Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you earn less than $122,000, you qualify for a Roth IRA in 2019. Youll qualify for a Roth IRA in 2020 if you earn less than $124,000. This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2019, you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here too. You can also contribute up to $6,000 in 2020.

You can also invest in a traditional IRA, which takes pre-tax dollars and lessens your taxable income just like a 401. Some people also have an IRA because when they left a previous employer, they moved their 401 funds into an IRA via an IRA rollover.

Why Does The Irs Impose Contribution Limits

Contributions to 401 plans are made using pretax dollars, which provides significant tax benefits. This means you dont have to pay federal income tax for contributions up to the $20,500 limit , which lowers your taxable income. And because earnings in a 401 account are on a tax-deferred basis, dividends and capital gains arent subject to tax until you withdraw your funds.

However, because of the substantial tax benefits offered by 401 retirement plans, the IRS works to ensure that plans do not unfairly benefit company owners and highly compensated employees over non-highly compensated employees. Thats where contribution limits and cost-of-living adjustments come into play. To ensure a 401 plan is structured fairly and not favoring specific employees, all 401 plans must pass a set of annual compliance tests.

What Happens If You Exceed The 401 Contribution Limit

If you go over the maximum 401 contribution for a given tax year, this is called an “excess contribution.” Excess contributions are subject to double-taxation if you do not disburse them by April 15 of the year following the tax year in question. If you discover you made an excess contribution, reach out to your plan administrator immediately to correct the issue.

Don’t Miss: What Is The Maximum Amount To Put In A 401k

Where To Invest If You Don’t Have A 401

Don’t worry if your employer doesn’t offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.

Excess Contribution Not Withdrawn By April 15

So what happens if you dont notice that youve over-contributed to one or more 401k plans until after April 15? In this situation, the excess contribution is taxed twice, once in the year when contributed and again when distributed .

Also, the earnings from the excess contribution will be taxable income for the following year. If the mistake is not corrected, then the IRS may disqualify the entire 401k plan retroactive to the beginning of year 1. This results in the employees entire 401k account balance to become income to the employee which would have massive adverse tax consequences.

But the main reason why you want to be more conservative in your self-employed 401k contribution is not the fine. Th main reason is the stress of getting an IRS audit letter in the mail. It will also take time to amend your tax returns. This process can take hours.

Id much rather miss out on contributing an extra $1,000 in my self-employd 401k than go through the torture of dealing with the IRS.

Remember, when in doubt, round down your self-employed 401k contribution amount.

Don’t Miss: Should I Contribute To Roth Or Traditional 401k

Is There An Income Limit For Contributing To A 401

Not exactly. If you have access to a 401 plan at work, you can put money into it no matter how high or how low your salary is. But listen up, high-income earners: The IRS does limit how much of your salary and compensation is eligible for a 401 match.

For 2021, the compensation limit contributions and matches) is limited to $290,000. So keep that in mind! In 2022, the compensation limit increases to $305,000.7

Heres how it works. Lets say you make $500,000 in 2022 and your company offers a 4% match on your 401 contributions. You contribute $20,500the maximum amount youre allowed to put into your 401 in 2022. But instead of matching that $20,500 , your employer only contributes $12,200. Why? Because your employer is only allowed to apply your match on up to $305,000 of your compensation, and 4% of $305,000 is $12,200.

Noit doesnt really make sense. But dont let that stop you from using all the tools you have to build wealth for the future!

What Is The Maximum An Employer Can Contribute To Your 401 In 2021 And 2022

Well, maybe there is one thing better than tax-free growthand thats free money! One of the best things about a 401 is that most employers offer some kind of match on your contributions, usually up to a certain percentage of your salary. In fact, about 86% of companies with a 401 plan provide a match on employee contributions.4 And the average employer 401 match is around 4.5% of your salary.5 For an employee who makes $50,000 a year, thats an additional $2,250 dedicated to their retirement savings each year. Thats free money to help you build wealth!

But there is a limit on how much you and your employer can put in together. Between you and your employer, the maximum that can be put into your 401 in 2021 is $58,000 . For 2022, that number jumps up to $61,000.6

You May Like: Can I Move My 401k To A Cd

Employer And Employee 401k Contribution Limits

You cannot go over a specified limit for 401k contributions, which applies to the sum of elective deferrals , employer matching contributions, employer nonelective contributions and allocations of forfeitures. Well define all of these below.

- Elective deferrals: Elective deferrals refer to amounts of money you elect to transfer from your pay and into your employers retirement plan.

- Employer matching contributions: Employer matching contributions refer to contributions your employer makes to your retirement plan account if you contribute to the plan from your salary. Heres an example of a common 401k match plan formula: 50 cents on the dollar up to 6% of the employees pay. Not taking advantage of the match means you dont get free money, so its always advantageous for you to get the match!

- Employer nonelective contributions: When an employer makes a contribution to an employee in an employer-sponsored retirement plan , these are employer nonelective contributions.

- Forfeitures: Forfeitures hold employer contribution amounts that accrue when you leave the plan and youre not fully vested in the plan. Vesting means that you own the money in your plan. If youre not fully vested and you leave your job, your company can take the money in your plan.

She calls Personal Capitals blend of technology and personal advice more 21st century. She added, I dont need a company with walnut-paneled offices. Its a modern, intelligent approach.

How Much You And Your Employer Can Contribute For You In 2022

If your employer offers a 401 plan, it can be one of the easiest and most effective ways to save for your retirement. But while a major advantage of 401 plans is that they let you put a portion of your pay automatically into your account, there are some limits on how much you can contribute.

Each year, usually in October or November, the Internal Revenue Service reviews and sometimes adjusts the maximum contribution limits for 401 plans, individual retirement accounts , and other retirement savings vehicles. In November 2021, the IRS made updates for 2022.

Recommended Reading: Can You Borrow Money Against Your 401k

Are Ss Retirement And Widows Benefits Combined Into One Payment

Social Security allows you to claim both a retirement and a survivor benefit at the same time, but the two wont be added together to produce a bigger payment you will receive the higher of the two amounts. For both retirement and survivor benefits, the payment amount rises if you wait past the minimum age to apply.

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Recommended Reading: Can I Withdraw From My 401k To Buy A House

What Is A Solo 401k

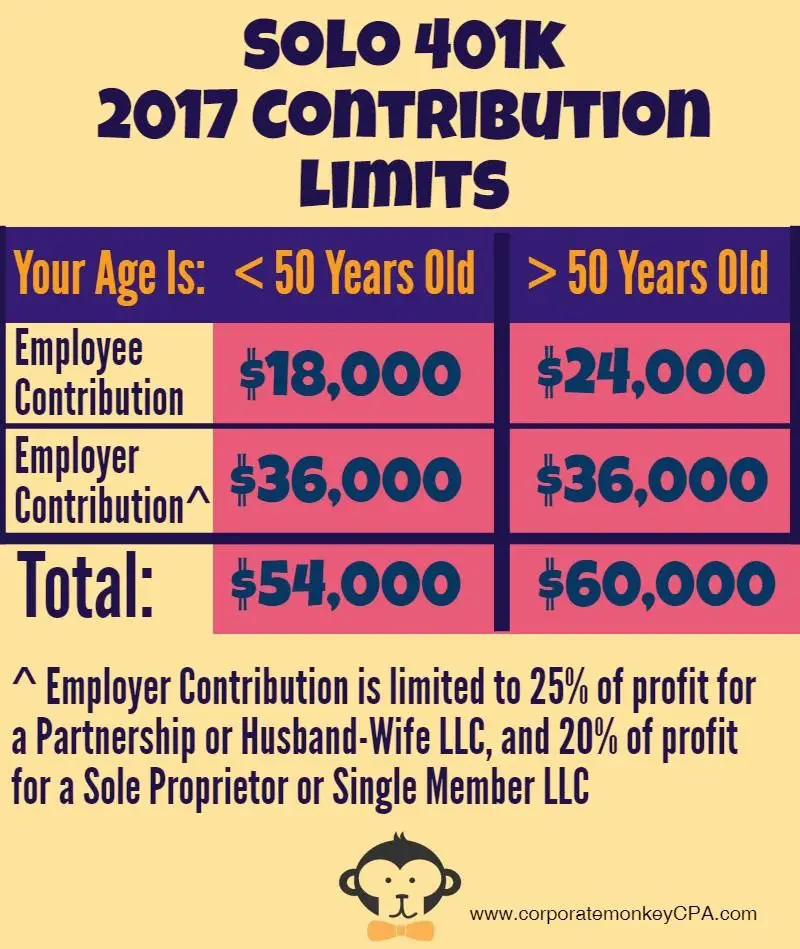

According to the IRSs own website, a Solo 401k is simply a one participant 401k plan. It is no different than any other 401k, except that it only covers the owner and maybe also, his or her spouse. Its key that the sponsoring business compensates the spouse. These plans follow all of the same rules as any other 401k plan. Except no full time W2 employees are allowed in a Solo 401k.

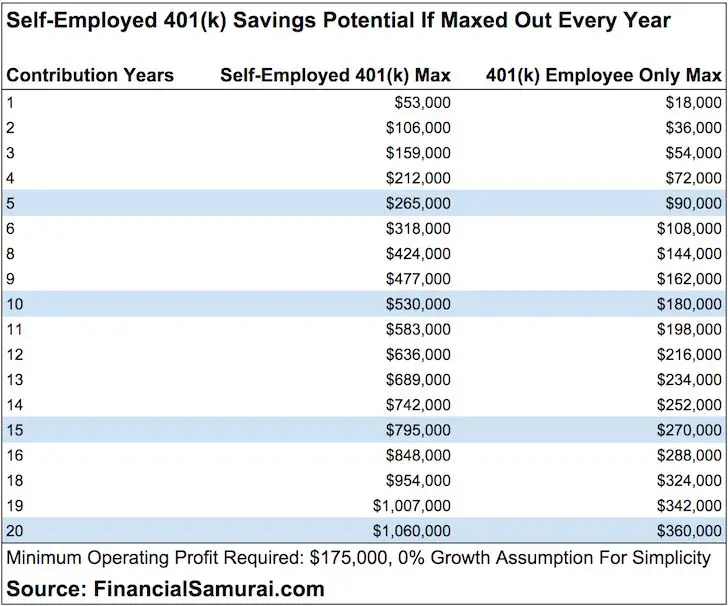

Solo 401ks, just like other 401k plans are designed to help you save for retirement. In a Solo 401k, you play multiple roles, including, employee and employer. As such, you get additional benefits and control compared to a large group 401k plan. In the Solo 401k you have very high contribution limits and multiple ways to contribute. With certain Solo 401k providers, you also have full control over your retirement assets and investments. This means you can invest in stocks, bonds, gold & silver, ETFs, private companies, mortgage notes, and bitcoin. All inside your Solo 401k plan.

Traditional Vs Roth 401k Contribution Limits

Some employers offer both a traditional 401k and a Roth 401k, but whats the difference between each? Lets walk through the differences between both account types so you can decide which type works best for your needs.

- Roth 401k: A Roth 401k refers to an employer-sponsored savings plan that gives you in which you can invest after-tax dollars for retirement. The perk to investing in a Roth 401k: You pay taxes on your money ahead of time, which means that you wont pay any taxes on your contributions after you take withdrawals after you reach age 59 ½ as long as the account has been funded for at least five years. All of your accumulated contributions and earnings come out tax free.

- Traditional 401k: A traditional 401k refers to an employer-sponsored plan that gives you the option to defer paying income tax on the amount you contribute for retirement. For example, lets say you earn $50,000 and max out your retirement plan at $19,500. Assuming you have no other deductions, your taxable earnings will reduce from $50,000 to $30,500. .

Wondering whether you should invest in both? You might want to take a tax-diversified approach because it could allow you to invest in many types of assets and allow you to diversify your savings. You can contribute to both a Roth and a traditional 401k plan as long as your total contribution doesnt go over $19,500 in 2021 and $20,500 in 2022.

Recommended Reading: How Much To Invest In 401k To Be A Millionaire

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 in 2021 and $20,500 for 2022 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

How Is The Individual 401k Contribution Calculated

An Individual 401k contribution consists of two parts, an employee salary deferral contribution and an employer profit sharing contribution. In 2021 the maximum salary deferral contribution is $19,500 and $26,000 if age 50 or older. In addition, a profit sharing contribution is permitted equal to 20% of net self employment income for unincorporated businesses or 25% of W-2 income for incorporated businesses. The 2021 Individual 401k contribution limit is $58,000 or $64,500 if age 50 or older. The 2020 limit is $57,000 or $63,500 if age 50 or older.

Also Check: How To Convert 401k Into Roth Ira

Why It’s Worth Meeting The Higher 401 Contribution Limit

If you can already afford to max out your 401 account, you should take advantage of the increased contribution limit in the new year and plan on saving an additional $1,000 to make your total contribution for the year $20,500.

It’s sort of a no-brainer option, thanks to these tax breaks that come with 401 contributions:

Workers Saving For Retirement Have A Reason To Rejoice Over The 401 Contribution Limits For 2022

Saving for retirement, at times, can seem like a daunting task. But utilizing a 401 account, if your employer offers one, is one of the best and most tax-friendly ways to build a nest egg. You should start saving in a 401 account as soon as you, though the IRS limits how much you can contribute each year.

Recommended Reading: How To Open A Self Directed 401k

Total 401 Employer And Employee Annual Contribution Limits

| 2021 | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$64,500 |

$67,500 |

Vanguard data from 2018 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

What Are The Irs Rules About How Much And When The Business Owner Must Make Contributions To An Individual 401k

The intent of the business owner must be to make significant contributions to the Individual 401k plan, however there are no established thresholds regarding how much money is required to be contributed annually. Also there are no IRS rules about how soon contributions must be made after establishing an Individual 401k plan.

Read Also: What Is The Maximum I Can Contribute To My 401k

Other Irs Retirement Account Changes For 2022

In addition to contribution increases to 457, 403, and 401 plans, the IRS has additional 2022 updates:

-

Traditional and Roth IRA contribution limits remain the same at $6,000, with traditional and Roth IRA catch-up contribution limits staying at $1,000.

-

Income ranges for determining eligibility to make deductible contributions to traditional IRAs, to contribute to Roth IRAs, and to claim the Saver’s Credit all were raised for 2022.

How To Invest 401 Money

Youll also need to decide how to invest your 401 money. One option, which most 401 plans offer, is target-date funds. You pick a fund with a calendar year closest to your desired retirement year the fund automatically shifts its asset allocation, from growth to income, as your target date gets nearer.

These funds also have model portfolios you can choose from and online tools to help you assess how much risk you want to take. You can also decide which fund choices would match up best with your desired level of risk.

Recommended Reading: How To Withdraw Funds From 401k