What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

What Is A Rollover Ira

A rollover IRA is an individual retirement account often used by those who have changed jobs or retired. A rollover IRA allows individuals to move their employer-sponsored retirement accounts without incurring tax penalties and remain invested tax-deferred. Consolidating multiple employer-sponsored retirement accounts can make it easier to monitor your retirement savings.

*Note: If you have an existing rollover or traditional IRA at Prudential, you can roll your assets into that account.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Read Also: How To Open A Solo 401k

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, you’d need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

S To Handle A 401 To Gold Ira Rollover

Once youve opened your gold IRA, you can contact the company managing your 401 account to begin the rollover process. First youll have to choose between a direct and indirect rollover. In an indirect rollover, you withdraw the funds from one account and then deposit them in another. With a direct IRA rollover, the funds move directly from one account to another. The direct option is usually much simpler, and it comes with less risk of IRS penalties.

With an indirect rollover, you have 60 days from the date you receive the funds to transfer the money to your custodian or gold IRA company. The funds become a taxable withdrawal if you dont complete the transfer in the 60 day period. If you are 59.5 years old or younger, a 10% early withdrawal penalty is also applicable.

With either rollover option, youll also have to make sure youve satisfied any special requirements the company might have for rollovers. Once youve met the requirements, the company will send a check with your funds to either you or your gold IRA custodian. At that point, youll have completed your 401 to gold IRA rollover.

Don’t Miss: Can You Roll A 401k Into A Roth

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

You May Be Charged Lower Fees

In 2016, a comprehensive study of annual fees by Employee Fiduciary found that the average 401 participant paid 2.2% of their balance as administrative and fund fees. While some plans had combined fund and administrative fees as low as 0.2%, others charged as much as 5%.

Check with your old 401 provider to see what fees you may owe them annually. By comparing fees, you can figure out if you would save money with an IRA rollover.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

Also Check: How To Avoid Penalty On 401k Withdrawal

Tax Withholding On Indirect 401 Rollover

When a 401 plan administrator writes you a check, the IRS requires them to withhold 20% of the funds as taxes. For example, if your funds total $40,000, the plan administrator will withhold $8,000, and write you a check for $32,000.

If you plan to deposit the funds into your IRA, you must make up the amount withheld, and deposit the entire amount within 60 days i.e. $40,000. After transferring the amount to IRA, the IRS will refund the 20% withheld amount when you file your annual returns. However, if you do not deposit the entire amount with 60 days, you will be required to pay income taxes, and an early withdrawal penalty if you are below 59 ½ years.

Keep Money In Your Current Plan

Typically, you only want to do this if your current plan offers great investments at low costs. Check with the current plan administrator to see if this is an available option for your plan. If it is, ask if there are extra fees for keeping your money in the current plan and if you can roll the plan over down the road if you change your mind. If everything checks out, work with your current

You May Like: How To Transfer 401k To Bank Account

Traditional Vs Roth: Which Type Of Ira Should I Roll My 401 Into

Now, the type of rollover IRA you transfer your money into depends on what type of 401 youre rolling over.

If you had a traditional 401, you can transfer the money into a traditional IRA without having to pay any taxes on it . Likewise, if you had a Roth 401, you could roll the money into a Roth IRA completely tax-free. Easy, right? Traditional to traditional, tax-free. Roth to Roth, also tax-free.

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover Chart PDF summarizes allowable rollover transactions.

Read Also: How Much Money Should I Put In My 401k

How To Purchase Cryptocurrency Using An Ira

To begin the process of investing in cryptocurrency you need to first identify the specific crypto option you want to invest in. There are a lot of cryptos there with bitcoin being the most popular. Other cryptocurrencies include Ox, Algorand, Augur, Basic Attention Token, BCAP, Bitcoin Cash, Bitcoin Gold, Bitcoin SV, Caspian, ChainLink, Civic, Dai, Decentraland, EOS, Ethereum, Ethereum Classic, FOAM, Golem, Kin, Kyber Network, Litecoin, Loom Network, Maker, Numeraire, OmiseGO, Orbs, Props Token, Stellar, Tezos, USD Coin, XRP, XYO, Zcash and Zilliqa.

Once you have identified your preferred investment option or options you need to instruct your trustee to make a purchase. This is done by filling out a Direction of Investment form. Your IRA trustee will then send funds from your IRA as per your instructions to make the cryptocurrency purchase. Your account trustee will hold all the transactional deeds, operating agreements and notes for safekeeping.

Invest Your Newly Deposited Funds

You’ll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

You May Like: How Do I Transfer 401k To New Employer

Technical Rollover Ira Benefits

Rollovers provide more technical benefits as well.

Unless you have an exceptionally good 401, its entirely possible that you can lower your account fees by rolling over funds to an IRA. Investment fees are the antithesis of returns, so this particular benefit can make a substantial difference.

However, fees arent everything in this decision. It can make sense to roll your 401 over even if the IRA fees are higher than your 401.

Why?

Perhaps the investment choices provides greater financial opportunities.

Having an IRA can also make it much easier to manage Roth conversions. With both a traditional and Roth IRA at the same custodian, its straightforward to accomplish.

Housing IRAs at the same custodian also opens the door to implement an asset location strategy along with your Roth conversions.

An example could be placing your income-generating assets in the traditional IRA, where they would be taxed at regular income tax rates anyway, and your high-growth assets like stocks in the Roth IRA, to grow tax-free.

IRAs also give you a significant charitable benefit over 401s.

The IRS allows you to make a Qualified Charitable Distribution of up to $100,000 tax-free from your IRA to donate to a qualified charity.

A QCD can even count as your annual RMD. That benefit doesnt exist for 401s.

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

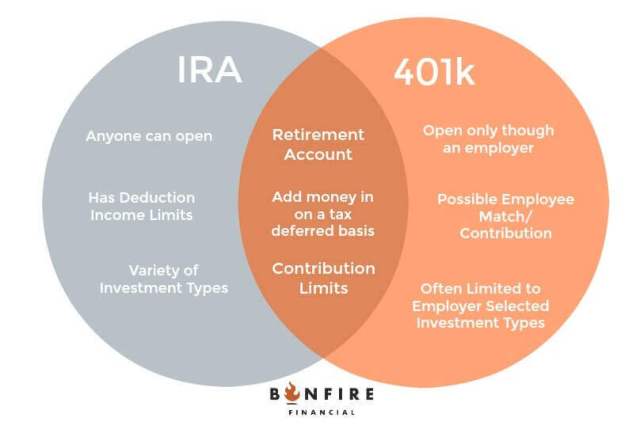

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Also Check: What Happens When You Roll Over 401k To Ira

By Step Guide To Rollover Your 401 To An Ira

If youve is the right decision, here is a step-by-step guide to getting you through the rollover process.

Start by researching and selecting a new IRA custodian.

There are several choices, and it can seem overwhelming. The main things to look for in a new financial institution are,

-

Robust investment selection,

What To Lookout For How To Switch 401k To Roth Ira

There are some drawbacks to investing in gold IRAs. The main drawback is that the IRA cannot hold both platinum and palladium. Another limitation is that the IRA cannot hold bullion or silver in amounts higher than $100. Investors interested in these types of investments must diversify their portfolios so that they are invested in gold IRAs with smaller amounts of each metal. It would be impractical to attempt investing in more than one type of investment through a self directed IRA.

As gold has become more valuable, so has the demand for IRAs that hold precious metals. Because of this, the IRS has implemented several rules that restrict where precious metals can be deposited and taken out of the country. When considering your retirement planning objectives, this rule should be the first thing you look into.

When you take advantage of a self-directed gold IRA you do not have to pay taxes on the gains. You do have to pay taxes on your regular income from your job, however, since the gains are in your own funds you do not have to report them to the IRS. If you choose an IRA that allows for direct transfer of funds, you will have to pay taxes on the full amount of the transactions even if they take place outside of your retirement account. For example, if you sell a product you made in your home town to purchase a new one, you will need to report the full sale amount as income to your tax return.

Recommended Reading: How Do I Transfer My 401k To A Roth Ira

Fees Can Be Another Source Of Conflict

Fees and expenses are a key potential source of conflict.

Financial institutions must be careful not to use quotas, bonuses, prizes or performance standards as incentives that … are likely to encourage investment professionals to make recommendations that are not in retirement investors best interest, the department said. Investment companies including brokerages, banks and insurers “should aim to eliminate such conflicts to the extent possible, not create them.

As an example provided by the department, suppose you want to roll $100,000 from your 401 into an IRA, and suppose that an investment company affiliated with your adviser pays him or her 1% annually to steer you into its investments. Assume, further, that this fee difference cuts your average return to 5% annually from what would have been 6% otherwise. Over 10 years, at 5%, your initial $100,000 balance would grow to $163,000, compared to the $179,000 it would have risen to if earning the full 6%.

In other words, that extra percentage point in fees would cost you $16,000, and as more time passes, that 1% difference in fees gets magnified, the department said. During the next 10 years, your IRA would lose out on another $39,000.

The new guidelines still allow 12b-1 fees, commissions and other costly means of compensation, but advisers acting as fiduciaries will need to demonstrate how their rollover recommendations are still in a client’s best interest, Norris said.

What To Do With Employee Stock

If you have employee stock through your former employer, youll also have to decide what to do with those shares. In the case of stock you already own, Deering advises that it might make sense to sell those shares. At the very least, ensure the stock doesnt make up a disproportionate percentage of your portfolio, as can sometimes happen with employee stock.

According to Deering, the primary consideration is whether theres anything that prevents you from selling the stock. In some cases, there may be lock-up periods that bar you from selling your shares for a particular amount of time. And if youve owned the shares for less than one year, then it makes sense to hold them until the one-year mark when you qualify for long-term capital gains tax treatment.

If you have any remaining stock options, those will likely expire within three months of leaving the company. Whether you choose to exercise those should depend on the current stock price compared to the price your options allow you to purchase them at, as well as how much of the companys stock you already have in your portfolio.

Recommended Reading: Can I Transfer My Ira To My 401k