make sure your own money base is solid, ensuring that you can afford to put some of your earnings away.

Maxing out your contributions probably isn’t your best choice if you’re struggling to pay bills each month, still working on other aspects of your finances, or if your 401 options aren’t great.

There are many key financial goals to meet as you get older and plan for retirement. Think about paying off high-interest debt, building an emergency fund, and securing overall financial wellness.

You May Like: How Do I Rollover My 401k Into An Ira

Rolling Out To Iras After An In

After completing a Roth conversion within your workplace retirement plan, rolling out to IRAs should be relatively straightforward if you choose to do that. If youre planning to roll the money out to a Roth IRA at some point and dont already contribute to a Roth IRA, it may make sense to open an account and make at least one contribution now, if possible, so the 5-year clock starts ticking on this account. Roth IRAs have a 5-year aging requirement as wellif youve never contributed to a Roth IRA and roll in money from a Roth 401 another 5-year clock starts in January of the year in which the rollover was done.

If you earn too much to contribute to a Roth IRA, you do have options. Read Viewpoints on Fidelity.com: Do you earn too much for a Roth IRA?

Defined Benefit Retirement Plan

This plan can be offered by sole proprietorships, S corporations, LLCs that are taxed as partnerships, and self-employed individuals.

Participants must provide proof of age and service to qualify for retirement benefits.

You’ll need to consult with a firm that specializes in defined benefit plans to find out how much you’ll have to put into the plan each year to accumulate enough money for your retirement.

Contributions must be made in cash and are tax-deductible, unlike contributions to SIMPLE IRA plans, SEP plans, or SEP-IRAs.

The total annual contribution can’t exceed $215,000 in 2018 or $56,000 if you’re self-employed.

This approach has some drawbacks: For one thing, there’s no convenient way to transfer the benefit of this type of plan to your heirs without paying taxes on it. And if you change or lose your job, the benefits are taxable as ordinary income until you reach age 59½.

Don’t Miss: How Much Do You Have To Take Out Of 401k

Dont Rely Only On Social Security

Based on Personal Capitals recent retirement survey, we found that a quarter of Americans expect Social Security to be their primary source of income during retirement. With half of Americans planning to retire at 65 or younger, its crucial to save in other investment vehicles, such as a 401k, in order to maintain your desired lifestyle in retirement.

We recommend not relying on Social Security it may not fully be there when you retire!

Is There A Company Match And If So What Are The Rules

Many employers offer incentives for employees to contribute to their 401 plans by matching contributions up to a certain point. For instance, some companies may match every dollar you contribute with 50 cents of their own, up to a certain percentage of your salary. Thats a nice benefit you dont want to miss out on. But individual plans vary widely, and there may be restrictions on qualifying for the company match or vesting schedules for the match. Ask your plan administrator for the rules that apply to your companys plan.

You May Like: Can I Rollover 401k To Td Ameritrade

Maximum 401 Contribution Limits

Many employers offer 401 matching contributions as part of their benefits package. With a 401 match, your employer agrees to duplicate a portion of your contributions, up to a certain percentage of your salary. In addition to matching contributions, some employers may share a percentage of their profits with employees in the form of non-matching 401 contributions.

While an employers 401 match and non-matching contributions dont count toward your $19,500 employee deductible contribution limit , they are capped by total contribution limits.

Total 401 plan contributions by both an employee and an employer cannot exceed $58,000 in 2021 or $61,000 in 2022. Catch-up contributions for employees 50 or older bump the 2021 maximum to $64,500, or a total of $67,500 in 2022. Total contributions cannot exceed 100% of an employees annual compensation.

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

You May Like: How To Check 401k Balance Fidelity

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Contributing To Your 401 Plan

As part of enrolling in a 401, you must decide how much you are going to contribute to the plan each year. There are some limits on the upper end, and your employer may require a minimum contribution if you want to join the plan.

But you may find that the critical question is what percentage of your earnings you are willing to commit to retirement savings. Many experts in the retirement field believe a ballpark amount is somewhere around 10 percent of your earnings. But it can be more or less, depending on your personal circumstances. If your company offers a match, you should contribute at least enough to get the full benefit of the match, otherwise you are leaving money on the table. And keep in mind that even if you are automatically enrolled at a certain level , this is often a minimum amount to save for a secure retirement. Consider increasing this amount, perhaps significantly, to give yourself a better shot at accumulating a robust retirement nest egg.

Read Also: Should I Roll My 401k Into An Ira

How Much Should I Contribute To My 401

Planning for retirement is a complex process that starts with an easy first step: saving money. A commitment to regular savings, as early as possible, will launch your retirement planning in the right direction.

As you get closer to retirement, you may want to be more purposeful about your savings. How much should I contribute to my 401? is one of the most common questions that financial services folks hear.

Figuring out how much to put in your 401 depends on your overall goals and financial situation, so it will vary for each person. The amount you can save is also determined by the Internal Revenue Service , because there are limits on how much money can be put aside.

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart , compounding interest is no joke.

Read Also: Should I Keep My 401k Or Rollover To Ira

Two Jobs Two 401s Contribution Limits If You Have More Than One 401

As previously mentioned, recall that contributions can be made to 401 plans in two ways: the individual deferral and the employer contribution, if any. The employer addition is typically profit-sharing, matching, or safe harbor. These respective limits also apply to those covered by more than one retirement plan.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Don’t Miss: How To Use Your 401k To Invest In Real Estate

Do Not Dip Into Your Funds Early

Peter Ferriello, CFP, Senior Wealth Advisor, and VP at Mollot & Hardy, Inc. Wealth Advisors

At a minimum, people should contribute an amount equal to their employer match. Many workers miss out on free money that their employer is willing to contribute to their account. This is a critical mistake that has a lasting impact on ones future. In order to calculate how much you should actually contribute beyond the match, it’s recommended you sit with a financial planning professional, preferably a CFP, who can help you calculate the amount that is necessary, but also realistic.

It’s also important to stress that taking loans and withdrawals from one’s 401k can have detrimental consequences on the future value of the account.

Ira Rollover Without An In

You can roll over after-tax contributions to a Roth IRA, and it is possible to do that before age 59½. There is a big catch though: Not all plans allow withdrawals while youre still with the company and your retirement plan may have some rules around the requirements for rolling out of the plan. In-service withdrawals come with some potentially complicated rules so its important to understand the rules the IRS has and those of your retirement plan.

In general, to roll after-tax money to a Roth IRA, earnings on the after-tax balance must, in most cases, also be withdrawn. You may have a few options.

If you have both pre-tax and after-tax contributions, you may be able to take a partial distribution from your retirement plan, consisting of just one or the other, if the plan separately tracks the sources of all of your contributions. In that case, you may want to roll out only the after-tax source balances and associated earnings directly into a Roth IRA.

The pre-tax contributions, along with the earnings from both the pre-tax and the after-tax contributions, can be rolled to a traditional IRA, incurring no current income tax.

Alternatively, you can roll everything into a Roth IRA, but you would need to pay income taxes on the pre-tax contributions and all of the earnings.

Important note: Any partial withdrawals or in-plan conversions may affect eligibility for net unrealized appreciation treatment on appreciated employer stock held in the plan.

You May Like: How To Sign Up For 401k On Adp

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Find Out What To Do If You Overcontributed To Your Employer

If you just realized you overcontributed to your 401, let me assure you, it’s all going to be okay.

The big fear everyone has when they find they’ve overcontributed to their 401 is that they’ll have to pay taxes and penalties. If you act fast enough, you’ll only pay extra taxes on the earnings attributable to the overcontribution. But if you act slowly, you’ll end up paying a lot more, including double taxes on the overcontribution and a potential early withdrawal penalty.

Also Check: Can You Transfer Money From 401k To Roth Ira

Is There An Employer Match

If your company matches, consider contributing at least enough to receive the full match amount, if youre able to afford it. Heres an example of what that might look like:

If your company has a 100% up to 5% match, that means they will match you dollar for dollar, up to 5% of your pay that you deposit into your 401 account. If you make $100,000, you will need to contribute at least $5,000 to get the maximum match of $5,000 annually.

If you dont contribute at least $5,000, you will be leaving money on the table that otherwise would have been yours. Keep aware of any increases your company may make to their matching contributions so you can adjust your contributions accordingly if youd like.

Next Steps To Figuring Out How Much To Put In Your 401

If youre unsure about how much you can afford to contribute to your 401, check out our paycheck impact tool that can help you calculate an exact number based off your salary and employer match options. If your employer doesnt offer a 401 matching plan, dont fret. There are still many ways you can save for retirement.

This website contains hyperlinks to other websites that are not associated with this site. Such unassociated websites may contain links to other unassociated sites as well. We make no endorsement, expressed or implied, about any of these linked sites, are not responsible for materials posted or activities that occur on such linked sites, and do not review content or advertisements posted on or activities occurring on these linked sites.

Recommended Reading: Should You Use 401k To Pay Off Debt

How Can I Reduce My Taxable Income

How to Reduce Taxable Income

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement.

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. You can contribute up to $20,500 in 2022, up $1,000 from last year.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, just 41% of workers contribute to one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to employer-sponsored plans: 68% of employed Americans.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

Don’t Miss: How Do You Cash Out A 401k