What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

Recommended Reading: Can I Start A 401k

Contact Your 401 Provider

Youre making great progress. You know where your 401 is and you have an IRA at Fidelity to transfer your money into. The next step is to initiate your rollover by contacting your 401 provider.

Often, the easiest way to do this is by phone. Your 401 providers phone number should be visible on an old account statement.

In order for your call to go smoothly, follow these tips:

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Also Check: How To Open A Solo 401k

Read Also: Is 401k Rollover To Ira Taxable

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Confirm A Few Key Details About Your Massmutual 401

First, get together any information you have on your MassMutual 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Read Also: What Happens To 401k When You Leave Your Job

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

What Is The Best Way To Rollover Your Fidelity 401k To A Gold Ira

A Fidelity IRA is a Traditional IRA that is often used by those who have changed jobs or retired and have assets accumulated in their employer-sponsored retirement plan, such as a 401.

Eligible distributions from such plans can be rolled over directly into a Fidelity Rollover IRA without incurring any tax penalties and assets remain invested tax-deferred.

Consolidating multiple employer-sponsored retirement plan accounts into a single Rollover IRA can make it easier to allocate and monitor your retirement assets.

Recommended Reading: Can I Roll A Roth Ira Into A 401k

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Recommended Reading: Should I Get A 401k

More People Than Ever Are Investing 401 Savings In Bitcoin

Here are seven reasons why.

Before you can take advantage of these rollover benefits, there are specific details you need to know, and three steps you must take.

Dont Miss: Can You Use 401k To Buy Investment Property

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

You May Like: Can I Take 401k Money To Buy A House

How Do I Choose An Ira Provider

Many financial institutions offer IRAs, including brokerage firms, banks, and newer fintech companies. In order to pick the best account for you, theres one up-front question to answer:

Do you want to make your own investment decisions, or would you rather have the investing decisions made for you so you can just set-it-and-forget-it?

If you want to make your own decisions, then what youll want is a self-directed IRA. That allows you to make your own trading decisions and invest in whichever financial securities youd like.

The key features to compare when choosing among self-directed IRAs include:

- What do you want to invest in? The exact investment options among IRA providers varies. Most of them allow you to invest in stocks, ETFs and options. Other specialized IRA providers will let you invest in private assets and cryptocurrency.

- Access to research and data. Some brokers provide access to premium research and data. If youre a more hands-on investor, this might be important to you.

- Ease of use while user interfaces are getting better across the board, newer fintech providers tend to be more popular with those who really value an intuitive app experience.

The key features to compare when choosing an automated account include:

Get matched with an IRA provider based on your preferences! If you choose to do an 401-to-IRA rollover, well match you with a provider based on your preferences as part of our rollover process.

You Can Leave Your Money Where It Is

If you have more than $5,000 in your 401k, you can leave it in your old employers 401k plan and even if you have less than that, they still might let you leave the money where it is, but you should ask. If you have less than $5,000, your employer has the option to make you take a distribution, but not all employers will exercise that right.

This is the simplest option, and its the one many people choose when theyre fired suddenly. You usually cant plan for a job loss, so you might not even have time to decide what to do with your 401k money before you get fired or laid off. And you might need some time to process the layoff for a while before you even get around to worrying about the money in your retirement plan.

Well, you might ask, how long do I have to rollover my 401k from a previous employer? Thats a good question. If you want to do a direct rollover, in which your former employer writes a check directly to your new employer for deposit into your new employers 401k plan, you can pretty much wait as long as you want.

However, if you want to do an indirect rollover, where you cash out the money and then deposit it into another tax-advantaged account yourself, you have 60 days from the time you cash out to deposit the money into another such tax-advantaged account, like an IRA. If youre planning to roll over the money into another 401k, you want to avoid this option, since your old employer will be required to withhold 20% from your payout for taxes.

Also Check: Can I Rollover 401k To Ira While Still Employed

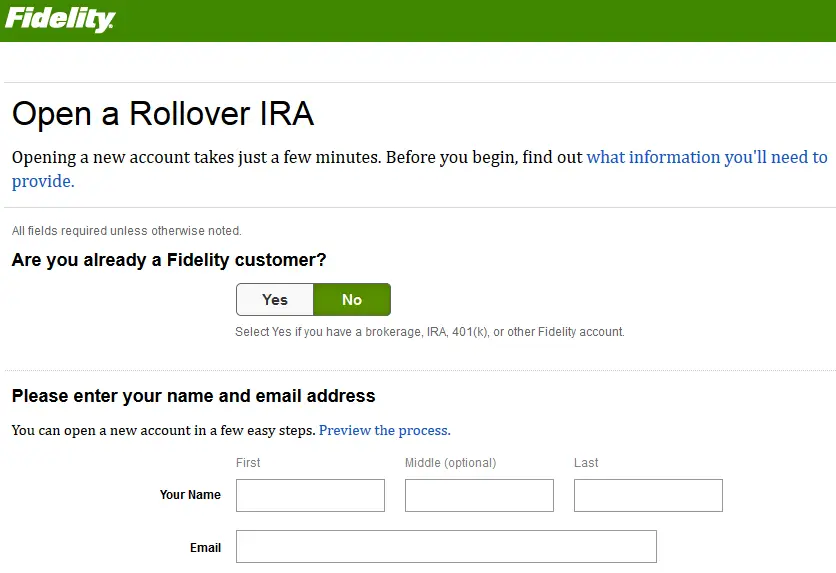

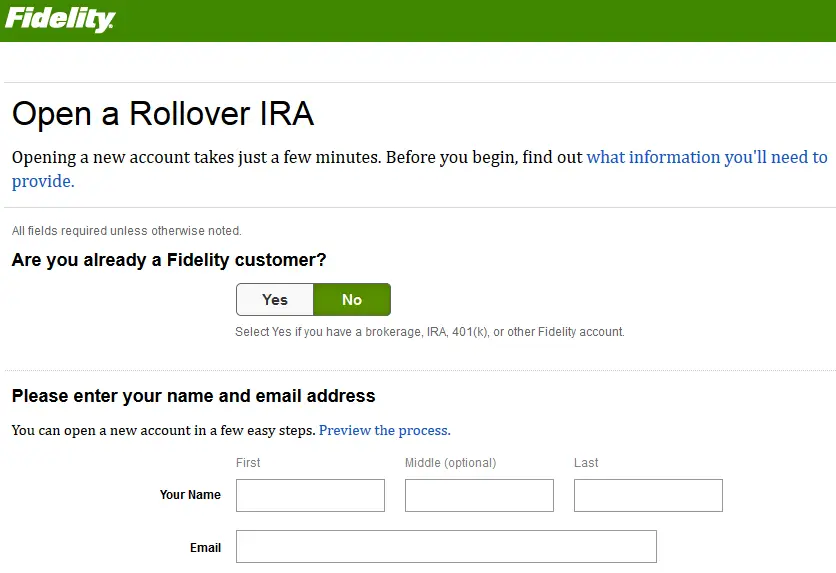

Set Up Your New Account

If you don’t already have a rollover IRA, you’ll need to open onethis way, you can move money from your former employer’s plan into this account. If there are both pre-tax and post-tax contributions in your 401, you might need to open a Roth IRA too.* Which IRA should you consider for your rollover?

How Many Time A 401k Be Rollover

A rollover from a 401k into another IRA may be made only once a year. The one-year wait period begins when the taxpayer receives the 401k distribution, not the date when he rolls it over into a rollover IRA. Keep in mind that this one year rule applies separately to each IRA account that an individual owns.

Don’t Miss: How To Switch 401k To Ira

Pick The Right 401 Withdrawal Reasons

While the IRS may allow you to make a hardship withdrawal, that doesnt mean youll escape the 10 percent penalty tax .

Only certain kinds of early withdrawals escape the penalty tax, including the following:

- Medical expenses above 10 percent of adjusted gross income

- Permanent disability of the account owner

- A series of substantial equal periodic payments from the account

So if they need the money for other hardship reasons , account owners will still end up paying the 10 percent penalty tax.

Also Check: How Do I Transfer 401k To New Employer

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Read Also: What’s The Maximum Contribution To A 401k