How Do Distributions Work

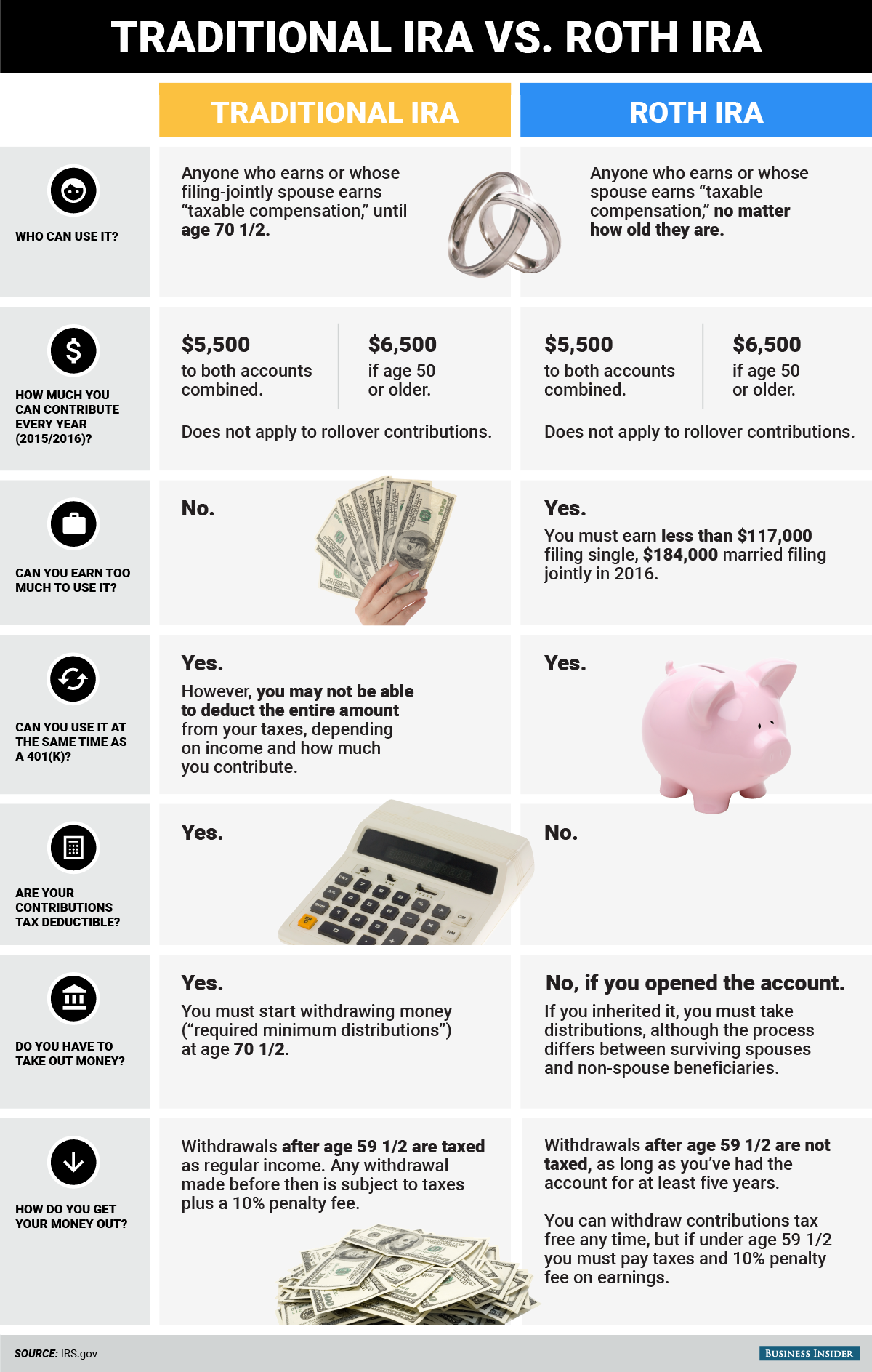

Some retirement plans have required minimum distributions . This is a withdrawal from the account that you must make, and usually theres a specific amount. This applies to traditional IRAs and both 401 plans. For IRAs, you must take the RMD when you turn 70 1/2. For 401s, you take the RMD when you turn 70 1/2 or when you retire, whichever comes later.

Note that you can take distributions before reaching the age of 70 1/2. Once you turn 59 1/2, you can start to take withdrawals without a penalty fee, if you choose to. If you withdraw funds before reaching 59 1/2 years of age, theres a 10% penalty fee.

Both IRA and 401 plans are great retirement planning tools. Planning your finances for retirement doesnt have to be hard. And there are simple steps you can take to make your life easier down the road.

To learn more about retirement planning and investing, sign up for our free e-letter below. Its packed with useful insight.

About Amber Deter

Amber Deter has researched and written about initial public offerings over the last few years. After starting her college career studying accounting and business, Amber decided to focus on her love of writing. Now shes able to bring that experience to Investment U readers by providing in-depth research on IPO and investing opportunities.

You Want More Fixed Income Options

Most 401 plans have a solid lineup of stock funds. But, theyre often much weaker when it comes to fixed-income options. In many cases, choices are limited. Also, plan trustees are often focused on encouraging participants to accumulate as much as they can. This typically results in accumulating stocks and stock related funds. However, as you get closer to retirement, youll probably want to shift to a less-aggressive mix of investments. Rolling your money into an IRA will provide you with a wide assortment of fixed-income options, from international bond funds to certificates of deposit.

What Is A 401k

A 401k plan is a retirement savings plan that is offered by your for-profit company. If you work for a non-profit company, then you may have access to whats called a 403 plan.

Your contribution to a 401k plan is deductible on both federal and state taxes in the year you make them. A 401k plan allows you to contribute up to $19,500 per year .

If youre an older employee, at least age 50, you can contribute an additional $6,500 , making it a total of $26,000 each year.

Read: 401k Contribution Limits for 2020: What Are They?

In most cases, your employer may offer a match. That is if you contribute 3% of your paycheck, your employer may match it with 3%, making your 401k contribution 6%.

Under some circumstances, you may be able to withdraw money from your 401k before age 59 1/2, but only if you show financial hardship.

Otherwise, youll get hit with a 10% penalty and federal, state and local taxes on that amount. See more on the IRA vs 401k withdrawal rules below.

| 2020 401k Maximum Contribution |

You May Like: How To Take Out 401k Money For House

How To Transfer 401k To Ira

If you have an existing IRA, you can transfer your balance into the IRA you have later consider opening a new account if that’s a concern for you).

If you dont have an existing IRA, youll need to make two decisions up front: which type of rollover IRA you want and where to open that account.

There are three steps to a rollover IRA.

» Check out our complete list of top IRA account providers

Why Have Both An Ira And A 401

Should you open up an IRA if you already have a 401? The short answer: yes. Its very common to have both types of accounts.

If you have access to an employee-sponsored retirement account like a 401, look to see if your employer matches your contributions and make sure you deposit enough to get that matchits free money. Afterwards, experts agree it makes sense to move the rest of your contributions to your IRA and max that out. Then you can go back to your 401 and max that beyond the match. You are allowed to contribute $19,500 a year to your 401 if youre under 50, and $26,000 a year if youre over 40.

Experts say that there is more flexibility with an IRA, when compared to an employee-sponsored retirement account like a 401. If your employer-sponsored 401 only has ten funds to pick from, you have to choose one of those. If those funds are actively managed, you will pay more in fees over the lifetime of the account than you would in a passively managed index fund thats held in your IRA, says Alex Klingelhoeffer, a fiduciary financial adviser with Exencial Wealth Advisors.

IRAs have more flexibility with the ability to invest in index funds, stocks, mutual funds, ETFs and bonds.

Also Check: How To Grow 401k Fast

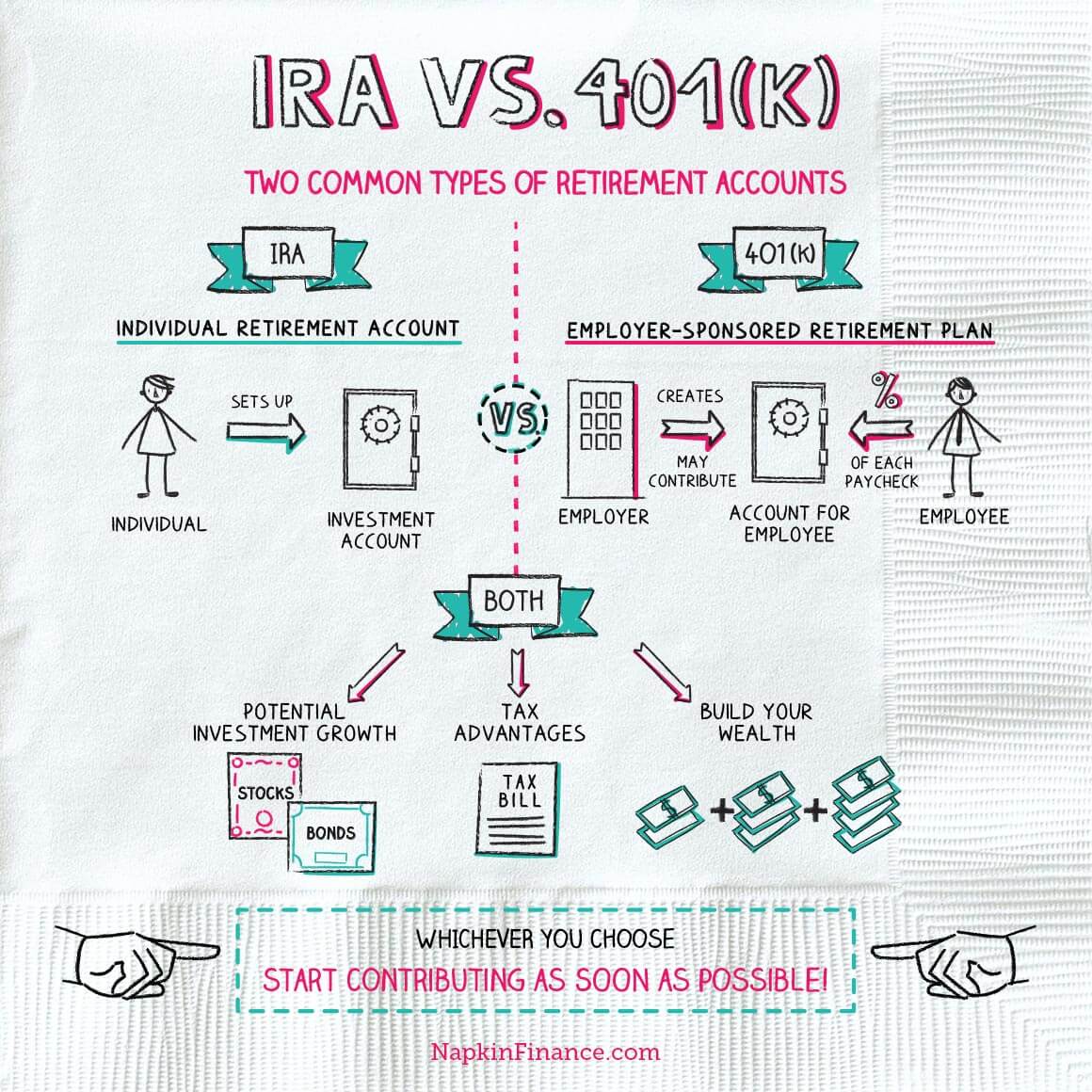

Ira Vs 401 Defined Contribution Plan

Most retirement plans are defined contribution plans. This means you contribute a certain amount each month, quarter or year. The payout you receive during retirement is based on the market value of the account. IRAs and 401s are most commonly defined contribution plans. Also, they both offer tax-advantaged retirement savings. However, there are a few key differences between these types of plans. The good news is that you dont have to choose one over the other. If your finances allow, you can and should, if possible contribute to both a 401 and an IRA.

Plans May Offer An Employer Match

While they might be harder to obtain, 401 plans make up for it with the potential for free money. That is, many employers will match your contributions up to some level.

401s sometimes will have a match depending on the employers generosity and financial position, says Michael Lackwood, founding principal of New York City-based Spring Delta Asset Management. If your employer does offer a match, it makes most sense to contribute to the 401 at least up to the maximum percentage match.

For example, if you contribute 4 percent of your salary, your employer may offer 2, 3 or 4 percent, as an inducement to help you save. Thats free money and an immediate return on your investment.

In contrast, youre on your own with an IRA, and your funds will consist only of what you contribute and any earnings on those contributions.

You May Like: How To Find My 401k Money

Stick With The 401k If

In addition to lower costs, many 401 plans offer stable-value funds. This is a low-risk option you cant get outside of an employer-sponsored plan. With recent yields averaging about 1.8%, stable-value funds provide an attractive alternative to money market funds. And unlike bond funds, they wont get hammered if interest rates rise. There are other good reasons to leave your money behind:

Ira Vs 401k: What To Know

Saving money for retirement is critical to ensure for a comfortable life after youre done working. Most people can no longer count on a pension to support them and need to put their own money aside.

There are a number of ways to do that. Two of the most common vehicles are:

- 401 account

Which should you choose? Heres what you need to know.

Also Check: How Do I Invest In My 401k

What Is The Difference Between Ira And 401k

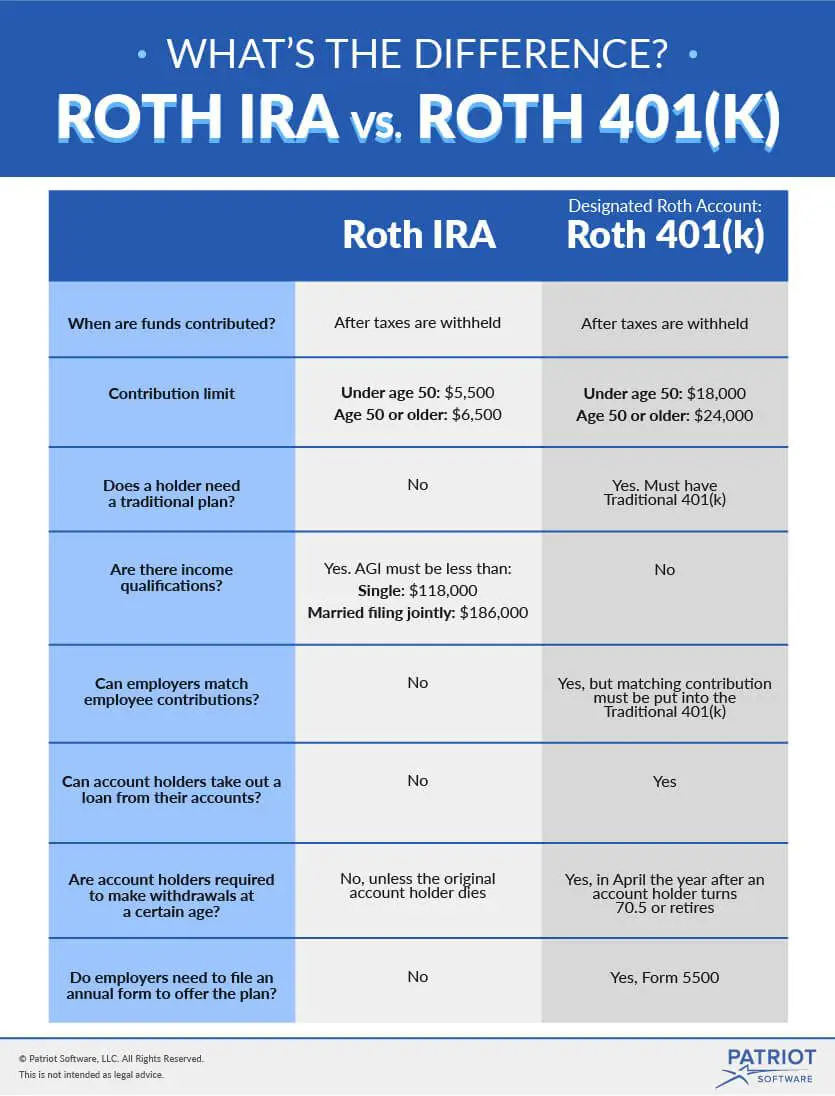

The key difference between IRA and 401k is that IRA is planned by the employee, whereas, 401k is planned by the employer. Another difference between IRA and 401k is their contribution rate. In IRA, if the person is 49 years of age or below, he can contribute up to $5k per year in the plan. If he is 50 years of age or above, he can contribute up to $6k per year. In a 401k plan, a person of age below 50 can contribute up to $16.5 per year to the vested account balance. A person of 50 years of age or above can, of course, contribute up to $22k per year to the vested account balance. Moreover, the 401k plan allows borrowing against the vested account balance. You can borrow a loan up to 50% of the vested account balance as long as the maximum amount of loan does not exceed $50,000, and the loan has to be of course repaid within a period of 5 years. IRA plan, on the contrary, does not allow you to borrow loans against the vested account balance.

Roth Ira Vs : Which Is Better For You

10 Minute Read | September 27, 2021

The Roth IRA and 401 are like cousins: They come from the same family of retirement investment accounts, so they have a lot in common. But look close enough, and youll see how different they are!

Once you understand how they work, you can choose the plan that will help you maximize your savings. And thats not just fancy investing talk. Your choice today could result in thousandsif not millionsof dollars down the road! You need to understand your options so you can be 100% prepared for retirement.

So, what are the major differences between a Roth IRA vs. a 401? And even more importantly: How do you know which one is better for you?

First, lets discuss the main features of each account.

You May Like: How To Recover 401k From Old Job

Is It Better To Have A 401 Or Ira

Whether a 401 or an IRA is better for an individual depends on what features are more desirable. A 401 allows for more money to be contributed each year on a pretax basis than an IRA. A 401 is also somewhat easier to manage for those who dont want to make investment decisions, since the plan would likely offer mutual funds.

However, a 401 might have a limited number of investment choices, depending on the financial provider managing the plan. An IRA, on the other hand, can offer more investment choices if its opened with an investment firm such as a broker. Also, an IRA allows the investor to manage those investments and hold their money in an IRA savings account, which many 401s do not allow.

Whats The Difference Between An Ira Plan And A 401k Plan

IRA vs 401k

- An IRA is a retirement account that you create, while a 401k is a retirement account that your employer sets up for you, and one that you fund. In some cases, your employer will match a portion of your 401k contributions.

- Maximum contribution: A 401k allows you to contribute $19,500 and up to $26,000 if youre an older employeeat least 50 years of age. Whereas, with an IRA you can contribute up to $6,000 each year. Your spouse, regardless whether he or she is working, can also contribute up to $6,000 into your IRA, making it a total of $12,000 per year. If you are 50 and older, you can put up to $7,000 in your IRA each year.

- Tax-deduction: Your contributions to a 401k are tax deductible in the year that you make them. Whereas, your contributions to an IRA may or may not be tax deductible.

- You decide where to open your IRA account , while with a 401k must be established by your employer.

Read Also: Can I Roll My Roth 401k Into A Roth Ira

You Can Afford To Contribute More Than You Can To An Ira

If you are under 50, you can only put $6,000 in an IRA, but up to $19,000 in a 401. After you turn 50, you can add an additional $1,000 to an IRA, but $6,000 more to your 401.

If $6,000 feels like a reach on its own, you may not want to contribute to a 401. But if a higher amount seems possible for you, it may be worth going for that 401 account.

What Can I Not Save In

- Financial instruments that are not traded on a regulated market or trading platform, such as unlisted shares

- Qualified shares in small companies.

- A bank can limit your opportunities to choose which securities you want in the account even though the securities are OK by law. Check with your bank so you are sure that the securities you want in the savings form are possible with them.

Also Check: When Leaving A Company What To Do With 401k

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Can You Have Both

Yes, you can have both a 401 and an IRA, although certain limitations apply. If you open a Traditional IRA in addition to your 401, your ability to claim tax deductions on contributions to your IRA phases out depending on your income level. For a Roth IRA, you may make contributions along with your 401 as long as you meet the Roth IRA income requirements.

Recommended Reading: How Much Money Should I Put In My 401k

Traditional Ira Vs Roth Ira Vs 401

- Alvin Carlos

Should you contribute to a Roth IRA, traditional IRA, or a 401k? We share with you everything you need to know about a Roth IRA, traditional IRA, and a 401k to help you decide which one you should contribute to. Your decision can impact how much retirement savings you can accumulate and how much money you will save in taxes. I will also share a bonus tip at the end.

Ira Vs : The Quick Answer

Both 401s and IRAs have valuable tax benefits, and you can contribute to both at the same time. The main difference between 401s and IRAs is that employers offer 401s, but individuals open IRAs . IRAs typically offer more investments 401s allow higher annual contributions.

If the IRA vs. 401 comparison is weighing on you, heres the quick answer:

-

If your employer offers a 401 with a company match: Consider putting enough money in your 401 to get the maximum match. That match may offer a 100% return on your money, depending on the 401. For example, some employers promise a 100% match up to 3% of salary. That means, if your salary is $50,000, your employer will put in $1,500, as long as you also contribute at least $1,500. Once you get the match, then consider maxing out an IRA for the year, return to the 401 and resume contributions there.

-

If your employer doesnt offer a company match: Consider skipping the 401 at first and start with an IRA or Roth IRA. You’ll get access to a large selection of investments when you open your IRA at a broker, and you’ll avoid the administrative fees that some 401s charge. After contributing up to the IRA limit, think about funding your 401 for the pre-tax benefit it offers. Here’s how and where to open an IRA.

Here’s more on the pros and cons of the IRA vs. 401 question:

» Want to turn a 401 into an IRA? See our guide to rollover IRAs

Also Check: How To Pull From 401k

Putting It All Together Ira Vs 401k

IRA vs 401k

One thing to realize here is that you can participate in both a 401k and an IRA. If your employer offers both, then which do you choose? The answer should be simple. Even with the lack of flexibility and self-management of a 401k, the traditional IRA does not provide nearly the same amount of punch that a 401k does.

I mean, were talking about a $5,500 limit of the IRA to the $55,000 limit of a 401k. That should be not brainer. Oh, lets not forget the free money you get if your employer is also contributing, even bigger no brainer.

But on the flip side, if you are self-employed or your employer does/doesnt offer a 401k, then you have the 401k to fall back on. If you are not planning on spending more than the $5,500 limit and/or your young, then the IRA is a great option. In fact, its an awesome option.

A lot of young people these days are very active and interested in financial markets and the access to learning about investing and trading is already greater than what was available to the normal person 15 years ago. Younger investors are very much attached to particular companies and philosophies so the ability to manage or at least direct their own retirement plan through an IRA may be the best choice for them.

You can do both

How To Get Started Investing In Either Iras Or 401s

If you want a 401 plan, check to see what your employer offers. You can only get a 401 plan through your job. The HR department is a good place to start looking for information about 401 plans at your work.

If you want an IRA, all you need to do is open an account with a broker. Figure out which IRA is best for you . Deposit your money and make sure its invested.

IRAs and 401s are not mutually exclusive you can get both.

Also Check: How Do I Transfer 401k To New Employer