Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

How To Get Money Out Of A Profit Sharing Plan

A profit sharing plan, or 401K plan, is a type of retirement plan run by businesses for their employees. Usually, you make contributions into the plan, and your employer also contributes to the plan. If you suddenly need to pay unexpected bills, you may be considering making a withdrawal from your profit sharing plan. If your employer allows early withdrawals, the procedure for doing so is fairly straightforward.

Because You Asked: How Long Does It Take To Cash Out 401k After Leaving Job

Not every job works out the way you might have hoped. Whatever your reason is for looking for a new employer, you’re probably wondering about cashing out your 401 k from your old job if you’re quitting before you reach retirement age. Depending on your individual retirement account, this may involve penalties.

This article discusses how long it might take for you to cash out your 401 k once you’ve left your job. It also goes over your possibilities for doing so and the different types of 401 k account you can have. If you don’t want to cash out the old account, you can generally transfer the money to a new 401 k plan or IRA account. It would help if you decided this based on any potential penalties and your investment options.

Also Check: How Do I Know Where My 401k Is

Accessing Money Before Traditional Retirement Age

But what happens if you retire before age 59 ½? Can you access your money early without penalties?

You could use the 401 option discussed above.

Unfortunately:

You must retire from the company with the 401 in the calendar year you turn 55 for this to work.

If the 401 option doesnt work for you, there is another option called Rule 72. This rule requires you to follow strict guidelines. That said, it allows you to take penalty-free withdrawals from traditional retirement accounts.

To do so, you must take substantially equal periodic payments.

Take A Cash Withdrawal

Partial, total, and systematic cash withdrawals allow you to receive income only as you need it and provide a high degree of flexibility. Your remaining accumulations continue to be tax-deferred until you take a distribution, and will continue to experience the investment performance of your chosen funds. See Cash Withdrawals and Loans for details. Keep in mind the following:

-

Income tax is due on cash withdrawals.

-

Your contributions and earnings are available for cash withdrawal at any age once you have terminated employment with the University.

-

University contributions and earnings are available for cash withdrawal at age 55 or older once you have terminated employment, or at any age as an official University of Michigan retiree .

Also Check: How To Collect My 401k Money

Find Out What’s Happening In Larchmont

“But it is MY money,” I have heard. “I’ll just pay the penalty.” Unfortunately it does not work that way. The IRS governs how these accounts operate and stipulates that, for a current employee, withdrawals can be made only for hardship reasons. They outline the reasons as follows:

- Expenses for medical care previously incurred by the employee, the employee’s spouse, or any dependents of the employee or necessary for these persons to obtain medical care

- Costs directly related to the purchase of a principal residence for the employee

- Payment of tuition, related educational fees, and room and board expenses, for the next 12 months of postsecondary education for the employee, or the employee’s spouse, children, or dependents

- Payments necessary to prevent the eviction of the employee from the employee’s principal residence or foreclosure on the mortgage on that residence

- Funeral expenses or

- Certain expenses relating to the repair of damage to the employee’s principal residence.

Further, the employee must provide proof to the employer plan trustee substantiating the request. There are, of course, additional rules and requirements as defined by the IRS and the employer.

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

Don’t Miss: How Long Does A 401k Rollover Take

How Long Does A Payout Take

The amount of time it can take for your 401 k payout to come to you varies depending on the type of retirement plan you have. If your situation is uncomplicated, you can expect to receive the check within days. However, a more complex case might mean it takes up to 60 days if you request to receive the money via check.

Do People Really Make 401k Hardship Withdrawals

401k Hardship withdrawals have been on the rise. According to a study by Fidelity, 2.2% of all 401 participants had made a hardship withdrawal at some point over the preceding 12 months.

Thats up from 2% in the prior year and was the highest level in 10 years.

Are you thinking of becoming part of the 2.2%? Sometimes the withdraw rules can be confusing, so its important to know when you are allowed to pull money from your 401k because of hardship.

Read on to learn what actually happens when you make a 401k hardship withdrawal.

Also Check: How To Grow 401k Fast

You Can Still Withdraw Early Even If You Get Another Job

You arent locked in to early retirement if you choose to take early withdrawals at age 55. If you decide to return to part-time or even full-time work, you can still keep taking withdrawals without paying the 401 penaltyjust as long as they only come from the retirement account you began withdrawing from.

Withdrawals After 59 1/2

To encourage retirement saving, the IRS slaps you with a 10 percent penalty if you siphon money from your 401 before reaching 59 1/2, even if you can prove a financial hardship. This is on top of regular income taxes on the withdrawal. While the penalty disappears after 59 1/2, you’ll still be liable for the income taxes. If you have a Roth 401 account, the contributions are made with after-tax dollars. Roth withdrawals are tax-free, as long as you’ve had the account open at least five years.

Read Also: How Much Does A 401k Cost A Small Business

Whats The Perfect Way To Withdraw Funds

The perfect way to withdraw the money needed to fund your retirement is a unique solution for you.

Remember to take RMDs if youre required to.

After that, there are plenty of options you can mix and match based on the types of accounts you hold.

Keep in mind:

Youll need the money to fund your entire retirement.

Dont use up all of your tax advantages in the beginning unless thats what makes the most financial sense for you.

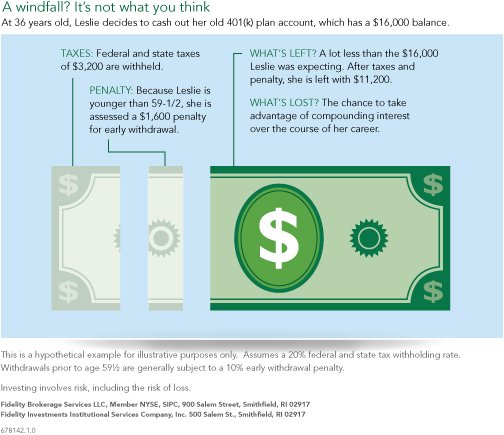

Compound Interest Only Works If You Leave The Money Alone

We talk a lot at Money Under 30 about compound interest. Its what makes a comfortable retirement possible for most of us. When you cash out your 401 early, youre not just subtracting that balance from your eventual retirement fund. Rather, youre deducting your balance, plus any interest your balance will earn over the next few decades, plus the interest the interest would earn! Taking a few hundred bucks now could cost you thousands down the road. Not to mention that you immediately lose almost 30% of your balance to taxes and fees.

It might feel like a small windfall now, but over the long term, youre taking yourself to the cleaners.

Most retirement funds are set up to allow your money to grow with few interruptions: Hence why the money you put into a 401 isnt taxed, why the interest you earn while your money is in the 401 isnt taxed, and why its relatively hard to remove money from your account until youre close to retirement age.

While we know its tempting to take that small pot of cash, we urge you to resist. And once youve gotten a new job, you should roll your old 401 into your new employers plan. Thatll take away the temptation entirely.

Read Also: What Is A Pension Vs 401k

Is Your 401k A Security Blanket

Most of us look at our 401k as a security blanket â something that we intend to pull out when we are suffering in the cold. There are a number of financial hardships that might tempt you to consider taking an early withdrawal:

- Urgent medical emergencies

- Rising college tuition costs

- Pressing home improvement needs

This 401k withdrawal calculator will help you decide whether to take a lump-sum distribution or to rollover to a tax-deferred account. Its side-by-side comparison of data gives you the information you need to make a decision that is right for you.

K Hardship Withdrawal Rules

Jeff Rose, CFP® | September 02, 2021

For many Americans struggling to make ends meet, a 401k hardship withdrawal appears to be a viable option.

When job loss, unexpected health issues, or recession hit, you may find yourself in dire need of help.

House or rent payment. Utility bills. Late credit cards notices. Debt collectors calling you every hour on the hour.

Read on to decide whether or not to pursue a 401k hardship withdrawal to alleviate the burden.

Read Also: Can I Roll My Roth 401k Into A Roth Ira

Should I Close My 401k And Withdraw My Funds

When American consumers take a whack in the wallet like they did with the coronavirus pandemic in the spring of 2020 asking for relief from their 401k account is a legitimate question.

The legitimate answer is: NO, DONT DO IT!

Not even if the federal government dangles some tantalizing incentives like removing penalties for early withdrawals, which they did during the COVID-19 pandemic in 2020.

The reason temporarily was bold-faced was the option ended December 31, 2020. The 10% penalty for withdrawals before the age 59 ½ is back in play.

Before the CARES Act was passed, taking an early withdrawal was available only to people 59 ½ or older. It was not an advisable choice before COVID-19 and its not an advisable choice after.

If you can avoid it.

A 401k account is a vital part of your financial future and should never be toyed with. However, if something drastic like COVID-19 brings the U.S. economy to its knees and your job/income sinks with it your 401k account might seem like the only ticket to get back on your feet.

Its not for two very good reasons:

- The value of stocks and mutual funds typically plummet during a crisis. Your investment might already have lost a significant amount of its value during a market downturn, meaning you already have significantly less money to borrow from.

- Less money in the account means you definitely will lose out on the gains from compounding interest that make long-term investing so attractive.

Changing Employers And A 401 K

A change of company might mean you change your 401 k too. Try to find out how long that company can hold your 401k after you leave. We encourage you to discuss this matter with your new employer. It’s important that you take your old 401 k into consideration when you look for a new place of work. You may also want to choose your new employer based on the kind of retirement plan is on offer.

Read Also: How Much Do You Get From 401k

What Are The Rules Regarding Hardship Withdrawals From My 401

The IRS code that governs 401 plans provides for hardship withdrawals only if:

The following four items are considered by the IRS as acceptable reasons for a hardship withdrawal:

Un-reimbursed medical expenses for you, your spouse, or dependents

Purchase of an employee’s principal residence

Payment of college tuition and related educational costs such as room and board for the next 12 months for you, your spouse, dependents, or children who are no longer dependents

Payments necessary to prevent eviction of you from your home, or foreclosure on the mortgage of your principal residence Hardship withdrawals are subject to income tax and, if you are not at least 59ý years of age, the 10% withdrawal penalty. You do not have to pay the withdrawal amount back.

What About My Current 401 Can I Access That Money At Any Time

You cannot take a cash 401 withdrawal while you are currently working for the employer that sponsors the 401 unless you have a major hardship. That being said, you can cash out your 401 before age 59 ½ without paying the 10% penalty if:

Additionally, you can cash out your 401 and pay the 10% penalty if you need funds for certain financial hardships and have no other source of funds. These hardships include:

Even if you meet these requirements, cashing out your 401 should always be seen as an absolute last resort.

You May Like: Can Business Owners Have A 401k

Just Because You Can Cash Out Your 401 Doesnt Mean You Should

Technically, yes: After youve left your employer, you can ask your plan administrator for a cash withdrawal from your old 401. Theyll close your account and mail you a check.

But you should rarelyif everdo this until youre at least 59 ½ years old!

Let me say this again: As tempting as it may be to cash out an old 401, its a poor financial decision. Thats because, in the eyes of the IRS, cashing out your 401 before you are 59 ½ is considered an early withdrawal and is subject to a 10% penalty on top of regular income taxes. Oh, yes, thats another thing: Since the 401 is funded with pre-tax money, you also have to pay taxes on it when you cash out.

In most cases, your plan administrator will mail you a check for 70% of your 401 balance. Thats your balance minus 10% for the withdrawal penalty and 20% to cover federal income taxes .

Its financially prudent to save for retirement and leave that money invested. But paying the 10% early withdrawal penalty is just dumb money its equivalent to taking money youve earned and tossing it out the window.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Also Check: What Should I Do With My Old Company 401k