How Much Could Your 401 Grow If You Stop Contributing

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

The Four Levels Of Retirement Savings

The lesson is: Figure out what percentage of your income you can save in total, and allocate it appropriately:

Level 1: Max out your employer match in your 401.

Level 2: Max out your emergency savings .

Level 3: Max out your Roth IRA .

Level 4: Max out your 401 .

This flowchart from my post on creating an automated investing program will also help:

Recommended Reading: How Do You Withdraw Money From A 401k

Traditional Versus Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $19,500, your taxable earnings for the 2021 tax year would be $60,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $19,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $58,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

How Much Should I Save For Retirement

We get that question a lot. So we asked Stanley Poorman, advice and planning manager for Principal®, who said theres no one-size-fits-all answer.

A good rule of thumb is to save 1015% of your income toward retirement, but that also depends on when you get started. That may be fine if youre 25, but if youre starting at 50, you may need to save more to retire comfortably, Poorman says.

One way to get a quick snapshot of how much you may need to save is to use the Retirement Wellness Planner. By entering a few numbers, youll get a sense of whether youre on track or not.

Another factor is whether you have a matching contribution from your employer, and if so, what percentage the company contributes. Poorman suggests deferring enough of your pay to get that match.

Recommended Reading: Is There A Maximum You Can Contribute To A 401k

Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you earn less than $122,000, you qualify for a Roth IRA in 2019. Youll qualify for a Roth IRA in 2020 if you earn less than $124,000. This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2019, you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here too. You can also contribute up to $6,000 in 2020.

You can also invest in a traditional IRA, which takes pre-tax dollars and lessens your taxable income just like a 401. Some people also have an IRA because when they left a previous employer, they moved their 401 funds into an IRA via an IRA rollover.

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Also Check: What Is A 401k Profit Sharing Plan

Benefits Of Having A 401k

Different 401k plans come with different perks, each with unique advantages.

Tax advantages: Traditionally, the savings in your 401k account is pre-tax. This means that the amount you contribute is exempt from current federal income tax, which also lowers your taxable income. In this case, you dont have to pay tax on the funds until you actually withdraw them. Since most people are in a lower tax bracket during their retirement years, this may lower the amount they pay in taxes on 401k withdrawals. However, depending on the type of plan you have, the tax break can come when you contribute money or withdraw funds during retirement .

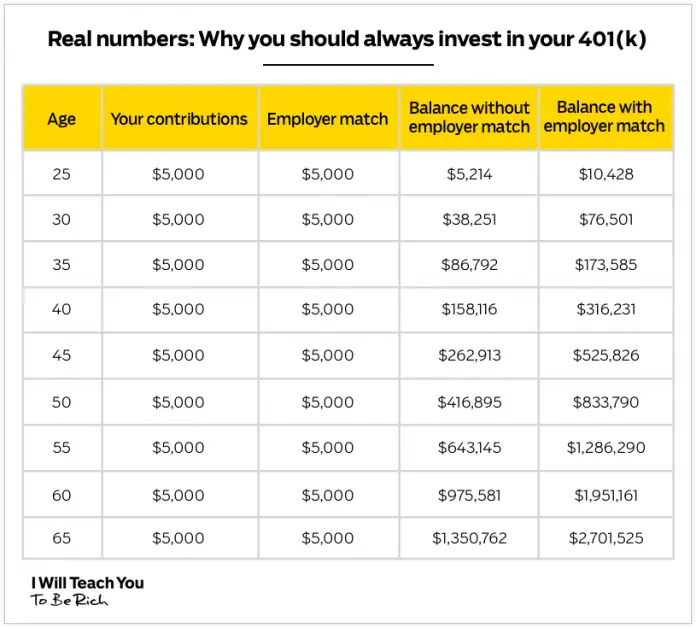

Employer matching contributions: In some cases, employers will offer to match the amount you put into your 401k, which is essentially free money! Employers might offer a certain percentage of what you contribute or even dollar-to-dollar matching. Consider saving up to the maximum annual contribution amount because employer contributions dont count towards your annual limit.

Lifetime contributions: In the case of some retirement accounts and IRAs, there is often an age limit for contributions. However, 401k accounts are not subject to this stipulation so you can contribute funds as long as you are working.

Automatic investment: For many, 401k plans may be the easiest way to save for the future because they automatically deduct funds from your paycheck and place them in the account. This way you dont have to think twice about your savings.

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 for 2021 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

Recommended Reading: How Do I Find Previous 401k Accounts

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

Don’t Forget The Match

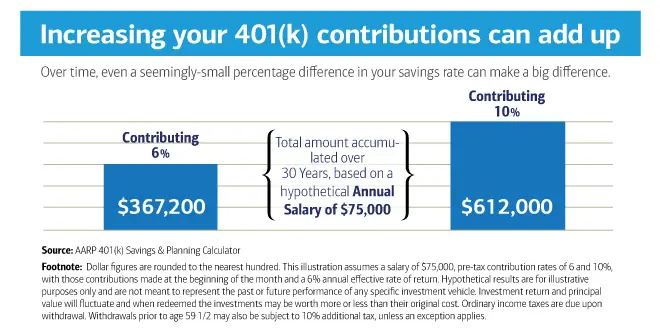

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

Read Also: When Can You Take Out 401k

How Much Interest Will 2 Million Dollars Earn

At the end of 20 years, your savings will have grown to $6,414,271. You will have earned in $4,414,271 in interest. How much will savings of $2,000,000 grow over time with interest?Interest Calculator for $2,000,000.RateAfter 10 YearsAfter 30 Years0.00%2,000,0002,000,0000.25%2,050,5662,155,5670.50%2,102,2802,322,8000.75%2,155,1652,502,54454 more rows

What Is The Average 401k Balance For A 65 Year Old

But most people dont have that amount of retirement savings. The median 401 balance is $22,217, a better indicator of what the majority of Americans have saved for retirement.Average 401 balance by age.AgeAverage 401 balanceMedian 401 balance55 to 64$171,623$61,73865 and up$192,887$58,0354 more rowsJul 20, 2020

Also Check: Should I Convert My 401k To A Roth Ira

How To Invest When To Withdraw

Pfau’s research highlights two other important variables. First, he notes that over time the safe withdrawal ratethe amount you can withdraw after retirement to sustain your nest egg for 30 yearswas as low as 4.1% in some years and as high as 10% in others. He believes that “we shift the focus away from the safe withdrawal rate and instead toward the savings rate that will safely provide for the desired retirement expenditures.”

Second, he assumes an investment allocation of 60% large-cap stocks and 40% short-term fixed-income investments. Unlike some studies, this allocation doesnt change throughout the 60-year cycle of the retirement fund . Changes in the persons portfolio allocation could have a significant impact on these numbers, as can fees for managing that portfolio. Pfau notes that “simply introducing a fee of 1% of assets deducted at the end of each year would increase the baseline scenarios safe savings rate rather dramatically from 16.62% to 22.15%.”

This study not only highlights the pre-retirement savings needed but emphasizes that retirees have to continue managing their money to prevent spending too much too early in retirement.

The Matching Contribution Bonus

For people who start saving early and take advantage of employer-sponsored plans, such as 401s, hitting savings goals isnt as daunting as it may sound. Employer matching contributions could significantly reduce what you need to save per month. These contributions are made pre-tax and it’s the equivalent of “free money.”

Say you save 3% of your income during a year and your company matches that 3% in your 401, “you will make a 100% return on the amount you saved that year,” says Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Mass.

Don’t Miss: How To Avoid Taxes On 401k

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Don’t Miss: Can You Roll Over 401k From One Company To Another

Financial Considerations Before Maxing Out Your 401

Your 401 is not the only thing that needs to be funded during your working years. There are a few key money goals that most experts agree you should focus on before you put all your excess cash in a 401. Ask yourself:

- Do you have at least three to six months of basic living expenses set aside in an emergency fund?

- Have you paid off any high-interest credit card debt, personal loans, car loans, or other debt?

- Are you on track to reach any financial goals such as having a child, paying for a wedding, or buying a home? Is there some other major purchase or milestone that you are keen on making?

- Do you have life insurance to provide for your loved ones?

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

You May Like: Who Is The Plan Sponsor Of A 401k