What Is A 401 Plan

Lets start with the basics. A 401 is an employer-sponsored plan for retirement savings. It allows employees the benefit of having retirement savings taken out of their paychecks before taxes. If your workplace offers a 401, youll fill out an enrollment packet that includes information about vesting, beneficiaries and investing options.

Why is it called a 401? The 401 plan is named for the 401 subsection of the tax code that governs how it works. Thats really all there is to it. The same goes for other plan types like the 403. Easy enough, right?

What Does It Mean To Be Vested

Vested is a term used to talk about how much of your 401 belongs to you if you leave your job. The money you contribute is yours, but some employers have guidelines about how much of their matching contribution you can take with you.

For example: If your company increases the amount you are vested in by 25% every year, leaving your job after only two years would mean you could only take 50% of the employer contributions to your 401 with you. Once youre fully vested, you keep 100% of the employer contribution. Your HR department can provide specific information about your companys vesting guidelines.

Scale Up Contributions Over Time

Once you’ve picked your investments, the best thing you can do is leave your account alone and let the contributions build.

In addition to low costs and diversity, consistently investing over time i.e., every paycheck will make the biggest difference in the size of your savings. Low-cost funds are only effective if you continuously invest in them and don’t try to time the market, or pull money out when it starts to drop, a recent report from Morningstar says.

Experts also advise increasing your contributions each time you get a raise or bonus by a percentage point or two, helping you reach your goals faster.

Finally, remember that while the stock market has historically increased around 10% per year, that’s not guaranteed, and there will be periods when it falls. Experts also expect returns to be lower, around 4%, over the next decade than they have been the previous 10 years.

Still, no one knows what will happen, except that the best course of action is typically to invest in low-cost index funds consistently, over many decades. Do that, and you’ll be on the path to building real wealth.

Read Also: How Much Money Should I Put In My 401k

You Worry A Lot About Your 401

If downturns in your 401 cause you a lot of worry, then you may be investing too aggressively.

If someone tends to move out of their investments because of volatility, then the portfolio is probably too aggressive for them, says Randy Carver, president and CEO at Carver Financial Services in the Cleveland area.

But its key to understand that while stocks are more volatile and you may not always feel comfortable owning them, they are also one of the best ways to grow your wealth over time, especially in an era of low interest rates and low bond yields.

If they are not invested to grow enough to meet long-term needs, it is too conservative, says Trujillo. The key is to look at longer periods of time, two or three years or more, to see trends, not just one or two months.

Search The National Registry

Still not having any luck? Past employers may list you as a missing participant if you no longer work for the company but left your 401 behind. The National Registry of Unclaimed Retirement Benefits is a nationwide, secure database listing retirement plan account balances that have been left unclaimed .

You May Like: What Happens When You Roll Over 401k To Ira

Whats The Most Important Thing To Know About A 401

A 401 has different components that youll need to manage in order to maximize your retirement savings opportunities. You will need to monitor your contribution rate and investment choices to ensure they are aligned with your financial goals, your stage in life, and your risk tolerance.

With steady contributions and some employer matching along the way, a 401 can be a great way to create your plan for amazing. Speak with a John Hancock Financial Advisor today to build a plan that works as hard as you do.

The content of this document is for general information only and is believed to be accurate and reliable as of the posting date, but may be subject to change. John Hancock does not provide investment, tax, or legal advice . Please consult your own independent advisor as to any investment, tax, or legal statements made here.

What Is An Ira

While there are a number of benefits to 401ks, they’re not the only retirement plan in the game. An IRA is an individual retirement account. Where a 401k can only be offered through an employer, an IRA account can be opened up by an individual whether they’re associated with an employer or not. That means they’re the best option for independent contractors without an employer or anyone who wants to do some extra retirement planning on top of their 401k.

Don’t Miss: How To Set Up A 401k Account

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Us Department Of Labors Abandoned Plan Search

In certain cases, such as in bankruptcies, employers abandon the 401 plans they provided to employees. If that happens, theyre required to notify you so you can receive the funds owed to you. If you werent notified or believe your plan may have been abandoned, you can use the U.S. Department of Labors Abandoned Plan Search. You can search by employer or plan name, and if a plan is found, youll receive the plan administrators contact information.

You May Like: How To Grow 401k Fast

How Much Should You Contribute

Everyone has different financial needs, but heres a golden rule: Whatever percentage your employer is willing to match, try to take full advantage of it. Anything less, and you could be leaving money on the table. Additionally, if financially possible, you may want to max out your 401 year after year.

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

Read Also: Can I Buy Individual Stocks In My 401k

When Can You Withdraw From A Roth Ira

You can withdraw the contributions you’ve made to a Roth IRA at any time. If you withdraw earnings before age 59 1/2, they’re subject to income taxes and a 10% tax penalty. You can withdraw earnings without a penalty under certain circumstances, including using it for a first-time home purchase and for qualified educational expenses.

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is free and only takes a few minutes.

Also Check: How To Find My 401k Money

Stay Away From Cryptocurrencies

Next-generation financial technologies like cryptocurrencies are even more dangerous than precious metals. For instance, all cryptocurrencies lost 80% of their values between January and September 2018.

Thus, the cryptocurrency crash of 2018 was worse than the dot.com crash of 2018. Bloomberg claims. For example, Ethereum , the second most popular cryptocurrency, had a Coin Price of $539.27 on March 24, 2018. However, Coinmarketcap calculates Ethereums price fell to $137.32 on March 24, 2019.

Consequently, cryptocurrencies are far more unstable than stocks, so you should stay away from them. Cryptocurrencies are more unpredictable because they are a new technology that most investors do not understand.

Obviously, cryptocurrencies do not belong in your 401K because altcoins are more likely to crash than stocks. Therefore, stay away from cryptocurrency unless you have a high tolerance for risk and money to burn.

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

You May Like: Can I Transfer My Ira To My 401k

Traditional And Roth Iras

Like 401s, contributions to traditional IRAs are generally tax-deductible. Earnings and returns grow tax-free, and you pay tax on withdrawals in retirement. Contributions to a Roth IRA are made with after-tax dollars, meaning you dont receive a tax deduction in the year of the contribution. However, qualified distributions from a Roth IRA are tax-free in retirement.

What Tax Traps Do I Need To Avoid

What types of income might you receive in retirement? How will your retirement income be taxed? In a recent retirement poll, 74 per cent of respondents said they worry about having enough income in retirement.

Yet the majority of respondents didnt know how retirement income is taxed, which may result in lost opportunities to implement strategies that might reduce the tax you pay by hundreds or even thousands annually.

One in five of respondents did not know how much annual income they might have in retirement. And some of the participants expected to leave at least a portion of their retirement to chance, relying on windfalls such as gifts or inheritances , or lottery winnings .

Don’t Miss: Why Cant I Take Money Out Of My 401k

What You Can Do Next

In order to keep track of your retirement accounts, you first must know where they all are. Once you gather all your old accounts in one place and make sure they are properly balanced, its about sticking to the same investment principles ensuring your money is in diversified, low-cost funds that you would follow for your current company retirement plan.

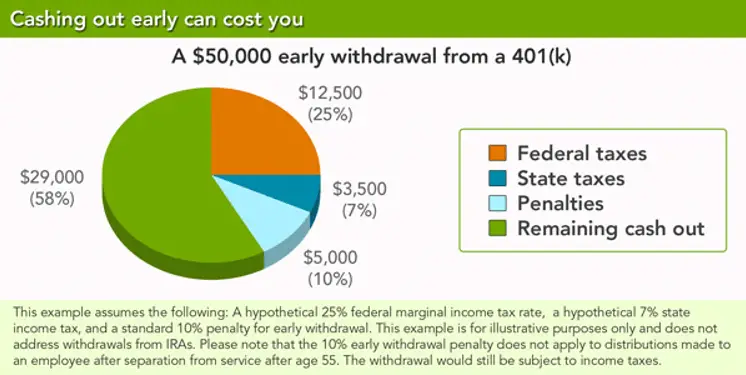

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

You May Like: How To Withdraw My 401k From Fidelity

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Calculate Your Risk Tolerance

All investing is risky and returns are never guaranteed, but it can actually be more risky to keep too much of your savings in cash, thanks to inflation.

Still, you don’t want to go all in on one stock or investment, particularly if a rocky market makes you uneasy and anxious, or likely to do something drastic, like pull your money out of your account.

You’ll want to determine an appropriate asset allocation, or how much of your investments will be in stocks and how much will be in “safer” investments, like bonds. Stocks have the potential for greater returns, but can be more volatile than bonds. Bonds are more stable, but offer potentially lower returns over time.

Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

But think about your investing horizon. If you have decades until you’re going to retire , then you can afford a bit more risk. You might choose an 80-20 stock mix for now. When you’re older, you’ll start scaling that back, depending on your goals and, again, your appetite for risk. Experts suggest checking that your investments are properly aligned with your risk tolerance each year and rebalancing as necessary, though how often you actually do will vary based on personal preference.

Read Also: Can I Contribute To Traditional Ira And 401k

Summary: Keeping Your 401k Safe

Finally, history proves stock market crashes are rare events that long-term market gains will make up.

If you can time the market to avoid the worst of a crash, then this is a good option.

Secondly, another way to keep your 401K safe is to keep your money in the market and use dollar-cost averaging to your advantage. Notably, the stock market erased all the losses from the 2007-2008 crash by October 2012, just four years later, and if you had doubled down on your investing during the worst periods of the crash, you would have a chance to outperform the market.

- Highly Recommended Reading: Fact-Based Research of 6 Major Stock Market Crashes & What Caused Them. The Facts About The Impact of Crashes & How To Avoid & Profit From Them.

This is not specific financial advice I am not a registered financial advisor I am a market analyst. If you are concerned about your investments, seek the help of a registered financial advisor who can provide tailored advice to suit your specific risk and portfolio requirements.

First Off Dont Lose Track Of It Youd Be Surprised How Many People Forget About Their Old 401s

Recently, a Capitalize Research study revealed that Americans have left behind over $1 trillion untouched in their old 401s. This implies that millions of employees are struggling to manage their retirement savings as they move from job to job, leading to the accumulation of money in these abandoned accounts.

The 401, a tax-advantaged savings plan, has helped revolutionize the American workforce since its enactment in 1978. However, millions of dollars are left unclaimed as people change jobs, relocate and subsequently forget about their old 401s. When you lose track of a 401 at an old employer, your savings in that account stagnate, leaving an opportunity toward building a secure financial future squandered.

Even if you are contributing to a new plan with your current employer, leaving money behind in an old 401 account and forgetting about it harms your overall financial well-being, prevents you from building a cohesive financial plan and does not allow all your money to work for you and your goals in the best possible way.

Also Check: How To Know If You Have A 401k