What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. Before you take any money out, ask yourself an important question:

Do you actually need the money now?

Rather than putting money away, you are actually paying it forward.

If you are relatively early on in your career, you may be single and financially flexible. But your future self may be neither of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement.

Consider contributing to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Some people find the ease of access comforting.

Keep a few factors in mind:

- There are income limits on contributing to a Roth IRA.

- You will still be taxed if you withdraw the funds early or before the account has aged five years.

Alternatives To Using Your 401 To Buy A House

Even if youre short on cash and facing hardship, there are other options you might want to consider before tapping into your 401 account to cover the down payment on a house.

IRA Account

If you have an IRA, you should look there for extra funds before considering an early withdrawal from your 401. IRAs are built with special provisions for first-time home buyers, which the IRS defines as anyone who hasnt owned a primary residence within the previous 2 years.

Under these provisions, first-time home buyers are allowed to withdraw up to $10,000 without incurring the 10% penalty. However, that $10,000 is still subject to state and federal income taxes. If your withdrawal exceeds $10,000, then the 10% penalty is applied to the additional distribution.

A Roth IRA is an even better option, if you have one. Some plans allow you to make a hardship withdrawal, and up to $10,000 can be withdrawn tax-free for the express purpose of a first-time home purchase.

FHA Loan

A Federal Housing Administration loan is a government-backed mortgage with looser requirements designed to make it easier for first-time home buyers to purchase a property. This includes low down-payment options and lower credit score requirements. For this reason, an FHA loan may be a better option than making a withdrawal from your 401.

- Size of your down payment

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Recommended Reading: How To Find 401k Balance

Also Check: What’s The Difference In An Ira And A 401k

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will likely trigger a lump-sum distribution.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

Alternatives To A 401 Early Withdrawal

As we mentioned, a 401 early withdrawal can be used in a financial emergency, but it shouldnt be your first choice. The good news is there are plenty of other options available to you.

There are several alternatives to an early withdrawal from retirement, however, most of them mean going into debt, Woodward said. The only difference is your credit will not be used in determining your eligibility for a 401 loan. Your credit will be used for credit cards , HELOCs, personal loans, and any other type of loan.

Your creditworthiness is a major factor when youre borrowing money. Some of the options below may only be available if you have good credit. In other cases, a poor credit score could make the loan cost-prohibitive.

Also Check: Can You Use 401k To Buy Stocks

How Much You Can Afford To Contribute

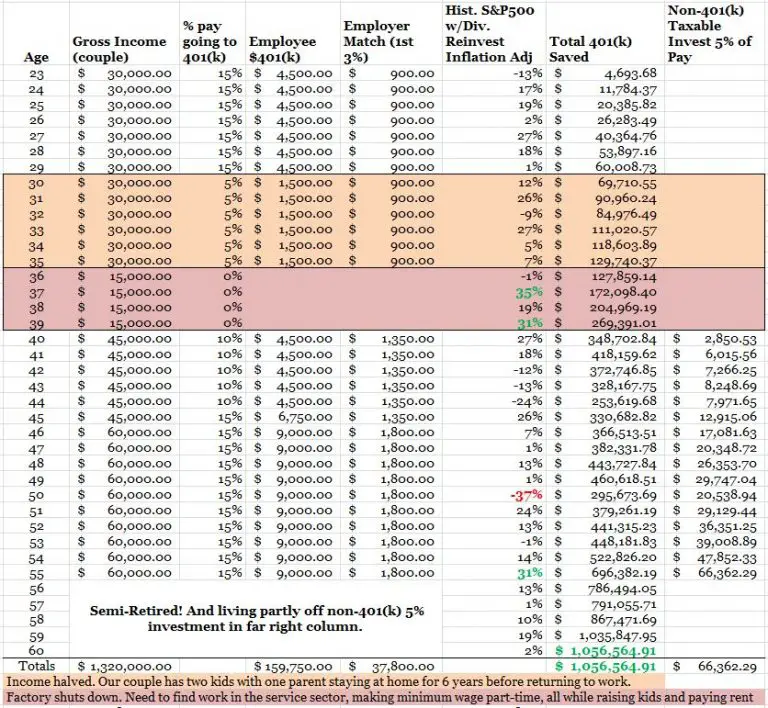

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways we’ll need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, it’s okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially “free money” so you don’t want to leave any sitting on the table.

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free, but there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in that case.

The age-55-and-up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year, but doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

Recommended Reading: How To Find My 401k Contributions

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: How To Know If You Have 401k Money

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Read Also: When Changing Jobs What To Do With 401k

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Consider A Roth Ira Conversion

If youâre still saving for retirement, you could also consider converting a portion of your 401 to a Roth IRA. You will owe tax on the amount of your Roth conversion in the year that you convert, but you likely wonât owe any additional taxes during your lifetime. This can help set you up to be more tax-efficient during retirement.

You might not be able to avoid paying taxes on a 401 withdrawal, but itâs a good idea to work with a financial advisor on your retirement plan. He or she can help you build a tax-efficient plan that also protects your retirement portfolio against other risks to your money, like market downturns or a long lifespan.

Are you on track for retirement?

See how much monthly retirement income you may have based on what youâre saving now.

Take the next step

Our advisors will help to answer your questions â and share knowledge you never knew you needed â to get you to your next goal, and the next.

Read Also: Can I Convert My 401k To An Ira

New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

Dont Miss: How To Withdraw From 401k After Age 60

How To Take Money Out Of A 401 After You Retire

When you reach retirement, you have a few options. You can either start making qualified distributions, extract a lump sum, let your account continue to accumulate earnings or roll your 401 assets over to an IRA.

1. Regular 401 Withdrawal

This applies if you are over the age of 59 ½ or, in some cases, over the age of 55. Most providers allow regularly scheduled withdrawals on a monthly or quarterly basis. When you take money out of a 401, the remaining balance can continue to grow depending on your investment portfolio. If you wait until you are 70 ½ years old to withdraw, you will have to withdraw required minimum distributions, or RMDs, which are periodic amounts based on life expectancy and account balance. You can always withdraw more, but never less.

Financial advisors usually recommend a withdrawal rate between 2% 7% a year, but it depends on your needs. Consider your life expectancy, expenses, other investments, family situation, employment status and Social Security benefits. You can calculate the potential outcome by assessing your account balance and current budget. We suggest looking at how a 4% withdrawal rate would add up, and adjusting from there.

The first step toward withdrawal is contacting your human resources representative or your 401 plan administrator or calling the number on your 401 plan statement. They can provide the paperwork you need to take money out of a 401.

2. Early 401 Distribution

3. 401 Rollover to IRA

Recommended Reading: What Is The Phone Number For Fidelity 401k

How Much Is Taxed On A 401k Withdrawal

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal.

How Long Does It Take To Cash Out 401k After Leaving Job

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Don’t Miss: When Can You Access 401k

Tips For Planning For Retirement

- To avoid ever getting into a situation where youre forced to borrow from your 401 plan, consider consulting a financial advisor. A financial advisor can help you budget and optimize your savings. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

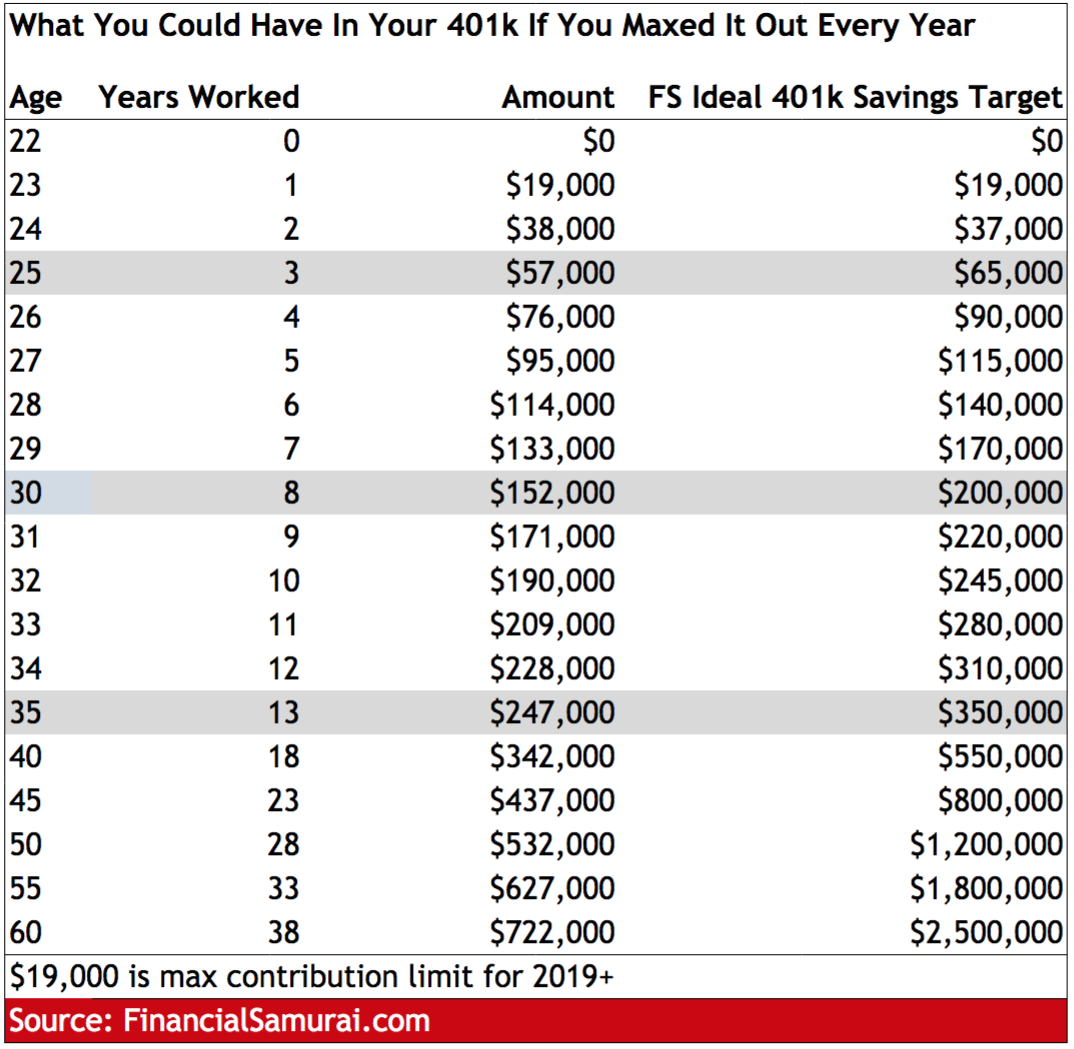

- Start early and keep your money in your retirement account. The longer your money is in your retirement account and the more money thats in there, the more work compound interest can do for you. Get an idea of how much youll need to save for retirement. SmartAssets retirement calculator can help determine whether your retirement savings are on track.

Withdrawal Rules Frequently Asked Questions

If you participate in a 401 plan, you should understand the rules around separation of service, and the rules for withdrawing money from your account otherwise known as taking a withdrawal. 401 plans have restrictive withdrawal rules that are tied to your age and employment status. If you dont understand your plans rules, or misinterpret them, you can pay unnecessary taxes or miss withdrawal opportunities.

We get a lot of questions about withdrawals from 401 participants. Below is a FAQ with answers to the most common questions we receive. If you are a 401 participant, you can use our FAQ to understand when you can take a withdrawal from your account and how to avoid penalties.

You May Like: How To Set Up My 401k

Roth Ira Hardship Withdrawals

If turning to your retirement savings is your last resort and you have a Roth IRA, this is the account you may want to consider tapping into first. The contributions you make into these accounts are taxed before they go in. So the IRS cant tax your contributions twice.

You can withdraw your contributions from a Roth IRA at any time without penalty. So if your Roth IRA contributions have been large enough to cover your financial burden, it might make sense to withdraw these first. Again, not the best financial decision. But as a last resort, youd at least avoid taxes and penalties.

However, its important to keep in mind were talking about contributions here.

This is the money you put into these accounts via automatic paycheck deduction or a bank transfer you initiated. This is separate from the earnings your contributions make from investment funds, interest, dividends or any other source.

The IRS doesnt permit you to withdraw any investment earnings on your contributions tax-free unless you meet two requirements. First, you have to be at least 59.5-years-old. Second, your account must have been open for at least five years. You must meet both stipulations before you can make tax-free qualified withdrawals from a Roth IRA.

Its also important to note that while you can withdraw your own contributions from a Roth IRA at any time, this is not the case with a Roth 401.