Rolling Over 401 Funds

When your C-corp is set up, and youve established its new retirement plan, its time to roll over your personal 401 funds to the new C-corp startup business. The custodian who currently holds your 401 funds will transfer funds to the new custodian of your C-corp’s retirement plan. Although this typically is a seamless transaction, call on your attorney if there are any bumps in the road with this process.

Can You Take A Loan From An Ira To Start A Business

Not technically. But there are ways you can use or take money from an IRA account that doesnt trigger a taxable event or early withdraw penalty.

One of those ways is to roll the IRAs funds into another type of retirement account, which you can do through methods like a Rollover for Business Start-ups transaction or a 60-day distribution. Another way is through the use of a self-directed IRA.

Theres often confusion between IRAs and 401 plans because most 401s allow you to borrow from your account via participant loans. You can use the money borrowed from your 401 for any purpose, but you can only borrow the lesser of up to 50 percent of your vested account balance or $50,000. There might also be a relatively short repayment term. IRAs dont allow participant loans, unlike 401s and other plans such as 403s, 457 plans, other types of profit-sharing plans, or as a defined benefit of a pension.

So, in short, you cant take a loan from your IRA for any reason including starting a business. But there are still ways you can use the money in your IRA to start a business.

Robs Can Fund Franchises

Senior tax analyst Dick O’Donnell notes that many people think 401 business financing is particularly suited to funding franchise startups. Franchises are typically associated with successful businesses that have proven track records, while a small mom-and-pop startup business leans more toward speculation and sentiment than concrete statistics.

Don’t Miss: How Do You Take Money Out Of 401k

Research Retirement Options For Your Business

It’s important to do your due diligence in researching firms that provide recordkeeping and third-party administration services for 401 plans. As you assemble your list, include a range of established, reputable mutual fund companies, brokerage firms, and insurance companies. Focus on providers that can serve you and your employees long-term with extensive resources and excellent customer service.

You may also want to hear from owners of businesses that are similar to yours, as they may be able to offer insights from their own experiences selecting 401 plan service providers.

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Also Check: What Happens When You Roll Over 401k To Ira

What To Consider: Is It Safe To Use My 401 K To Start A Business

Starting a business with the funds from a 401 K makes a lot of sense for most people. After all, you have a lot of your personal savings tied up into investments and retirement accounts, so why not make the most of it to pursue a lifelong passion?

There is definitely some risk involved, so be sure to consider the tax and liability issues of this endeavor as well as any penalties related to early withdrawal from your retirement plan. Otherwise, consider some of these business ideas as you pursue your next adventure.

With the business financing from your 401 K in place, theres nothing left to stop you!

-

63 Views

May 30, 2021, 11:58 am

-

33 Views

May 21, 2021, 1:12 pm

-

32 Views

May 4, 2021, 2:52 am

-

16 Views

May 4, 2021, 2:47 am

-

20 Views

Fees For Robs Accounts Setup And Ongoing

Because a ROBS Rollover for Business Startup is not a loan, you dont have to pay it back and do not incur interest fees. Instead, you will pay for ROBS professionals for both expert guidance and financial setup of your ROBS accounts which enable you to legally use your 401k funds to invest in your business, buy a company or franchise or launch a new business.

Account Set up Fees

ROBS providers will typically charge $5,000 to set up your entire Rollover for Business Startup structure. Because of this cost, it is generally not worth it to do a ROBS setup for under $50,000. This fee includes professional consultation which is vital for such a complicated process.

THE easiest, fastest and cheapest way to start your business!$0 Plus State Filing Fees with Incfile.com!

You are required to make this payment upfront, and you cannot use the proceeds of the ROBS to pay this fee. BUT, because you are doing this as an individual, and not a business, when you initiate your personal 401k transfer you can take out a personal loan and repay it with the monies from the ROBS once it is set up. That is what I would do if I had significate money in my retirement account but not a lot of ready cash.

This fee includes setting up your C-type corporation, a valuation of your business , the creation of the company retirement plan and all required paperwork documentation filed correctly with the IRS.

Ongoing Maintenance Fees

Read Also: Can You Roll A Traditional 401k Into A Roth Ira

Capitalizing Your New Startup

With your seed money now in hand because of your 401 business financing, youre ready to capitalize your new startup. You can use funds for working capital, business acquisition, paying employees or even as a down payment for additional financing the IRS sets no limits on the use of ROBS funds, with the exception that they cannot be used for your personal expenses that only benefit you.

How Do I Create A 401 Plan

Creating a 401 plan for a companyeven a small oneis a complex process. The following is a basic overview of the steps for getting approval and starting the plan:

- Write a plan with the help of a plan adviser and send it to the IRS for a determination letter .

- Find a trustee to help you decide how to invest contributions and manage individual employee accounts.

- Begin making employer contributions, if offered, and allowing employee contributions through your payroll system.

You May Like: How Do I Transfer 401k To New Employer

When Can You Withdraw From A Roth Ira

You can withdraw the contributions you’ve made to a Roth IRA at any time. If you withdraw earnings before age 59 1/2, they’re subject to income taxes and a 10% tax penalty. You can withdraw earnings without a penalty under certain circumstances, including using it for a first-time home purchase and for qualified educational expenses.

Faq About Robs Rollover For Business Startups

Can I use my IRA to start a business?

Yes, you can access your IRA or 401 retirement saving funds to finance your startup business. It is done by financial professionals, such as Guidant, which create a C corporation that holds your retirement funds and uses them to purchase stock in your new startup company. Thus you are financing your own business with your IRA stock purchases.

Can I take money out of my 401K to buy a business?

Yes, you can withdraw monies, with the help of finance professionals to either start a business or buy an existing business. You will not pay taxes on the withdrawn funds nor will you be charged an early withdrawal penalty fee. These accounts are tax-exempt, so you do not have to pay taxes.

Can you use retirement funds to launch a company?

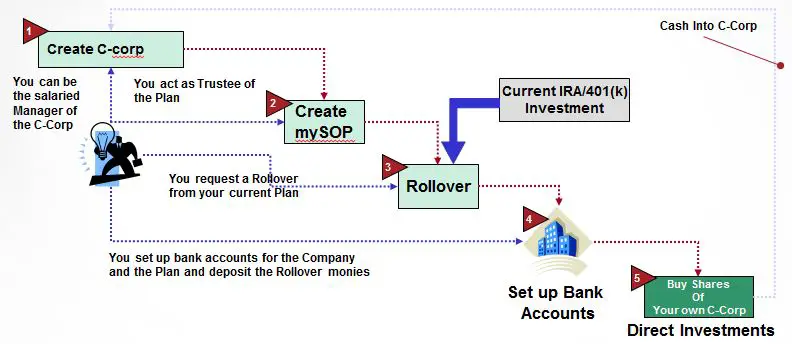

Yes, you can use your retirement savings to launch your new business. The first step to use your retirement funds is to set up and incorporate a separate business which will have its own 401 plan within it. Then you will transfer, rollover, your existing 401, IRA into the new corporations plan. Both retirement accounts are tax exempt, so you will not pay additional taxes. Once this has been done, you can then purchase stock shares in your new startup company thus withdrawing the funds for your business startup funding.

Can I use my 401K account to invest in real estate?

What is an IRA LLC?

Is this new? I never heard of ROBS Rollover for Business Startups before?

Is it legal in all 50 states in America?

Don’t Miss: How To Transfer 401k From Fidelity To Vanguard

How Borrowing Against A 401 Plan Works

IRS rules on 401 loans include:

- Limited to $50,000 or half your vested balance

- Loans limited to five-year terms

- Interest rates are set by the administrator, comparable to five-year business loans

- Interest payments go back into your plan

Employers may also establish rules for how you can borrow against your account. Some employers limit loans to the contributions youve made into the plan while others allow you to borrow against both your contributions and the employers matching contributions.

If your employment ceases while you still owe money on your 401 loan, you are responsible for repaying the loan on an expedited timeline. You will have until the due date of your next federal tax return to repay the remaining balance owed. If the funds have not been fully repaid by the time your federal taxes are due, the remaining amount owed will be treated as taxable income.

Taking Normal 401 Distributions

But first, a quick review of the rules. The IRS dictates you can withdraw funds from your 401 account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work. Depending on the terms of your employer’s plan, you may elect to take a series of regular distributions, such as monthly or annual payments, or receive a lump-sum amount upfront.

If you have a traditional 401, you will have to pay income tax on any distributions you take at your current ordinary tax rate . However, if you have a Roth 401 account, you’ve already paid tax on the money you put into it, so your withdrawals will be tax-free. That also includes any earnings on your Roth account.

After you reach age 72, you must generally take required minimum distributions from your 401 each year, using an IRS formula based on your age at the time. If you are still actively employed at the same workplace, some plans do allow you to postpone RMDs until the year you actually retire.

In general, any distribution you take from your 401 before you reach age 59½ is subject to an additional 10% tax penalty on top of the income tax you’ll owe.

Recommended Reading: How Do I Transfer My 401k To A Roth Ira

How Does 401 Business Financing Work

401 business financing allows you to tap into your retirement account and use that money to start or buy a business or franchise. To access your money without triggering an early withdrawal fee or tax penalty, a ROBS structure must first be put in place. The structure has multiple moving parts, each of which must meet specific requirements to stay compliant with the IRS.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

You May Like: How To Grow 401k Fast

Distribute Assets From 401k

2

Fill out the paperwork. You have the option of a partial withdrawal or a complete withdrawal depending on how much money you need to access.

3

Sign and submit the form. Distributions are added to annual gross income. Distributions before age 59 1/2 have an automatic 20 percent federal withholding and are assessed a 10 percent IRS penalty on top of income taxes.

4

Use the funds to buy the business.

A Bad Lending Environment And Provisions In The Tax Code Make Tapping Retirement Funds A Tempting Start

Were you laid off over the past couple of years and sick of the job-hunting circus? Have the itch to start up your own business but know there’s no chance in hell you’re getting a bank loan? Tired of watching your retirement funds whipsaw with the stock market?

If you answered “yes” to these questions – and there are surely a lot of you out there in this economy – you might already be considering tapping into your 401 to start a business. And thanks to provisions in the tax code, you can do so without penalty if you follow the right steps.

But don’t get too excited: This financing technique isn’t for everyone. Here’s what you need to know.

Financing a Start-Up with Your 401: The Process

The steps to financing a business with your retirement savings are simple enough, but legally are a bit complex. The first action is to establish a C corporation that has created but not issued stock. The corporation then adopts a retirement plan. Specifically, what you want is a profit-sharing plan that allows 100 percent of the plan assets attributable to rollovers to be invested in employer stock.

A 401 can be tailored to meet these needs. Then, you rollover your retirement funds from your previous employer or IRA into the new 401 plan. The funds can come from multiple sources and even multiple people – maybe a spouse who will also be part of the business or former co-workers who were also laid off and are looking for a new opportunity. This can help you limit your risk.

You May Like: How To Recover 401k From Old Job

Robs Vs Retirement Plan Loans

All of this being said, however, one of the biggest and most important differences between a retirement plan loan and a ROBS is that a ROBS isnt a loan. The appeal of a ROBS, then, is that by using one you wont have any debt to pay backânot to yourself and not to a third party.

However, just as is the case with 401 loans, using a ROBS poses the risk of losing retirement funds. If you roll over money into your business and the business doesnt do well, you could lose your retirement savings. Plus, since theres no ceiling on the amount of money you can use with a ROBS, that actually creates greater risk. If your business doesnt do well, you could potentially lose all of your retirement savings, not just a subset.

Moreover, there are other disadvantages that are unique to a ROBS: Setting up a C-corp and a new retirement plan isnt simple, you need to comply with numerous legal rules to avoid hefty tax penalties, and theres a slightly elevated risk of an IRS audit when you do a ROBS.

Who A Robs Is Right For

A rollover for business startups is best suited for individuals with a larger amount of money saved for retirement. While you may not need to use your entire retirement portfolio to fund your business, most ROBS plans require at least $50,000 to start, and some franchises or business startups require much more to get up and running.

Read Also: How Do I Invest In My 401k

What Steps Are Involved In Borrowing From My 401

Removing money from a retirement account requires careful consideration of the costs and a frank assessment of the risks.

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

Also Check: What Is An Ira Account Vs 401k