How To Save For Retirement Without A 401

6 Minute Read | September 27, 2021

If youre frustrated by all the retirement planning advice that puts the 401 center stage, youre not alone. Nearly one-third of all workers dont have access to an employer-sponsored retirement savings plan.1 And even though some employees have a 401, not all employers offer to match what their workers put into it.

But even if you find yourself without a 401 option or a plan without an employer match, dont panic! You still have plenty of options available to help you invest 15% of your gross income into retirement savings, which is what we recommend. You can still reach your retirement goals.

Heres how to save for retirement when you dont have a 401we’re about to break it all down.

You Can Rollover Previous 401s

Lastly, you can rollover your old 401s-even from previous employer-sponsored plans-into your Solo 401.

When managing your retirement savings, consolidating your accounts makes it easy to monitor how well your investments are performing.

Beagle does the hard work for you to find your old 401s, identify any hidden fees you might be paying, and gives you advice on how best to consolidate them. for free to get started organizing your retirement accounts.

Tags

What Is A 401

A 401 plan is a tax-advantaged retirement account offered by employers in the US. This retirement vehicle is named after Section § 401, subsection k, of the US Internal Revenue Code.

This type of account allows employees to save for retirement by contributing a portion of their income to the account over time. Contributions are made through payroll every pay period. Employees can choose to contribute a percentage of their salary or a fixed amount up to a certain limit. These investment vehicles are tax-advantaged, meaning they lower your taxable income since they’re funded with pre-tax money and the funds in the account grow tax-free.

Some employers contribute to employees’ 401 plans by offering an employer match. For example, an employer may offer to match an employee’s contributions dollar-for-dollar up to the first 5% of the employee’s salary.

Quick tip: Find out your employer match rules and contribute enough to your 401 to capture the full amount. This is extra money on top of your contribution and will help your retirement account grow faster.

Employer contributions often come with strings attached, such as a vesting schedule. Vesting means employer contributions and earnings on them are not property of the employee until certain conditions are met. Most times, employers require employees to be employed for a defined period before all employer contributions and earnings become the employee’s property.

Don’t Miss: How To Take Money Out Of 401k Without Penalty

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

How Do You Start Saving

Participating in a 401 plan through your employer is usually the easiest way to get started putting money away for the long term. Most employers who are looking for top-quality employees offer a 401 as a benefit, which helps them to retain talent.

When considering accepting a job offer, take a look at the benefits package, and especially consider the 401 and how the matching contribution works. If it’s a choice between a company that matches dollar for dollar, and a company that doesn’t, consider that matching money to be additional income. It might be worth choosing that company for just that reason.

While not all companies offer matching contributions, and some have a delayed start for matching, everyone should be contributing the maximum amount they can to a 401.

Recommended Reading: When Leaving A Job What To Do With 401k

How To Open A 401 Without An Employer

While you cannot open a 401 without an employer, you can avail of other tax-advantaged retirement plans without an employer. This includes opening a solo 401, a traditional IRA, or a Roth IRA.

- Open a solo 401: If you are self-employed and have no W2 employees, then this may be a good option for you. For a solo 401 you are both the employee and the employer which means that you can put more into the 401.

- Open a traditional IRA: If you are not offered a 401 through your employer, then a traditional IRA may be an option for you. A traditional IRA allows individuals to save for retirement with tax-deferred growth. It also has more investment options compared to 401 plans. Depending on your income, you may be able to deduct your traditional IRA contributions from your tax return.

- Open a Roth IRA: This may be a good option for you if you are younger and have the time to benefit from compound interest. A traditional IRA and Roth IRA have the same contribution limits but they are taxed differently. You cannot deduct your Roth IRA contributions from your tax return, but your Roth IRA will grow tax-free.

It is best to talk to a credentialed, financial advisor about these options to find the best one for you and your employment situation.

Pros And Cons Of Robs

ROBS should be carefully analyzed from all angles. Here are some important considerations.

-

Complicated eligibility process, including becoming a C corporation, which has major business implications

-

Depleting retirement funds is considered risky

-

Considered questionable by the IRS since they only benefit the business owner, and IRS audits on ROBS businesses tend to be burdensome due to heavy paperwork

-

Historically used for businesses on the brink of failureand when they fail, owners tend to lose their retirement funds and businesses, according to the IRS

-

Costly to start a set-up fee costs about $5,000, and about $130 a month thereafter, depending on the plan

Recommended Reading: How To Switch 401k To Ira

Why Saving Is Hard For The Self

The reasons for not saving toward retirement wont be a surprise to any self-employed person. The most common include:

- the lack of steady income

- paying off major debts

- education expenses

- costs of running the business

Setting up a retirement plan is a do-it-yourself job just like everything else an entrepreneur undertakes. No human resources staffer is going to walk you through the company-sponsored 401 plan application. There are no matching contributions, no shares of company stock, and no automatic payroll deductions.

Youll have to be highly disciplined in contributing to the plan and, because the amount you can put in your retirement accounts depends on how much you earn, you wont really know until the end of the year how much you can contribute.

Still, if freelancers have unique challenges when it comes to saving for retirement, they have unique opportunities, too. Funding your retirement account can be considered part of your business expenses, as is any time or money you spend on establishing and administering the plan. Even more important, a retirement account allows you to make pretax contributions, which lowers your taxable income.

Many retirement plans for the self-employed allow you, as a business owner, to contribute more money annually than you could to an individual IRA.

Substantial Equal Periodic Payments Section 72

If youre no longer employed, there may also be an option to set up a series of substantial equal periodic payments according to section 72 which would allow you to start withdrawals from a 401 over a period of 5 years or until age 59 ½, whichever is longer.

These periodic payments must be calculated according to one of three IRS-approved methods: fixed amortization, fixed annuitization, or required minimum distribution.

There are more conditions and moving parts to this type of arrangement, and you cant change your mind later if you decide you dont want to make a withdrawal in one of the appropriate years.

This option should be used with caution because if something goes wrong, then the withdrawals you did take become subject to the 10% penalty + interest.

Read Also: How To Transfer My 401k To My Bank Account

You Can Take It With You

If you leave your job someday for another, you can take your 401 with you. This won’t go into a box with your other belongings rather, you’ll need to roll over that account into a new one and for many people, converting that 401 to an IRA is a great idea. You’ll want to consult our guide for 401 rollovers when that time comes.

About the author:Dayana Yochim is a former NerdWallet authority on retirement and investing. Her work has been featured by Forbes, Real Simple, USA Today, Woman’s Day and The Associated Press.Read more

Make Your 401k Policy

Put it in writing. Announce the introduction of the 401k policy to your staff. Outline who can contribute, when they can enroll, and how much the employer contributions will be. Answer the common questions about the tax implications and when the contributions will become vested . Youll also be asked about fees and when they can withdraw their money, so have those answers in there.

Other Questions Related to How to Start a 401k for My Small Business:

You May Like: How To Make 401k Grow Faster

Options For A New Retirement Investment Account

The first important decision in the process is about what type of tax-advantaged retirement account to choose and which provider to go with. And the available accounts have different advantages and disadvantages. The first thing to consider is the fee structure of the potential new account.

In many cases, employer-sponsored 401 accounts wont offer the lowest fees because the companies that use them dont always look for the best deal for their employees. For that reason, it should be possible to save some extra money by finding a new provider with lower fees. So take the time to shop around.

Then theres the matter of what type of tax-advantaged account to open. Here are the three main options and how they differ:

How A Roth 401 Works

Like Roth IRAs, Roth 401s are funded with after-tax dollars. You don’t get any tax benefit for the money you put into the Roth 401, but when you begin to take distributions from the account, that money will be tax-free, as long as you meet certain conditions, such as holding the account for at least five years and being 59½ or older.

Traditional 401s, on the other hand, are funded with pretax dollars, providing you with an upfront tax break. But any distributions from the account will be taxed as ordinary income.

This basic difference can make the Roth 401 a good choice if you expect to be in a higher tax bracket when you retire than when you opened the account. That could be the case, for example, if you’re relatively early in your career or if tax rates shoot up substantially in the future.

Also Check: How Is 401k Paid Out

What About A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Is A Solo 401k Worth It

The flexibility around solo 401 contributions, investment options, and relatively low management requirements makes the plan an attractive alternative for small business owners or sole proprietors who want to save for retirement proactively.

Both the salary deferral and the income-sharing contributions are optional and can be adjusted at any time. You could contribute to your solo 401 using either method or not contribute at all in a given year based on the fluctuating profitability of your business.

Contributions to your solo 401 also allow you to leverage other tax incentives that could amount to significant savings in the long run.

Also Check: Can I Roll My Roth 401k Into A Roth Ira

Start Your Own Retirement Plan

When youre an employee, you can only use a 401 plan if your employer establishes a plan and youre eligible to contribute. All too often, thats not the case. But you still have options.

Ask for a 401: Your employer might be willing to set up a 401 they just havent done it yet. Start the conversation by asking why there isnt one, why you want one, and that there are potential tax benefits for employers. Explain that valuable employees like yourself would be even more valuable with excellent benefits. Offer to do some of the legwork required to get the plan up and running. In some cases, especially with small organizations, your employer simply doesnt have time to set up a plan. Cost is another factor companies and small nonprofits might be hesitant to pay plan costs . If cost is the primary concern, discuss less-expensive options like SIMPLE plans. Only time will tell if itll actually happen, but it never hurts to ask.

IRAs: If you dont have a 401, you may still be able to save in an individual retirement account , and you might even receive tax benefits similar to a 401. Unfortunately, the IRS sets maximum annual limits much lower for IRAs. Still, something is better than nothing. Evaluate traditional IRAs for potential pre-tax saving, and Roth IRAs for possible tax-free withdrawals . Another drawback of IRAs ) is that you may need to qualify to make contributions or receive a deduction. Speak with a tax expert before you do anything.

How To Maintain Your Businesss 401 Plan

Choosing a 401k plan for your small business, and setting it up for use is just the beginning. To ensure that your plan continues to serve your employees and yourself, there are certain things you need to take note of. Depending on the type of 401 plan you choose to go with, you will need to conduct nondiscrimination testing, make employer contributions, report plan information, and keep up with fees. If not, you may incur penalties for yourself.

-

Your plan has to undergo annual testing

If you have a traditional 401 plan, it is subject to annual 401 testing to ensure all employees benefit, not just highly compensated employees. There are two types of tests you need to conduct: Actual Deferral Percentage and Actual Contribution Percentage tests.

These tests compare salary deferrals of highly compensated employees to non-highly compensated employees. The nondiscriminatory testing is basically used to keep employers in check. Should you fail this test repeatedly, you would incur penalties for yourself.

-

You have to remit contributions

Since you deduct 401k monies from salaries, you are required to make employer contributions if you have a safe harbor or SIMPLE 401 plan. Keep in mind that there can be penalties for late 401 contributions, so you have to ensure that your contributions are always timely.

-

Make your reports

-

Note your fees and dues

Read Also: How To Convert 401k To A Roth Ira

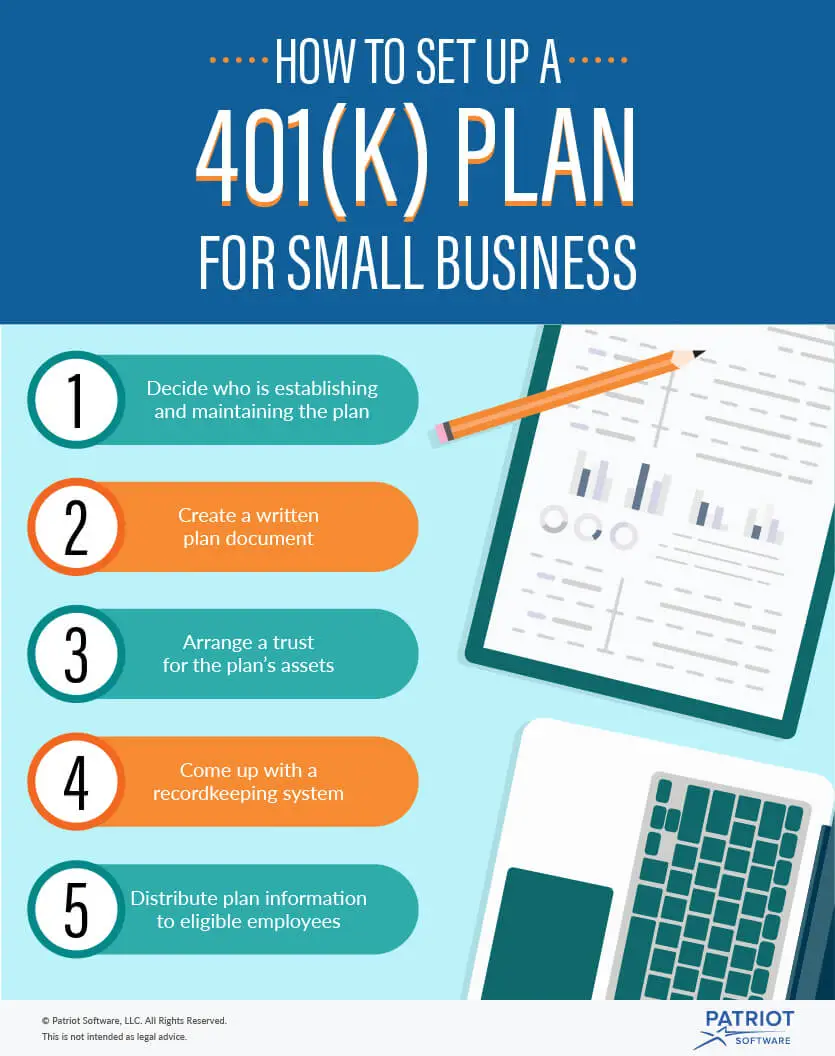

How To Set Up A 401k For A Small Business

Setting up a 401 for your small business includes some crucial steps, some of which can be outsourced. It’s important to remember that the employer maintains a fiduciary duty to ensure that the plan is providing a benefit to participants. The U.S. Department of Labor provides in-depth details of the process:

1. Create a 401 plan document

Create a plan document that complies with IRS Code and outlines the details of your retirement plan. Set up procedures to ensure the document is followed.

2. Set up a trust to hold the plan assets

A plan’s assets must be held in trust to assure its assets are used solely to benefit the participants and their beneficiaries. At least one trustee must handle the plan’s activities regarding contributions, plan investments, and distributions. Given that these decisions affect the plan’s financial integrity, selecting a trustee is a critically important decision. Another fiduciary, such as the employer who sponsors the qualified retirement plan, will generally assign the trustee.

3. Maintain records of 401 employee contributions and values

Maintain accurate records that track employee contributions and current plan values. Many small businesses choose to work with a 401 recordkeeper to help them manage plan setup and ongoing record management.

4. Provide information to plan participants

What If I Run A Small Business With Employees

Once you have employees, the rules of the road change a bit. A great choice is a SIMPLE IRA, which requires you to offer up to a 3% match for your employees every yearand contributions are tax-deductible. SIMPLE IRAs come with an individual limit of $13,500 a year.8

|

Retirement Option |

|

25% of earned income |

Recommended Reading: How To Pull From 401k

What Are The Potential Tax Benefits Of A Solo 401

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.