Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation. The total contribution limit for a solo 401 is $57,000 for 2020, not counting the employee’s $6,500 catch-up amount for those over the age of 50. For 2021, the employer maximum is $58,000. In other words, in 2021 you can contribute $58,000 along with a $6,500 catch-up contribution if applicable for a total of $64,500 for the year.

Should You Do A Roth Solo 401k

One of the options that’s become important is allowing for a Roth solo 401k. Surprisingly, many brokerage firms currently don’t allow a Roth solo 401k, but it can be a valuable option.

When it comes to your solo 401k, it’s important to remember that you have two aspects of contributions to your plan:

Where a Roth option comes in handy is if you’re looking for tax diversification. With Roth contributions, you are using post-tax money. So, you will pay more in taxes today, but you will pay less in the future. However, if you’re putting in large profit sharing contributions into your solo 401k, then it might make sense to make Roth contributions.

The reason? It will give you tax diversification in retirement. You can choose whether you use taxable or tax free money in the future – and options are always great.

The important thing to remember here is options. You just want the options to be able to invest how you choose.

How Much Can You Contribute To An Individual 401

According to Allec, the contribution limits have both an employee and employer component. You fill both those roles. In 2021, an employee can contribute up to $19,500 if they are under 50. For those 50 or older, the maximum is $26,000. The $6,500 difference is a catch-up provision, meaning older individuals can save more for their retirement.

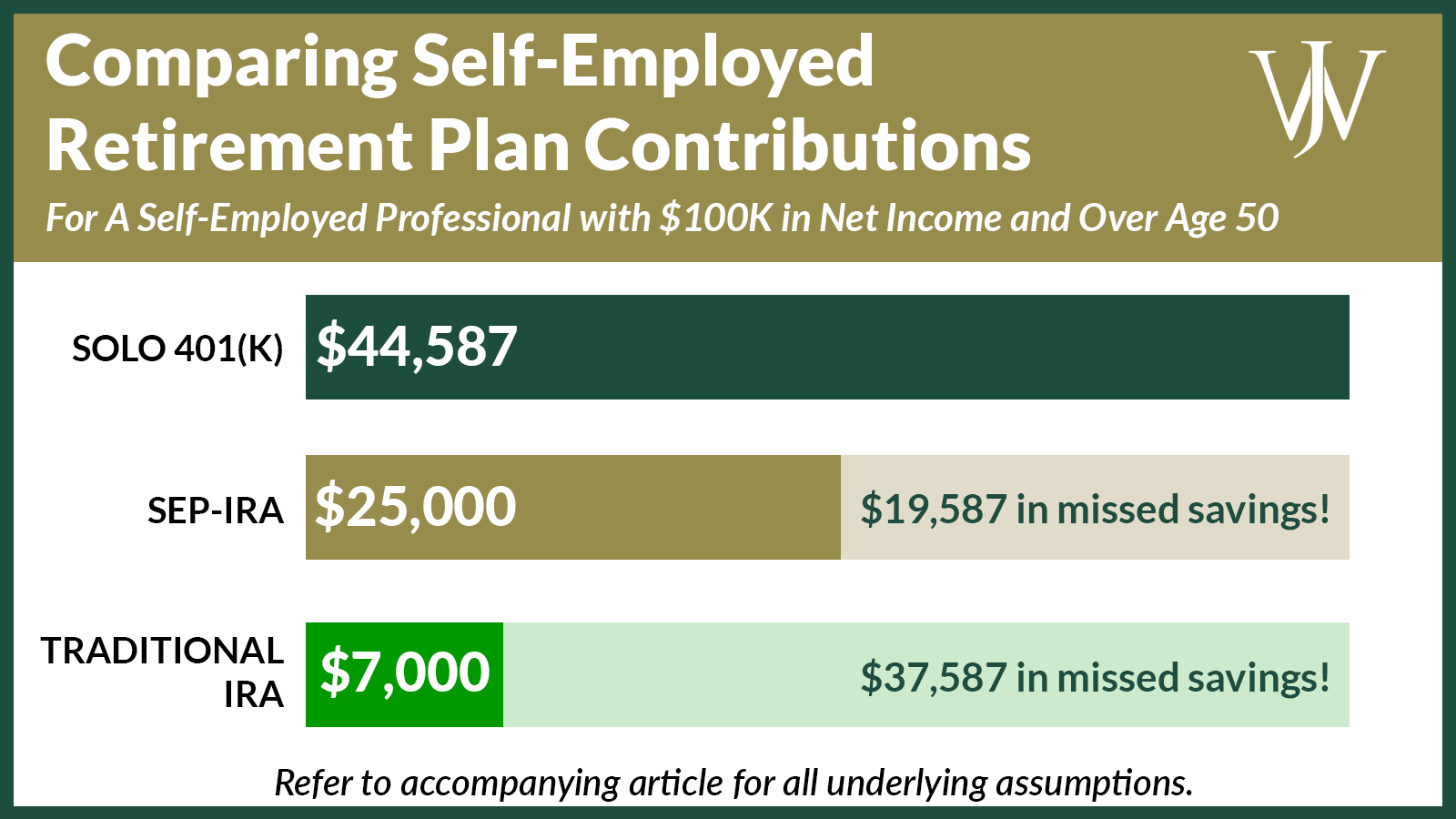

As for the employer component, you can make a nonelective contribution to the 401 of 25% of your Form W-2 wages. For example, if you earn $100,000 in wages in 2021, you can contribute $19,500 as an employee and $25,000 as an employer for a total of $44,500. For a sole proprietorship, the employer component is 20% of your net income from self-employment, which is calculated as your self-employment income as reported on Schedule C, less your deduction for half of the self-employment taxes paid.

When you contribute as both an employee and an employer, the threshold amount in 2021 is $58,000 if you’re under 50 and $64,500 if you’re 50 or older.

These limits usually change every year, and typically they go up to adjust for inflation. The increase is usually a round number, not a percentage.

If your spouse works for your business and is compensated, he or she can participate in your business’s solo 401 at the same limits as above.

Recommended Reading: What’s The Maximum Contribution To A 401k

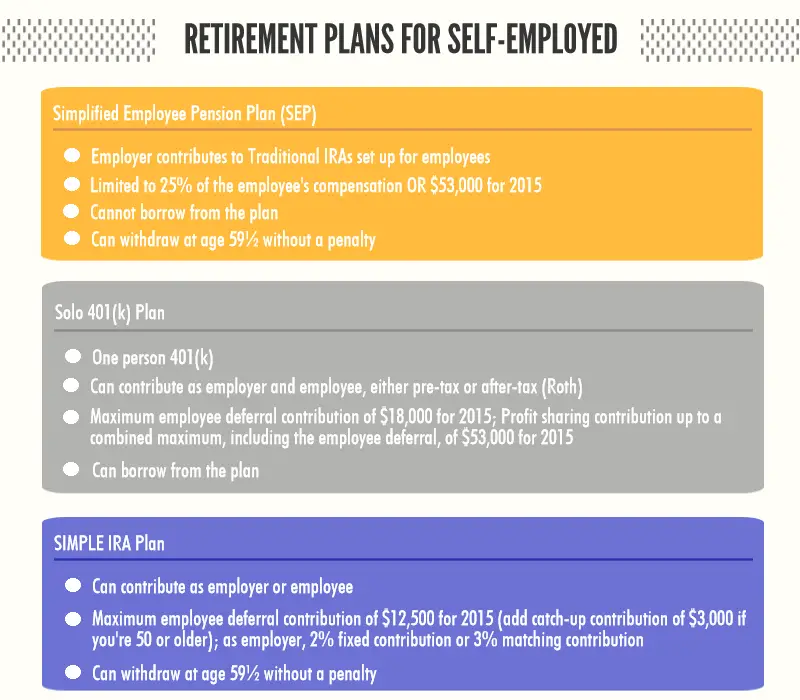

Savings Incentive Match Plan For Employees Ira

If you received at least $5,000 in compensation from your business in each of the previous two years, you can make pretax contributions to a SIMPLE IRA. As of 2021, up to $13,500 of your net earnings from self-employment can go into the plan. In addition, you can either contribute up to a 3% match of your net earnings from self-employment, or make a fixed contribution of 2% of net earnings from self-employment that don’t exceed $290,000 for 2021.

How To Open A Traditional And Roth Solo 401k

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Also Check: How To Open A 401k Plan

Tax Benefits Of A Solo 401 Plan

If the couple continued to work as outlined in the example, all of that money would stay within the protected confines of the 401 account, earning dividends, interest, capital gains, and profits without having to pay any income taxes until they began withdrawing from the plan.

They would pay taxes in the 12% tax bracket and have enough retirement income to withdraw the same amount as they paid themselves while they were working. They would have plenty of money left over in their accountthey could withdraw $75,000 per year for the rest of their lives and still have their plan earning more than $190,000 per year for them x 8% per year).

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contribution may be made up through the business tax filing due date plus extensions.

Also Check: How To Borrow From 401k For Home Purchase

What Are The Tax Benefits Of A Solo 401

Solo 401s share the same tax benefits as their traditional 401 counterparts.

You can elect to contribute pre-tax earnings to your Solo 401 and pay taxes when you distribute your funds during retirement. In turn, youâll lower your immediate income tax obligation.

Or, you can choose to contribute after-tax earnings into a Roth Solo 401, then your distributions during retirement would be tax-free.

Additionally, any matching contributions you make as your employer are tax-deductible for your business, lowering its tax obligation as well.

Benefits Of A Solo 401

Solo 401s provide several advantages over other types of retirement accounts.

One of the main advantages is that contribution limits are typically the highest among retirement plans. Like an employer-sponsored 401, contributions can be made from the employee and employer. With a solo 401, you wear both hats and can make contributions in both roles.

You May Like: What Is The Difference Between Roth 401k And Roth Ira

An Example Of How A Roth 401 Plan Works

To demonstrate how extreme this tool can be for super-savers and aggressive investors: a successful married couple in 2021 could put up to $39,000 between the two of them into these tax shelters. For the sake of perspective, picture an affluent husband and wife, 30 years old, who are in the top of the household income distribution. They set up their new retirement system and fund it, earning an average of 7% every year for 35 years, never missing an Individual Roth 401 contribution. By the time they turned 65, they could be sitting on more than $5.8 million in tax-free wealth.

Who Wants A Self

The self-directed IRA might appeal to an investor for any of several reasons:

- It could be a way to diversify a portfolio by splitting retirement savings between a conventional IRA account and a self-directed IRA.

- It could be an option for someone who got burned in the 2008 financial crisis and has no faith in the stock or bond markets.

- It may appeal to an investor with a strong interest and expertise in a particular type of investment, such as cryptocurrencies or precious metals.

In any case, a self-directed IRA has the same tax advantages as any other IRA. The investor who has a strong interest in precious metals can invest pre-tax money long-term in a traditional IRA, and pay the taxes due only after retiring.

The self-directed aspect may appeal to the independent investor, but it’s not completely self-directed. That is, the investor personally handles the decisions on buying and selling but a qualified custodian or trustee must be named as administrator. Otherwise, it’s not an IRA as the IRS defines it.

The administrator is usually a brokerage or an investment firm.

Also Check: How To Find Lost 401k

What Are The Differences Between Making Pre

Self Employed 401k salary deferral contributions can be made as Roth 401k or Traditional 401k .

The basic difference between a Roth 401k and a Traditional 401k is that the Roth 401k is funded with after-tax contributions while the Traditional 401k is funded with pre-tax contributions. In other words, with a Roth 401k you pay taxes today in return for a tax-free withdrawals in retirement. Traditional 401k contributions are tax deductible and are made pre-tax so you save taxes today, but withdrawals are taxed in retirement. As a result, the choice between the two 401k options comes down to whether you believe your income taxes rates will be higher or lower in retirement. If you believe your income tax rates will be higher at retirement then making Roth 401k contributions may be more advantageous. Also, there may be some estate tax benefits of a Roth 401k because in the case of death, the Roth 401k assets are tax free to your heirs.

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

Also Check: How Much Does A 401k Cost A Small Business

Retirement Planning For The Self Employed

Not everyone has a boss. In an economy upended by COVID, individuals, sometimes by choice and sometimes not, are striking out on their own and starting new businesses or becoming part of the gig economy. A critical issue for these workers is how to save for retirement. If you are self-employed, you may ask which retirement account is best for you. This question requires careful analysis because there is not one plan that is right for everyone.

Traditional or Roth IRA

For many who are new to gig work or have just started their own business, the best place to start saving for retirement may be with a traditional or Roth IRA. This is the easiest way to go. It simply requires making a contribution. However, the annual contribution limits are much lower than for other retirement savings options. For 2021, the maximum IRA contribution is $6,000 for those under age 50 and $7,000 for those over age 50. For those just starting out, the low dollar limit may not be a problem, but for higher earners it may not allow enough savings.

For those who are interested in a Roth option, a Roth IRA may be a good idea because there are no Roth options available for SEP IRA or SIMPLE IRA plans. However, Roth IRAs are subject to income limits, so this may not work for those with higher incomes.

The SEP limit for 2021 for self-employed individuals is 20% of up to $290,000 of compensation , limited to a maximum annual contribution of $58,000.

SIMPLE IRA Plan

Solo 401 Plan

Making the Choice

What Fees Are Associated With A Solo 401

Annual or maintenance fees for these plans, according to Allec, usually run between $20 and $200. You’ll pay the least if your needs are simple you don’t have any employees besides yourself, there’s no rollover and you’re OK with investing in a budget brokerage firm’s products. If you have more interesting investment appetites, another provider can accommodate those. These providers usually charge higher fees to maintain your plan, but you also have more flexibility with your investment and plan options.

Also Check: What Happens To My 401k If I Switch Jobs

Do I Need A 401 Solo Plan

For sole proprietorship businesses, solo 401 plans are very effective ways to set aside and grow a large amount of money for retirement. If you’re a small business owner and don’t yet have a retirement plan set up, a solo 401 is an excellent way to save for retirement.

If you happen to need to hire employees at some time during your business’s lifetime, you’ll need to be sure to adjust the plan to include them equally or create criteria to define benefit-eligible employees and create retirement plans for them.

What If I Run A Small Business With Employees

Once you have employees, the rules of the road change a bit. A great choice is a SIMPLE IRA, which requires you to offer up to a 3% match for your employees every yearand contributions are tax-deductible. SIMPLE IRAs come with an individual limit of $13,500 a year.8

|

Retirement Option |

|

25% of earned income |

You May Like: How Do I Open A 401k Account

Can You Contribute A Lump Sum To A Self

According to Bergman, a self-employed individual can usually make an employee deferral lump-sum contribution to a plan so long as he or she has sufficient earned income. However, in the case of a W-2 owner/employee, the employee deferral contribution should not be more than the income earned for that income period. In the case of employer profit-sharing contributions, those can be made by the employer in a lump sum.

How To Start A Solo 401

Follow the steps below if you’re interested in opening up a solo 401.

Once you’ve done these four things, you may begin choosing your investments and making regular contributions to your account. You can also roll over funds from other retirement accounts in your name if you choose.

You must make your solo 401 employee contributions by Dec. 31, but you have until the tax filing deadline for the year — usually April 15 of the following year — to make your employer contribution.

One last thing to note is that if you have $250,000 or more in your solo 401 by the end of the year, you’re required to submit a Form 5500-EZ information return to the IRS with your taxes for that year so you don’t run into trouble with the federal government.

Recommended Reading: How To Rollover Fidelity 401k To Vanguard

To Roll Over Other Plan Assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

You Earn A High Income And Would Like To Make Roth Ira Contributions But Cant Based On The Roth Ira Income Limits

- Roth IRAs have income limits, but Self Employed Roth 401k plans have no income limits.

- Everyone qualifies for a Self Employed Roth 401k. In 2020 you cant contribute fully to a Roth IRA if your adjusted gross income exceeds $196,000 if you file a joint tax return with your spouse and $124,000 if you file as single or head of household.

- Higher contribution limits are permitted with a Self Employed Roth 401k than a Roth IRA regardless of income.

- In 2020 participants can contribute up to $19,500 to a Roth 401k and $26,000 if age 50 or older. 2020 Roth IRA contribution limits are $6,000 and $7,000 if age 50 or older.

Read Also: How To Rollover 401k From Empower To Fidelity