Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $22,500, your taxable earnings for the 2022 tax year would be $57,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $22,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $66,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

Other Irs Retirement Account Changes For 2023

In addition to contribution increases to 457, 403, and 401 plans, the IRS has additional 2022 updates:

-

SIMPLE retirement plan contribution limits increased to $15,500 in 2023 .

-

Traditional and Roth IRA contribution limits increased to $6,500 in 2023 traditional and Roth IRA catch-up contribution limits remain at $1,000.

-

Income ranges for determining eligibility to make deductible contributions to traditional IRAs, to contribute to Roth IRAs, and to claim the Saver’s Credit all were raised for 2023.

Are You Able To Contribute More Than Your Match

Maybe maxing out is not right for you but you feel comfortable contributing more than whats required to earn your match. As we discussed earlier in this article, there is also not a single formula for determining an employers match, and therefore it may be possible for you to budget in a higher contribution amount . To that we say go forth and contribute.

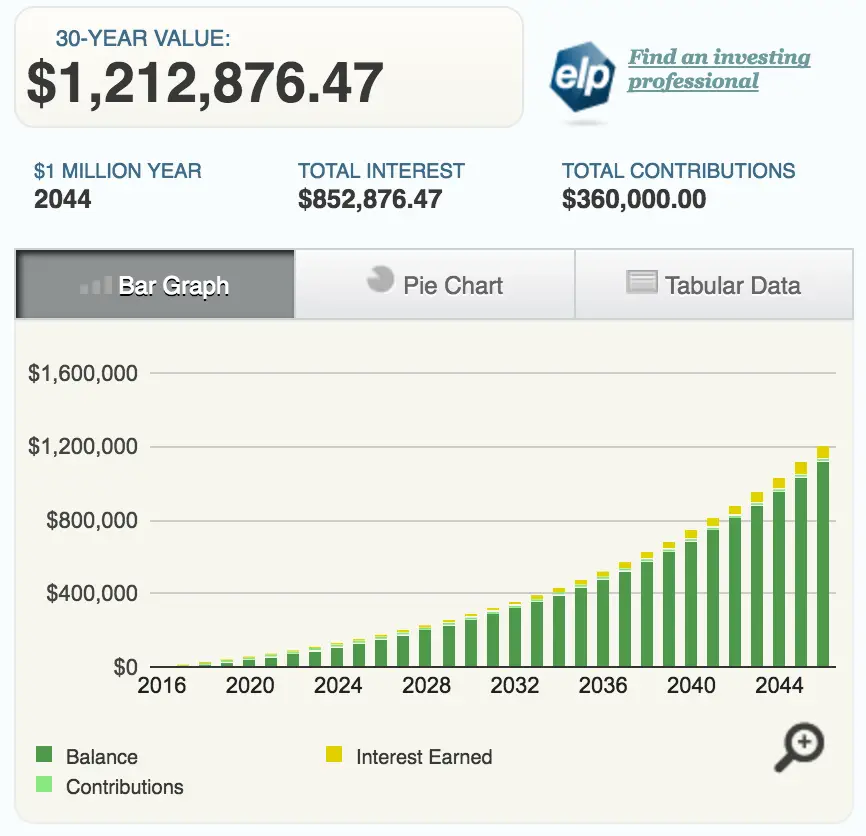

While you may not get more from your employer once you exceed your matching requirement, contributing more than your match allows you to not only save more, but also take greater advantage of your tax-advantaged account and compounding interest. That small change today may not feel like much, but could create a ripple effect come time for retirement.

We know that life happens and unexpected expenses come up. Know that you can change your contribution amount at any time – that goes for both increasing and decreasing.

When determining how much more you could possibly contribute towards your 401, its helpful to:

Examine your expenses: Add up your average monthly expenses like rent or mortgage, utilities, food and entertainment. Make sure to include any student loans or credit card debt youre paying down.

Chart your goals: Its helpful to consider retirement alongside a series of other milestones and even unplanned expenditures that have meaningful financial commitments on your path to retirement.

- Overall risk tolerance

- Outside investment and retirement accounts

- Prior investment experience

You May Like: Can I Take A Loan From My 401k

How Much Can You Contribute

For 2022, you can contribute up to $20,500, and an additional $6,500 if you are age 50 or older, or a total of $27,000. Note that employer matching contributions dont count toward this limit, but there is a limit for employee and employer contributions combined: Either 100% of your salary or $57,000 , whichever comes first.

When it comes to matching, specific terms of a 401k plan can vary widely. Your employer may use a very generous matching formula, or choose not to match employee contributions at all. Additionally, not all employer contributions to an employees 401k plan are the result of matching. Employers may make regular deferrals to employee plans regardless of employee contributions, though this is not particularly common.

Make sure you check your employers plan documents for the details on exactly how your 401k works.

Following are two common types of company contributions.

Self Employment Income Compensation Limits For 2022 And 2023

IRS records show that, in Tax Year 2014, an estimated 53 million taxpayers contributed almost $255 billion to tax-qualified deferred compensation plans. A popular form of deferred compensation plans, known as a solo 401 plans, permits employees to save for retirement on a tax-favored basis.

Video Slides: 2022 & 2023 Self-Directed Solo 401k Contribution Limits and Types

Recommended Reading: How To Find All 401k Accounts

How 401 Plan Contribution Limits Work

The 401 plan is a long-term savings plan designed to help people build their retirement savings. The IRS labels a 401 as a qualified retirement plan, which means it has certain tax benefits for the employee, the employer, or both.

The tax advantage for employees is that their contributions are deducted from gross income, not net income. That means less take-home pay, which lowers the employees taxes, and the money goes into an investment account on an ongoing basis.

For some 401 plans, employers can match some percentage of their employees contributions, but its strictly voluntary. The average 401 match ranges from 3% to 7% of the employees gross salary.

Do Employer Contributions Affect The 401 Contribution Limit

If both an employee and an employer contribute to a 401 plan, this boosts the employeeâs saving efforts. But does that free money from an employer count toward oneâs annual contribution limit?

In short, the answer is no. An employerâs 401 plan contributions donât count toward the employeeâs contribution limit. So, even if an employee younger than 50 puts $20,500 into their 401 one year, their employer can still contribute funds.

Still, there is a total contribution limit to note.

All plan contributionsâmeaning the total of elective deferrals , employer match funds, employer non-elective contributions, and allocations of forfeituresâcannot surpass the IRSâs overall limit on contributions. For tax year 2022, this limit is the lesser of:

- $61,000 or $67,500 for those over 50

- 100% of an individualâs annual compensation

This limit is designed for employees who have more than one retirement savings account that is managed by the same employer, or a related employer.

High-earning employees may face another hurdle when it comes to salary deferrals: contribution cut-offs. While most plans will allow high-earners to continue making contributions until they reach their annual contribution limit, some will cut off contributions early if their income hits a certain threshold.

Don’t Miss: How To Track Your 401k

Are You Meeting Your Match

Weve said it before, and well say it again. At the very least, do what you can to contribute the minimum amount required to earn your employers match. Not doing so is equivalent to not earning your full salary. While this may reduce your take-home pay, consider the growth potential of your retirement account from compound interest over the long run.

Overall Limit On Contributions

Total annual contributions to all of your accounts in plans maintained by one employer are limited. The limit applies to the total of:

- elective deferrals

The annual additions paid to a participants account cannot exceed the lesser of:

However, an employers deduction for contributions to a defined contribution plan cannot be more than 25% of the compensation paid during the year to eligible employees participating in the plan .

There are separate, smaller limits for SIMPLE 401 plans.

Example 1: In 2020, Greg, 46, is employed by an employer with a 401 plan, and he also works as an independent contractor for an unrelated business and sets up a solo 401. Greg contributes the maximum amount to his employers 401 plan for 2020, $19,500. He would also like to contribute the maximum amount to his solo 401 plan. He is not able to make further elective deferrals to his solo 401 plan because he has already contributed his personal maximum, $19,500. He would also like to contribute the maximum amount to his solo 401 plan.

Read Also: How To Move Your 401k To A New Job

Total 401 Employer And Employee Annual Contribution Limits

| 2022 Limit | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$67,500 |

$73,500 |

Many employers offer 401 matching contributions as part of their job benefits package. That means they agree to duplicate a portion of your contributions up to a set percentage of your salary. In addition, some employers may also share a percentage of their profits with employees in the form of non-matching contributions.

While an employers 401 matching and non-matching contributions dont count toward your annual employee deductible contribution limits, they are capped by total contribution limits.

Vanguard data from 2021 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

Roth 401 Vs Traditional 401

Although the contribution limits are the same for traditional 401 plans and their Roth counterparts, a designated Roth 401 account is technically a separate account within your traditional 401 that allows for the contribution of after-tax dollars. The elected amount is deducted from your paycheck after income, Social Security, and other applicable taxes are assessed. The contribution doesn’t garner you a tax break in the year you make it.

The big advantage of a Roth 401 is that no income tax is due on these funds or their earnings when they’re withdrawn after you retire. A traditional 401 works in the opposite way. That is, savers make their contributions on a pretax basis and pay income tax on the amounts withdrawn when they retire. Neither of these 401 accounts imposes income limitations for participation.

When available, savers may use a combination of the Roth 401 and the traditional 401 to plan for retirement. Splitting your retirement contributions between both kinds of 401s, if you have the option, can help ease your retirement tax burden.

You May Like: What Kind Of 401k Do I Have

Contribution Limits For 2021 And 2022

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2021 and $20,500 for 2022. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2021 and 2022. This brings the maximum amount they can contribute to their 401s to $26,000 in 2021 or $27,000 in 2022.

The IRS also imposes a limit on all 401 contributions made during the year. In 2021, it rises to $58,000 and $64,500, respectively. In 2022, it rises to $61,000 and $67,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf.

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $290,000 in 2021 or $305,000 in 2022, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

Here’s a useful reference chart to help you remember these important limits and thresholds:

| Type of Contribution |

|---|

What Is A Good 401 Match

A good 401 match is usually 5% to 7% of your salary, up to a dollar-for-dollar match. For example, if you contribute 5% of your $50,000 salary, your employer will contribute 5% as well, for a total contribution of 10%. If you contributed 7%, your employer would contribute the full 7%. The 401 contribution limit for 2019 is $19,000, so if youre contributing 5%, thats $950 per year. A good 401 match can help you reach your retirement savings goals sooner. And its free money! So if your employer offers a 401 plan with a good match, take advantage of it.

You May Like: Can I Roll My 401k Into An Ira

Do Rolled Over Funds Count Towards My Contribution Limit

It depends. If you made the contribution in the same tax year, then the amount you contributed will count towards your contribution limit, regardless if you rolled them over. If you have rolled over funds from a previous 401, but made the contribution in a previous tax year, that balance does not count towards your annual limit.

For example, lets say you were employed at Company X for 2 years from April 2020 to April 2022, and joined Company Y in May 2022. Any contributions you made from April 2020 until December 31, 2021 would not count towards your 2022 limit, even if you roll it over to your Company Y 401. If you already contributed $5,000 to your 401 with Company X before you departed, your remaining 2022 allowable contribution amount would be $15,500 .¹

What Is A Dollar

An employer contributes the same dollar amount as their employee, up to a certain percentage of the employees salary, in a 401 plan.

A usual employer offer is matching 3% of your salary contributions dollar-for-dollar. However, my former employer bettered that by matching up to 7% dollar-for-dollar.

Read Also: How To See My 401k Balance

What Happens If I Exceed My 401 Limit By Mistake

If you contribute too much to your 401 and notice your mistake before the tax filing deadline, you can probably correct it with your employer. Youll need to notify your plan administrator. Theyll return the excess money to you, and youll get a new W-2 and pay taxes on your new total taxable wages.

If you dont catch the mistake before tax day, you may have to pay taxes twice on the amount you contributed over the limit. Thats because the excess contribution cant be deducted from your taxes in the year it was made, and because the IRS will still count that money as taxable when its distributed too.

What Is The Standard 401 Employer Contribution

There is no standard 401 employer contribution as companies can decide for themselves how much they will add to an employees plan.

No account yet? Register

Short answer: There is no standard 401 employer contribution as companies can decide for themselves how much they will add to an employees plan. That said, market trends are emerging, and the data below can give you a sneak peek into how your contributions compare with those of your competitors.

You May Like: How To Contribute To Retirement Without 401k

Change In Business Name Affect On Contributions Question:

You can still setup the solo 401k in 2021 under your sole proprietor business. Next year in 2022, we can update the plan to list the new self-employed business. All else would remain the same . The 2022 annual solo 401k contributions would be based on your new self-employment income and you would have until 2023 to make those contributions.

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Recommended Reading: How Much Can I Invest In My 401k

What Are The Tax Benefits To The Employer For Offering A 401 Matching Plan

Employers can use the contributions to employee 401 accounts as tax deductions on their federal corporate income tax returns. These contributions may also be exempt from state and payroll taxes. As a result, the employer keeps their employees happy, sees reduced turnover and benefits financially with tax deductions.

Why Does The Irs Impose Contribution Limits

Contributions to 401 plans made using pretax dollars provide significant tax benefits. This means you dont have to pay federal income tax for contributions up to the $22,500 limit , which lowers your taxable income. And because earnings in a pretax 401 account are on a tax-deferred basis, earnings in your account are not subject to tax until you withdraw your funds.

Because of the substantial tax benefits offered by 401 retirement plans, the IRS works to ensure that plans do not unfairly benefit key employees and highly compensated employees. To ensure a 401 plan is structured fairly and not favoring specific employees, all 401 plans must pass a set of annual compliance tests.

Don’t Miss: Can I Use 401k To Buy A Home

Solo 401k Contribution Limits And Types

Section 415 of the Internal Revenue Code is where you can find the contribution limits that apply to 401k plans including solo 401k plans.

- Ones contributions to a Solo 401k cant exceed the self-employment compensation .

- Moreover, one can only make Solo 401k contributions based on ones earned self-employment income .

What If I Have A Roth 401

If you have a Roth 401, you pay income taxes on your contributions now, rather than when you take that money out during your retirement. But your employer isnt likely to pay the taxes on matching contributions , so if you have a Roth, their matching contributions usually go into a separate, traditional 401. Youll pay the taxes on the traditional when you withdraw the money.

Also Check: How To Transfer Money From 401k To Ira

Recommended Reading: How To Draw From 401k