What Happens To My 401k If I Get Fired Or Laid Off

Getting laid off or fired can be a scary experience. Make sure all of your financial bases are covered, including your 401k.

If youve been let go or laid off, or even if youre worried about it, you might be wondering what to do with your 401k after leaving your job.

The good news is that your 401k money is yours, and you can take it with you when you leave your old employer. Whether that means rolling it over into an IRA or a new employers 401k plan, cashing it out to help cover immediate expenses, or simply leaving it in your old employers 401k while you look into your options, your money isnt going anywhere.

What Happens To Your 401 When You Quit

Look whats that? Oh hey, its the bright future ahead of you now that youve left that old job behind. Time to move on to new opportunities whether theyre waiting for you right now, or youre about to take some time to discover your next step.

But theres one slice of your old job hanging out in your periphery that employers 401, and all your money invested in it. So whats going to happen to that account, and what do you need to do next?

What Are The Terms Of A 401 Loan

The terms of a 401 are usually set by the planâs administrator. However, there are some IRS regulations that must be followed in order to stay compliant.

The IRS caps 401 loan amounts to the lesser of $50,000 or 50% of the 401 account balance. Additionally, the IRS requires 401 loans to be repaid within a five-year term. However, due to the COVID-19 pandemic and the subsequent legislation to help Americanâs that five-year term has been extended to six years. Itâs essential to check the most recent information or discuss it with your planâs administrator if you can extend the repayment term length.

The interest rate on a 401 is typically a point or two above the prime interest rate at the time of application. Remember, the interest you repay towards your 401 loan goes back into your 401 account. Think of it as youâre paying yourself back as the bank for taking the loan out.

Lastly, your planâs administrator may charge fees for you to take out a 401 loan from their plan. Typical origination fees range between $50 and $100. Some 401 plans charge a monthly maintenance fee throughout the term of the 401 loan of $25 to $50.

Read Also: What Percent To Put In 401k

Also Check: Where Can I Rollover My 401k To An Ira

Roll It Over Into An Ira

If youre not moving to a new employer, or if your new employer doesnt offer a retirement plan, you still have a good option. You can roll your old 401 into an IRA. Youll be opening the account on your own, through the financial institution of your choice. The possibilities are pretty much limitless. That is, youre no longer restricted to the options made available by an employer.

The biggest advantage of rolling a 401 into an IRA is the freedom to invest how you want, where you want, and in what you want, says John J. Riley, AIF, founder, and chief investment strategist for Cornerstone Investment Services LLC in Providence, R.I. There are few limits on an IRA rollover.

One item you might want to consider is that in some states, such as California, if you are in the middle of a lawsuit or think there is the potential for a future claim against you, you may want to leave your money in a 401 instead of rolling it into an IRA, says financial advisor Jarrett B. Topel, CFP for Topel & DiStasi Wealth Management LLC in Berkeley, Calif. There is more creditor protection in California with 401s than there is with IRAs. In other words, it is harder for creditors/plaintiffs to get at the money in your 401 than it is to get at the money in your IRA.

If you have an outstanding loan from your 401 and leave your job, youll have to repay it within a specified time period. If you dont, the amount will be treated as a distribution for tax purposes.

Make Sure You Do Something With Your 401

Your 401 money represents an important component of your retirement savings. Its critical that you manage this money effectively both while you are working for an employer and when you leave.

You have several choices for this money when you leave your job. Its important to make an affirmative decision for this money whenever you leave a job. This can be the difference between achieving your retirement goals and falling short.

So You Want to Learn About Investing?

Don’t Miss: How To Choose Fidelity 401k Investments

You Could Withdraw The Money

Technically, youre allowed to withdraw your money from your old 401, but unless youre facing some really dire financial circumstances, we advise against it. Thats because youd get hit with big penalties from the IRS and likely owe taxes on the money, too which could all add up to as much as 50% of the balance in your account. Yeah ouch.

Can You Lose Your 401 If You Get Fired

There are two types of contributions to a 401: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your own contributions and can not lose this portion of your 401.

Read Also: Can I Roll Over A 403b To A 401k

Rollover Your Old 401k Money Into A New Ira

Known as a rollover IRA, this type of IRA is designed to accept the transfer of assets from a former employers 401k. If your new employer doesnt offer a 401k or youre not pleased with the plans costs or investment options, this is probably your best option because it will give you the most flexibility and control to stay on track with your retirement savings goals. In fact, this is what we generally recommend to our clients who have old 401ks. IRAs generally have more investment options, no plan fees, and greater withdrawal flexibility.

In order to execute a rollover IRA, your first step is to open a new IRA with an investment advisor or financial institution. The rollover process is similar to the one described above except that you will instruct the administrator of your former employers 401k to transfer plan assets directly into your new rollover IRA.

Conversely, you can have a check sent directly to you, but make sure that the check is made payable to your IRA custodian for benefit of your name. The former plan administrator will withhold 20% of the amount for the payment of taxes and you will have 60 days to deposit the full balance, including the 20% withheld, into your rollover IRA. Failure to deposit the entire amount into your new IRA could result in current tax liabilities plus a 10 percent penalty if youre under age 59½.

What Options Do I Have For My Current 401

When you leave an employer, you have several options:

- Leave the account where it is

- Roll it over to your new employers 401 on a pre-tax or after-tax basis

- Roll it into a traditional or Roth IRA outside of your new employers plan

- Take a lump sum distribution

The truly smart move for you depends on your own individual circumstances and goals.

Some items to consider include:

- Your current account balance

- Whether you fear collection actions, because workplace plans provide creditor protection that IRAs dont

- Quality of your new companys retirement plan versus your former plan in terms of investment options, fees and whether or not loans are permitted

- Options available to you in an IRA outside of your employers plan

The good news is that you do not have to make any decisions about your existing 401 immediately. You may want to speak with a financial advisor first to discuss your options.

You May Like: How To Get Money From Your 401k

Will You Owe Taxes Probably No

If you dont have the option to transfer to another employer-sponsored plan, or you do not like the fund options in the new 401 plan, establishing a rollover IRA for the funds is a good alternative. You can transfer any amount, and your money continues to grow tax-deferred.

It is important, however, to specify a direct rollover from plan to plan. If you take control of your 401 funds in an indirect rollover, in which the money passes through your hands before going into the IRA, your old employer is required to withhold 20% of it for federal income tax purposes and possibly state taxes as well.

Recommended Reading: How Do You Know If You Have An Old 401k

Heres What Happens To Your 401 When You Leave Your Job

Lets face it: Nowadays, most workers dont stay in the same job or work for the same company for the duration of their careers. But what happens if you funded a 401 and then switch jobs, leave your company or get laid off? What happens to the money you accumulated when you move on?

The important thing to know is you get to decide what happens to it. Here are some of your options, assuming you are too young to begin taking distributions:

Dont Miss: How To Take Out 401k Money For House

Don’t Miss: How To Borrow From 401k For Home Purchase

How To Transfer 401 To A New Job

If you want to transfer your 401 to your new employer then you must contact both your old and new 401 plan administrator. Your new 401 plan administrator can confirm if they will accept the transfer, and can give you the details you need for the rollover. You will likely need to fill up a rollover form with your old 401 plan administrator to initiate the transfer.

Resist The Temptation To Cash Out Your Retirement Savings If You Are Fired Or Laid Off From A Job If You Have A 401k Roll Your Money To A New Plan So You Can Continue To Contribute And Grow Your Savings

Losing a job is a stressful experience. Adding to that stress is the decision youll have to make about what to do with your 401. The good news is that retirement plans are portable. That means you can take your nest egg with you when you leave a job. Lets look at the options available to you:

Transfer to your new companys plan. When you start a new job, you can move the money from your previous employer to your new employers retirement savings plan . Not all plans accept rollovers, so youll need to check with your new employer.

Roll over your old plan to an IRA. You can move your retirement savings from a previous employer to an IRA without paying taxes or penalties. If you roll your money over to an IRA, you can continue to save for retirement while you look for new employment or start working for yourself.

Icon is an IRA and accepts rollovers. You need to first open an Icon account and then we can help you with the process of rolling over your funds.

Dont cash out. Whatever you do, dont cash out your savings, even if you think its a small amount. Not only will you have to pay taxes and an extra 10% early withdrawal penalty, but youll also lose out on your future savings.

Read Also: What To Do With Old 401k Account

You Asked We Answer: How Long Can A Company Hold Your 401k After You Leave

Having a strong 401 k plan is a priority for most Americans. In the USA, a 401 k plan or IRA is the basis of your retirement savings. The absence of a universal welfare plan means that these accounts are the responsibility of your employer. However, some jobs don’t work out. You might end up resigning before you reach retirement age. When this happens, it can affect your 401 k plan. If you resign early, you may need to figure out what to do with your old 401 k account.

Depending on the amount in your 401 k and your age at retirement, you may have full access to the funds. Otherwise, you might need to wait a certain period of time. You might also be required to transfer the 401 k funds to a new account from the old account. Withdrawing the money before you’re old enough can mean you face penalties. This article discusses your options when you leave your job before you’ve reached retirement age.

What Happens To Unvested 401k Money When You Quit

If you quit your job, you will lose the unvested percentage from your employers contributions to the account. That is the money will be forfeit: meaning that the money will stay with your company and can be used to fund other accounts.

You will receive only the vested percentage. If your employer has vesting regulations, make sure that you are fully vested before you quit your job. That is the only way you will receive 100% of contributions made to your account.

Related: What happens to your 401 when you quit your job?

Recommended Reading: Can You Have More Than One 401k

Rollover The Money Into Your New Employers 401k Plan

If your new employer offers a 401k plan with low costs and a wide variety of investment options, this might be a viable option to consider. However, we generally recommend that people rollover their 401k plans into an IRA as they are usually lower cost and have more investment options, but more on that later.

If you are interested in rolling the money over into your new employers 401k, meet with the HR department or retirement plan custodian to find out more about your new companys plan, including whether you will be allowed to participate as soon as youre hired or will have to work for a certain number of days before youre eligible.

To accomplish this rollover, you will instruct the administrator of your former employers 401k to transfer your assets directly into your new employers plan once your account has been established. Alternatively, you can instruct the former employers 401k administrator to send you a check but you must deposit the funds into your new account within 60 days to avoid paying income taxes and a potential penalty on distribution.

Vesting May Limit Access To Some 401 Funds

In principle, it’s illegal for a company to restrict access to your personal 401 funds and the earnings they have made. However, in practice, the balance in the account may not all be yours, because some money may have been contributed by your employer via employer matching and you may not have worked long enough in the job for those company contributions to have vested to you.

Once you have reached the point of becoming fully vested, often within a few years, the funds are all yours, and barring other issues, the company is obliged to release them. “If you are restricted from accessing your vested 401 funds, that is indeed illegal,” says Stephen Rischall, CFP®, CRPC®, and a partner in Navalign Wealth Partners, adding, “At all times you have full rights to withdraw all of your contributions made to the plan in addition to fully vested employer matching contributions, if applicable.”

Nevertheless, Mark T. Hebner, founder and president of Index Fund Advisors, explains, “If there was a vesting schedule associated with matching contributions, and you left before the date those funds fully vested, you can legally be denied access to them.”

A company’s vesting schedule determines when employees own their employer’s contributions to their 401 accounts workers are always fully vested in their own contributions.

Read Also: Which Is Better 401k Or Ira

Cashing Out A 401 In The Event Of Job Termination

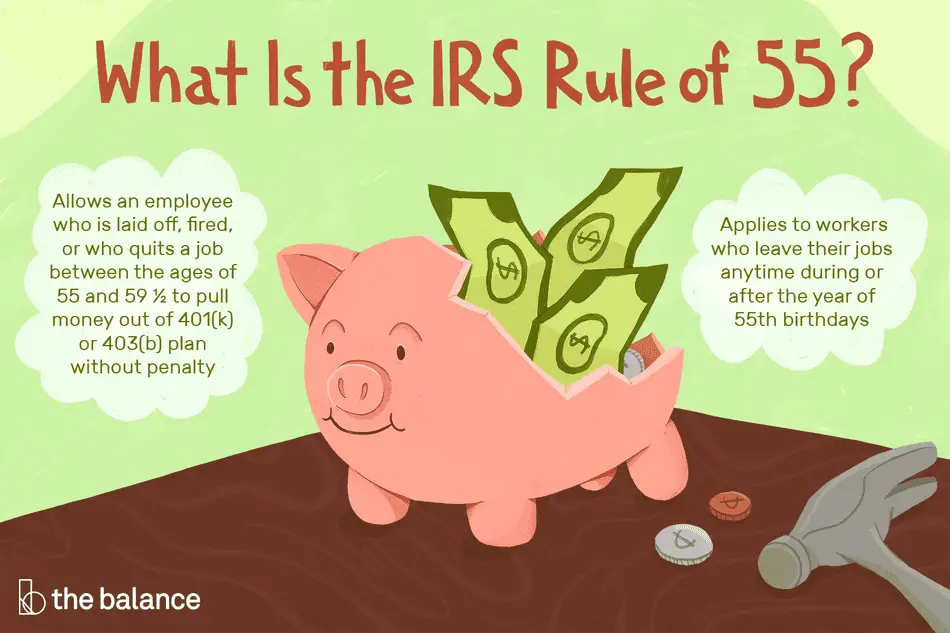

In case you are fired, you can cash out your 401 plan even if you are below the age of 59 ½ years. You just need to contact the administrator of your plan and fill out certain forms for the distribution of your 401 funds. However, the Internal Revenue Service may charge you a penalty of 10% for early withdrawal, subject to certain exceptions.

Rollover Your Retirement Savings Account Into An Ira

If you are fired or laid off, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. This is called a rollover IRA.

If you decide to roll over your money to an IRA, you can use any financial institution you choose you are not required to keep the money with the company that was holding your 401.

Ask the mutual fund company, bank or brokerage that will manage your IRA for an IRA application. Make sure your former employer does a direct rollover, meaning that they write a check directly to the company handling your IRA. If they write the check to you, they will have to withhold 20% in taxes.

Don’t Miss: Can You Get 401k If You Quit

Transfer Your 401 To Your New Employer

If youre changing jobs and your new employer offers a 401, you dont have to worry about what happens to 401 if you leave your job â you can create a new account and transfer your funds to it.

Your new employer 401 plan might be flexible and work well with your investment options and financial goals. Also, since it is easier to track your investment accounts when they are in one place, moving your money to your new 401 account can be a good option. 401-to-401 transfers are seamless and dont include taxes or penalties.

Learn how to transfer your old 401 to your new one before you leave your job. If you receive your proceeds from your old employer via check or cash, a mandatory 20% tax is applied to the savings. If you fail to deposit the money to your new retirement account within 60 days, you are subject to penalties and taxes.