Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

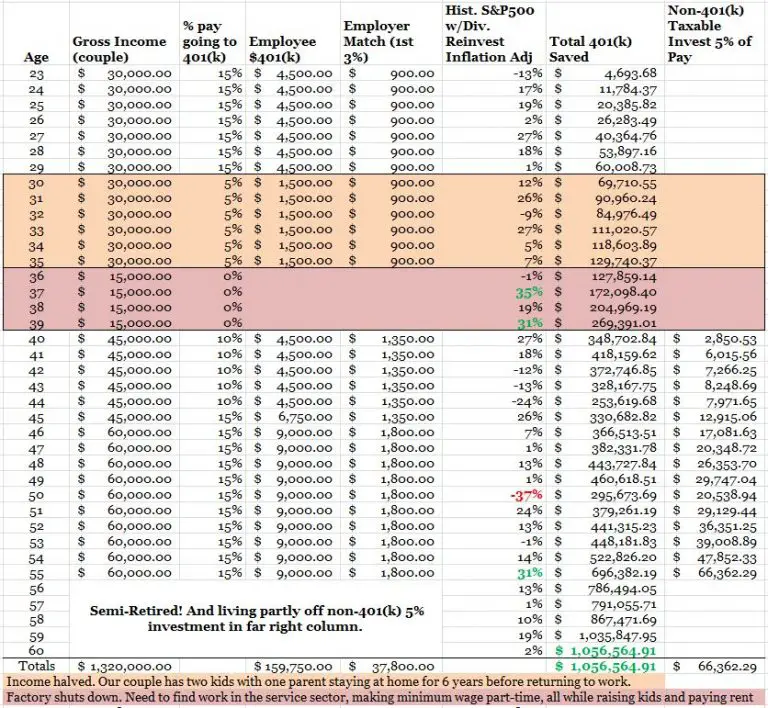

Is It Too Late To Start Saving

In a perfect world, youd start saving in your early 20s. However, personal finances come with their ups and downs, so putting money aside for your 401k is often not a priority or not a possibility. If this is you, consider that its never too late to start saving for retirement. While many people aim to retire early, life doesnt stop at 65, and its better to save late than not save at all.

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

Also Check: Can I Manage My Own 401k

How Much Of My 401 Can I Withdraw Each Month

Saving money for retirement is important, but knowing how to tap that money is even more critical. When you are in the workforce, you know exactly how much you have to work with each month. But when you retire and start living off the money in your 401k, you need to do some serious calculations to determine how much you can afford to withdraw without depleting your nest egg.

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

You May Like: How To Collect My 401k Money

Tax Rules: Withdrawals Deductions & More

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pre-tax money in 2021. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

Taxes On Employer Contributions To Your 401

In addition to your contributions, an employer may also put money into your 401. Once that money is in your account, the IRS treats it the same as your contributions. You wont pay any taxes while the money is in your account, but you will pay income taxes when you withdraw it. Unlike your own contributions, you dont pay any payroll taxes when your employer contributes to your account. Its truly free money. It doesnt even count toward the $19,500 contribution limit for 2021.

Recommended Reading: Can Business Owners Have A 401k

If You Start At Age 2:

With a 4% rate of return: $843.24 per month

- Annual salary needed if you save 10% of your income: $101,189

- Annual salary needed if you save 15% of your income: $67,459

With a 6% rate of return: $499.64 per month

- Annual salary needed if you save 10% of your income: $59,957

- Annual salary needed if you save 15% of your income: $39,971

With an 8% rate of return: $284.55 per month

- Annual salary needed if you save 10% of your income: $34,146

- Annual salary needed if you save 15% of your income: $22,764

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Recommended Reading: How Do I Know If I Have A 401k

When To Start Saving For A 401k

Not everyone gets the opportunity to invest in their 401k early on. As soon as it becomes available, consider taking advantage of this benefit. As of 2017, individuals under 49 could legally contribute $18,500 per year. Those 50 years or older, can save an additional $6,000 for a total annual $401k contribution of $24,500.

Many 20-something-year-olds have student debt, changed jobs a handful of times, have not started saving, or are not in a job where a 401k plan is offered. In this case, well look at the amount you should have saved starting at age 30.

A good rule of thumb is to add on one year of salary saved for every five years of age for example, at age 30 youd want to have saved one year of salary, at age 35, two years, at age 40, three years, and so on. Use these guidelines along with your post-retirement budget to gauge if you are on track for a comfortable retirement.

Amazons 401k Match Explained

Amazon 401K: Important Things You Should Know About!

Levels.fyi · February 19, 2021

If you are a software engineer receiving your first six-figure offer from , you must be beyond excited. However, in addition to the annual base salary, at Levels.fyi, we suggest that you also pay attention and gain a thorough understanding of the full array of offered benefits and eligible compensations, including Amazon’s 401k match, sign-on bonus, and relocation benefits. Having knowledge of these will allow you to take advantage of your full compensation and negotiate better deals.

This article will answer questions on everything you need to know about Amazon’s 401k contributions and match, along with other considerations to take into account.

Read Also: Can You Convert Your 401k To A Roth Ira

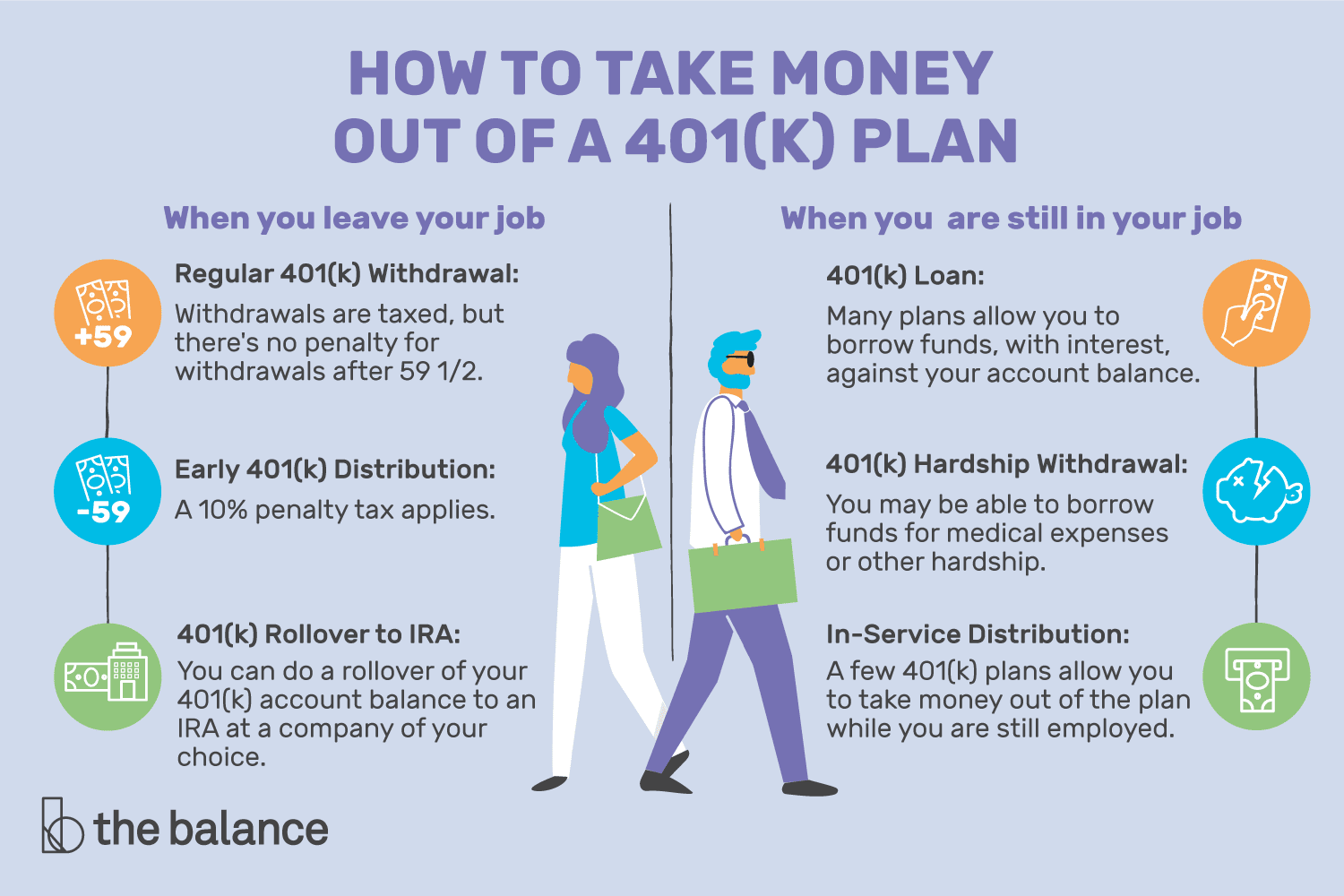

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

What You Need To Know To Avoid Costly Mistakes

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

Read Also: How To Cash Out Nationwide 401k

How Much Does A 401 Cost Employers

LAST REVIEWED May 07 202112 MIN READ

Think that 401 plans are an expensive benefit reserved exclusively for large businesses with deep pockets? Think again. While this may have been a reality in the past, modern providers use technology to cut costs. And many companies, including small businesses, arent aware that 401 plans are now a realistic option for them.Adding a 401 to your benefits package is a cost-effective way to compete for great talent and reduce turnover of current employees.

Use A Fee Disclosure Form To Collect Information

Given the complexity of fee structures and schedules, begin by requesting that potential plan providers fill out a 401 Plan Fee Disclosure Form. This sample form provided by the DOL is a helpful tool and includes a list of possible administrative expenses, start-up expenses, termination fees, and the definition of pricing terms. Bottom line: yes, 401 plans cost money however, requesting a fee schedule that details every cost will help ensure that youre informed about the costs required.

You May Like: How To Switch 401k To Ira

Safe Harbor Contribution Limits

In 2021, the basic employee deferral limits for a Safe Harbor plan are the same as any employer-sponsored 401: $19,500 per year for participants under age 50, and $26,000 when you include catch-up contributions for employees over age 50 or older.

As an added benefit, with Safe Harbor provisions in place and less to to worry about when it comes to nondiscrimination testing, owners and highly compensated employees can truly max out their deferrals. That means they can take full advantage of their contribution limits.

What Is A 401 And How Do They Work

A 401 is a retirement savings plan sponsored by employers. You fund the account with money from your paycheck, you can invest that money in the stock market, and you earn some tax perks for participating.

That’s the basic definition of a 401. The more interesting angle is what a 401 can do for you. The 401 is a powerful resource for achieving financial independence, especially when you start using it early in your career. Said another way, if you like money and wish to have more of it in the future, you can use a 401 to make that happen.

Read on for a closer look at how the 401 works, when you can withdraw funds from a 401, and what happens to your 401 if you change jobs.

Read Also: How To Open A Solo 401k

How Much Tax Do You Pay On 401 Distributions

A withdrawal you make from a 401 after you retire is officially known as a distribution. While youve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw. If you withdraw $10,000 from your 401 over the course of the year, you will only pay income taxes on that $10,000. Its possible to withdraw your entire account in one lump sum, though this will likely push you into a higher tax bracket for the year, so its smart to take distributions more gradually.

The good news is that you will only have to pay income tax. Those FICA taxes only apply during your working years. You will have already paid those when you contributed to a 401 so you dont have to pay them when you withdraw money later.

State and local governments may also tax 401 distributions. As with the federal government, your distributions are regular income. The tax you pay depends on the income tax rates in your state. If you live in one of the states with no income tax, then you wont need to pay any income tax on your distributions. So depending on where you live, you may never have to pay state income taxes on your 401 money.

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

You May Like: How To Make 401k Grow Faster

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

How Much Money Do You Really Have In Your 401

Couple Sitting On Couch Shocked At 401 Taxes

Getty

Many people overestimate how much money they have in their 401. This overestimation often has two components: how much they can use today and how much that balance buys them in future retirement income. 401 accounts are often seen as working like a checking or savings account. You go to the bank or ATM and pull out the amount you want. But funds in a checking account have been taxed, so you receive the amount you withdraw as long as you have sufficient funds. On the contrary, money in your 401 has not been taxed, so you receive less than the amount you withdrew because taxes are deducted. Additionally, if you are under age 59 ½, the government assesses a 10% penalty. In the governments eyes, the tax deferral they were giving you was for retirement savings. They assume that if you are withdrawing money before age 59 ½, you are using it for something other than retirement spending.

Pre-59 ½ use

Lets illustrate. A loving mother wants to help her child with a $100,000 down payment to buy a house. She goes to pull out $100,000 and gets only $70,000. Thats because $10,000 is subtracted for the early-withdrawal penalty and $20,000 for federal taxes. State taxes could further shrink that amount. If she wants to provide $100,000, she will have to withdraw about $134,000 to cover the penalty and Federal taxes.

Post-59 ½ voluntary withdrawal

Taxes due on 401 withdrawal

James Brewer

Post-59 ½ involuntary withdrawal

Recommended Reading: Can You Roll A 401k Into A Self Directed Ira