Getting The Most From Your Employer 401 Match

Getting the most from your 401 plan is one of the best things you can do when planning your retirement. That’s because your employer may match the money you put into your account. If you work at a place that offers a 401 match benefit, when you put money from your paycheck into your 401, your employer puts money into the account, too.

If your company offers a match, you may have gotten a notice about it when you started your job. You can ask the 401 plan manager at work whether a 401 match is offered if you haven’t already heard about it. Companies want employees to contribute to their 401, so they match the funds as a way to spur on workers to save for their futures.

Think of matching funds as free money you receive from your job after you make pre-tax contributions to your 401 plan from your paycheck. If you fail to put money into your 401, you give up the chance to receive your employer’s matching amount.

How Do I Maximize My Employer Match

If youre not maximizing your employer match, youre in the minority. In 2018, nearly two-thirds of Vanguard plan participants received the full employer-matching contribution.

While you can contribute up to the maximum amount specified by the IRS, you can contribute less. To make the most out of your workplace retirement plan, set the minimum contribution to your plan to reach your employers maximum matching contribution.

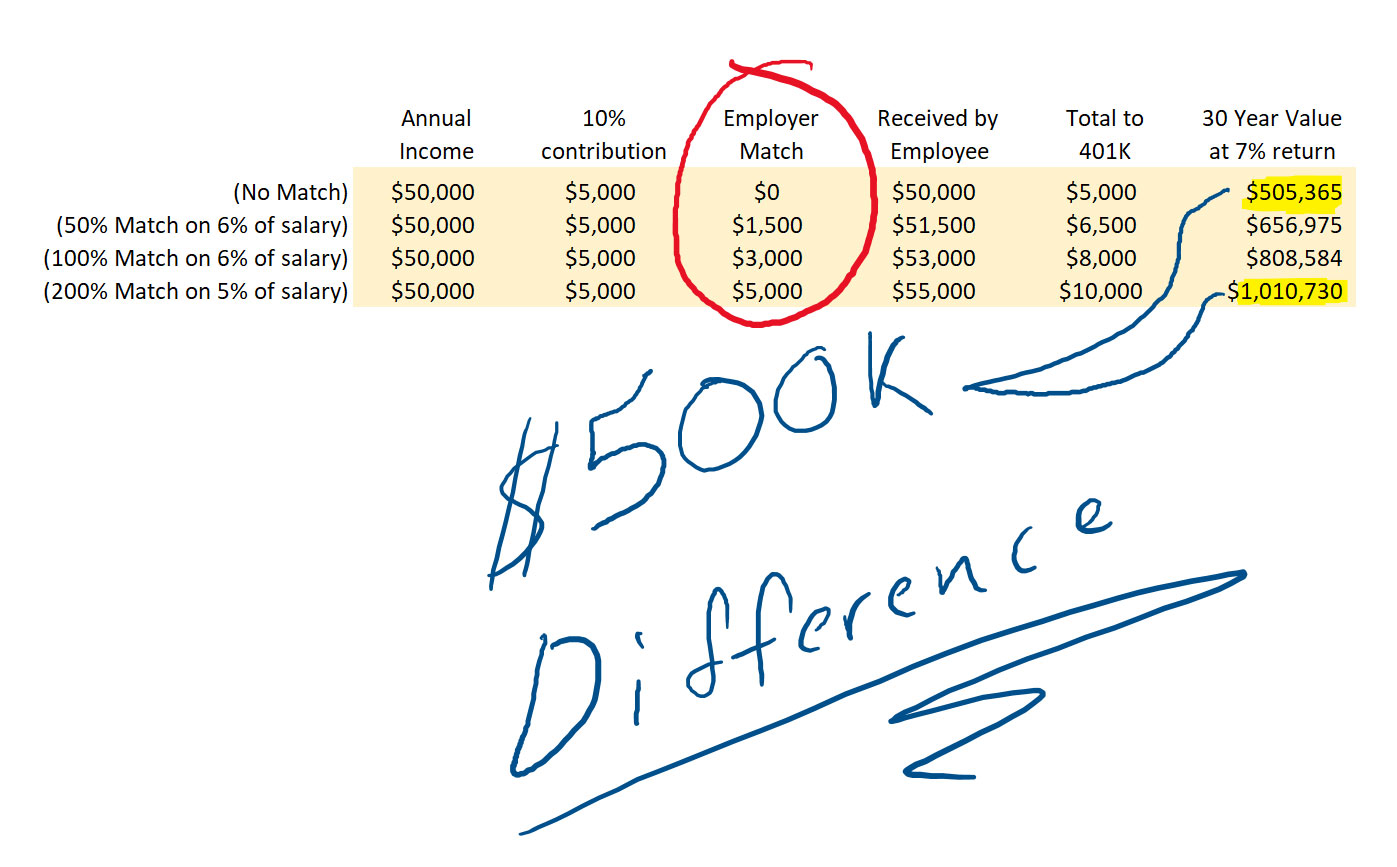

Lets calculate what a match might look like assuming you have an annual salary of $50,000:

| Employer Match Type | ||||

|---|---|---|---|---|

| $0.50 per dollar on the first 6% of pay | $3,000 | $4,500 | ||

| Multi-tier formula | $1.00 per dollar on the first 3% of pay $0.50 per dollar on the next 2% of pay | $2,500 | $2,000 | $4,500 |

In 2018, the average employee contribution to maximize employer match was 7.4% of their annual pay, according to Vanguard data. Your plan rules will dictate the actual contribution percentage to maximize your employer match so contact your plan administrator for more details.

How Much Can I Contribute

Another good reason to take advantage of a 401 match is that it allows you to exceed the annual 401 maximum contribution limits set by the IRS. For 2020 and 2021, you can contribute up to $19,500 of pretax income to a 401. If you are 50 or older, you can contribute another $6,500 in what are called catch-up contributions.

When including employer contributions, the maximum amount you can contribute in 2020 is the lesser of $57,000 for participants 49 or younger or 100% of the participant’s compensation. In 2021, the limit is $58,000 for participants 49 or younger .

You May Like: Can I Sign Up For 401k Anytime

Suggested Next Steps For You

If you are not able to max out your 401k contributions, then the best strategy may be to contribute the minimum amount required to take advantage of your employers contributions.

Here are some steps you can take now, and for free, to help you manage and evaluate your 401k:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Understand The Value Of An Employer Match

A 401 or similar employer-sponsored retirement plan can be a powerful resource for building a secure retirementand an employer match can add a substantial amount to your nest egg. Let’s assume you are 30 years old, make $40,000 and contribute 3 percent of your salary$1,200to your 401. And, for the sake of this example, let’s assume you continue to make the same salary and the same contribution each year until you are 65. After 35 years, you will have contributed $42,000 to your 401.

Now let’s assume you get a match from your employer. One of the most common matches is a dollar-for-dollar match up to 3 percent of the employee’s salary. Taking full advantage of the match literally doubles your savings, even assuming no increase in the value of your investments: Instead of having set aside $42,000 by the time you retire, you will have set aside $84,000, with $42,000 in free contributions. Look at it this way: it’s a no-cost way for you to increase your contributions by 100 percent.

In reality though, the impact will be even bigger than that. That’s because when you invest money its value compounds. Check out The Time Is Now: The True Value of Time for Young Investors to learn how taking full advantage of a match early in your career can add up.

Also Check: How Do I Find My Old 401k Account

Assign The Matching Benefit To An Employee

On the Cards menu, point to Payroll, and then click Benefit.

In the Employee Benefit Maintenance window, type an employee ID in the Employee ID field. In the Benefit Code field, type the benefit code that you created.

When you are asked whether you want to use the default information from the Benefit Setup window, click Default.The default entries from the Benefit Setup window will populate specific fields. However, you may want to change the matching benefit as necessary for specific employees.

Click Save.

Calculation 1

Consider the following scenario:

-

You want to match 50 percent of the deduction up to 4 percent of gross wages

-

The employee wants to withhold 4 percent of gross wages or less on the deduction

In this scenario, the benefit will be 50 percent of the deduction. The benefit is calculated as follows:

benefit = deduction × benefit percentageIn this scenario, the specific benefit is calculated as follows:

benefit = deduction × 0.5

Calculation 2

If the employee wants to withhold more than 4 percent of gross wages, the benefit will match 50 percent up to 4 percent of the gross wages. The benefit will be calculated as follows:

benefit = gross wages × employer maximum × benefit percentageIn this scenario, the specific benefit is calculated as follows:

benefit = gross wages × 0.04 × 0.5

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

Don’t Miss: What Is An Ira Account Vs 401k

Why Do Employers Match 401s Anyways

401s and other defined contribution plans are more cost-effective for the employer than managing a traditional pension plan funded entirely by the company, and are also preferred by most private-sector employees.

While an employer match is not required by the IRS, this company match can be a selling point for recruiting employees particularly if competing firms are offering a generous 401 matching plan.

Employers also get tax benefits for contributing to 401 accounts employer matches can be deducted on their federal corporate income tax returns, and theyre often exempt from payroll taxes and state taxes as well.

Whats A Typical Employer Match To A 401

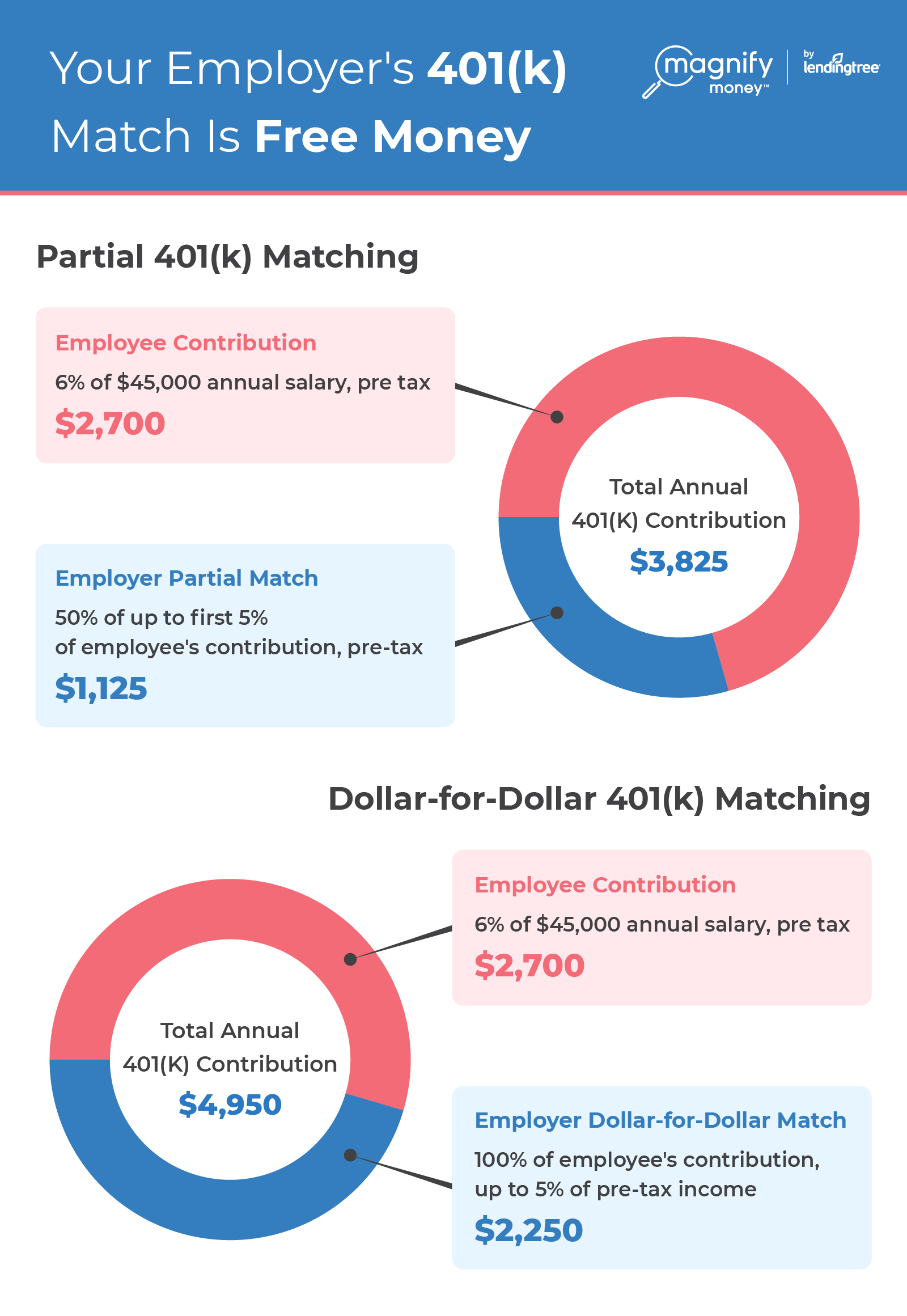

Ever wondered how employers calculate matched contributions? In 2018, Vanguard administered more than 150 distinct match formulas . With 71% of plans using it, the most popular formula is the single-tier formula, such as $0.50 per dollar on up to 6% of pay. Under this single-tier formula, an employee making $60,000 per year could get up to $1,800 in employer-matched contributions.

Here are the most common employer matching formulas per the Vanguard survey:

| Match Type | Percentage of Plans Using This Type | |

|---|---|---|

| Single-tier formula | $0.50 per dollar on the first 6% of pay | 71% |

| Multi-tier formula | $1.00 per dollar on the first 3% of pay $0.50 per dollar on the next 2% of pay | 21% |

| Single- or multi-tier formula with a $2,000 maximum | 6% | |

| Variable formula, based on age, tenure or similar vehicles | 2% |

There are literally hundreds of matching formulas out there, so contact your 401 plan administrator regarding the rules and specifics of the matching formula used by your employer.

-

The most common matching formula among Vanguard plan holders was $0.50 per dollar on the first 6% of pay.

-

The second most popular formula for employer matching contributions is $1.00 per dollar on the first 3% of pay and $0.50 on the next 2% of pay. Under this multi-tier formula, the same worker in our previous example would receive up to $2,400 in matching contributions.

Don’t Miss: How Much Can You Put In Your 401k A Year

Safe Harbor Matching Formulas In 2021

Another type of 401 plan, popular particularly among small businesses with a handful of highly compensated employees, is the Safe Harbor plan which exempts them from annual ADP and ACP nondiscrimination testing, in exchange for agreeing to make generous and fully vested 401 contributions to all eligible employees.

The most common formulas for 401 matching contributions are:

- Basic Match: 100% match on the first 3% put in, plus 50% on the next 3-5% contributed by employees.

- Enhanced Match: 100% match on the first 4-6% put in.

- Nonelective Contribution: 3% of employee compensation, regardless of employee deferrals.

Retirement Isn’t Freebut Your 401 Match Is

Many of us herald this time of year as the arrival of summer, the end of the school year and seemingly longer days with more sunlight. Yet June is also a great time to check in with your employer-sponsored retirement plan.

Are you leaving free money on the table? In addition to offering the potential for free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Here are four steps to get the most out of your retirement savings.

Read Also: Should I Open A 401k

How This Should Impact Your 401 Deferral Strategy

The purpose of an employer match is to get employees to contribute to their 401 plans. Vanguards figures suggest this is fairly successful 65% of 401 plan participants contribute at least enough to qualify for the maximum employer match available from their plans.

The flip side, though, is that this means over one-third of plan participants are not contributing enough to maximize the money they could be getting from their employers.

Recognize The Tax Advantages

In addition to potentially offering free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Contributions to tax-advantaged retirement accounts, such as a 401, are made with pre-tax dollars. That means the money goes into your retirement account before it gets taxed.* Plus, your contributions, any match your employer provides and any earnings in the account are all tax-deferred. That means you don’t owe any income tax until you withdraw from your account, typically after you retire.

With pre-tax contributions, every dollar you save will reduce your current taxable income by an equal amount, which means you will owe less in income taxes for the year. But your take-home pay will go down by less than a dollar.

You May Like: How Do I Stop My 401k

How Does The Employer Match Work

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution: a percentage of the employees own contribution and a percentage of the employees salary. Employers might match 25%, 50%, or even 100% of an employees contribution up to a set percentage of the employees salary.

Some companies may match contributions dollar for dollar, while others match at a smaller percentage. Other employers may set a hard dollar-based cap instead of limiting match contributions to a percentage of the employees total salary. Total employer contributions cannot exceed 25% of eligible employees annual salary or compensation.

No matter what your companys match program is, its important to strategize. Retirement experts regularly encourage employees to contribute enough to reach the maximum possible employer contribution, or at least as much as they can comfortably contribute. This ensures employees arent leaving money on the table, especially since its part of their total compensation.

Do Employers Really Match Contributions To 401s

Yes. And it has been the norm for several years now. In the 18th edition of its How America Saves report, Vanguard analyzed 1,900 defined contribution retirement plans plans) representing a total of 5 million participants and found that 95% of plans provide employer contributions, up from 91% in 2013.

Employers recognize the power of a 401 as a strong tool for attracting and retaining talent. 31% of employees value an employer-sponsored 401 over a salary raise, according to a Glassdoor poll. In addition, a 401 match contribution is tax-deductible for employers. Every dollar a company contributes to employees 401 plans is tax-deductible, providing ongoing tax benefits to companies.

Read Also: How To Get My 401k Early

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

$1 Million Has Long Been The Recommended Goal For Retirement Savings Some Even Suggest That Number Should Be Upgraded To $2 Million For Millennials And Gen Z

If these numbers are starting to give you anxiety, youll be happy to hear that theyre reachable. According to Fidelity, the number of 401 plans with a balance of $1 million or more jumped to a record 168,000 in the second quarter of 2018, up from 119,000 a year earlier. Thats a 41 percent surge!

One of the top ways to make a $1 million 401 a reality is to take full advantage of your employer match. Thats when an employer contributes an amount to your retirement savings plan in addition to what you contribute. The rules for matches vary by company, and often depend on the amount that you contribute yourself.

Lets break down how employer matching works, the key rules to review, and how to maximize contributions to your workplace retirement plan.

Also Check: How To Find Out If Someone Has A 401k

Simplified Formula Example 401k Match

In this video we’ll look at how to simplify some formulas we created in a previous video by replacing IF statements with the MIN function and a bit of Boolean logic.

Make sure you watch the first video if you haven’t already.

In the example we have formulas that calculate a company match for an employer-sponsored retirement plan in two tiers.

The calculations for both tiers use one or more IF statements, and the second formula is a bit complicated.

Let’s look at how we can simplify these formulas.

=IFFor Tier 1, the company match is capped at 4%. If the deferral is less than or equal to 4%, we can simply use it as is and multiply C5 by B5, but when the deferral is greater than 4%, we simply multiply 4% by B5.

First, we can simplify things a bit by just having the IF function figure out the percent. Then multiply the result by B5.

=IF*B5It’s always a good idea to remove duplication in a formula when possible.

But we can also remove the IF function completely by using the MIN function instead.

=MIN*B5Essentially, the way this works is that we take the smaller of C5 or 4%, then multiply by B5. No need for IF.

For Tier 2 we have a more complicated formula:

=IF*B5,2%*B5))*50%Now in the outer IF, we check the deferral, and if it’s less than 4%, we’re done. This means the entire match is handled in Tier 1, so Tier 2 is simply zero.

Let’s first move B5 out of the IF like we did before.

=IF*B5)*50%=IF,0%)*B5*50%=*MIN,0%)*50%*B5What If I Have A Roth 401

If you have a Roth 401, you pay income taxes on your contributions now, rather than when you take that money out during your retirement. But your employer isnt likely to pay the taxes on matching contributions , so if you have a Roth, their matching contributions usually go into a separate, traditional 401. Youll pay the taxes on the traditional when you withdraw the money.

Also Check: What Should I Do With My Old Company 401k