Placing Real Estate Investment Question:

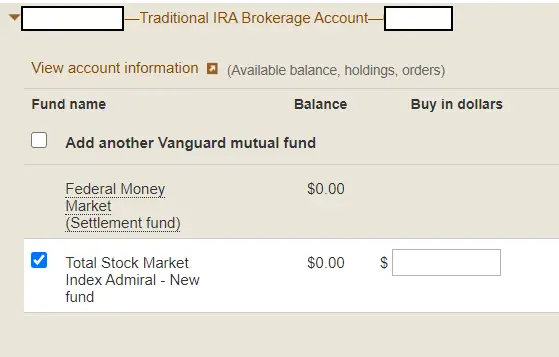

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

Fidelity Funds Are Renowned For Their Managers’ Stock

Fidelity celebrates good stock picking. The firm holds a contest every year for its portfolio managers: They get 60 seconds to pitch one idea, and the best pitch wins a dinner for four. The best performer after 12 months also wins dinner.

Maybe that’s why many of the best Fidelity funds stand up so well in our annual review of the most widely held 401 funds.

Here, we zero in on Fidelity products that rank among the 100 most popular funds held in 401 plans, and rate the actively managed funds Buy, Hold or Sell. A total of 22 Fidelity funds made the list, but seven are index funds, which we don’t examine closely because the decision to buy shares in one generally hinges on whether you seek exposure to a certain part of the market.

Actively managed funds are different, however. That’s why we look at the seven actively managed Fidelity funds in the top-100 401 list. We also review seven Fidelity Freedom target-date funds as a group as they all rank among the most popular 401 funds. And we took a look at Fidelity Freedom Index 2030 it has landed on the top-100 roster for the first time, and while it’s index-based, active decisions are made on asset allocation.

This story is meant to help savers make good choices among the funds available in their 401 plan. It is written with that perspective in mind. Look for our reviews of other big fund firms in the 401 world, which currently include Vanguard, and will soon include American Funds and T. Rowe Price.

Need Help Or Have Questions

Contact MIT Benefits by phone, email or in-person, or see the additional contact options below.

| Vendor |

|---|

- How do I find out who I designated as my Pension Plan or Supplemental 401 beneficiary?

To find out who you designated as your Pension Plan beneficiary or to designate a new beneficiary, visit PensionConnect or call 855-464-8736 .

To find out who your Supplemental 401 beneficiary is, call Fidelity Investments at MIT-SAVE , or visit Fidelity NetBenefits to designate your beneficiary online.

- How do I update my life insurance and retirement plans to include my spouse or domestic partner?

Visit Atlas to evaluate your participation in the MIT Optional Life Insurance Plan. Spouse or partner life insurance coverage can be added within 31 days from the date of your marriage or domestic partnership or during Open Enrollment.

Review and update your beneficiaries under the MIT Optional Life Insurance Plan, the MIT Basic Retirement Plan and the MIT Supplemental 401 Plan to ensure they are current. If you are married and your most recent beneficiary designation on file for the MIT Retirement Plan does not designate your spouse as the sole primary beneficiary, and does not have spousal consent for this designation, your spouse will be beneficiary of 100% of your account balance. More on beneficiaries.

Recommended Reading: How Much Money Should I Put In My 401k

How Often Can You Reallocate 401k

Rebalancing How-To Financial planners recommend you rebalance at least once a year and no more than four times a year. One easy way to do it is to pick the same day each year or each quarter, and make that your day to rebalance. By doing this, you will distance yourself from the emotions of the market, Wray said.

How Does Brokeragelink Work

Put simply, its an account within your UC 403, 457, or DC Plan that gives you access to thousands of mutual funds available through Fidelity FundsNetwork®, as well as exchange-traded funds .

A BrokerageLink account is not for everyone.

- If you are comfortable managing a portfolio of expanded investment choices and, you are prepared to assume the responsibility of more closely monitoring this portion of your portfolio, then BrokerageLink may be appropriate for you.

- However, if you do not feel comfortable actively managing a portfolio of options beyond those available through the UC Retirement Savings Program fund menu, BrokerageLink may not be a good choice.

Remember that it is always your responsibility to ensure that the options you select are consistent with your particular situation, including your goals, time horizon, and risk tolerance.

Don’t Miss: How Do I Start My Own 401k

Modify Your 403 Contribution

Note: All contribution amounts must be in whole percentages and changes will become effective with the current or next pay period, or as soon as administratively possible.

Need Help Call Fidelity

Most questions related to your Nazarene 403 Retirement Savings Plan account can be answered by phoning a Fidelity retirement services specialist at 866-NAZARENE . If you still have questions after doing this, phone Pensions and Benefits USA at 888-888-4656.

Also, Fidelity has a broad array of valuable tools, such as calculators and informational videos to assist in managing your financial life. We encourage you to explore their many resources.

Unless otherwise noted, transaction requests confirmed after the close of the market, normally 4 p.m. Eastern time, or on weekends or holidays, will receive the next available closing prices.

The investment options available through the plan reserve the right to modify or withdraw the exchange privilege.

Read Also: How Much In 401k To Retire

Roper St Francis Healthcare Retirement Plan

Whether your retirement is five or 50 years away, the Roper St. Francis Healthcare 403 retirement plan is a valuable teammate benefit and one of the most powerful ways to enhance your long-term financial well-being. We encourage you to invest in yourself and your future by participating in this plan through Fidelity Investments.

Your retirement savings plan is an important benefit, so you need the right information, resources, and support to help you make decisions with confidence. With more than 65 years of financial services experience, Fidelity can help you put a plan in place that balances the needs of your life today with your retirement vision for tomorrow.

How Do I Contact Fidelity Investments?

For service needs in addition to your RSFH Retirement Plan, stop by one of the Fidelity Investor Centers. To find the Investor Center nearest you, visit www.fidelity.com/branches/branch-locations.

How Do I Log-In To My Online Retirement Account?

If you already have a username and password with Fidelity, you can use your existing login information.

Why Save in the Roper St. Francis Healthcare Retirement Plan?

Who Is Eligible to Participate in the Retirement Plan?

Looking for More Ways to Boost Your Retirement Savings?

Here are just a few examples: *

How Do I Update My Name or Address on My Fidelity Investments Account?

How Do I Change My Investments?

Investing In You And Your Future

After one year of service American will provide you with an employer contribution to your 401 account. The amount contributed will depend on your workgroup.

Team members with prior service or who transfer to American from one of its wholly owned subsidiaries will have their prior service at the subsidiary credited towards the one-year eligibility requirement and toward the service requirement for vesting full ownership of your 401 account balance.

American will contribute 16% of your eligible compensation to your 401 account up to the IRS limits. Participation is automatic, and you will be eligible for this nonelective company contribution* after completing one year of service.

If you do not have an investment election on file, your nonelective company contributions will be made to the Target Date Fund closest to the year you will turn age 65.

You are always 100% vested in your contributions, the nonelective company contributions and any associated earnings.

*A nonelective company contribution is a contribution to your 401 account that the company makes regardless of whether you are making your own contributions.

Flight Attendants receive a nonelective company contribution*, plus you are eligible to receive matching company contributions based on your eligible compensation. You become eligible to receive the following employer contributions after completing one year of service:

TWU-designated team members

IAM-designated team members

Don’t Miss: Can You Use 401k To Buy Investment Property

Are You Investing Enough For Retirement

Periodically, you may decide to invest more for retirement. This can be easily done using the following steps:

Is Now A Good Time To Rebalance My 401k

At a minimum, you should rebalance your portfolio at least once a year, preferably on about the same date, Carey advises. You could also choose to do so on a more periodic basis, such as quarterly. An investor who rebalances quarterly would sell bonds and buy stocks to get back to a 60/40 portfolio mix.

Don’t Miss: How Do I Find Previous 401k Accounts

What Is A Good Rate Of Return On A 401

How you define a good rate of return depends on your investment goals. Average 401 returns typically range between 5% and 10% depending on market conditions and risk profile. If you’re playing catch-up, you may want higher returns. If you have a long way until retirement and a low tolerance for risk, you might be comfortable with a lower return.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Can I Borrow From My 401k To Start A Business

Is A 401 Worth It

You don’t have to master investing to allocate money in your 401 account in a way that meets your long-term goals. Here are three low-effort 401 allocation approaches and two additional strategies that might work if the first three options aren’t available or right for you.

Work With An Advisor For A Tailored Allocation Strategy

In addition to the above options, you can opt to have a financial advisor recommend a portfolio that is tailored to your needs. The advisor may or may not recommend any of the above 401 allocation strategies. If they pick an alternate approach, they will usually attempt to pick funds for you in a way that coordinates with your goals, risk tolerance, and your current investments in other accounts.

If you are married and you each have investments in different accounts, an advisor can be of great help in coordinating your choices across your household. But the outcome won’t necessarily be betterand your nest egg won’t necessarily be biggerthan what you can achieve through the first four 401 allocation approaches.

Also Check: How To Check How Much Is In Your 401k

Uw Voluntary Investment Program

Save beyond your mandatory UW retirement plan by enrolling in the UW Voluntary Investment Program , a tax-advantaged 403 retirement plan that offers an array of mutual funds and annuities.

You choose your funds and how much you want to contribute. While contributions arent matched by UW, they are tax advantaged. And because the VIP is optional, you can start or stop contributions at any time.

Plus, get help when you need it from Fidelity Investments, the VIP administrator and the nations largest investment management firm.

If youre looking for even more ways to maximize your retirement savings, you can also enroll in the Washington state Deferred Compensation Programs.

Enroll in VIP

Enrolling in the VIP is optional. Its another way for you to save in addition to your primary UW retirement plan. Even if you arent participating in another UW plan, you can still enroll in the VIP.

All UW employees are eligible to participate .

Once you enroll, your contributions are automatically deducted from your paycheck. You can contribute up to 75 percent of your salary or as little as $15 per paycheck. You can change your contribution amount at any time.

To choose your funds and start making contributions, enroll through Fidelity Investments.

Investment and tax options

Whats your approach to investing for retirement? Would you rather avoid taxes now and pay later, during retirement? Or would you prefer to pay taxes now so you dont have to later?

IRS contribution limits

Loans

How To Change Plan Providers: Fidelity To Self

Process:

- New Solo 401k Plan Documents

- List the original plan effective date

Additional Considerations:

- Have you been filing Form 5500-EZ?

- If not, need to file under the IRS Correction Program

Also Check: Can You Pull From 401k To Buy A House

Education Resources & Tools

Planning & Guidance Center

Model and plan your retirement strategy with interactive tools and calculators.

- Complete the Investor Profile Questionnaire for a comprehensive asset mix review. Learn about your risk tolerance and asset allocation.

- Model different savings scenarios using the Take Home Pay Calculator or Contribution Calculator

- See how changes in your savings habits could change your estimated monthly retirement income with Income Simulator

- Try hypothetical scenarios using the Roth Modeler to see differences between pre-tax and Roth after-tax deferrals

- Use the Fidelity Income Strategy Evaluator® to help build a portfolio for your retirement income.

Library

Search the Library for a variety of multi-media financial resources

- Watch a video about managing your debt

- Read an article to learn more about stocks, bonds and short-term investments

- Listen to a podcast about retirement planning

Life Events

Refer to Life Events to help with timely financial and benefits decisions.

- New Hire Checklist

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on “Register Now” at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose “Contribution Amount“. If you are already logged in, click on the “Contributions” tab.

Step 2:There are three choices:

- Contribution Amount – to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program – to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers – to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

You May Like: Should I Rollover 401k To New Employer

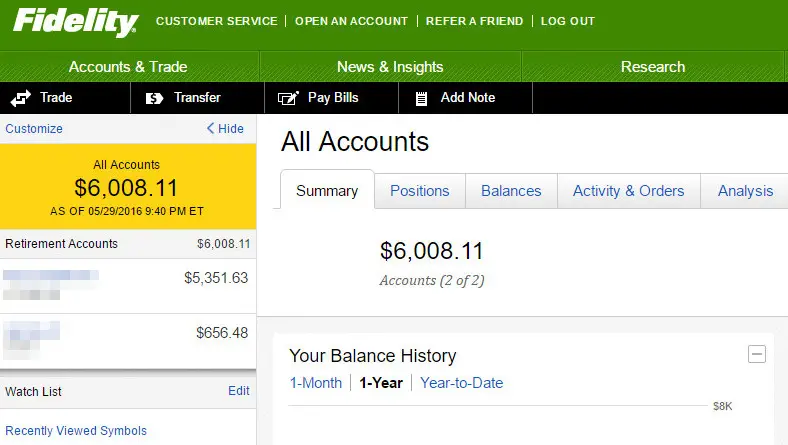

Managing Your Fidelity Account Online

A Nazarene 403 Retirement Savings Plan account has been established for most qualified Nazarene ministers with Fidelity Investments. You can learn about your account, create a username and password, establish how much you want to contribute, and modify your investments at www.netbenefits.com/atwork. Follow these steps to initialize your account:

- Visit www.netbenefits.com/atwork.

- Select Register at the top of the screen.

- You’ll be asked to confirm basic information and submit.

- Follow the instructions.

- Watch this video for assistance in set up of your PIN.

If you prefer to speak directly with a Fidelity retirement services specialist, you may phone 866-NAZARENE for assistance.