How Much Will You Need In Retirement

The sum youll need to retire is a highly personal question but needs careful consideration.

I believe retirement is a financial number versus a retirement age. Assess how much you need in your retirement account to live at least 20 years in retirement without having to go back to work to pay your bills, says Shaquana Watson-Harkness, personal finance coach and founder of Dollars Makes Cents, an online debt management and investing training course.

Rita-Soledad Fernández Paulino, a NextAdvisor contributor and creator of Wealth Para Todos, told us how she calculates her financial independence number using Trinity Studys 4% rule. According to the 4% rule, you can estimate how much money youll need to live on during retirement using this quick calculation:

Annual Expenses x 25 = Nest Egg .

For example, if your annual expenses are $40,000, multiply that by 25 for a total of $1M the amount youd need to retire, based on the 4% rule above.

If youre already freezing up thinking about million-dollar sums, remember youre not solely responsible for saving up this much on your own. The market, through compound interest, will do most of the heavy lifting for you, especially if you invest early and let your portfolio grow for decades.

Thats why starting early is so important.

My Personal 401k Situation

My husband and I are attempting to save for retirement in multiple ways so that we will never be forced to take more than we want from any one savings plan. Theoretically, we should be able to balance the taxed withdrawals from my 401k along with non-taxed withdrawals from our Roth IRAs in such a way as to stay in the lowest tax bracket in retirement. This method should also allow us to stretch all of our retirement accounts to cover nice, long lives.

What are your experiences with a 401k?

Roth 401 Vs Traditional 401

Although the contribution limits are the same for traditional 401 plans and their Roth counterparts, technically, a designated Roth 401 account is a separate account within your traditional 401 that allows for the contribution of after-tax dollars. The elected amount is deducted from your paycheck after income, Social Security, and other applicable taxes are assessed. The contribution doesn’t garner you a tax break in the year you make it.

The big advantage of a Roth 401 is that no income tax is due on these fundsor their earningswhen they’re withdrawn after you retire. A traditional 401 works in the opposite way: Savers make their contributions on a pretax basis and pay income tax on the amounts withdrawn once they retire. Neither of these 401 accounts imposes income limitations for participation.

When available, savers may use a combination of the Roth 401 and the traditional 401 to plan for retirement. Splitting your retirement contributions between both kinds of 401s, if you have the option, can help you ease your tax burden in retirement.

Read Also: How To Take Out 401k Money For House

The Contribution Limits Also Apply To Roth 401 Contributions

Contribution limits for Roth 401 contributions are the same as they are for traditional 401 contributions. That means you can contribute up to $19,500 per year to either a regular 401 plan, or a Roth 401 plan.

More likely, you will want to contribute to both, in which case youll have to allocate how much of the $19,500 limit will go into each part of your 401.

Not coincidentally, the 401 limits are virtually the same as the limits for both the 403 plan and the Thrift Savings Plan .

In addition, any employer matching contributions to the plans are not included in the employee contribution limits listed above.

Your employer can contribute a matching contribution that exceeds the $19,500 regular contribution limit, or even the combined $26,000 limit if you are age 50 or older. It is always a good idea to figure out whether a Roth 401k vs Roth IRA is best for you.

Can I Contribute 100 Percent Of My Salary To A 401

If your earnings are below $19,500, then the most you can contribute is the amount you earn. It should also be noted that a 401 plan document governs each particular plan and may limit the amount that you can contribute. This applies especially to highly compensated employees, which in 2021 is defined as those earning $130,000 or more or who own more than 5 percent of the business.

Sponsors of large company plans have to abide by certain discrimination testing rules to make sure highly compensated employees dont get a lopsided benefit compared to the rank and file. Generally, highly compensated employees cannot contribute higher than 2 percentage points of their pay more than employees who earn less, on average, even though they likely can afford to stash away more. The goal is to encourage everyone to participate in the plan rather than favor one group over another.

There is a way around this for companies that want to avoid discrimination testing rules. They can give everyone 3 percent of pay regardless of how much their employees contribute, or they can give everyone a 4 percent matching contribution.

Also Check: How To Recover 401k From Old Job

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

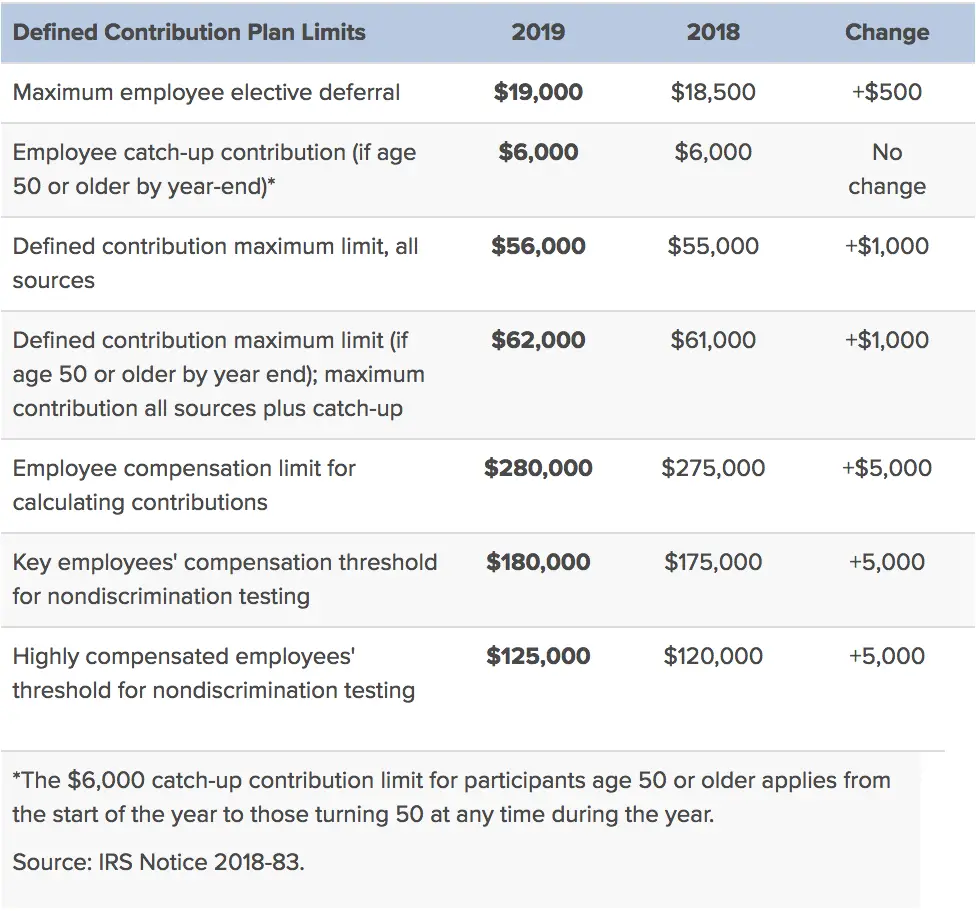

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Here’s an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Maximum 401 Company Match Limits

To account for inflation, the employee and employer match limits for 401s fluctuate each year. Since inflation is projected to rise, the contribution maximum is increasing as well. According to the IRS, the employee contribution amount limits per year include:

- 2018: $18,500

- 2019: $19,000

- 2020: $19,500

The contribution amount employers decide to match often varies depending on the companys overall budget. The limit per year that employees and employers can contribute combined include:

- 2018: $55,000

- 2019: $56,000

- 2020: $57,000

If you have employees who are 50 years and older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2018 and 2019 but increased in 2020. The limits for these additional contributions per year are:

- 2018: $6,000

You May Like: How To Withdraw My 401k From Fidelity

Total Annual 401 Contribution Limits

Total contribution limits for 2021 are the following:

- $58,000 total annual 401 if you are age 49 or younger

- $64,500 total annual 401 if you are age 50 or older

The dollar amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

What Is A Highly Compensated Employee

The IRS definition of a HCE can change each year. An employee who earns more than $130,000 in 2021 is an HCE. The IRS also uses a calculation called annual nondiscrimination testing that applies to HCEs.

Unless youre the business owner or executive, you wont need to worry about being a highly compensated employee. And, if you are, you should speak with a financial planner to understand what limits apply to you. The rules require computations that youll want a professional to perform.

We can help you gain control of your finances and live better…for less.

, our daily email newsletter. It doesn’t cost anything. And, it could make a huge difference in the way you live! Subscribers get Are You Heading for Debt Trouble? A Simple Checklist and What You Can Do About It for FREE!

Start your journey to financial independence.

to get money-saving content by email each day aimed at helping you live better for less, get better with money, and fix your finances so you can achieve financial independence.

Since one of the biggest hurdles to achieving financial independence is debt, subscribers get a copy of Do You Have Too Much Debt? A Checklist and Solutions for FREE!

We respect your privacy. Unsubscribe at any time.

You May Like: How Do I Transfer 401k To New Employer

How Do Employer Contributions Factor In

One of the best things about using a 401 for retirement is that many employers match your contributions. Imagine that your employer matches 50 cents for every dollar an employee contributes. That means your employer is giving you 50 cents free for each dollar you contribute.

Up to a certain limit, employers can also choose to make contributions no matter what you contribute yourself. That means that even if youre not maxing out your 401, an employer can give you a holiday gift of $1,000 into your 401 regardless of what youre putting in.

The total contribution limit is $58,000 for both employers and employees, or 100% of their total pay. Remember that, if youre over 50, your base contribution limit increases to $64,500. Thats $58,000 plus $6,500 in catch-up contributions.

Highly compensated employees those who earn more than $130,000 in compensation or own more than 5% of the company regardless of compensation face stricter contribution limits to their 401. This is to prevent wealthy employees from unfairly benefiting from tax benefits associated with 401 plans. To combat this, the IRS uses a test called the actual deferral percentage, or ADP. This helps to ensure every employee is participating proportionately to their company’s 401 plan.

Are There Separate Limits For Roth 401s

No. Roth 401s have the same contribution limit as regular 401s. For 2021, that limit is $19,500. You can contribute to both a traditional 401 and a Roth 401 account in the same year, as long as your total contributions dont exceed that amount. If youre choosing between the two, learn about the differences between a Roth and traditional 401.

|

career counseling plus loan discounts with qualifying deposit |

Promotionno promotion available at this time |

Promotionof free management with a qualifying deposit |

Also Check: Can You Convert Your 401k To A Roth Ira

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $56,000 for 2019, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,000 employee contribution to the Roth solo 401k for 2019, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,000 employee contribution on the Roth solo 401k. Note that you can also split up the $19,000 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,000 of catch-up contributions to work with if you are age 50 or older in 2019 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

Save As Much As You Can

For most people, the biggest factor in the size of your 401 balance at retirement isn’t your rate of return, but the amount you save. Consider two employees who each earn $100,000 a year, get 3 percent raises each year, and earn 5 percent on their 401 plan. One contributes 5 percent of his salary each year the other contributes 8 percent. After 20 years, the worker who invests 5 percent of her salary a year will have $222,386. A worker who invests 8 percent will have $355,818.

“Anytime you can increase your savings is always a good idea, says Michael Foguth, president and founder of Foguth Financial Group in Brighton, Mich. So, yes, maxing out a retirement account is a good strategy to boost savings quickly.”

And if you can afford to save more, turbocharge your savings by taking advantage of the catch-up contribution if you’re over 50, adds Foguth. It allows you to save more money in your older working years, which is critical because you’re likely closer to retirement, he says.

And if can’t afford to max out your 401 right now, but that’s your goal, don’t give up. Do it gradually over time, says Michael Ingram, CFP, partner and wealth advisor at Octavia Wealth Advisors in San Diego.

Also Check: How Do I Transfer My 401k To A Roth Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The 401 Max Contribution For 2020

In November 2019, the IRS announced that the contribution limits were higher for 2020. Employees who participate in 401, 403, and most 457 plans can now contribute $19,500. Combined employer and employee contribution limits increased to $57,000. If youre over the age of 50, the limit is $6,500.

The limits increased by $500 for individuals and seniors and $1,000 for combined employer and employee contributions.

Don’t Miss: How Do You Take Money Out Of 401k

Do Employer Pension Plan Contributions Affect Your Rrsp Limit

Yes, RRSPs and registered pension plans share contribution room. The main difference between the two is an RRSP is set up by individuals and funded solely by personal contributions, while a pension plan is run by employers.RRSPs and pension plans provide similar tax-deferred benefits, but are funded by different sources . Thats why they share contribution room: to prevent people who have both a workplace pension and an RRSP from double-dipping on tax benefits.When you and/your employer contribute to your pension plan, it reduces your RRSP contribution room the following year. This amount is called a pension adjustment, and can be found on the T4 slip given to you by your employer each year.

Hsa Contribution Limits Increase

If youre already maxing out your 401 or other retirement contributions, you might consider putting pre-tax dollars toward an HSA , if you have one. An HSA helps those with high-deductible health plans save taxes on money earmarked for medical expenses not covered by the plan.

Unlike a flexible spending account , which has a use it or lose it provision, the assets you contribute to an HSA are yours for the long term and can be rolled over each year. Plus, it offers a triple tax advantage: money put in isnt taxed, it grows tax-free, and youre not taxed when you take money out to pay for qualified medical expenses.

Taking advantage of the increased 2021 HSA contribution limits may help you pay for health-related expenses down the line in retirement.

| Coverage type |

|---|

| $7,200 |

You May Like: Why Cant I Take Money Out Of My 401k

Contribute To A Roth Ira

The Roth IRA is the peanut butter to the 401s jellythey just go better together! The beautiful thing about the Roth IRA, which stands for individual retirement account, is that it lets you enjoy tax-free growth and tax-free withdrawals in retirement. Tax-free . . . dont you just love the sound of that?

In 2021, you can put up to $6,000 into a Roth IRA .6 Sticking with our example above, maxing out your Roth IRA and investing $6,000 into your account brings your total retirement savings for the year to $9,750 . . . just a little bit short of your retirement savings goal.

So what are we going to do with the remaining $1,500? Its time to send you back . . . back to the 401!

How Much Can I Contribute To A 401k

Most employees can currently put in $19,500 a year of their own money in a 401k account, excluding employer contributions.

However, workers who are older than 50 years old are eligible for an extra catch-up contribution of $6,500 in 2020 and 2021.

It means over-50s can contribute up to $26,000 each year.

The current limit on total employer and employee contributions is $57,000, or 100% of employee compensation , whichever is lower.

For workers age 50 and up, the base limit is $63,500.

You can contribute to multiple traditional 401k plans and Roth 401k accounts in the same year, but your total contributions can’t exceed the annual limit.

Money guru Dave Ramsey recommends households to max out the amount of contributions, if you can afford it – but it will be a lot of money for some.

Don’t Miss: How Do I Invest In My 401k