Types Of 401 Investments

The most common type of investment choice offered by a 401 plan is the mutual fund. Mutual funds can offer built-in diversification and professional management, and can be designed to meet a wide variety of investment objectives. Be mindful that investing in a mutual fund involves certain risks, including the possibility that you may lose money.

Your 401 plan may offer other types of investments. Some of the more common ones include:

Best Fidelity Funds For Your 401k: Total Bond

Manager: Ford ONeilExpenses: 0.45%

Primary manager Ford ONeil uses the Barclays U.S. Universal Bond Index as an investment guide for Fidelitys diversified bond fund, Fidelity Total Bond Fund .

Investments in this $17 billion-plus fund are allocated across investment-grade , high-yield and emerging-market bonds. The investment-grade debt includes a 29% total weighting in U.S. Treasuries. The result? A 30-day yield around 3.5%.

Foreign holdings make up 9.8% of the investments.

Jim Lowell is the editor of Fidelity Investor. Fidelity Investor today and youll also receive his free report on the top sector funds and ETFs for 2015.

Article printed from InvestorPlace Media, https://investorplace.com/2015/03/10-best-fidelity-funds-401k/.

Best For Low Fees: Charles Schwab

Charles Schwab

The Individual 401 Plan from Charles Schwab is our top choice for low fees. The account has no opening or maintenance fees as well as no commission trades for stocks or ETFs and over 4,000 no-load, no-transaction-fee mutual funds. Customers can also use its robo-advisor, Schwab Intelligent Portfolios, with no extra fees.

-

Accounts are free to open and charge no recurring fees

-

Access to trade stocks, ETFs, and thousands of mutual funds for free

-

Option for a no-cost robo-advisor

-

No solo 401 loans

-

High fees for some mutual fund trades and broker-assisted trades

Charles Schwab is our top choice for low fees in a solo 401 plan. Schwabs version charges no recurring fees and no setup fees. It offers commission-free trades for all stocks and ETFs as well as over 4,200 no-transaction-fee funds on the Schwab OneSource funds list. While Schwab offers excellent customer service, be aware that automated phone trades cost $5 and broker-assisted trades cost $25 each. However, many customers could use this account without paying any fees.

Schwabs Solo 401 doesnt offer 401 loans. Its active investment platform may not satiate all expert investors, and its active charting and analysis tools lag behind some other brokerage platforms for active traders. However, the pending integration of TD Ameritrade will bring the coveted thinkorswim platform under the Schwab umbrella, which is something active traders at Schwab can look forward to.

Don’t Miss: What Percent To Put In 401k

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on Register Now at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose Contribution Amount. If you are already logged in, click on the Contributions tab.

Step 2:There are three choices:

- Contribution Amount to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

You May Like: Should I Rollover 401k To New Employer

How We Chose The Best Solo 401 Companies

To choose the best solo 401 companies, we looked at 10 top providers of solo 401 accounts. In evaluating providers, we focused on pricing, investment options, account features, and trading platforms.

Pricing and fees were the single biggest factor considered, followed by investment choices. The ability to make Roth contributions or take out a 401 loan was the third major factor considered, as they may be less important to some investors. Account trading platforms, both online, desktop, and mobile, were also considered but carried less weight, as they are not as important to the typical retirement account investor.

Read Also: Can I Withdraw My 401k If I Leave My Job

Benefits Of The Mit 401 Plan

When you enroll in and contribute to your 401 account, you are 100% vested that is you fully own your contributions, MITs matching contributions, and all interest earned on the investments you choose through the Plan.

In addition, you receive tax benefits when you contribute to your MIT Supplemental 401 account. You can choose when you receive your tax benefits right away, with pre-tax contributions, or later on, with Roth post-tax contributions.

Save on a pre-tax basis and receive tax benefits now

- Your 401 contributions are deducted from your paycheck before taxes are applied, reducing your current taxable income and therefore your taxes.

- In retirement, you will pay federal and state income taxes on any amount you withdraw from the plan.

Save on a post-tax basis and receive tax benefits later

- Your 401 contributions are taken out of your paycheck after federal and state income taxes have been applied, so they will not reduce your current taxable income or your taxes.

- In retirement, you will pay no taxes on any amount you withdraw as long as you take the distribution after age 59½ and at least 5 years after the first Roth contribution was made.

Determine How Much You Can Contribute

Workers under 50 can contribute up to $19,500 to a 401 in 2020, but how much you actually earmark for the account depends on your income, debt level and other financial goals. Still, financial experts advise contributing as much as you are able to, ideally between 10% to 15% of your income, especially when you are young: The sooner you start investing, the less you’ll have to save each month to reach your goals, thanks to compound interest.

“That’s your company literally saying: ‘Hey, here’s some free money, do you want to take it?'” financial expert Ramit Sethi told CNBC Make It. “If you don’t take that, you’re making a huge mistake.”

Read Also: What To Do With 401k When You Leave Your Job

What Is Fidelity 401k

3.9/5

Simply so, what is a 401k plan and how does it work?

A 401k is a qualified retirement plan that allows eligible employees of a company to save and invest for their own retirement on a tax deferred basis. Only an employer is allowed to sponsor a 401k for their employees.

Beside above, does fidelity have a 401k? Fidelity’s 401 plans for small businesses through Fidelity Workplace Services can help you offer competitive benefits to your employees.

One may also ask, what are Fidelity 401k Fees?

For instance, Fidelity Investments is America’s biggest provider of 401s. A typical advisory fee for a Fidelity portfolio account starts at 1.7% and decreases from there by as much as half, depending on how much you put in.

How do I withdraw money from my Fidelity 401k?

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelity’s website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

Best For Low Operating Costs: Charles Schwab

Not many names are as well known in the financial industry as Charles Schwab. Charles Schwab offers Index Advantage 401 plans with low fees it also has some other plans you can choose from.

You can get plan advice and access to accounts that offer interest through the Schwab Bank. Its plans have no annual fees plan members get full access to all investing services.

If you’re self-employed or own your business, you can pay into an individual 401 plan. These plans offer many of the same benefits as a traditional 401. One great thing about the individual 401 plan is that you can direct where you invest your money.

This plan has monthly service fees that vary based on your needs. Payments into your plan are tax-deductible, and gains are tax-deferred.

All Charles Schwab plans come with planning help and 24/7 service and support.

Recommended Reading: How Is 401k Paid Out

Convert To An Ira And Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Best For Small Employers: Employee Fiduciary

Employee Fiduciary has low fees for its 401 plans. The firm invites you to compare their 401 plan against your current plan. It claims to have the same choices as larger firms but with lower fees.

You’ll need $500 to open a plan or $1,000 to convert an existing plan. There are more than 377 mutual funds and ETFs to choose from. It also gives you access to a broker through TD Ameritrade. The fees for its 401 plans are low, and it provides tax return forms and annual report summaries.

The company also sends out benefit statements and has a toll-free number for plan members that need help. Low-cost investment options include Vanguard funds, index funds, and Exchange Traded Funds .

You May Like: How To Roll Over 401k To New Employer Vanguard

Start With Your Strategy

We think a good investment is one that makes sense for your financial situation, goals, timeline, and risk tolerance. So it makes sense to start with an overall asset mix that takes into account stocks, bonds, and cash.

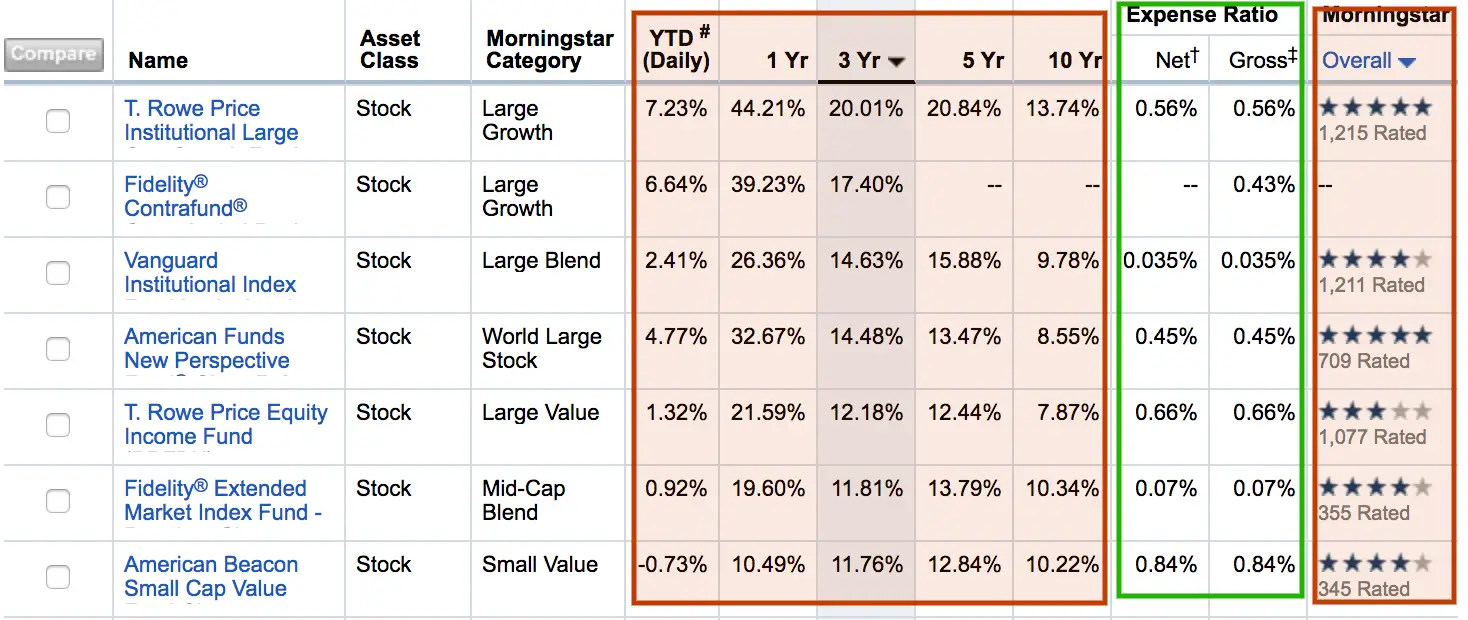

Within those categories you will want to diversify among company size, style, issuer, credit quality, and other criteria. The Fidelity Mutual Fund Evaluator offers 9 top-level asset allocation choices, each broken down into more specific categories. A funds category and specific strategy matter a great deal because each category has a different risk profile. Adding higher-risk investments may or may not make sense for you, but the risk level is among the most important criteria to consider when you make an investment choice.

How Often Are Dividends Paid On 401k

The word dividend comes from the Latin word dividendo, which meaning to divide. Dividends, as you may know, are a way for corporations to distribute their profits to their shareholders. This isnt a new occurrence. Dividends have been paid by corporations for more than 400 years. The Dutch East India Firm was the first company on record to issue a dividend in the early 1600s1. Do dividends make a difference? Yes, absolutely! Dividends have accounted for almost 40% of the S& P 500s total return since 19292.

Recommended Reading: How Do I Access My 401k Account

Investigation About Insiders’ Private Investments

A private venture capital firm, F-Prime Capital Partners, managed on behalf of owners and other key leaders of Fidelity Investments, has been described as directly competing with Fidelity Investments public funds. A 2016 Reuters investigation identified multiple cases where F-Prime Capital Partners was able to make investments at a fraction of the price of Fidelity Investments. Because of SEC regulations, investments by F-Prime Capital Partners preclude Fidelity from making the same early investments. The investigation describes that this competition forces Fidelity to delay investing until later and at much higher prices than F-Prime Capital Partners, resulting in lower returns for Fidelity fund shareholders.

Corporate governance experts have stated that the practice is not illegal, but that it poses a clear corporate conflict of interest. Fidelity spokesmen have stated that they are following all laws and regulations.

The same Reuters investigation documents six cases where Fidelity Investments became one of the largest investors of F-Prime Capital companies after the start-up companies became publicly traded. Legal and academic experts said that major investments by Fidelity mutual funds – with their market-moving buying power – could be seen as propping up the values of the F-Prime Capital investments, to the benefit of Fidelity insiders.

Fidelity declined to comment on this aspect of the investigation.

Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

Read Also: How To Borrow From 401k For Home Purchase

Processing Solo 401k Loan Question:

I received the rollover check from John Hancock for my former employer 401k and will go into the local Fidelity Investments office tomorrow to deposit the check into the new brokerage account that you helped me set up for the self-directed solo 401k that you provide. I would like to make sure I understand the process to create a solo 401k participant loan against the balance. I think you all create the paperwork. Whats the method to move the loan amount from the fidelity account into my personal checking account. Do I just use the fidelity transfer functionality, get a check drafted or ?

Also, I will be rolling over an IRA account as well. Am I limited to 1 loan or can I take out a second loan against the additional amount?

Managing Your Fidelity Account Online

A Nazarene 403 Retirement Savings Plan account has been established for most qualified Nazarene ministers with Fidelity Investments. You can learn about your account, create a username and password, establish how much you want to contribute, and modify your investments at www.netbenefits.com/atwork. Follow these steps to initialize your account:

- Select Register at the top of the screen.

- Youll be asked to confirm basic information and submit.

- Follow the instructions.

- Watch this video for assistance in set up of your PIN.

If you prefer to speak directly with a Fidelity retirement services specialist, you may phone 866-NAZARENE for assistance.

Also Check: How To Find Out If I Have Any 401k

Need Help Or Have Questions

Contact MIT Benefits or see the additional contact options below.

| Vendor |

|---|

- How do I find out who I designated as my Pension Plan or Supplemental 401 beneficiary?

To find out who you designated as your Pension Plan beneficiary or to designate a new beneficiary, visit PensionConnect or call 855-464-8736 .

To find out who your Supplemental 401 beneficiary is, call Fidelity Investments at MIT-SAVE , or visit Fidelity NetBenefits to designate your beneficiary online.

- How do I update my life insurance and retirement plans to include my spouse or domestic partner?

Visit Atlas to evaluate your participation in the MIT Optional Life Insurance Plan. Spouse or partner life insurance coverage can be added within 31 days from the date of your marriage or domestic partnership or during Open Enrollment.

Review and update your beneficiaries under the MIT Optional Life Insurance Plan, the MIT Basic Retirement Plan and the MIT Supplemental 401 Plan to ensure they are current. If you are married and your most recent beneficiary designation on file for the MIT Retirement Plan does not designate your spouse as the sole primary beneficiary, and does not have spousal consent for this designation, your spouse will be beneficiary of 100% of your account balance. More on beneficiaries.