How To Make An Electronic Signature For Your Adp 401 Form In The Online Mode

Follow the step-by-step instructions below to eSign your adp401k login:

After that, your adp 401k login employee is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with a number of additional features like Merge Documents, Add Fields, Invite to Sign, and many others. And due to its multi-platform nature, signNow can be used on any gadget, personal computer or smartphone, irrespective of the operating system.

Login And Technical Issues

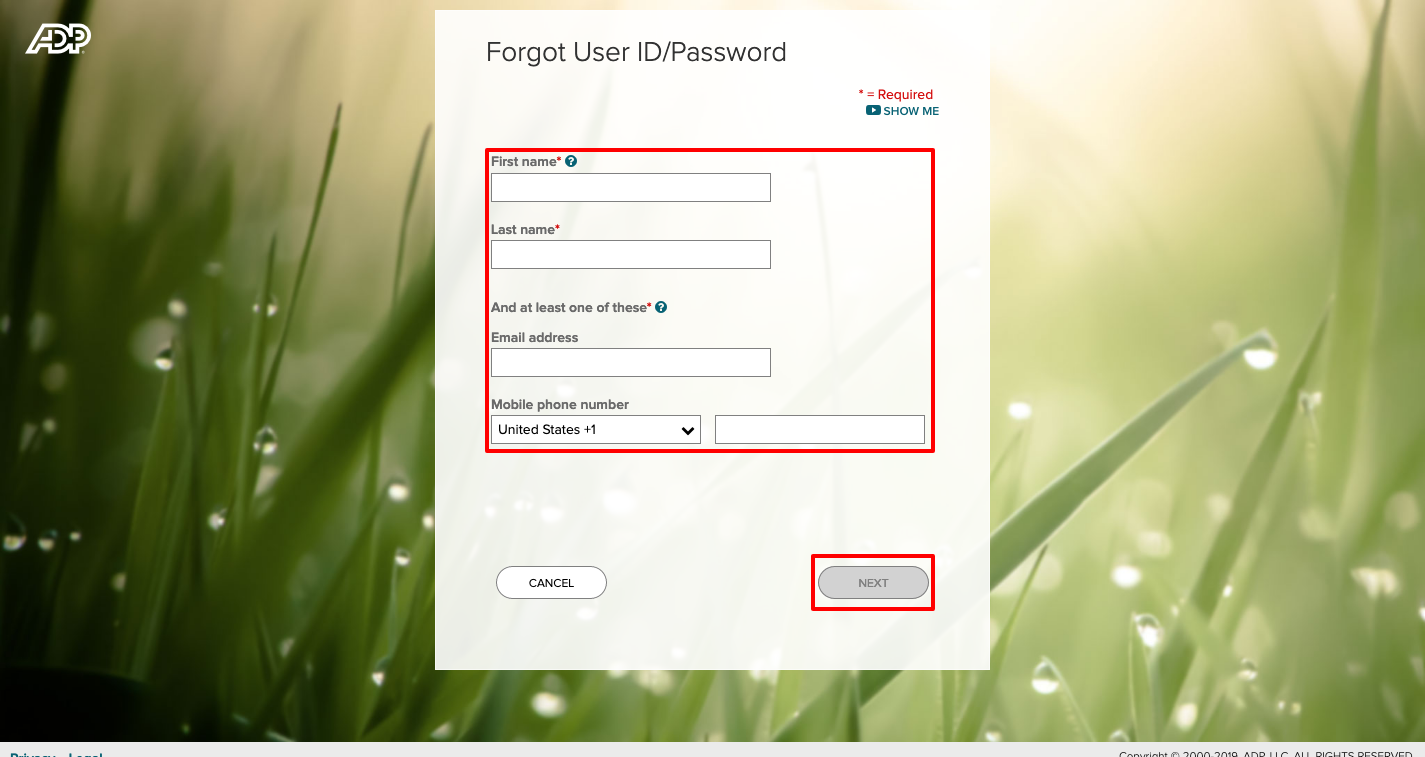

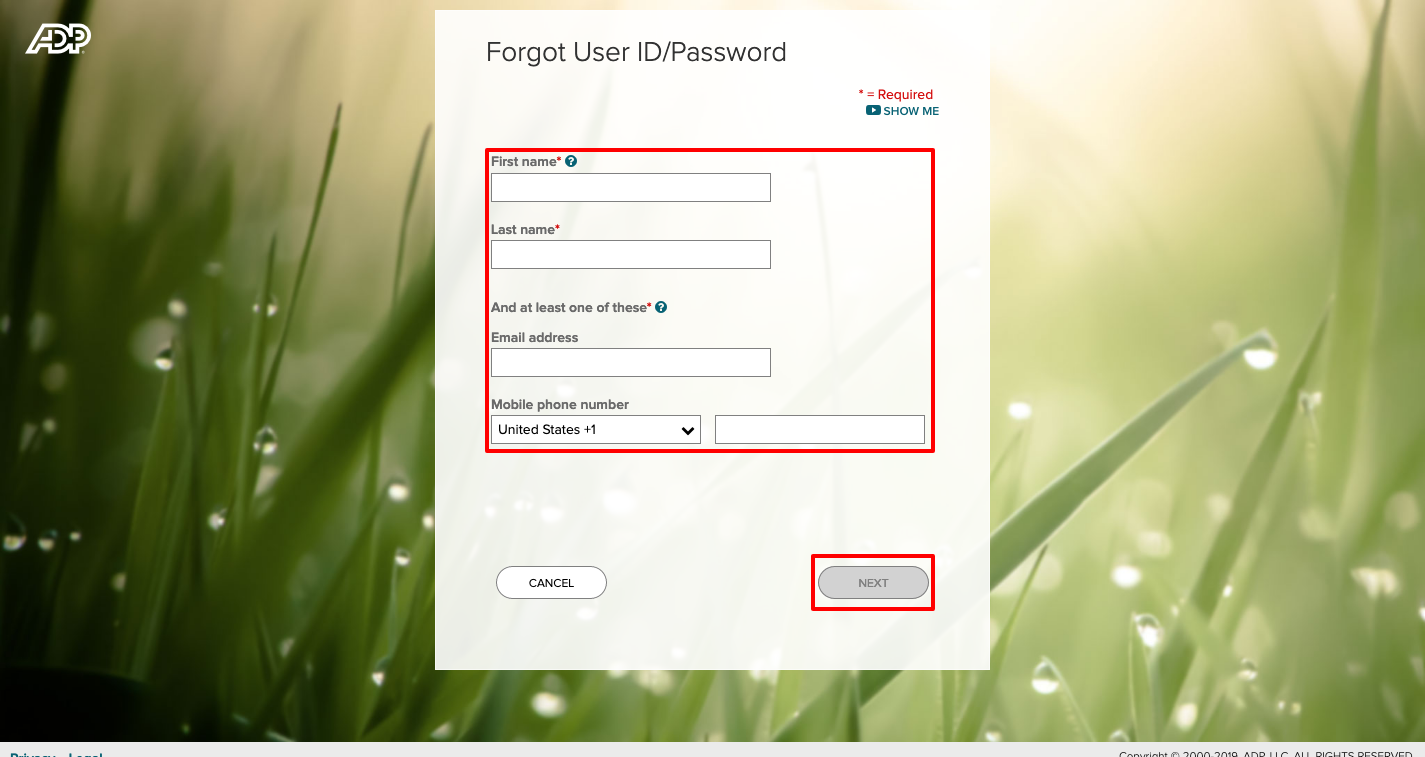

Trouble Logging In?

- Never logged in before?

- If you have never logged in before, ask your employer if they allow online access and request the registration code to sign up. Only your employer can give you online access. ADP cannot provide you with a registration code.

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Don’t Miss: What Will My 401k Be Worth At Retirement

Dont Let Your Adp 401 Fees Get Out Of Hand

Even if yours are below average now, ADPs revenue sharing can cause them to very quickly become excessive as assets grow. For this reason, its crucial that you compare your plans fees on a regular basis.

Too much trouble? Weve got a solution.

Simply switch to a 401 provider that charges fees based on headcount not assets – to the extent possible. Such a fee structure will make it easier for you to keep your 401 fees in check as your plan grows. You just might save some money while youre at it.

About Eric Droblyen

Eric Droblyen began his career as an ERISA compliance specialist with Charles Schwab in the mid-1990s. His keen grasp on 401k plan administration and compliance matters has made Eric a sought after speaker. He has delivered presentations at a number of events, including the American Society of Pension Professionals and Actuaries Annual Conference. As President and CEO of Employee Fiduciary, Eric is responsible for all aspects of the companys operations and service delivery.

- Connect with Eric Droblyen

Theres Another Way To Stay Compliant

Passing annual nondiscrimination tests is a crucial part of a 401 plans administration. And as you can see in the examples above, correcting a failure can have unwelcome consequences for employees or require making employer contributions you may not have budgeted for. To address any risk early, its highly advisable to conduct plan testing throughout the year to stay in front of things.

And dont forget that a Safe Harbor 401 lets you skip these annual tests by creating incentive for more of your employees to save. Bottom line, a little planning can go a long way toward keeping your 401 compliant.

Read Also: Can You Use Your 401k To Buy Real Estate

How Much Should An Employer Contribute To The Plan

The amount you as an employer decide to contribute is entirely up to you. As you make this decision, consider the tax savings you can receive for making employer contributions. Employer matches are tax-deductible on federal corporate income tax returns, and some administrative fees associated with managing a 401 plan are tax-deductible as well.

You can match as much as you want as long as it stays within the IRS limitations, which combine both employer and employee contributions. According to the IRS, this combined total is the lesser of 100 percent of an employee’s compensation or $61,000 for 2022, not including “catch-up” elective deferrals of $6,500 for employees age 50 or older.

Also consider factors such as the positive impact a matching contribution can have on employee morale and worker retention strategies. Given the steep costs of hiring and training new employees, an employer match offers the opportunity to truly invest in your workforce. These considerations may help guide your decisions about how much to contribute to the 401 plan.

How Adp And Acp Tests Work

The ADP test compares the average salary deferral percentages of highly compensated employees to that of non-highly compensated employees . An HCE is any employee who owns more than 5% interest in the company at any time during the current or previous plan year or earned more than $130,000 during the 2020 tax year.

The ADP test takes into account both pre-tax deferrals and after-tax Roth deferrals, but no catch-up contributions, which may be made only by employees age 50 and over. To pass the test, the ADP of the HCE may not exceed the ADP of the NHCE by more than two percentage points. In addition, the combined contributions of all HCEs may not be more than two times the percentage of NHCE contributions.

The ACP test uses a similar method as the ADP test except that it uses matching contributions or employee after-tax contributions.

You May Like: What Is Ira And 401k

Offer Optional Benefits To Employees

Benefits such as health insurance, dental care, life insurance and retirement plans can make your business an attractive place to work. Employees typically pay a portion of the cost, which is deducted from their paycheck. How much depends on the types of plans you offer and the level of coverage the individual chooses. Some benefits, such as those offered under a cafeteria plan that meets the specific requirements and regulations of section 125 of the Internal Revenue code, may be offered on a pretax basis. Others, like Roth IRA retirement plans, are deducted on a post-tax basis.

Nondiscrimination Tests: How To Stay Compliant

Does your companys 401 plan benefit all your employees, or does it favor owners and executives who make more money? Thats what the two major 401 nondiscrimination tests try to assess each year.

What do you need to do to pass the tests? Well, our friends at the IRS have made that piece of the equation a little more complex, so lets take a closer look at what each nondiscrimination test measures, how to apply them, and what it means if your plan fails. As you read this, also keep in mind that its possible to set up a Safe Harbor 401 plan, that’s exempt from nondiscrimination testing.

Also Check: How To Opt Out Of Fidelity 401k

The Actual Contribution Percentage Test

The ACP test is similar to the ADP test, but it compares the average employer contributions received by HCEs and NHCEs, rather than how much they defer. ACP is calculated by dividing the companys contribution to an employee by his or her W-2 income:

Here, Winterfell Consulting gives the HCE, Jon, a 3% total contribution, while NHCEs Sansa, Arya, and Bran receive an average contribution of 1.5%.

How To Avoid The Mistake:

One way to avoid this type of mistake is by establishing a safe harbor 401 plan or by changing an existing plan from a traditional 401 plan to a safe harbor 401 plan. Under a safe harbor 401 plan, the employer isnt required to perform the ADP and ACP tests, if it meets certain requirements.

Problems may happen when theres a communication gap between the employer and plan administrator regarding what the plan document provides and what documentation is needed to ensure compliance. Several main areas where these communication problems may occur:

- Count all eligible employees in testing:

Recommended Reading: What Age Can You Take Out 401k

How Long Do I Have To Deposit The Check

You should deposit the check you get right away. Even if the check is made out to your IRA provider , you should try to do it within 60 days of receiving it.

Get a prepaid envelope sent directly to your door with a tracking number! Start a rollover with Capitalize and well send you a prepaid priority mail envelope with detailed instructions to make sure your rollover is transferred successfully. Get started

What Is An Employee Retirement Benefits Provider

An employee retirement benefits provider is a company that helps small business owners set up and administer retirement plans for themselves and/or their employees. Providers offer a range of services, including plan design, administration and recordkeeping. Companies also offer various types of plans, investment options, features and services, depending on the role they play.

Read Also: How To Fill Out 401k

How Does Payroll Work

Running payroll consists of many calculations. You need to account for wages, hours, benefits, tax deductions and garnishments, as well as comply with federal and state regulations throughout every step. The key to success is to set up a process from the beginning that helps address compliance issues. Otherwise, you could face costly penalties for filing payroll taxes incorrectly or missing a deadline. Bottom line theres a lot more to payroll than just cutting a check every few weeks.

Helpful Payroll Tools To Get Payroll Done

Whether youre running payroll manually or working with a service provider, youre not in this alone. ADP offers a host of tools that can help both you and your employees manage payroll-related finances:

- If you offer stock options or employee discounts, this must be reported to the government.

- Payroll fraud Updates to employee bank accounts and Forms W-4 should be done in person, instead of email, to prevent payroll phishing scams.

Recommended Reading: How To Rollover 401k To Ira Td Ameritrade

How To Create An Electronic Signature For The 99 02: Termroth 068qxd Pcms Online

Are you looking for a one-size-fits-all solution to eSign adp 401k withdrawal? signNow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. All you need is smooth internet connection and a device to work on.

Follow the step-by-step instructions below to eSign your 99 0287_termroth 068qxd pcms:

After that, your 99 0287_termroth 068qxd pcms is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with a number of extra features like Invite to Sign, Merge Documents, Add Fields, etc. And due to its multi-platform nature, signNow works well on any device, desktop or mobile phone, irrespective of the operating system.

How Do I Choose An Ira Provider

Many financial institutions offer IRAs, including brokerage firms, banks, and newer fintech companies. In order to pick the best account for you, theres one up-front question to answer:

Do you want to make your own investment decisions, or would you rather have the investing decisions made for you so you can just set-it-and-forget-it?

If you want to make your own decisions, then what youll want is a self-directed IRA. That allows you to make your own trading decisions and invest in whichever financial securities youd like.

The key features to compare when choosing among self-directed IRAs include:

- What do you want to invest in? The exact investment options among IRA providers varies. Most of them allow you to invest in stocks, ETFs and options. Other specialized IRA providers will let you invest in private assets and cryptocurrency.

- Access to research and data. Some brokers provide access to premium research and data. If youre a more hands-on investor, this might be important to you.

- Ease of use while user interfaces are getting better across the board, newer fintech providers tend to be more popular with those who really value an intuitive app experience.

The key features to compare when choosing an automated account include:

Get matched with an IRA provider based on your preferences! If you choose to do an 401-to-IRA rollover, well match you with a provider based on your preferences as part of our rollover process.

Recommended Reading: How To Roll Over 401k To Ira Vanguard

What Are The Benefits Of A 401 Plan Compared To Other Retirement Options

When compared to other retirement options , the benefits of a 401 retirement plan include a broad range of advantages for both employers and employees. Along with a vesting schedule to incentivize retention, both business owners and staff can benefit from:

Tax-advantaged retirement saving: With a 401, employees can save upfront with pre-tax dollars while they are working. By the time they need their savings to fund their retirement, they will likely be in a lower tax bracket, which can generate long-term tax savings.

Employer match: Matching contributions are among the top benefits of 401 plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary.

Defrayed 401 plan startup costs: Eligible employers may be able to claim a tax credit of up to $5,000 for the first three years to pay for associated costs of starting a qualified plan such as a 401 for employees. Claiming the credit requires completing Internal Revenue Service Form 8881, Credit for Small Employer Pension Plan Startup Costs.

How To Do Payroll Using Professional Services

As your small business grows and you hire more employees, DIY payroll may become too difficult and time consuming. Or, you may decide that your efforts would be better spent on improving your products and services instead of administrative tasks. At that point, it makes sense to outsource payroll.

You have several options in this regard work with a payroll service provider, outsource your entire HR department with a professional employer organization or hire an accountant. Of the three, payroll service providers tend to be the most cost effective and offer a host of benefits, including accuracy, compliance support and data security.

Recommended Reading: What Is The 401k Retirement Plan

Adp Paystub / Paycheck

Questions / Errors: Please contact your employers payroll department. They are the only ones that can correct any errors on your paycheck. To protect your privacy, ADP is not authorized to access your payroll information.

Online Access: If your company has given you online access to view your paycheck, login at . If you have never logged in before, ask your employer if they allow online access and request the registration code to sign up. Only your employer can give you online access. ADP cannot provide you with a registration code.

Quick Guide On How To Complete Adp 401 Form

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

SignNow’s web-based service is specifically created to simplify the management of workflow and improve the whole process of competent document management. Use this step-by-step guideline to complete the Adp 401 form quickly and with excellent accuracy.

Read Also: Can Self Employed Get 401k

Research Retirement Options For Your Business

It’s important to do your due diligence in researching firms that provide recordkeeping and third-party administration services for 401 plans. As you assemble your list, include a range of established, reputable mutual fund companies, brokerage firms, and insurance companies. Focus on providers that can serve you and your employees long-term with extensive resources and excellent customer service.

You may also want to hear from owners of businesses that are similar to yours, as they may be able to offer insights from their own experiences selecting 401 plan service providers.

Choose An Account Type

Traditional 401s are standard at workplaces, but more employers are adding the Roth 401 option, too.

As with Roth IRAs versus traditional IRAs, the main difference between the two types of plans is when you get your tax break:

-

The regular 401 offers it upfront since the money is automatically taken out of your paycheck before the IRS takes its cut . Youll pay income taxes down the road when you start making withdrawals in retirement.

-

Contributions to a Roth 401 are made with post-tax dollars , but qualified withdrawals are tax-free

-

Investment earnings within both types of 401s are not taxed

Another upside to the Roth 401 is that, unlike a Roth IRA, there are no income restrictions to limit how much you can contribute.

The IRS allows you to stash savings in both a traditional 401 and Roth 401, which can add tax diversification to your portfolio, as long as you dont exceed the annual maximum contribution limits .

Also Check: How Many Days To Rollover 401k